Source: Company reports/FGRT

2Q17 Results

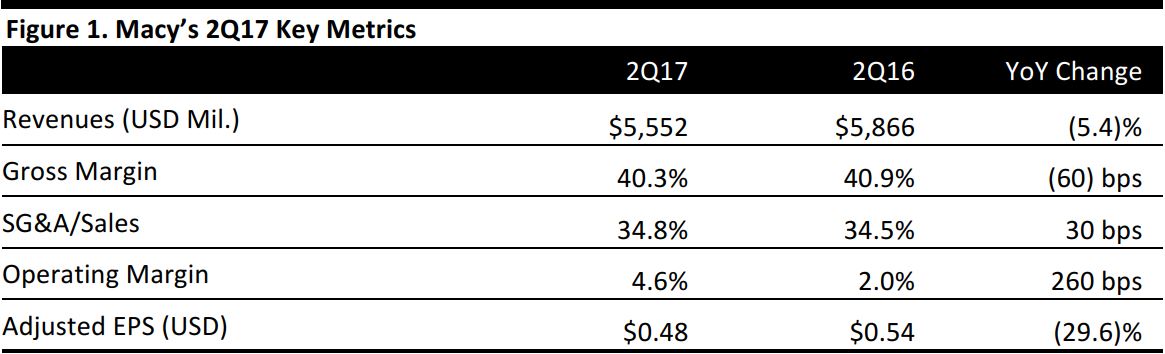

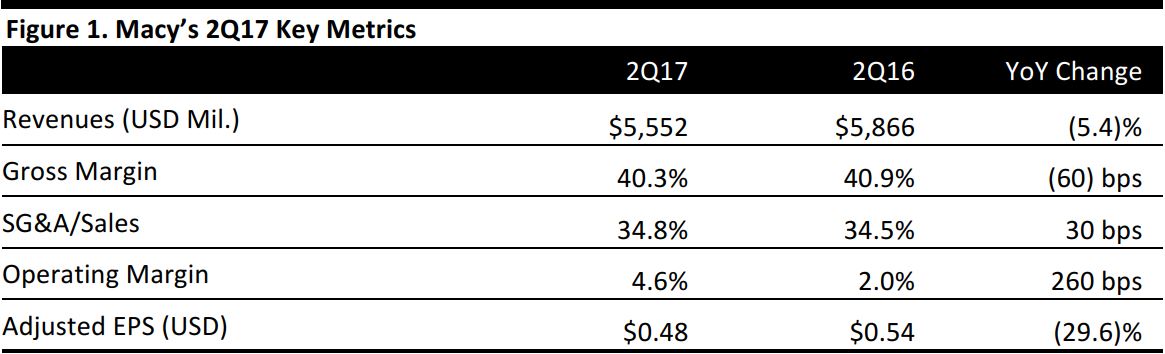

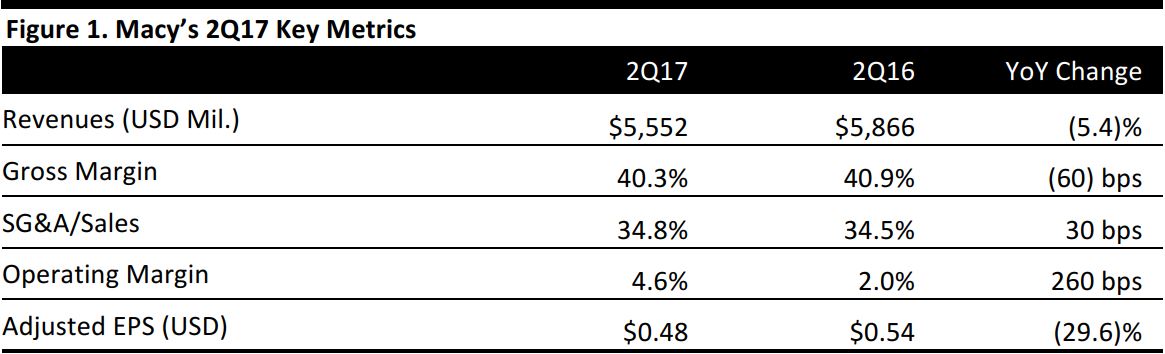

Macy’s reported 2Q17 adjusted EPS of $0.48, beating the consensus estimate of $0.46.

Total revenues declined by 5.4% year over year, to $5.55 billion, reflecting announced store closures. Comps were down 2.8% and down 2.5% on an owned-plus-licensed basis.

The strongest categories were fine jewelry, fragrance, men’s apparel and women’s shoes. There was continued success in testing the Backstage banner inside Macy’s stores. Sales from international tourists were down 9%; the decline was unanticipated and worse than the performance recorded in the first quarter.

The company’s digital channel recorded strong, double-digit growth in the quarter, driven by strong mobile performance. The company retained 12% of its closed-store sales. Its Backstage offering added about 6% in incremental sales to 38 stores where the concept operates.

The second quarter results indicate that Macy’s will achieve the high end of the $200–$260 million of additional sales it expects from contributions of its strategic initiative.

FY17 Outlook

Management reiterated its prior full-year guidance and thinks the company is on track to meet its comp sales and earnings guidance. The company is projecting adjusted EPS of $3.37–$3.62 for the full year, excluding the impact of anticipated settlement charges and net premiums and fees associated with debt repurchases. Macy’s expects revenues to be down 3.2%–4.3%, versus the consensus of a 4.3% decline. The company expects comps to be down 2.2%–3.3% (and down 2.0%–3.0% on an owned-plus-licensed basis), versus the consensus of a 3.2% decline.

For the second half of the year, the company expects comps to be down 0.8%–2.6%.