DIpil Das

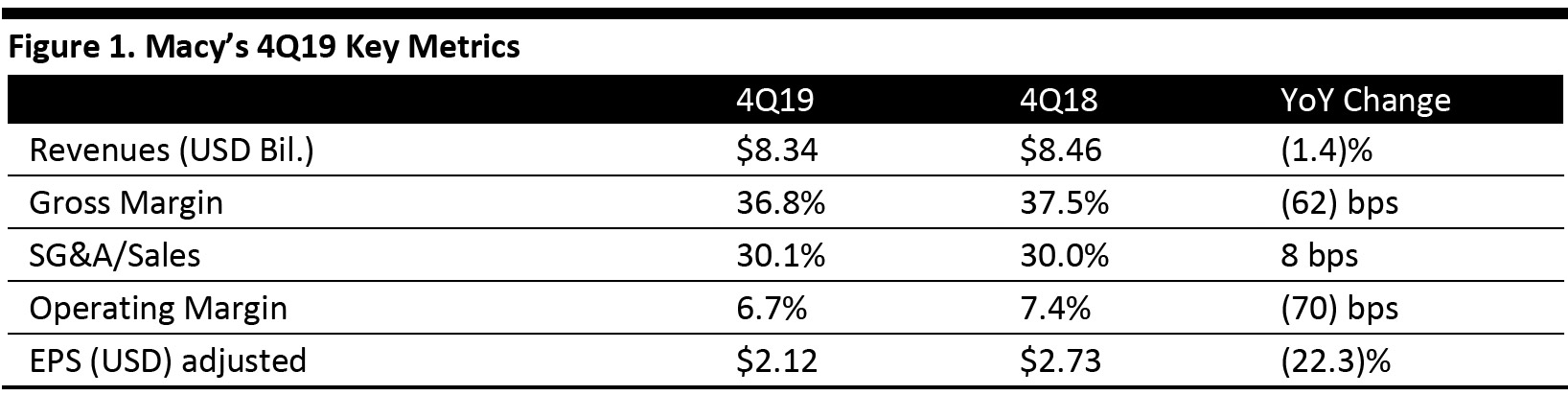

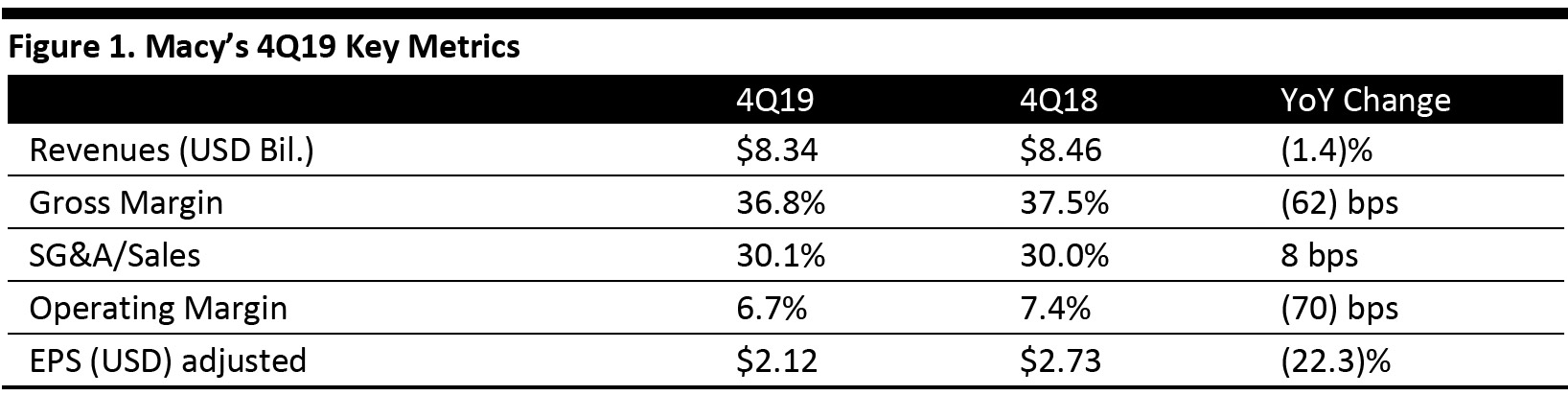

[caption id="attachment_104171" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

4Q19 Results

Macy’s fiscal 4Q19 revenues were $8.34 billion, down 1.4% year over year and even with the consensus estimate of $8.3 billion. The company reported 4Q19 adjusted EPS of $2.12, down 22.3% from the year-ago period but higher than the consensus estimate of $1.96.

