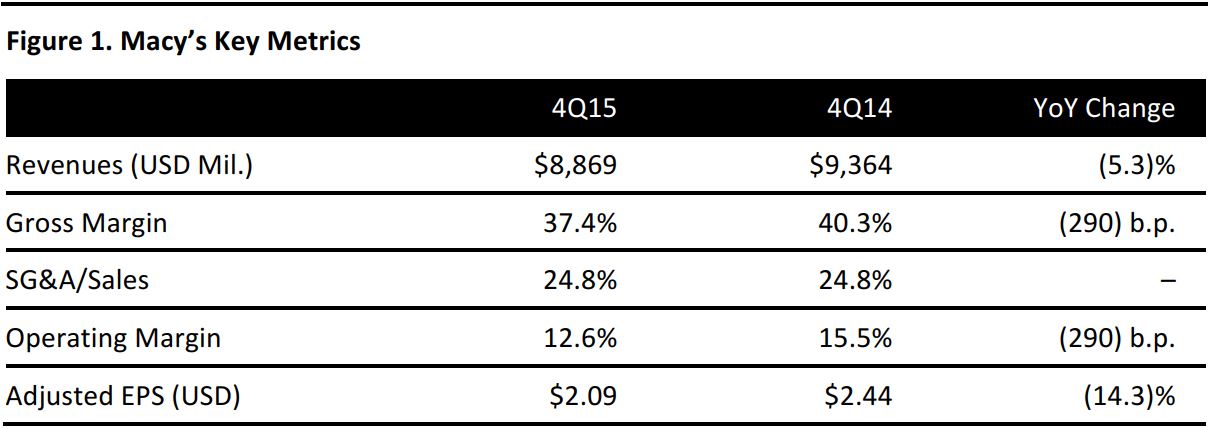

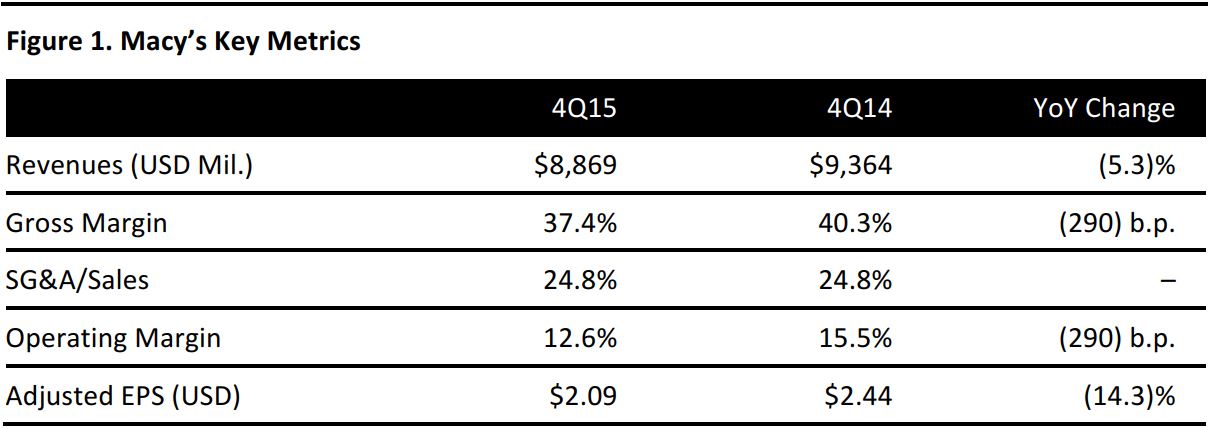

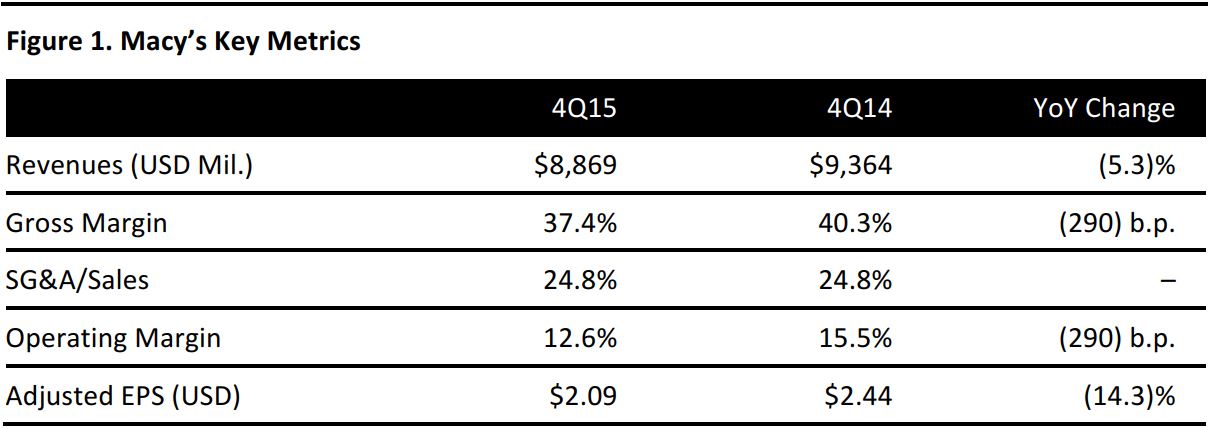

Source: Company reports

Macy’s reported 4Q15 EPS of $2.09, excluding items, versus the consensus estimate of $1.89.

Total revenue was $8.87 billion versus consensus of $8.83 billion. Comps were down 4.8% on an owned basis and down 4.3% on an owned and licensed basis. Sales trends improved in January as the weather turned colder in the Northern region.

Inventories were up 1.6% at the end of the year, at $5.5 billion. Sales declined by 5.3% in the fourth quarter but were up 0.7% on a comp basis.

In FY15, the company opened 26 stores and closed 40 stores. New stores included a Macy’s in Ponce, Puerto Rico;a Bloomingdale’s in Honolulu, Hawaii; 15 Bluemercury stores; six Macy’s Backstage stores; and three Bloomingdale’s Outlets.

FY16 guidance calls for EPS of $3.80–$3.90 versus expectations of $3.90. That is based on a 2% decline in total revenue, implying total revenues of $26.54 billion versus consensus of $26.48 billion. Comps on an owned and licensed basis are expected to decline by 1%, while comps on an owned basis are expected to be down 50basis points. Capital expenditures are planned to be $900 million compared to $1.1 billion in the prior year.