Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

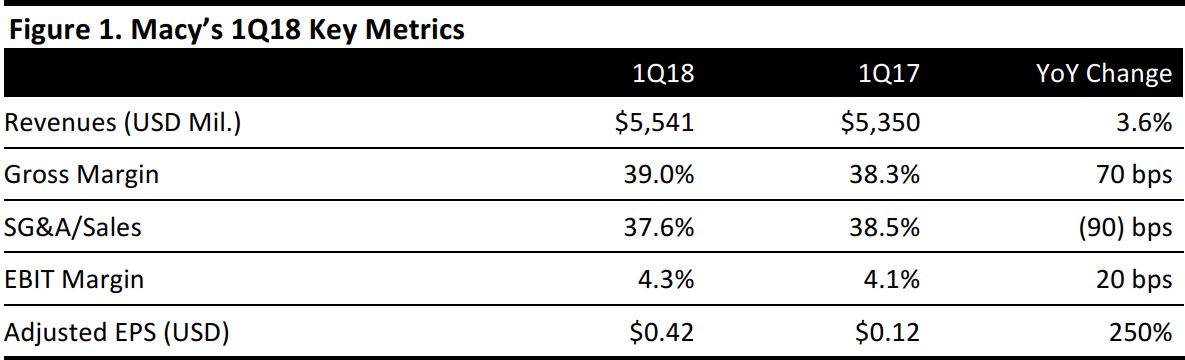

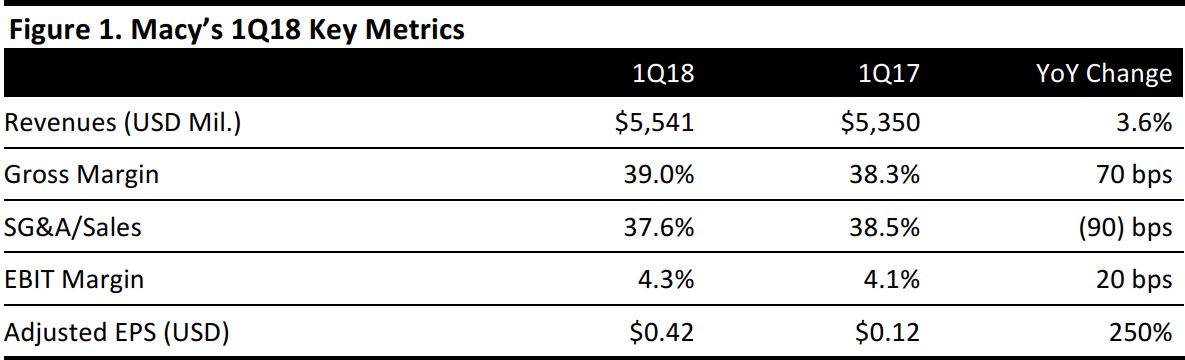

1Q18 Results

Macy’s reported 1Q18 adjusted EPS of $0.42, compared with the consensus estimate of $0.35. Total revenues increased by 3.6% year over year, to $5.541 billion, exceeding analysts’ estimates of $5.391 billion. Comparable sales were up 3.9% on an owned basis and up 4.2% on an owned-plus-licensed basis. Comps benefited from the shift of the Macy’s Friends and Family promotion from the second quarter to the first. Excluding the effects of that shift, Macy’s estimates that comps increased by 1.7% on an owned-plus-licensed basis.

The company’s quarterly performance benefited from strong consumer and international tourist spending. Macy’s also cited progress in enhancing the omnichannel customer experience, maintenance of a healthy inventory position and the introduction of loyalty programs as contributing to performance over the period.

The company reported a strong performance across all three of its brands—Macy’s, Bloomingdale’s and Bluemercury—and across all US regions. The company saw continued improvement in its brick-and-mortar business and said that the digital business continued to growth at a double-digit rate.

Outlook

Due to the strong start of the year, management raised its full-year guidance. The company is now projecting adjusted EPS of $3.75–$3.95 (up $0.20 from prior guidance), versus the consensus estimate of $3.70. The company expects revenue growth of (1.0)%–0.5% and comp growth of 1.0%–2.0% on an owned-plus-licensed basis; the comp guidance is one basis point higher than previous guidance. Macy’s expects comps on an owned basis to be 20–30 basis points below comps on an owned-plus-licensed basis.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research