Comparable sales fell 0.6% on an owned basis and 0.5% on an owned plus licensed basis.

Management said Macy’s had a “solid” holiday season, driven by an uptick in sales in the 10 days before Christmas, saying performance was led by six business categories that account for nearly 40% of Macy’s sales: dresses, fine jewelry, big ticket items, men’s tailored, women’s shoes, and beauty. The company said holiday sales were supported by its “growth stores” (stores that have been remodeled and upgraded to a new format) and Macy’s Backstage (its off-price business).

Total online sales were up high single digits for the quarter.

FY19 Results

Total FY19 revenues were $24.56 billion, down 1.6% from $24.97 billion the prior fiscal year. Comp sales for owned stores were down 0.8% compared to a 1.7% increase in FY18, while comp sales for owned plus licensed stores were down 0.7% compared to 2.0% for FY18.

Adjusted earnings per share were down 30.4% to $2.91 from $4.18 in the year ago period.

The company reported that FY19 did not “play out as intended,” which it also detailed at its investor day on February 5, 2020. Management did report it saw trend improvement in the fourth quarter, including a sales uptick leading up to the holidays. Macy’s reported it ended the year with a clean inventory position.

Management also reiterated its five-point Polaris strategy it announced at the investor day, a three-year plan designed to stabilize profitability and position the company for sustainable, profitable growth.

Specifically, the plan calls for the company to:

