albert Chan

[caption id="attachment_94716" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

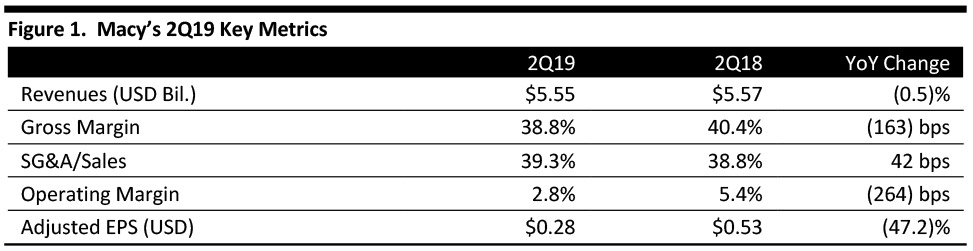

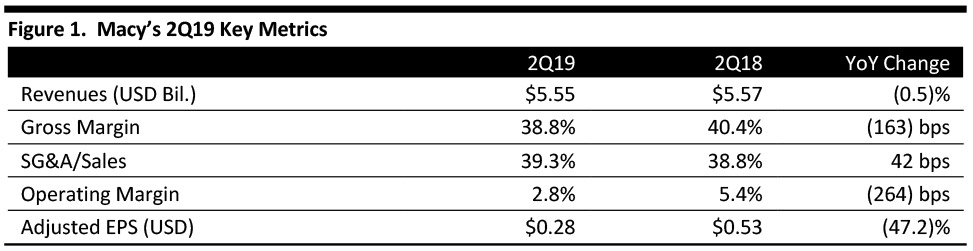

Macy’s fiscal 2Q19 revenues were $5.55 billion, down 0.5% year over year and even with the consensus estimate. The company reported 2Q19 adjusted EPS of $0.28, down 47.2% from the year-ago period and lower than the consensus estimate of $0.46.

The company saw comparable sales growth of 0.2% on an owned basis compared to the consensus estimate of 0.4%, and 0.3% on an owned plus licensed basis, even with the consensus estimate.

The company reported that its earnings per share was below expectation due to the following contributing factors: elevated spring inventory and lower customer demand for fashion in key women’s sportswear private brands which resulted in markdowns. The company also reported international tourism business was down.

Management reported that while it experienced seasonal inventory challenges in the second quarter, its brick-and-mortar stores are performing well – led by its Growth50 and Backstage concepts. Specifically, the company reiterated that it is expanding its Growth50 store improvement concept to 100 more stores which it expects will be completed ahead of the holiday season – totaling 150 stores in its portfolio. These stores will comprise approximately 50% of Macy’s brick-and-mortar sales, and management said it expects to see strong performance from these stores because its customer engagement in its Growth50 stores is much higher than its other stores.

In 2019, Macy’s is expanding Backstage, its off-price “locations,” to an additional 50 stores, with 47 of them already complete. The company has more than 200 Backstage shops within a Macy's, and Backstage locations within Macy's stores that have been open for more than 12 months have comped in the mid-single digits.

In August, Macy’s began a pilot with ThredUp, the world's largest fashion resale marketplace in 40 Macy's stores across the country. As today’s consumer is interested in sustainability and shopping fashion and resale, management emphasized that the partnership gives the company an opportunity to reach a new customer and also keep them coming back to shop an ever-changing selection of styles and brands that the company does not typically carry.

The company also launched My List at Bloomingdales, a fashion rental service. The learnings from Bloomingdale's may lead to the development of a similar rental service at Macy's in the near future.

Outlook

For FY19, management lowered its EPS guidance to $2.85-3.05 from $3.05-3.25 and compared to the consensus estimate of $3.05. The company said that its revised EPS guidance does not reflect the fourth tranche of tariffs on goods from China and management continues to evaluate the tariff details and is working with its vendor partners and suppliers in China to help to mitigate the potential impact.

The company reaffirmed flat net sales growth guidance and said it anticipates comparable sales growth of flat to 1% for owned stores and owned and licensed stores.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Macy’s fiscal 2Q19 revenues were $5.55 billion, down 0.5% year over year and even with the consensus estimate. The company reported 2Q19 adjusted EPS of $0.28, down 47.2% from the year-ago period and lower than the consensus estimate of $0.46.

The company saw comparable sales growth of 0.2% on an owned basis compared to the consensus estimate of 0.4%, and 0.3% on an owned plus licensed basis, even with the consensus estimate.

The company reported that its earnings per share was below expectation due to the following contributing factors: elevated spring inventory and lower customer demand for fashion in key women’s sportswear private brands which resulted in markdowns. The company also reported international tourism business was down.

Management reported that while it experienced seasonal inventory challenges in the second quarter, its brick-and-mortar stores are performing well – led by its Growth50 and Backstage concepts. Specifically, the company reiterated that it is expanding its Growth50 store improvement concept to 100 more stores which it expects will be completed ahead of the holiday season – totaling 150 stores in its portfolio. These stores will comprise approximately 50% of Macy’s brick-and-mortar sales, and management said it expects to see strong performance from these stores because its customer engagement in its Growth50 stores is much higher than its other stores.

In 2019, Macy’s is expanding Backstage, its off-price “locations,” to an additional 50 stores, with 47 of them already complete. The company has more than 200 Backstage shops within a Macy's, and Backstage locations within Macy's stores that have been open for more than 12 months have comped in the mid-single digits.

