DIpil Das

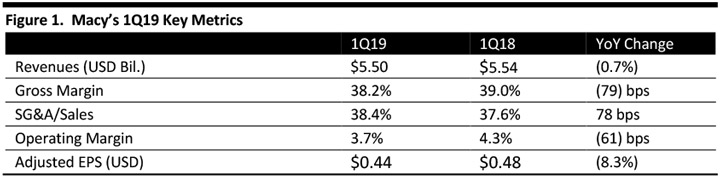

[caption id="attachment_87998" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Macy’s reported 1Q19 revenues of $5.50 billion, down 0.7% year over year and just below the consensus estimate of $5.53 billion. The company reported 1Q19 adjusted EPS of $0.44, excluding special items, down 8.3% from the year ago period but beating the consensus estimate of $0.33.

The company saw comparable sales growth of 0.6% on an owned basis, and 0.7% on an owned plus licensed basis. This is the sixth consecutive quarter of comparable sales growth.

The company reported that each of its brands, Macy's, Bloomingdale's and Bluemercury, performed to expectations. The total number of transactions was up 5.7% in the quarter, while average units per transaction were down 2.2%, as Macy’s reported its Platinum customers continued to spend more in total but purchased fewer units in multiple transactions.

Bloomingdale's flagship store on 59th Street benefitted from renovations in its shoe departments, ready-to-wear, and beauty, completed last year. Bloomingdale's The Outlet had strong performance in the quarter.

Management said Bluemercury brand had a strong quarter in specialty stores, shops within Macy's and on Bluemercury.com. Its proprietary brand, M61, continued to be an important growth driver, increasing penetration in total sales in the quarter.

The company reported continued improvement in its brick-and-mortar business led by Growth 50 stores, which outperformed the rest of its store fleet. In the first quarter, Macy’s saw significant sales contribution from Backstage, Macy’s off-price in-store option, which it expanded to 120 stores in 2018 for a total of 170 Backstage locations in Macy's stores. The company reported it plans to expand Backstage to another 50 Macy’s stores. Management said that it is “getting better at off-price every day.”

Management said combined, its buy online pickup in store (BOPIS) and buy online ship to store account for 10% of digital demand, up from 3.5% a year ago. Macy’s has “At Your Service” centers at each of each store for customers to pick up packages.

The company reported that its e-commerce business delivered double-digit growth, with its expanded vendor direct program contributing to growth. With vendor direct, third-party brands fulfill orders and ship directly to customers. Macy’s said it plans to add one million SKUs to the program in 2019. Management highlighted that mobile remains its fastest-growing sales channel.

Macy’s acquired Story in April 2018 and opened in 36 locations in 15 states on the same day. Story is a retail concept that takes the point of view of a magazine, changes like a gallery and has a unique merchandising approach. Each Story at Macy's has a robust events calendar and community outreach plan that has a new theme and merchandise every 10 to 15 weeks. Management said customer response has been positive and that Story gives new customers a reason to visit the stores and current customers a reason to come back to see what's new.

Outlook

For FY19 management said the company anticipates comparable sales of flat to up 1% for both its owned stores and owned and licensed stores. The company expects net sales to be approximately flat, and diluted earnings per share to be $3.05-3.25, compared to consensus of $3.10.

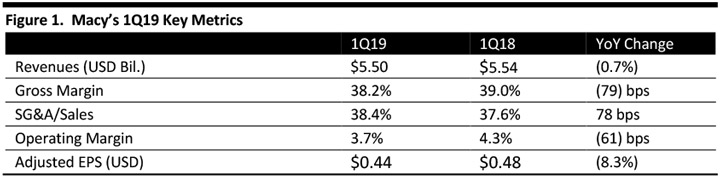

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Macy’s reported 1Q19 revenues of $5.50 billion, down 0.7% year over year and just below the consensus estimate of $5.53 billion. The company reported 1Q19 adjusted EPS of $0.44, excluding special items, down 8.3% from the year ago period but beating the consensus estimate of $0.33.

