Source: Company reports/Fung Global Retail & Technology

1Q17 Results

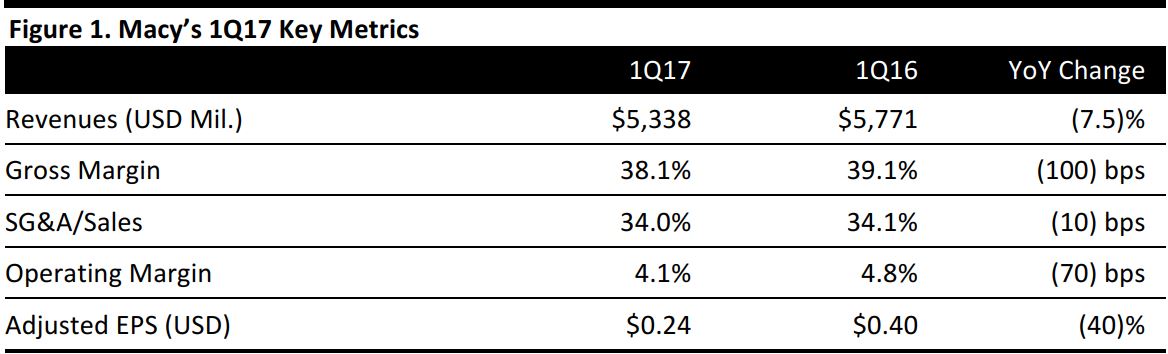

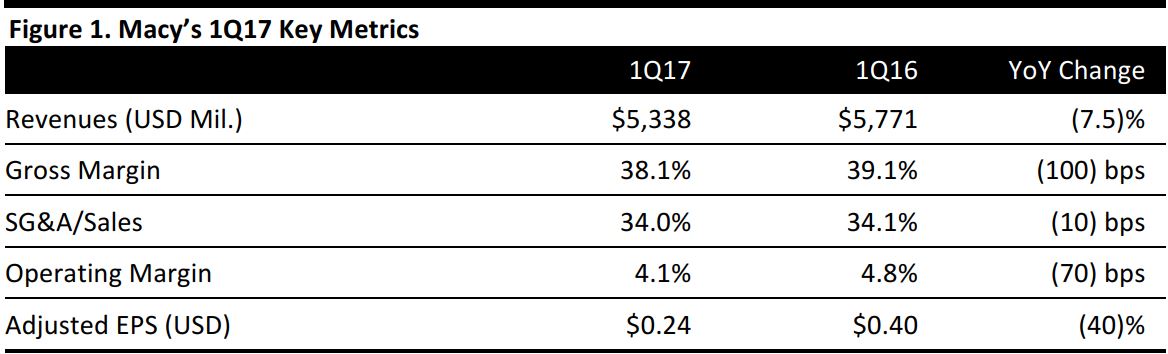

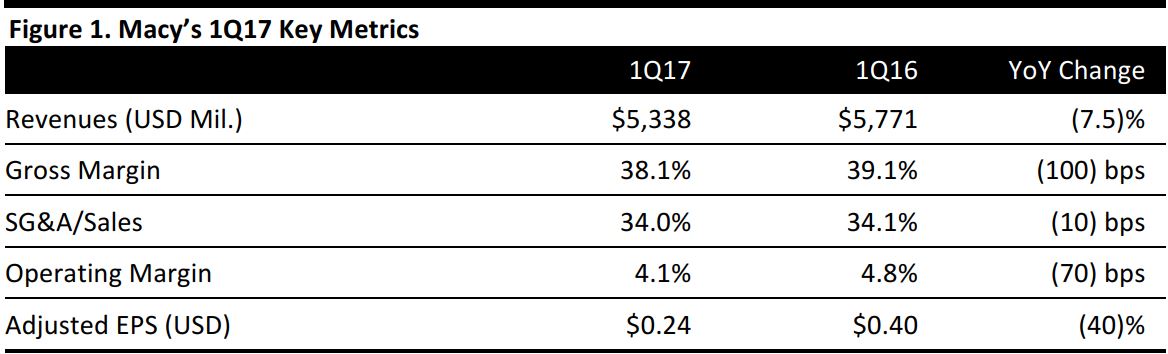

Macy’s reported 1Q17 adjusted EPS of $0.24 compared with the consensus estimate of $0.36.

Total revenues declined by 7.5% for the period, to $5.34 billion, which reflects the store closures announced in 2016. Comps were down 5.2% and down 4.6% on an owned-plus-licensed basis.

The strongest categories were women’s apparel (specifically active and dresses), fine jewelry, fragrances, women’s shoes, furniture and mattresses. Weaker categories included handbags, fashion jewelry and watches, housewares and tabletop. The Southwest region was the strongest in the quarter, while the Northeast was the weakest. Trends at Bloomingdale’s were similar to those at Macy’s.

Sales continued to grow at a double-digit rate in the digital channel. Bluemercury also experienced double-digit comp growth as well as continued successful store openings.

The company continues to work to stabilize its brick-and-mortar business by testing and iterating new pilot programs that it can bring to scale in the future while also investing in growing its digital businesses.

In the first quarter, the company opened two new Macy’s stores―one in Murray, Utah, and one in Los Angeles―as well as 10 new freestanding Bluemercury stores and 11 new Macy’s Backstage stores within existing Macy’s stores. Additionally, one Bloomingdale’s store opened in Kuwait under a license agreement with Al Tayer Group. In the second quarter, the company announced the sale and closure of the Macy’s store at Temple Mall in Temple, Texas.

FY17 Outlook

Management reiterated its prior full-year guidance. The company is projecting EPS of $3.37–$3.62 versus consensus of $3.34. The company expects revenues to be down 3.2%–4.3% and comps to be down 2.2%–3.3% (and down 2.0%–3.0% on an owned-plus-licensed basis).