Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

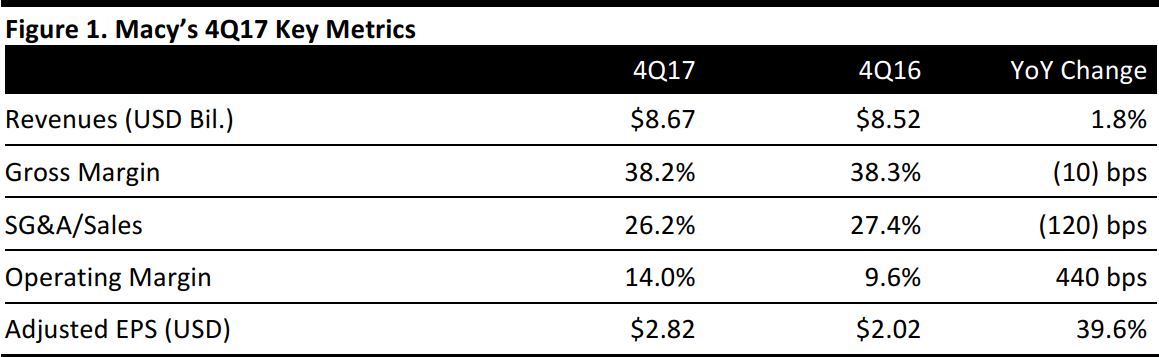

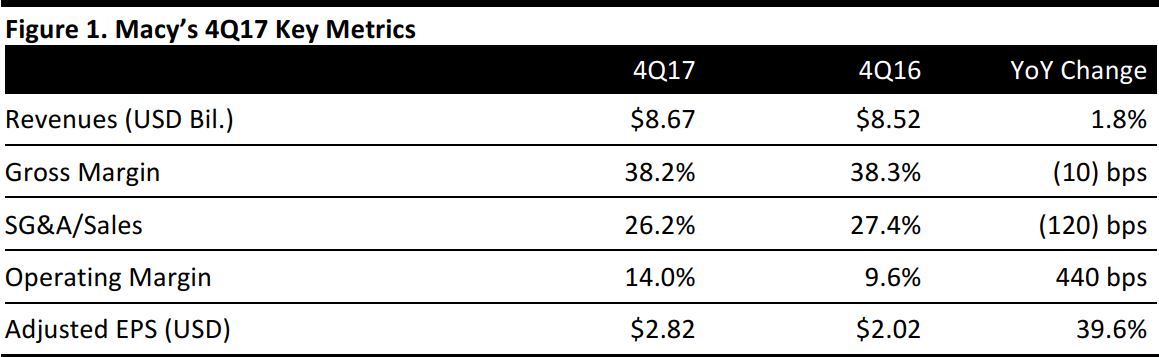

4Q17 Results

Macy’s reported 4Q17 revenues of $8.67 billion, up 1.8% and roughly in line with the consensus estimate. Adjusted EPS was $2.82, beating the $2.67 consensus estimate and up from $2.02 in the year-ago quarter.

Comp sales were up 1.3% on an owned basis, versus the 0.4% consensus estimate, and were up 1.4% on an owned-plus-licensed basis.

Management was pleased with the momentum in 4Q17 and with the company’s promotional cadence and inventory position. Macy’s saw an improving trend in its physical store operations and continued growth in its e-commerce business. The company’s digital business recorded its 34th quarter of double-digit growth.

The strongest-performing categories included fragrances, dresses, fine jewelry, men’s tailored clothing, coats, children’s, shoes and home textiles. The juniors category underperformed. Macy’s saw some improvement in beauty, handbags and housewares. Sales from tourists declined year over year, but improved versus the third quarter.

FY17 Results

Macy’s reported full-year revenues of $24.8 billion, down 3.7% year over year. Adjusted EPS for the year was $3.77, versus $3.11 in the previous year. Comp sales for the year were down 2.2% on an owned basis and down 1.9% on an owned-plus-licensed basis.

Outlook

Management provided the following guidance for 2018:

- Comp growth of flat to up 1% on both an owned and owned-plus-licensed basis.

- A decline in total sales of 0.5%–2% year over year.

- Adjusted EPS of $3.55–$3.75, compared with the consensus estimate of $3.18.

Management expects the second half of the year to be better than the first half of the year as the company rolls out various strategic initiatives.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research