The company saw comparable sales growth of 0.6% on an owned basis, and 0.7% on an owned plus licensed basis. This is the sixth consecutive quarter of comparable sales growth.

The company reported that each of its brands, Macy's, Bloomingdale's and Bluemercury, performed to expectations. The total number of transactions was up 5.7% in the quarter, while average units per transaction were down 2.2%, as Macy’s reported its Platinum customers continued to spend more in total but purchased fewer units in multiple transactions.

Bloomingdale's flagship store on 59th Street benefitted from renovations in its shoe departments, ready-to-wear, and beauty, completed last year. Bloomingdale's The Outlet had strong performance in the quarter.

Management said Bluemercury brand had a strong quarter in specialty stores, shops within Macy's and on Bluemercury.com. Its proprietary brand, M61, continued to be an important growth driver, increasing penetration in total sales in the quarter.

The company reported continued improvement in its brick-and-mortar business led by Growth 50 stores, which outperformed the rest of its store fleet. In the first quarter, Macy’s saw significant sales contribution from Backstage, Macy’s off-price in-store option, which it expanded to 120 stores in 2018 for a total of 170 Backstage locations in Macy's stores. The company reported it plans to expand Backstage to another 50 Macy’s stores. Management said that it is “getting better at off-price every day.”

Management said combined, its buy online pickup in store (BOPIS) and buy online ship to store account for 10% of digital demand, up from 3.5% a year ago. Macy’s has “At Your Service” centers at each of each store for customers to pick up packages.

The company reported that its e-commerce business delivered double-digit growth, with its expanded vendor direct program contributing to growth. With vendor direct, third-party brands fulfill orders and ship directly to customers. Macy’s said it plans to add one million SKUs to the program in 2019. Management highlighted that mobile remains its fastest-growing sales channel.

Macy’s acquired Story in April 2018 and opened in 36 locations in 15 states on the same day. Story is a retail concept that takes the point of view of a magazine, changes like a gallery and has a unique merchandising approach. Each Story at Macy's has a robust events calendar and community outreach plan that has a new theme and merchandise every 10 to 15 weeks. Management said customer response has been positive and that Story gives new customers a reason to visit the stores and current customers a reason to come back to see what's new.

Outlook

For FY19 management said the company anticipates comparable sales of flat to up 1% for both its owned stores and owned and licensed stores. The company expects net sales to be approximately flat, and diluted earnings per share to be $3.05-3.25, compared to consensus of $3.10.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Macy’s reported 1Q19 revenues of $5.50 billion, down 0.7% year over year and just below the consensus estimate of $5.53 billion. The company reported 1Q19 adjusted EPS of $0.44, excluding special items, down 8.3% from the year ago period but beating the consensus estimate of $0.33.

The company saw comparable sales growth of 0.6% on an owned basis, and 0.7% on an owned plus licensed basis. This is the sixth consecutive quarter of comparable sales growth.

The company reported that each of its brands, Macy's, Bloomingdale's and Bluemercury, performed to expectations. The total number of transactions was up 5.7% in the quarter, while average units per transaction were down 2.2%, as Macy’s reported its Platinum customers continued to spend more in total but purchased fewer units in multiple transactions.

Bloomingdale's flagship store on 59th Street benefitted from renovations in its shoe departments, ready-to-wear, and beauty, completed last year. Bloomingdale's The Outlet had strong performance in the quarter.

Management said Bluemercury brand had a strong quarter in specialty stores, shops within Macy's and on Bluemercury.com. Its proprietary brand, M61, continued to be an important growth driver, increasing penetration in total sales in the quarter.

The company reported continued improvement in its brick-and-mortar business led by Growth 50 stores, which outperformed the rest of its store fleet. In the first quarter, Macy’s saw significant sales contribution from Backstage, Macy’s off-price in-store option, which it expanded to 120 stores in 2018 for a total of 170 Backstage locations in Macy's stores. The company reported it plans to expand Backstage to another 50 Macy’s stores. Management said that it is “getting better at off-price every day.”

