Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

2Q18 Results

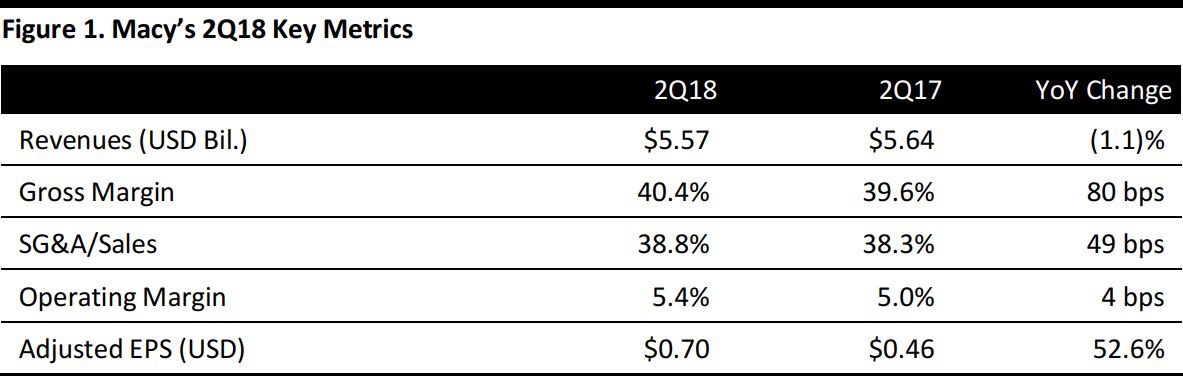

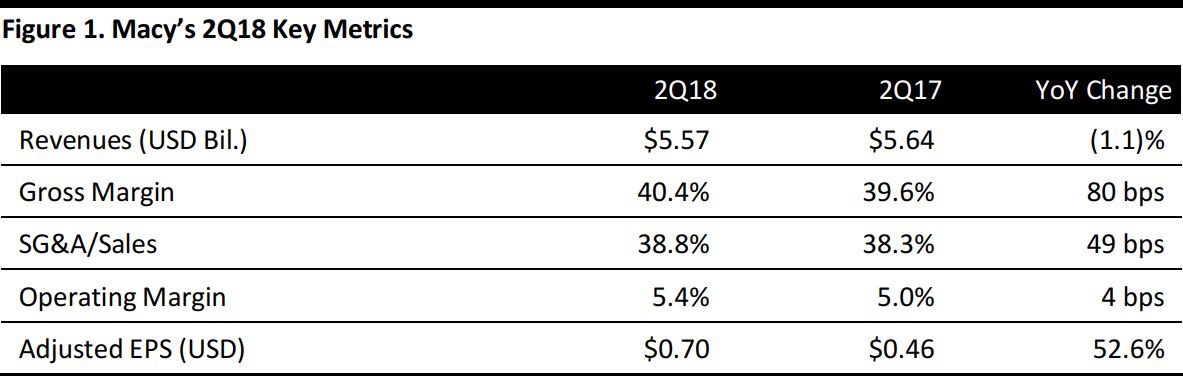

Macy’s reported 2Q18 revenues of $5.57 billion, down 1.1% year over year but beating the consensus estimate of $5.55 billion.

Adjusted EPS was $0.70, beating the $0.51 consensus estimate. The adjusted figure excludes impairment and other costs, settlement charges, losses on the early retirement of debt and the associated tax effect of these charges. GAAP EPS was $0.53, compared to $0.36 in the year-ago quarter.

Details from the Quarter

- Management welcomed Paula Price, who joined the company as CFO in July.

- Management characterized the quarter as strong, marking the third consecutive quarter of positive comps.

- Adjusting for the Friends and Family shift from the second to first quarter, comps would have been 2.9% on an owned-plus-licenses basis.

- Management commented that a consistent focus on the customer drove improved performance, and the company’s North Star Strategy (built on inspiration, fashion, value and great experiences) aims to improve the customer journey along every step of the way, removing points of friction and amplifying the positive aspects.

- Trends improved for the brick-and-mortar business, with growth reported by 50 stores.

- The digital business grew by double digits, including a very strong July. Sales were up by 50% on the Macy’s app in the first half of the year from the year-ago period. Average unit retail was up 5% in the first half of the year.

- Management cited strong performance across all business families, including every geography and all three brands—Macy’s Bloomingdale’s and Bluemercury—which turned in strong quarterly performance.

- Bloomingdale’s saw strength in men’s, handbags and cosmetics, as well as good regular-price sell-through through on all fall trends, across all categories. The newly renovated shoe floor at the 59th Street flagship store has continued to gain momentum after the first quarter opening. Renovated areas are performing above expectations, and the renovation is expected to be completed by year-end.

- Management discussed five strategic initiatives:

- Loyalty program: Management is pleased with the loyalty program launched last year, with more than 1 million new members at the bronze level.

- Backstage expansion: The expansion continues, with 47 new Backstage stores opening in the quarter, for a total of 65 stores opened in the first half of the year. Macy’s remains on track to complete 120 openings this year.

- Vendor Direct: The expansion of Macy’s online offerings remains on track. By fourth quarter, customers on macys.com will have access to a significantly expanded assortment, including a greater selection of products great national and private brands, plus the addition of new brands and categories.

- Pickup program: The expansion of Macy’s store pickup program, which includes buy online, ship to store (called BOSS); and buy online pickup in store (called BOPS—typically BOPIS). BOSS expanded to 50 stores in the quarter and will be in almost every store by the end of the third quarter. Macy’s is rolling out At Your Service stations in every store to enhance pickup.

- The Growth 50 initiative: This initiative, in which 50 stores are receiving special attention, continues, and the stores are performing as expected. Some 50 new stores will receive the treatment in 2019.

- Macy’s is making investments in stores across the fleet, and At Your Service centers and mobile checkout are planned for almost every store. The company plans to activate 60 virtual-reality furniture locations in the third quarter.

- In the quarter, Macy’s announced an investment in b8ta, a technology-powered retailer that enables the company to scale the market faster. Macy’s plans to open up two new markets in the fall, in Atlanta and in Los Angeles. Story, which was acquired in 1Q, should also bring new content and experiences to stores.

Outlook

Macy’s raised its full-year guidance as follows:

- EPS—$3.95–$4.15 from $3.75–$3.95 previously.

- Revenue growth—flat to 0.7% from a decline of 1% to an increase of 0.5% previously.

- Comps—2.1%–2.5% from an increase of up 1%–2% previously (comps on an owned basis are expected to be 20–30 bps below comps on an owned-plus-licenses basis).

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research