DIpil Das

What’s the Story?

On February 23, 2021, Macy’s reported its fourth-quarter and annual financial results from fiscal 2020, ended January 31, 2021. The company also provided an update on its Polaris Strategy. We present highlights in this report.Financial Results: Fourth-Quarter and Full-Year 2020

Increase in Digital Increased Delivery Costs, Impacting Gross Margin Macy’s reported that its revenues for the fourth quarter of fiscal 2020 (4Q20) declined by 18.7% year over year, from $8.3 billion to $6.8 billion. The company’s comparable sales were down 17.0% on an owned basis. Digital sales represented 44% of sales in 4Q20, up from 30% of sales in the year-ago quarter. In terms of categories, apparel experienced a year-over-year decline of 33% in 4Q20, while soft home was up 11%, driven by textiles and housewares. The fine jewelry, fragrance and designer skincare category saw year-over-year growth of approximately 14% across Bloomingdale’s and Macy’s. The company expects these category trends to continue through the first half of 2021. For apparel, casual wear did well, but the dress categories remain depressed. Macy’s reported that its delivery expenses in 4Q20 increased materially over last year. Carrier surcharges accounted for approximately one-third of the increase, which drove a 310-basis-point decline, year over year, in the gross margin rate—from 36.8% to 33.7%. Management said it was able to partially shift the impact of higher delivery costs by shifting consumers to pickup channels, as 25% of Macy’s digital sales were fulfilled in stores. Attracting a Younger Demographic in 4Q20; Around 4 Million New Digital Customers Macy’s reported that 7 million new customers transacted with the company in 4Q20, a 2% increase over 4Q19. Furthermore, 4 million of those customers transacted with Macy’s through digital channels. Management reported that these new consumers are younger and more diverse than its traditional customer. Specifically, of the 4 million new digital consumers, 38% were under the age of 40 (the age of Macy’s average shopper). According to the company, there have been two growth drivers behind this: Its Star Rewards Loyalty program is gaining traction, and Klarna, the flexible payment program, is also helping to bring in new, younger consumers. Approximately two-thirds of the customers Macy’s acquired through Klarna were new to the retailer, with 45% of them under 40 years old, according to the company. Stores Set To Comprise 65% of Sales in Fiscal 2021 For fiscal 2020 in total, ended January 31, 2021, comparable sales at Macy’s were down 27.9% year over year on an owned basis, and revenues declined by 29.4% from fiscal 2019—from $24.6 billion to $17.3 billion. Management described 2021 as a recovery and rebuilding year. The company expects 2021 to be bifurcated, with continued pandemic challenges in the spring and momentum building in the fall. Macy’s expects net sales to be $19.75–20.75 billion 2021, up 14–20% over 2020—emphasizing that this is lapping a year of significant declines due to store closures, with expected stabilization reflected in the expectations. Stores are targeted to represent about 65% of net sales for the year, with digital sales accounting for the remaining 35%. Macy’s saw unprecedented digital growth in 2020, and management stated that its outlook reflects “a more normalized growth cadence but one heavily focused as a digitally led business.” The company anticipates that customers will be more comfortable in public spaces as vaccination distribution scales up. Macy’s has not made significant assumptions around tourism-based sales recovering in 2021. In the future, the company is targeting annual sales comps of low single digits as business normalizes somewhat, with digital sales exceeding 40%. For stores, Macy’s reported that malls will continue to face headwinds that will lead to low–to-mid-single-digit comp store sales declines after recovering from the pandemic in 2021 and 2022.Polaris Strategy Update

Management provided an update on the Macy’s Polaris Strategy, which comprises five pillars: win with fashion and style; deliver clear value; excel in digital shopping; enhance store experience; modernize supply chain; and enable transformation (see image below). [caption id="attachment_123801" align="aligncenter" width="725"] Macy;s outlined the key pillars of its Polaris strategy