Management said combined, its buy online pickup in store (BOPIS) and buy online ship to store account for 10% of digital demand, up from 3.5% a year ago. Macy’s has “At Your Service” centers at each of each store for customers to pick up packages.

The company reported that its e-commerce business delivered double-digit growth, with its expanded vendor direct program contributing to growth. With vendor direct, third-party brands fulfill orders and ship directly to customers. Macy’s said it plans to add one million SKUs to the program in 2019. Management highlighted that mobile remains its fastest-growing sales channel.

Macy’s acquired Story in April 2018 and opened in 36 locations in 15 states on the same day. Story is a retail concept that takes the point of view of a magazine, changes like a gallery and has a unique merchandising approach. Each Story at Macy's has a robust events calendar and community outreach plan that has a new theme and merchandise every 10 to 15 weeks. Management said customer response has been positive and that Story gives new customers a reason to visit the stores and current customers a reason to come back to see what's new.

Outlook

For FY19 management said the company anticipates comparable sales of flat to up 1% for both its owned stores and owned and licensed stores. The company expects net sales to be approximately flat, and diluted earnings per share to be $3.05-3.25, compared to consensus of $3.10.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Macy’s reported 1Q19 revenues of $5.50 billion, down 0.7% year over year and just below the consensus estimate of $5.53 billion. The company reported 1Q19 adjusted EPS of $0.44, excluding special items, down 8.3% from the year ago period but beating the consensus estimate of $0.33.

The company saw comparable sales growth of 0.6% on an owned basis, and 0.7% on an owned plus licensed basis. This is the sixth consecutive quarter of comparable sales growth.

The company reported that each of its brands, Macy's, Bloomingdale's and Bluemercury, performed to expectations. The total number of transactions was up 5.7% in the quarter, while average units per transaction were down 2.2%, as Macy’s reported its Platinum customers continued to spend more in total but purchased fewer units in multiple transactions.

Bloomingdale's flagship store on 59th Street benefitted from renovations in its shoe departments, ready-to-wear, and beauty, completed last year. Bloomingdale's The Outlet had strong performance in the quarter.

Management said Bluemercury brand had a strong quarter in specialty stores, shops within Macy's and on Bluemercury.com. Its proprietary brand, M61, continued to be an important growth driver, increasing penetration in total sales in the quarter.

The company reported continued improvement in its brick-and-mortar business led by Growth 50 stores, which outperformed the rest of its store fleet. In the first quarter, Macy’s saw significant sales contribution from Backstage, Macy’s off-price in-store option, which it expanded to 120 stores in 2018 for a total of 170 Backstage locations in Macy's stores. The company reported it plans to expand Backstage to another 50 Macy’s stores. Management said that it is “getting better at off-price every day.”

Management said combined, its buy online pickup in store (BOPIS) and buy online ship to store account for 10% of digital demand, up from 3.5% a year ago. Macy’s has “At Your Service” centers at each of each store for customers to pick up packages.

The company reported that its e-commerce business delivered double-digit growth, with its expanded vendor direct program contributing to growth. With vendor direct, third-party brands fulfill orders and ship directly to customers. Macy’s said it plans to add one million SKUs to the program in 2019. Management highlighted that mobile remains its fastest-growing sales channel.

Macy’s acquired Story in April 2018 and opened in 36 locations in 15 states on the same day. Story is a retail concept that takes the point of view of a magazine, changes like a gallery and has a unique merchandising approach. Each Story at Macy's has a robust events calendar and community outreach plan that has a new theme and merchandise every 10 to 15 weeks. Management said customer response has been positive and that Story gives new customers a reason to visit the stores and current customers a reason to come back to see what's new.

Outlook

For FY19 management said the company anticipates comparable sales of flat to up 1% for both its owned stores and owned and licensed stores. The company expects net sales to be approximately flat, and diluted earnings per share to be $3.05-3.25, compared to consensus of $3.10.