Nitheesh NH

[caption id="attachment_78143" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

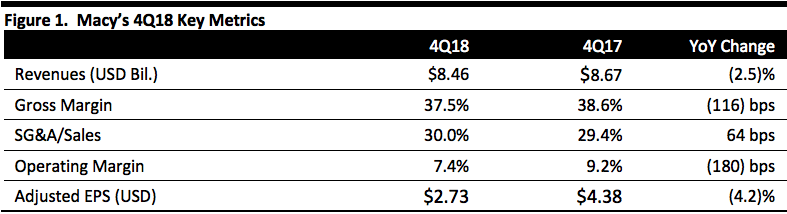

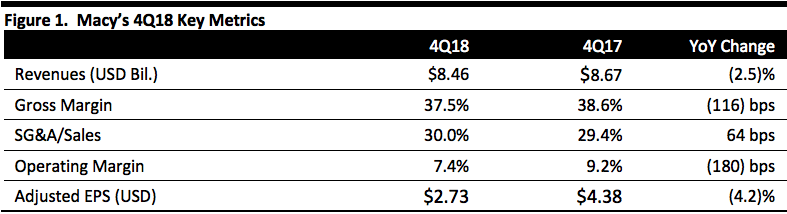

Macy’s reported 4Q18 revenues of $8.46 billion, down 2.5% year over year and beating the consensus estimate of $8.44 billion. The company reported 4Q18 EPS, excluding special items, of $2.73, down 4.2% from the year ago period but beating the consensus estimate of $2.53.

For the full year, the company reported $24.97 billion in revenue, up 0.1% from the year ago of $24.93 billion.

The company saw comparable sales growth of 0.4% on an owned basis, and 0.7% on an owned plus licensed basis. The company had its fifth consecutive quarter of positive comp sales and achieved a full year of positive comparable sales growth for the first time since 2014.

The company reported 2018 holiday sales results were lower than expected due to two events: A fire at its West Virginia facility caused merchandise to be unavailable during Cyber Week, and the company limited its pre-Christmas “earn and redeem” event to Star Rewards loyalty members only, which management speculated may have dampened sales.

For the fourth quarter, Macy’s reported strength in fragrances, skincare, women's shoes, activewear, fine jewelry, men's tailored clothing and furniture. The company reported disappointing performances in women's sportswear, handbags and color cosmetics. By region, the South, Southwest and Midwest were the strongest.

By brand, Bloomingdale’s saw double-digit sales growth online and an improved trend in stores' performance. The company reported its Bloomingdale’s flagship store in NYC had its best year since 2013.

Bluemercury’s total sales were up double digits and the company opened 26 new stand-alone stores over the year. Online sales increased more than 50%. The company is continuing to expand its proprietary brands Lune+Aster and M-61, which account for more than 10% of Bluemercury’s total sales.

At Macy’s the company provided an update on its 2018 Strategic Update of its North Star Strategy covering its five key strategic initiatives. The highlights include:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Macy’s reported 4Q18 revenues of $8.46 billion, down 2.5% year over year and beating the consensus estimate of $8.44 billion. The company reported 4Q18 EPS, excluding special items, of $2.73, down 4.2% from the year ago period but beating the consensus estimate of $2.53.

For the full year, the company reported $24.97 billion in revenue, up 0.1% from the year ago of $24.93 billion.

The company saw comparable sales growth of 0.4% on an owned basis, and 0.7% on an owned plus licensed basis. The company had its fifth consecutive quarter of positive comp sales and achieved a full year of positive comparable sales growth for the first time since 2014.

The company reported 2018 holiday sales results were lower than expected due to two events: A fire at its West Virginia facility caused merchandise to be unavailable during Cyber Week, and the company limited its pre-Christmas “earn and redeem” event to Star Rewards loyalty members only, which management speculated may have dampened sales.

For the fourth quarter, Macy’s reported strength in fragrances, skincare, women's shoes, activewear, fine jewelry, men's tailored clothing and furniture. The company reported disappointing performances in women's sportswear, handbags and color cosmetics. By region, the South, Southwest and Midwest were the strongest.

By brand, Bloomingdale’s saw double-digit sales growth online and an improved trend in stores' performance. The company reported its Bloomingdale’s flagship store in NYC had its best year since 2013.

Bluemercury’s total sales were up double digits and the company opened 26 new stand-alone stores over the year. Online sales increased more than 50%. The company is continuing to expand its proprietary brands Lune+Aster and M-61, which account for more than 10% of Bluemercury’s total sales.

At Macy’s the company provided an update on its 2018 Strategic Update of its North Star Strategy covering its five key strategic initiatives. The highlights include:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Macy’s reported 4Q18 revenues of $8.46 billion, down 2.5% year over year and beating the consensus estimate of $8.44 billion. The company reported 4Q18 EPS, excluding special items, of $2.73, down 4.2% from the year ago period but beating the consensus estimate of $2.53.