In August, Macy’s began a pilot with ThredUp, the world's largest fashion resale marketplace in 40 Macy's stores across the country. As today’s consumer is interested in sustainability and shopping fashion and resale, management emphasized that the partnership gives the company an opportunity to reach a new customer and also keep them coming back to shop an ever-changing selection of styles and brands that the company does not typically carry.

The company also launched My List at Bloomingdales, a fashion rental service. The learnings from Bloomingdale's may lead to the development of a similar rental service at Macy's in the near future.

Outlook

For FY19, management lowered its EPS guidance to $2.85-3.05 from $3.05-3.25 and compared to the consensus estimate of $3.05. The company said that its revised EPS guidance does not reflect the fourth tranche of tariffs on goods from China and management continues to evaluate the tariff details and is working with its vendor partners and suppliers in China to help to mitigate the potential impact.

The company reaffirmed flat net sales growth guidance and said it anticipates comparable sales growth of flat to 1% for owned stores and owned and licensed stores.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Macy’s fiscal 2Q19 revenues were $5.55 billion, down 0.5% year over year and even with the consensus estimate. The company reported 2Q19 adjusted EPS of $0.28, down 47.2% from the year-ago period and lower than the consensus estimate of $0.46.

The company saw comparable sales growth of 0.2% on an owned basis compared to the consensus estimate of 0.4%, and 0.3% on an owned plus licensed basis, even with the consensus estimate.

The company reported that its earnings per share was below expectation due to the following contributing factors: elevated spring inventory and lower customer demand for fashion in key women’s sportswear private brands which resulted in markdowns. The company also reported international tourism business was down.

Management reported that while it experienced seasonal inventory challenges in the second quarter, its brick-and-mortar stores are performing well – led by its Growth50 and Backstage concepts. Specifically, the company reiterated that it is expanding its Growth50 store improvement concept to 100 more stores which it expects will be completed ahead of the holiday season – totaling 150 stores in its portfolio. These stores will comprise approximately 50% of Macy’s brick-and-mortar sales, and management said it expects to see strong performance from these stores because its customer engagement in its Growth50 stores is much higher than its other stores.

In 2019, Macy’s is expanding Backstage, its off-price “locations,” to an additional 50 stores, with 47 of them already complete. The company has more than 200 Backstage shops within a Macy's, and Backstage locations within Macy's stores that have been open for more than 12 months have comped in the mid-single digits.

In August, Macy’s began a pilot with ThredUp, the world's largest fashion resale marketplace in 40 Macy's stores across the country. As today’s consumer is interested in sustainability and shopping fashion and resale, management emphasized that the partnership gives the company an opportunity to reach a new customer and also keep them coming back to shop an ever-changing selection of styles and brands that the company does not typically carry.

The company also launched My List at Bloomingdales, a fashion rental service. The learnings from Bloomingdale's may lead to the development of a similar rental service at Macy's in the near future.

Outlook

For FY19, management lowered its EPS guidance to $2.85-3.05 from $3.05-3.25 and compared to the consensus estimate of $3.05. The company said that its revised EPS guidance does not reflect the fourth tranche of tariffs on goods from China and management continues to evaluate the tariff details and is working with its vendor partners and suppliers in China to help to mitigate the potential impact.

The company reaffirmed flat net sales growth guidance and said it anticipates comparable sales growth of flat to 1% for owned stores and owned and licensed stores.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Macy’s fiscal 2Q19 revenues were $5.55 billion, down 0.5% year over year and even with the consensus estimate. The company reported 2Q19 adjusted EPS of $0.28, down 47.2% from the year-ago period and lower than the consensus estimate of $0.46.

The company saw comparable sales growth of 0.2% on an owned basis compared to the consensus estimate of 0.4%, and 0.3% on an owned plus licensed basis, even with the consensus estimate.

The company reported that its earnings per share was below expectation due to the following contributing factors: elevated spring inventory and lower customer demand for fashion in key women’s sportswear private brands which resulted in markdowns. The company also reported international tourism business was down.

Management reported that while it experienced seasonal inventory challenges in the second quarter, its brick-and-mortar stores are performing well – led by its Growth50 and Backstage concepts. Specifically, the company reiterated that it is expanding its Growth50 store improvement concept to 100 more stores which it expects will be completed ahead of the holiday season – totaling 150 stores in its portfolio. These stores will comprise approximately 50% of Macy’s brick-and-mortar sales, and management said it expects to see strong performance from these stores because its customer engagement in its Growth50 stores is much higher than its other stores.

In 2019, Macy’s is expanding Backstage, its off-price “locations,” to an additional 50 stores, with 47 of them already complete. The company has more than 200 Backstage shops within a Macy's, and Backstage locations within Macy's stores that have been open for more than 12 months have comped in the mid-single digits.

In August, Macy’s began a pilot with ThredUp, the world's largest fashion resale marketplace in 40 Macy's stores across the country. As today’s consumer is interested in sustainability and shopping fashion and resale, management emphasized that the partnership gives the company an opportunity to reach a new customer and also keep them coming back to shop an ever-changing selection of styles and brands that the company does not typically carry.

The company also launched My List at Bloomingdales, a fashion rental service. The learnings from Bloomingdale's may lead to the development of a similar rental service at Macy's in the near future.

Outlook

For FY19, management lowered its EPS guidance to $2.85-3.05 from $3.05-3.25 and compared to the consensus estimate of $3.05. The company said that its revised EPS guidance does not reflect the fourth tranche of tariffs on goods from China and management continues to evaluate the tariff details and is working with its vendor partners and suppliers in China to help to mitigate the potential impact.

The company reaffirmed flat net sales growth guidance and said it anticipates comparable sales growth of flat to 1% for owned stores and owned and licensed stores.