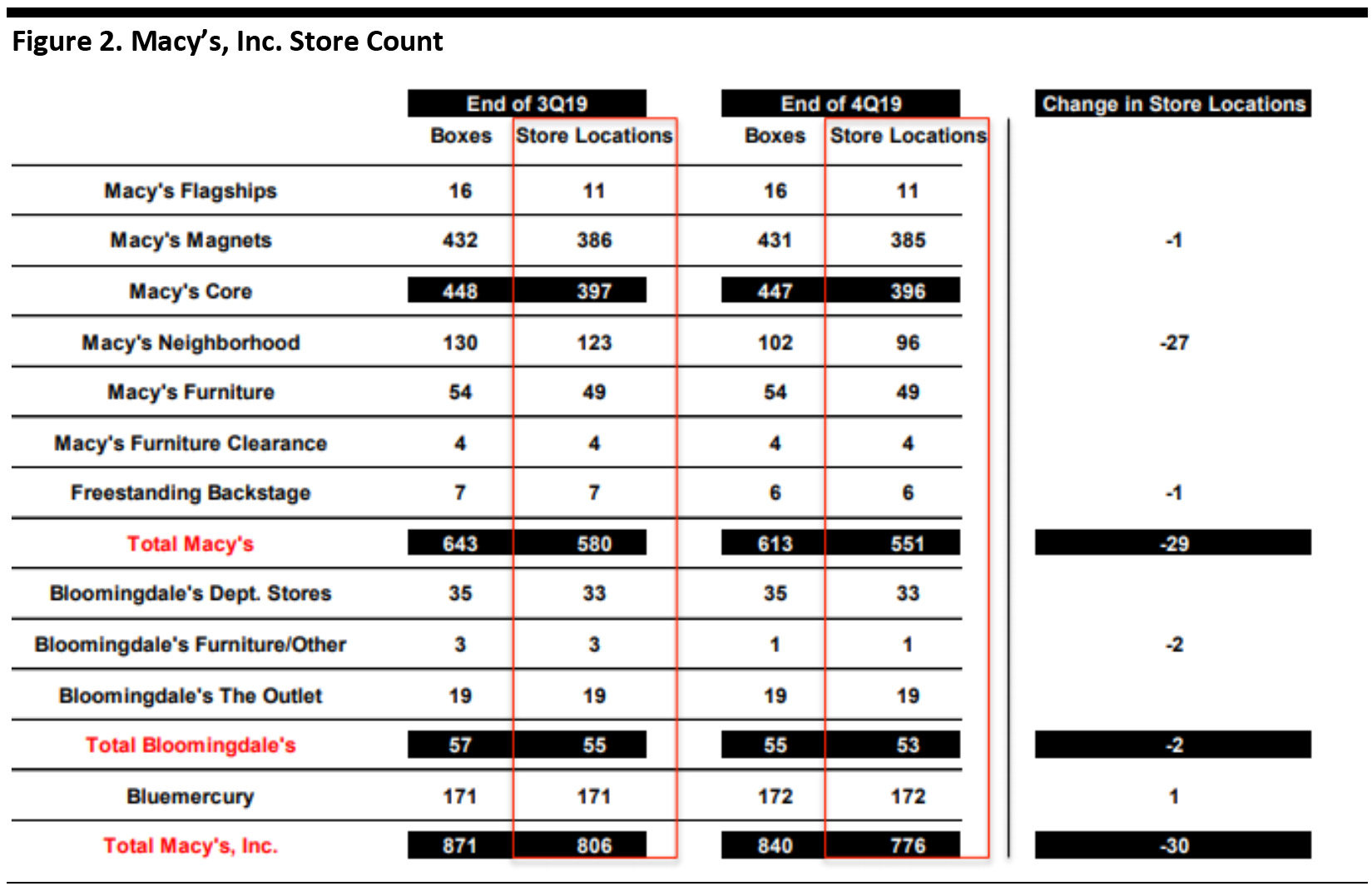

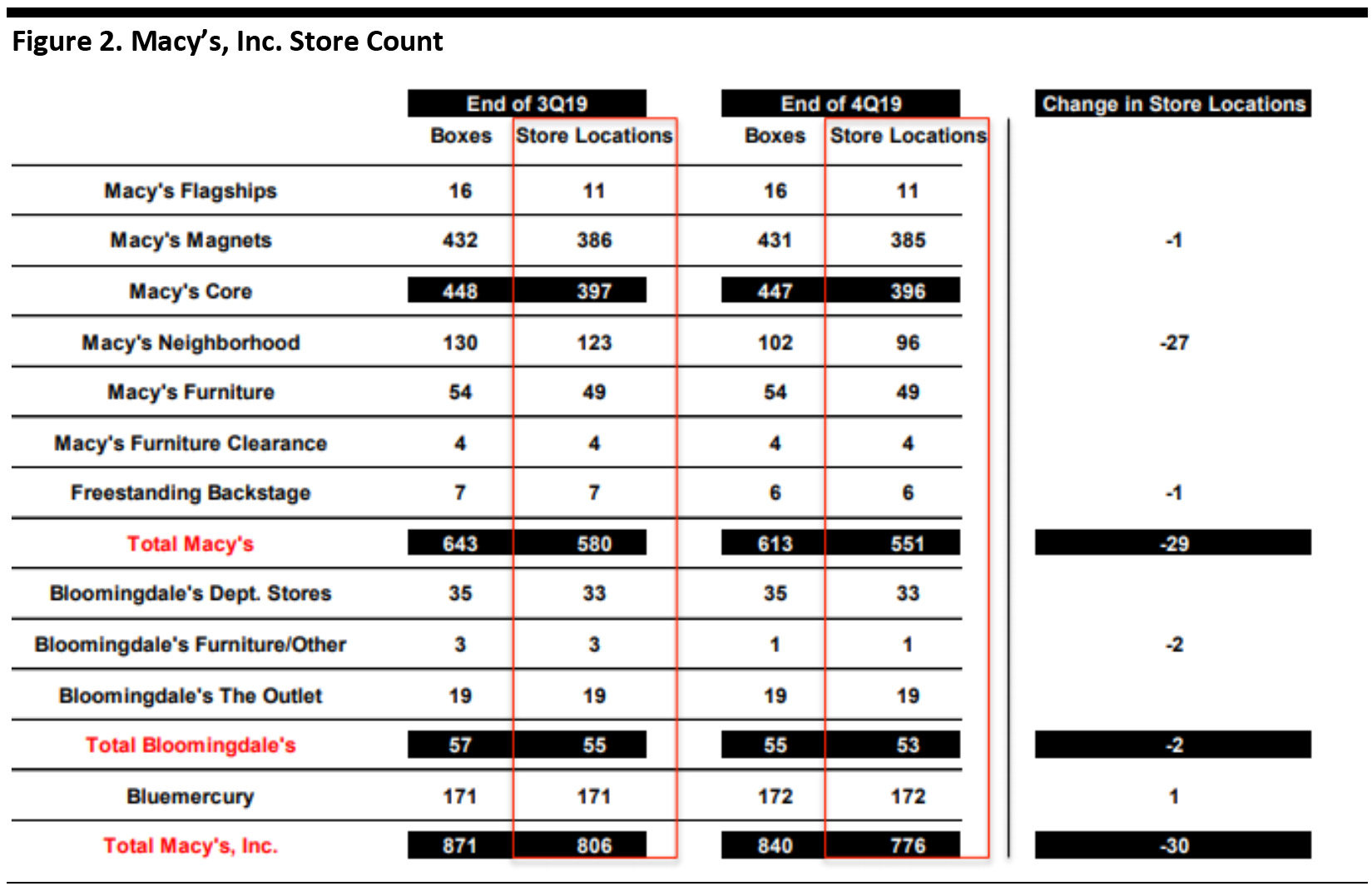

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Macy’s fiscal 4Q19 revenues were $8.34 billion, down 1.4% year over year and even with the consensus estimate of $8.3 billion. The company reported 4Q19 adjusted EPS of $2.12, down 22.3% from the year-ago period but higher than the consensus estimate of $1.96.