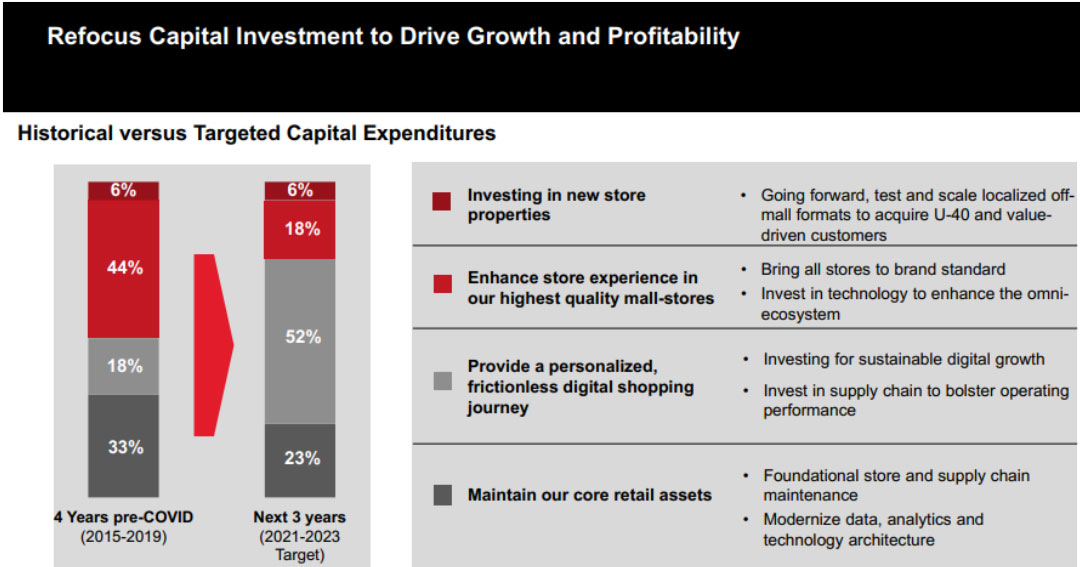

Macy;s outlined the key pillars of its Polaris strategy Source: Macy’s [/caption] Digital Sales To Grow to $10 Billion in Three Years; Macy’s To Invest 2.5X Higher Capital Spend in 2021 As part of the third Polaris Strategy pillar, Macy’s aims to grow its digital sales to $10 billion by 2023. To support this growth, the company plans to spend “a large percentage of its capital” on the digital experience, supply chain and technology transformation. In 2021, Macy’s expects its capital spend to be 2.5 times its previous highest amount, totaling $650 million. The company reported progress against this initiative: It has launched a refreshed homepage with curated visual content, more precise search and browse functions, and a more intuitive bag and checkout experience with broader ways to pay. In high-engagement categories such as beauty, Macy’s is creating immersive online experiences to enable customers to discover new products and shop with confidence. These experiences include virtual consultations with the company’s own beauty consultants. Digital growth in the beauty category at Macy's grew more than 60% year over year in 2020. Management said that the company is carrying these learnings into other categories. [caption id="attachment_123802" align="aligncenter" width="725"]

Macy’s expects capital expenditure to drive growth and profitability

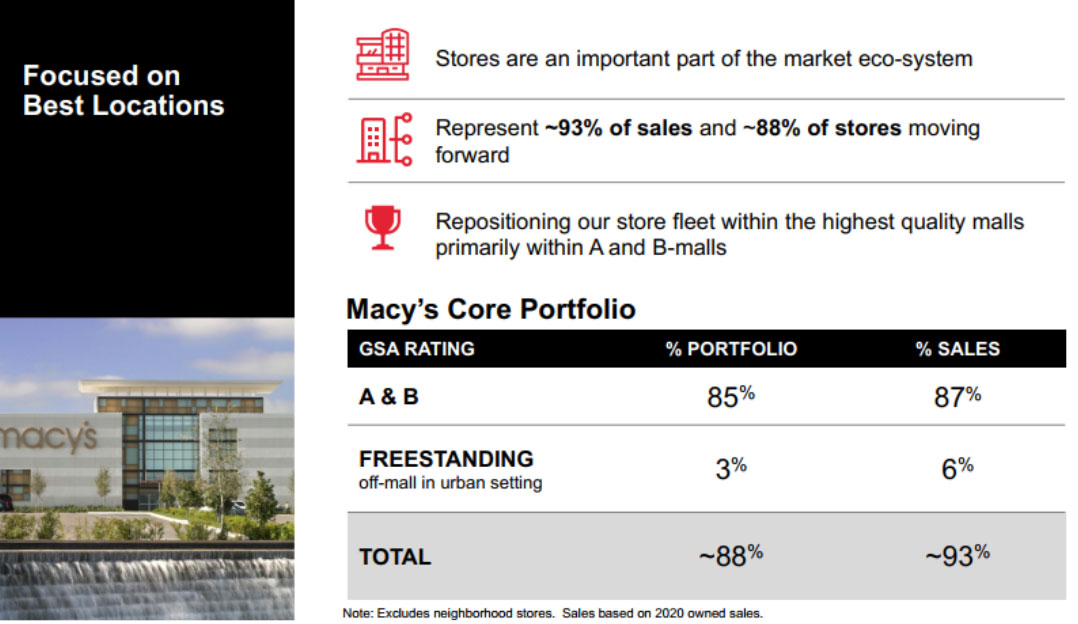

Macy’s expects capital expenditure to drive growth and profitability Source: Macy’s [/caption] Plans To Add 35 Backstage Stores in 2021 and Proceed with 125 Store Closures The company reported that Backstage, its off-price channel, will continue to be a significant element in assortment—aligning with the first pillar of the Polaris Strategy. Macy’s Backstage outperformed comp sales in Macy’s stores by more than 3X in 2020. The company plans to open about 35 new store-within-stores in 2021. As part of the fourth Polaris Strategy pillar, Macy’s management stated that its store fleet has high value and will remain a critical part of the retailer’s future. The company is committed to the 125 store closures that it announced in January 2020; approximately 60 stores have already closed or will close soon. Macy’s said that the sales from these stores totals approximately $1.3 billion. The closures will reduce the company’s footprint in C and D malls, and following the closure of all 125 locations, at least 85% of sales will be derived from A and B mall stores. [caption id="attachment_123803" align="aligncenter" width="725"]

