Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

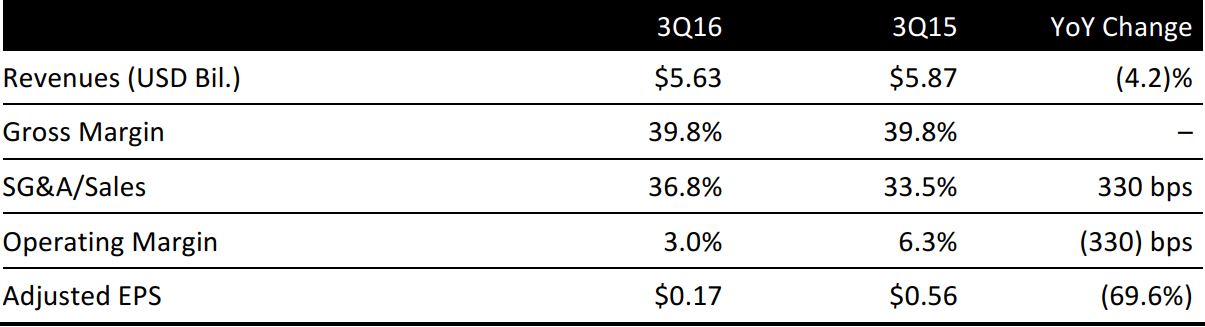

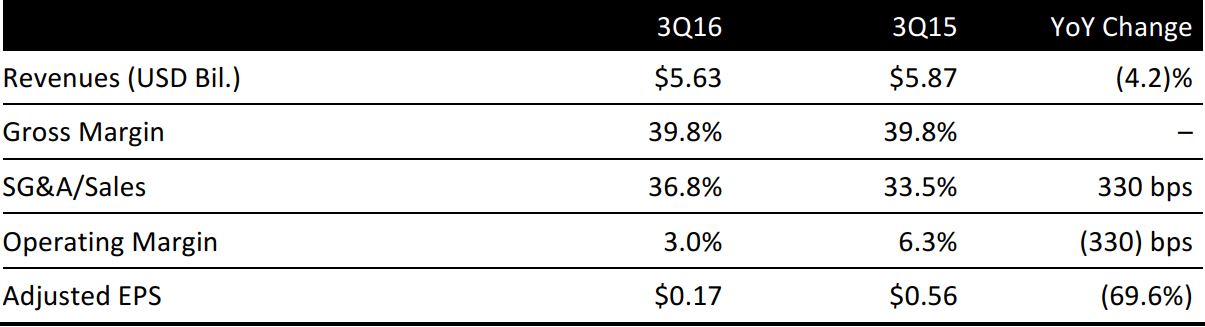

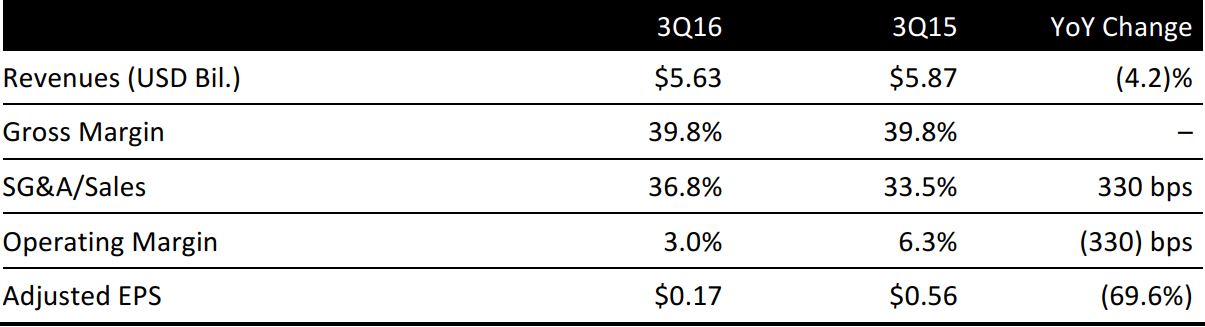

Macy’s reported adjusted 3Q16 EPS of $0.17 versus the consensus estimate of $0.41. The miss was driven by SG&A expenses.

Total revenues were $5.63 billion, inline with analysts’ expectations. Comparable-store sales declined by 3.3% on an owned basis and by 2.7% on an owned-plus-licensed basis. The difference between the change in total and comparable-store sales was driven by the closing of 41 underperforming Macy’s stores at the end of fiscal year 2015.

2016 OUTLOOK

Management reaffirmed its full-year EPS guidance of $3.15–$3.40 versus consensus of $3.37. Comps on an owned-plus-licensed basis are expected to be (2.5)%–(3.0)% versus (3.0)%–(4.0)% previously. Comps on an owned basis are expected to be 50basis points lower.

MACY’S CONTINUES TO FOCUS ON UNLOCKING REAL ESTATE VALUE

Macy’s also announced a strategic alliance with Brookfield Asset Management to increase the value of its real estate portfolio. Brookfield will have the exclusive right to create a “predevelopment plan” for 50 Macy’s real estate assets for up to 24 months. These assets include owned and ground-leased stores and associated land, most of which are located in malls not owned by major mall owners. The breadth of opportunity within the portfolio ranges from the additional development on a portion of an asset (such as a Macy’s-controlled land parcel adjacent to a store) to the complete redevelopment of an existing store.