Comparable sales fell 0.6% on an owned basis and 0.5% on an owned plus licensed basis.

Management said Macy’s had a “solid” holiday season, driven by an uptick in sales in the 10 days before Christmas, saying performance was led by six business categories that account for nearly 40% of Macy’s sales: dresses, fine jewelry, big ticket items, men’s tailored, women’s shoes, and beauty. The company said holiday sales were supported by its “growth stores” (stores that have been remodeled and upgraded to a new format) and Macy’s Backstage (its off-price business).

Total online sales were up high single digits for the quarter.

FY19 Results

Total FY19 revenues were $24.56 billion, down 1.6% from $24.97 billion the prior fiscal year. Comp sales for owned stores were down 0.8% compared to a 1.7% increase in FY18, while comp sales for owned plus licensed stores were down 0.7% compared to 2.0% for FY18.

Adjusted earnings per share were down 30.4% to $2.91 from $4.18 in the year ago period.

The company reported that FY19 did not “play out as intended,” which it also detailed at its investor day on February 5, 2020. Management did report it saw trend improvement in the fourth quarter, including a sales uptick leading up to the holidays. Macy’s reported it ended the year with a clean inventory position.

Management also reiterated its five-point Polaris strategy it announced at the investor day, a three-year plan designed to stabilize profitability and position the company for sustainable, profitable growth.

Specifically, the plan calls for the company to:

Source: Company reports [/caption]

Outlook

For FY20, management reiterated guidance for earnings per share of $2.45-2.65, compared to the consensus estimate of $2.46. The company projects revenues in the range of $23.623.9 billion and comparable sales for its owned plus licensed stores of (2.5)% to (1.5)%, and comp sales of its owned stores approximately 40 basis points higher than its owned plus licensed stores.

Management reiterated it expects 2020 to be a transition year, and that it expects to achieve the Polaris goals as outlined on its investor day.

Factors Impacting 2020

Management said that while the consumer environment remains healthy, it expects slower economic growth overall versus the prior year, in addition to the following challenges:

Source: Company reports [/caption]

Outlook

For FY20, management reiterated guidance for earnings per share of $2.45-2.65, compared to the consensus estimate of $2.46. The company projects revenues in the range of $23.623.9 billion and comparable sales for its owned plus licensed stores of (2.5)% to (1.5)%, and comp sales of its owned stores approximately 40 basis points higher than its owned plus licensed stores.

Management reiterated it expects 2020 to be a transition year, and that it expects to achieve the Polaris goals as outlined on its investor day.

Factors Impacting 2020

Management said that while the consumer environment remains healthy, it expects slower economic growth overall versus the prior year, in addition to the following challenges:

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Macy’s fiscal 4Q19 revenues were $8.34 billion, down 1.4% year over year and even with the consensus estimate of $8.3 billion. The company reported 4Q19 adjusted EPS of $2.12, down 22.3% from the year-ago period but higher than the consensus estimate of $1.96.

Comparable sales fell 0.6% on an owned basis and 0.5% on an owned plus licensed basis.

Management said Macy’s had a “solid” holiday season, driven by an uptick in sales in the 10 days before Christmas, saying performance was led by six business categories that account for nearly 40% of Macy’s sales: dresses, fine jewelry, big ticket items, men’s tailored, women’s shoes, and beauty. The company said holiday sales were supported by its “growth stores” (stores that have been remodeled and upgraded to a new format) and Macy’s Backstage (its off-price business).

Total online sales were up high single digits for the quarter.

FY19 Results

Total FY19 revenues were $24.56 billion, down 1.6% from $24.97 billion the prior fiscal year. Comp sales for owned stores were down 0.8% compared to a 1.7% increase in FY18, while comp sales for owned plus licensed stores were down 0.7% compared to 2.0% for FY18.

Adjusted earnings per share were down 30.4% to $2.91 from $4.18 in the year ago period.

