Source: Company reports/FGRT

3Q17 Results

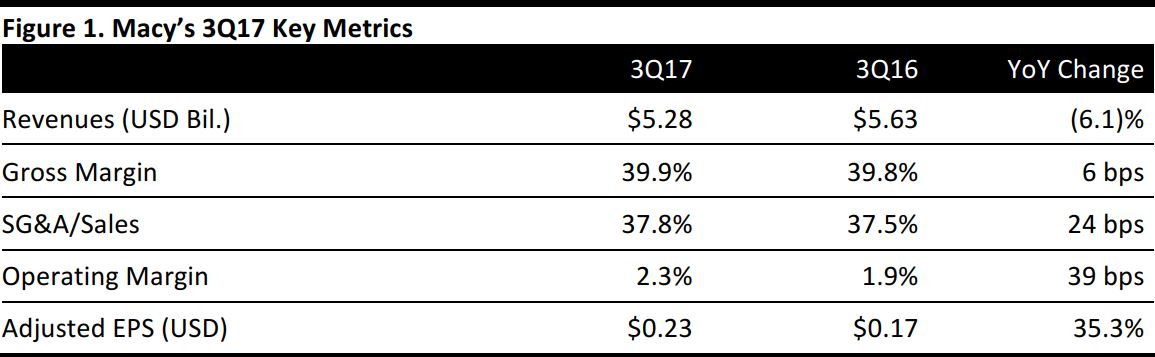

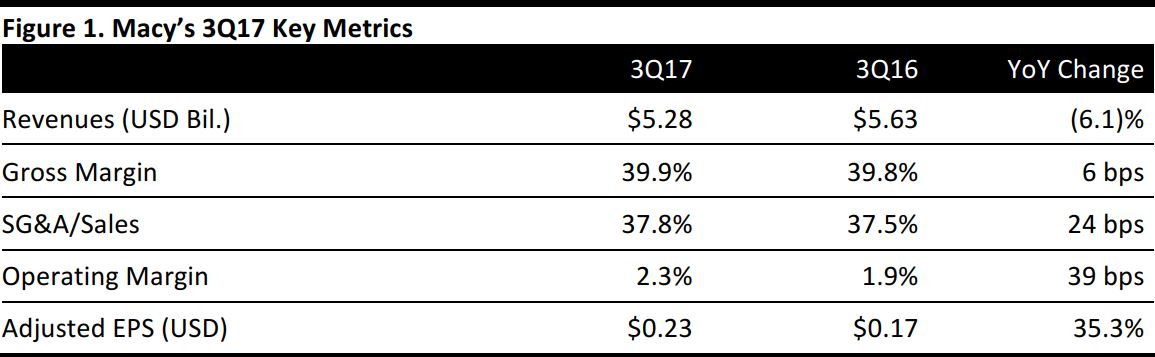

Macy’s reported 3Q17 revenues of $5.28 billion, down 6.1% and roughly in line with the $5.31 billion consensus estimate. The quarter was the 11th in a row that the company has seen sales decline.

Adjusted EPS was $0.23, beating the $0.19 consensus estimate and up 35.3% year over year. The figure includes a $0.11 benefit from the pretax impact of restructuring and other costs and a $0.07 benefit from the pretax impact of settlement charges, offsetting a $0.07 charge for the tax effect of these items. GAAP EPS was $0.12, up from $0.05 in the year-ago period.

Details from the Quarter

Management lauded its gross-margin increase, which resulted from holding tighter inventory, positive reactions to the launch of the new Macy’s Star Rewards loyalty program, double-digit growth in e-commerce sales and the potential of the Backstage format in Macy’s stores.

Key points from the quarter include:

- E-commerce posted double-digit growth in the quarter, and management expects a sales lift of 100–150 basis points in 4Q17, driven by increased penetration in digital sales.

- One goal of the revamped loyalty program is to target the best customers, who represent about 10% of the company’s sales.

- Management lauded its successes in cost management and its continued progress on the organizational side. The company is seeing benefits from its previously announced merchandising restructuring, which aims to combine three organizations into one.

- New President Hal Lawton joined the company in mid-September and he has technology and digital expertise within retail.

- The recent hurricanes hurt sales by $20 million (or 30 basis points) and the warm fall weather hurt sales of cold-weather items by $50 million.

- The digital business has posted 33 sequential quarters of double-digit growth.

- The strongest categories were fragrances, fine jewelry, dresses, men’s tailored clothing, active and shoes excluding boots. Trends improved for handbags and cosmetics.

- The weakest categories were cold-weather products, including coats, boots and winter accessories.

- Sales were softer in the home-related businesses at Macy’s during the quarter, but they improved significantly in October.

- Sales at Bloomingdale’s were stronger than at Macy’s, particularly in the home categories. Bluemercury also had a good quarter.

- Sales were relatively similar across the US, other than in the hurricane-affected areas.

- The average number of transactions decreased by 7.3%. Average units per transaction increased by 1% and the average unit retail transaction size increased by 2.9%, largely due to lower levels of clearance activity.

- Inventory was down 6.9% and was down 4.2% on a comparable basis.

- Proprietary credit-card penetration was 47.4%, down 110 basis points from the year-ago quarter. However, the trend improved to only 70 basis points below 3Q16 and October 2016 after the launch of the new Star Rewards loyalty program.

Outlook

Management reiterated its prior guidance for FY17:

- The company expects comparable sales on an owned basis to decline by 2.2%–3.3% and comparable sales on an owned-plus-licensed basis to decline by 2.0%–3.0%.

- The company expects total sales to decline by 3.2%–4.3%, reflecting a 53rd week (comparable sales are measured on a 52-week basis).

- The company expects adjusted EPS of $3.37–$3.62, compared with the consensus estimate of $3.32.