Macy’s plans to reposition its store fleet

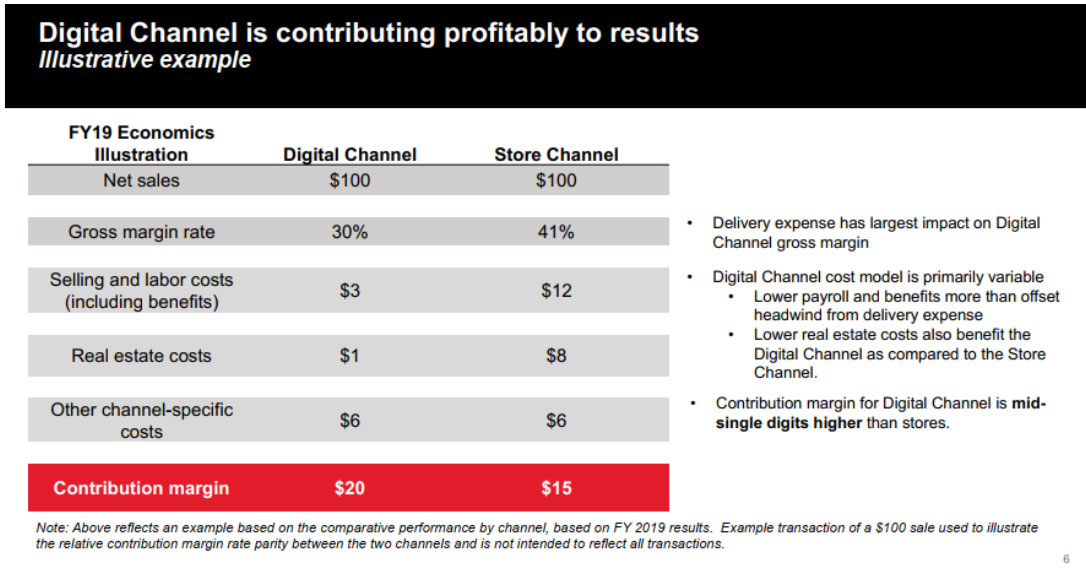

Macy’s plans to reposition its store fleet Source: Macy’s [/caption] Focus on Supply Chain and Fulfillment Services To Further Increase Profitability Management emphasized that Macy’s Polaris Strategy is focused on accelerating top-line growth to increase profitability across all channels—digital and physical. The company strategy is focused on consumer preference for a digital shopping experience, and management highlighted that its brick-and-mortar and digital channels work together. Macy’s digital sales per capita are two to three times higher in markets where there are Macy's stores. When the retailer has closed stores over the last five years, the growth rate of digital sales has dropped “meaningfully” in a multi-store market and “significantly” in a single-store market, according to Macy’s. Learning lessons from 2020, the company highlighted that its fourth and fifth Polaris Strategy initiatives aim to meet the inventory and fulfillment needs of consumers shopping in a multi-channel environment—such as by offering BOPIS (buy online, pick up in-store), curbside-pickup and same-day delivery services. As shown in the image below, Macy’s digital channel is contributing positively to profitability at a higher rate than its stores channel. Delivery expense is the biggest challenge for the retailer, and this cost is variable compared to fixed store costs. In order to address this, the company plans to concentrate efforts on improvements in its supply chain and inventory allocation. Macy’s is focusing on operations and driving personalized behavior through digital—reducing packages per order, increasing the percentage of orders picked up by customers at stores, and linking its best shipping offers to its loyalty program and Macy's proprietary credit card holders. [caption id="attachment_123804" align="aligncenter" width="725"]

The digital channel is contributing positively to profitability at Macy’s

The digital channel is contributing positively to profitability at Macy’s Source: Macy’s Polaris Strategy, 2021 [/caption] Testing Off-Mall Locations and Scaling Store Fulfillment The company is focusing on two initiatives to enhance the consumer experience:

- Scaling store fulfillment, BOPIS, curbside-pickup and same-day delivery services

- More closely connecting online and offline, which includes investing in technology that enhances the way it engages with customers and elevates in-store experiences—from category merchandising and store layout to transaction and staffing models