For the full year, the company reported $24.97 billion in revenue, up 0.1% from the year ago of $24.93 billion.

The company saw comparable sales growth of 0.4% on an owned basis, and 0.7% on an owned plus licensed basis. The company had its fifth consecutive quarter of positive comp sales and achieved a full year of positive comparable sales growth for the first time since 2014.

The company reported 2018 holiday sales results were lower than expected due to two events: A fire at its West Virginia facility caused merchandise to be unavailable during Cyber Week, and the company limited its pre-Christmas “earn and redeem” event to Star Rewards loyalty members only, which management speculated may have dampened sales.

For the fourth quarter, Macy’s reported strength in fragrances, skincare, women's shoes, activewear, fine jewelry, men's tailored clothing and furniture. The company reported disappointing performances in women's sportswear, handbags and color cosmetics. By region, the South, Southwest and Midwest were the strongest.

By brand, Bloomingdale’s saw double-digit sales growth online and an improved trend in stores' performance. The company reported its Bloomingdale’s flagship store in NYC had its best year since 2013.

Bluemercury’s total sales were up double digits and the company opened 26 new stand-alone stores over the year. Online sales increased more than 50%. The company is continuing to expand its proprietary brands Lune+Aster and M-61, which account for more than 10% of Bluemercury’s total sales.

At Macy’s the company provided an update on its 2018 Strategic Update of its North Star Strategy covering its five key strategic initiatives. The highlights include:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Macy’s reported 4Q18 revenues of $8.46 billion, down 2.5% year over year and beating the consensus estimate of $8.44 billion. The company reported 4Q18 EPS, excluding special items, of $2.73, down 4.2% from the year ago period but beating the consensus estimate of $2.53.

For the full year, the company reported $24.97 billion in revenue, up 0.1% from the year ago of $24.93 billion.

The company saw comparable sales growth of 0.4% on an owned basis, and 0.7% on an owned plus licensed basis. The company had its fifth consecutive quarter of positive comp sales and achieved a full year of positive comparable sales growth for the first time since 2014.

The company reported 2018 holiday sales results were lower than expected due to two events: A fire at its West Virginia facility caused merchandise to be unavailable during Cyber Week, and the company limited its pre-Christmas “earn and redeem” event to Star Rewards loyalty members only, which management speculated may have dampened sales.

For the fourth quarter, Macy’s reported strength in fragrances, skincare, women's shoes, activewear, fine jewelry, men's tailored clothing and furniture. The company reported disappointing performances in women's sportswear, handbags and color cosmetics. By region, the South, Southwest and Midwest were the strongest.

By brand, Bloomingdale’s saw double-digit sales growth online and an improved trend in stores' performance. The company reported its Bloomingdale’s flagship store in NYC had its best year since 2013.

Bluemercury’s total sales were up double digits and the company opened 26 new stand-alone stores over the year. Online sales increased more than 50%. The company is continuing to expand its proprietary brands Lune+Aster and M-61, which account for more than 10% of Bluemercury’s total sales.

At Macy’s the company provided an update on its 2018 Strategic Update of its North Star Strategy covering its five key strategic initiatives. The highlights include:

- Loyalty: Macy’s improved its Macy’s Star Rewards member loyalty program, which it says helped drive up platinum loyalty spending 10%. Management reported Platinum customers generate nearly 30% of the company’s sales. The company aslo launched a -neutral option as part of its loyalty program, which added three million new members.

- Backstage: The company opened 120 new Backstage locations within its stores. Macy’s reports that total store sales increased more than 5% in locations with a Backstage store within a store. Furthermore, approximately 15% of its customers shop at Backstage and the main store, and Backstage stores that have been open for one year are experiencing double-digit comp growth. In 2019, the company reported it plans to add backstage locations to 45 more Macy’s stores.

- Store Pickup: The company expanded “Buy Online Pickup in Store” (BOPIS), launched a “Buy Online Ship to Store” (BOSS) feature, and built "At Your Service" centers in all of its stores. Macy’s reported approximately 7% of online sales are picked up in stores and store pickup nearly doubled during the holiday season.

- Vendor Direct: Expanded vendor direct program on macys.com, nearly doubling online SKUs. The company reported that approximately 10% of online sales are attributable to Vendor Direct. In 2019, the company plans to continue its aggressive expansion of vendors and SKUs.

- Growth50: Macy’s reported it implemented its growth investment model in 50 Macy's stores, which includes a mix of size and geography with upgrades including facilities, fixtures, assortment and customer service. Management reported these stores outperformed Macy’s overall fleet for sales growth in fiscal 2018 and achieved higher customer retention and brand attachment scores. In 2019, the compnay reported it plans to expand its growth investment strategy to another 100 stores.

- Mobile: The company plans to enhance the Macy’s mobile app with new features and functions.

- Destination Businesses: Macy’s plans to invest in areas in which the company already has strong market share to drive growth in areas including dresses, fine jewelry, big ticket items, men’s tailored, women's shoes and beauty.