Source: Company reports/Fung Global Retail & Technology

4Q16 Results

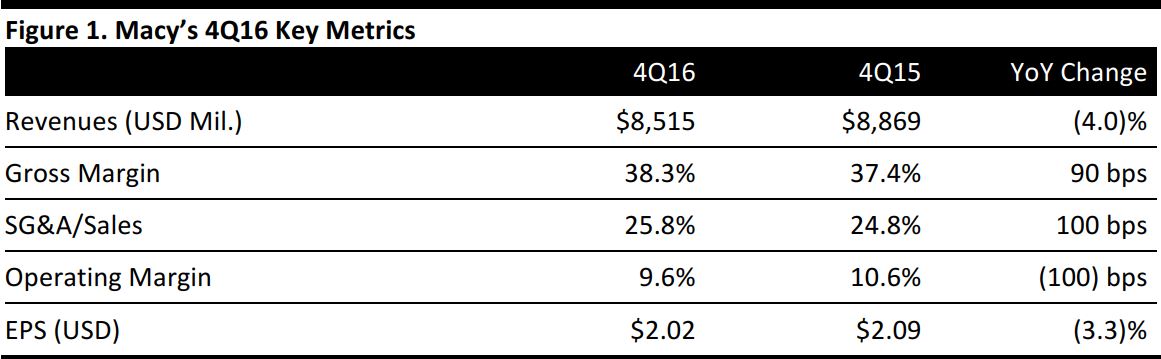

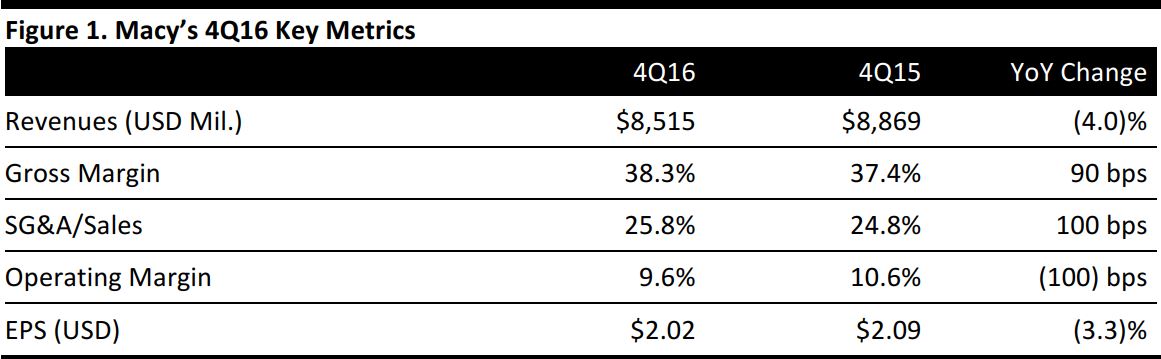

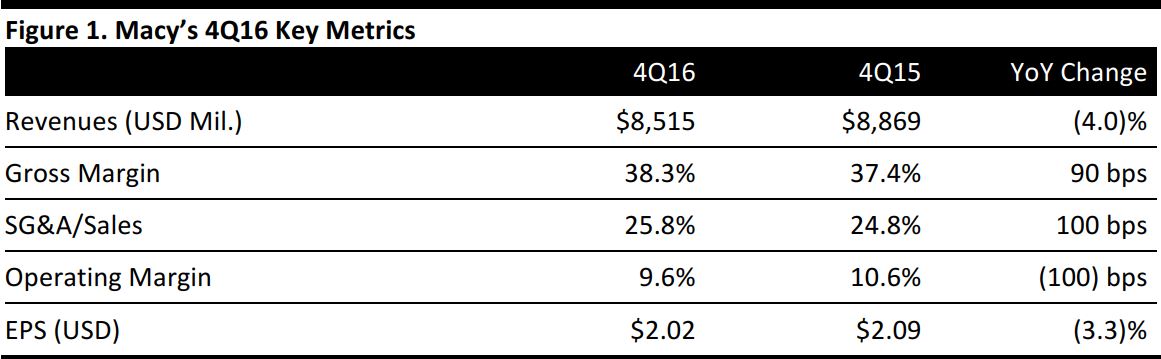

Macy’s reported 4Q16 total revenues of $8.5 billion, down 4% from 4Q15 and missing the consensus estimate of $8.6 billion. EPS was $2.02, beating the consensus estimate of $1.95. Comparable sales declined by 2.7% for the quarter. On an owned-plus-licensed basis, comps were down 2.1%.

Management acknowledged the difficulties the company experienced in 2016, but highlighted positive initiatives in fine jewelry, women’s shoes and private label categories.

The company continued to readjust its physical store footprint. Real estate transactions in 2016 generated $673 million in cash, which will help fund some of the adjustments in the business. Management also announced plans to continue to harvest real estate value opportunistically, closing less productive stores and selling the associated real estate. For example, the company has completed the sale of its Union Square Men’s building in San Francisco for $250 million in gross proceeds. In addition, Macy’s is exploring ways to improve its Herald Square store location in New York City. It is working with Brookfield Asset Management on about 50 identified assets for redevelopment.

Regarding its previously announced CEO transition, Macy’s noted that Jeff Gennette, President of Macy’s, will assume the CEO role. Terry Lundgren will continue as Executive Chairman of Macy’s.

2016 Results

Total sales for FY16 were $25.8 billion, down 4.8% from $27.0 billion the previous year. On an owned basis, comps were down 3.5% from 2015. On an owned-plus-licensed basis, full-year comps declined by 2.9%.

2017 Outlook

In FY17, the company expects comp sales to decline by 2.2%–2.3% and comps on an owned-plus-licensed basis to decline by 2%–3%. Total sales are expected to decline by 3.2%–4.3%, reflecting the 66 stores closed in 2016. EPS is expected to be $2.90–$3.15 versus the consensus estimate of $3.17. Capital expenditures are expected to be $900 million.

Regarding its real estate adjustments, the company announced plans to open new Macy’s stores in two locations, as well as 30 new Bluemercury locations and 30 Macy’s Backstage locations. The company is planning several international store openings, including a new Bloomingdale’s in Kuwait in spring 2017 and a new Macy’s and a new Bloomingdale’s in Abu Dhabi, UAE, in 2018.