The company reported that FY19 did not “play out as intended,” which it also detailed at its investor day on February 5, 2020. Management did report it saw trend improvement in the fourth quarter, including a sales uptick leading up to the holidays. Macy’s reported it ended the year with a clean inventory position.

Management also reiterated its five-point Polaris strategy it announced at the investor day, a three-year plan designed to stabilize profitability and position the company for sustainable, profitable growth.

Specifically, the plan calls for the company to:

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Macy’s fiscal 4Q19 revenues were $8.34 billion, down 1.4% year over year and even with the consensus estimate of $8.3 billion. The company reported 4Q19 adjusted EPS of $2.12, down 22.3% from the year-ago period but higher than the consensus estimate of $1.96.

Comparable sales fell 0.6% on an owned basis and 0.5% on an owned plus licensed basis.

Management said Macy’s had a “solid” holiday season, driven by an uptick in sales in the 10 days before Christmas, saying performance was led by six business categories that account for nearly 40% of Macy’s sales: dresses, fine jewelry, big ticket items, men’s tailored, women’s shoes, and beauty. The company said holiday sales were supported by its “growth stores” (stores that have been remodeled and upgraded to a new format) and Macy’s Backstage (its off-price business).

Total online sales were up high single digits for the quarter.

FY19 Results

Total FY19 revenues were $24.56 billion, down 1.6% from $24.97 billion the prior fiscal year. Comp sales for owned stores were down 0.8% compared to a 1.7% increase in FY18, while comp sales for owned plus licensed stores were down 0.7% compared to 2.0% for FY18.

Adjusted earnings per share were down 30.4% to $2.91 from $4.18 in the year ago period.

The company reported that FY19 did not “play out as intended,” which it also detailed at its investor day on February 5, 2020. Management did report it saw trend improvement in the fourth quarter, including a sales uptick leading up to the holidays. Macy’s reported it ended the year with a clean inventory position.

Management also reiterated its five-point Polaris strategy it announced at the investor day, a three-year plan designed to stabilize profitability and position the company for sustainable, profitable growth.

Specifically, the plan calls for the company to:

- Strengthen customer relations: Build customer value by expanding the Macy’s Star Rewards Loyalty program through the launch of Loyalty 3.0, which the company hopes will accelerate personalization and monetization.

- Curate quality fashion: Drive a disciplined merchandise category and aim to be the best destination for brands, balancing sales and margins. Management reported it is committed to building four, $1 billion private brands.

- Accelerate digital growth: Enhance the digital experience across the Macy’s website and app, and grow its omni-channel customer base to improve profitability.

- Optimize the store portfolio: Continue the “growth treatment” for stores in the best malls and expand off-mall profitability; test a retail ecosystem with a mix of Macy’s store formats within a geographic market.

- Reset the cost base: Right-size the organization and expense base; improve working capital and balance top-line growth.

- Comparable store sales at the 50 “growth” stores (that have been renovated) outperform the overall Macy's fleet.

- Backstage locations open for more than 12 months achieved mid-single-digit comparable sales growth and have improved both gross margin and inventory turn.

Source: Company reports [/caption]

Outlook

For FY20, management reiterated guidance for earnings per share of $2.45-2.65, compared to the consensus estimate of $2.46. The company projects revenues in the range of $23.623.9 billion and comparable sales for its owned plus licensed stores of (2.5)% to (1.5)%, and comp sales of its owned stores approximately 40 basis points higher than its owned plus licensed stores.

Management reiterated it expects 2020 to be a transition year, and that it expects to achieve the Polaris goals as outlined on its investor day.

Factors Impacting 2020

Management said that while the consumer environment remains healthy, it expects slower economic growth overall versus the prior year, in addition to the following challenges:

Source: Company reports [/caption]

Outlook

For FY20, management reiterated guidance for earnings per share of $2.45-2.65, compared to the consensus estimate of $2.46. The company projects revenues in the range of $23.623.9 billion and comparable sales for its owned plus licensed stores of (2.5)% to (1.5)%, and comp sales of its owned stores approximately 40 basis points higher than its owned plus licensed stores.

Management reiterated it expects 2020 to be a transition year, and that it expects to achieve the Polaris goals as outlined on its investor day.

Factors Impacting 2020

Management said that while the consumer environment remains healthy, it expects slower economic growth overall versus the prior year, in addition to the following challenges:

- The trajectory of Macy’s business over the past year.

- Challenges of mall-based retail.

- Some disruption from changes the company is making through Polaris.

- Small impact on first quarter sales from declining tourism.

- Fewer than 50% of the company’s private brands are sourced from China, so it is too early to estimate the supply chain impact.