albert Chan

On February 5, 2020, Macy’s hosted its investor day in New York City—the first in three years. The day focused mainly on its Macy’s strategy: Management indicated future investor presentations would focus on Bloomingdales and Bluemercury.

Macy’s Introduces Polaris Strategy: Changes “Painful but Necessary”

Jeffrey Gennette, Chairman and CEO, opened the investor day acknowledging that Macy’s is in a transition period as the company announces organizational changes, campus closures and additional store closures. Macy’s plans involve significant structural changes to bring down costs, bring teams closer and to reduce duplicative work, said Gennette, and making deep cuts that impact every area of the business, adding “these changes are painful, but they are necessary.”

Gennette introduced the Polaris strategy, which was developed over six months by business leaders across the organization.

[caption id="attachment_103370" align="aligncenter" width="700"] Source: Company reports[/caption]

1. Macy’s Aims to Strengthen Customer Relationships by Expanding its Loyalty Program

Source: Company reports[/caption]

1. Macy’s Aims to Strengthen Customer Relationships by Expanding its Loyalty Program

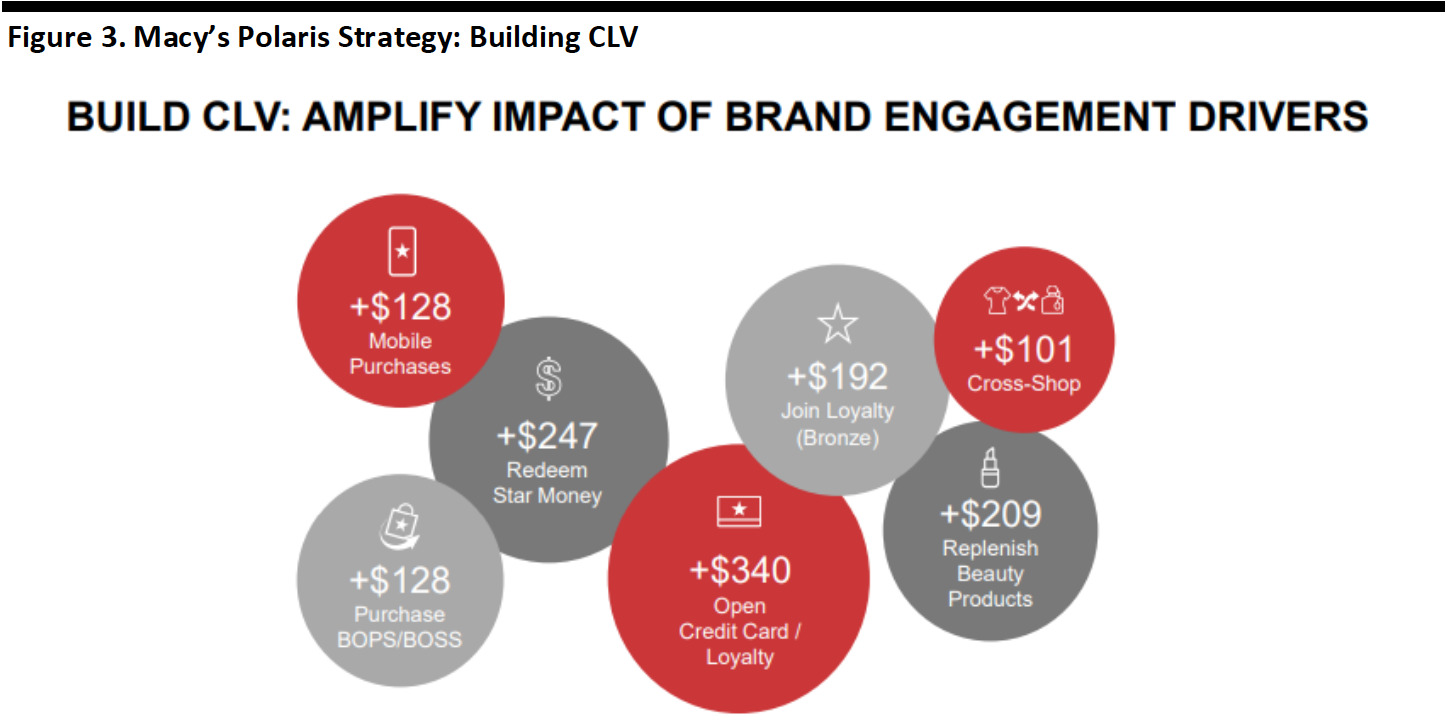

Rich Lennox, Chief Marketing Officer, outlined Macy’s vision of improving profitability by increasing customer engagement and acquisition. Lennox outlined three strategic priorities: identify, engage and migrate the next generation of customers into top loyalty tiers; leverage data to develop customers; and, build an ecosystem through loyalty, monetization and personalization.

[caption id="attachment_103371" align="aligncenter" width="700"] Source: Company reports[/caption]

Lennox focused on the company’s loyalty program, noting 40 million people shopped Macy's in the last 12 months, and more than 28 million enrolled in the company’s Star Rewards loyalty program since it launched just over two years ago.

Macy’s also hopes to increase engagement with customers who shop there only occasionally, and to bring new customers to the brand, building customer lifetime value (CLV). Macy’s believes the more omnichannel touchpoints they have with the customer, the more profitable and the more connected that customer is. The goal of the loyalty program is to reach, target, and retain users.

[caption id="attachment_103372" align="aligncenter" width="700"]

Source: Company reports[/caption]

Lennox focused on the company’s loyalty program, noting 40 million people shopped Macy's in the last 12 months, and more than 28 million enrolled in the company’s Star Rewards loyalty program since it launched just over two years ago.

Macy’s also hopes to increase engagement with customers who shop there only occasionally, and to bring new customers to the brand, building customer lifetime value (CLV). Macy’s believes the more omnichannel touchpoints they have with the customer, the more profitable and the more connected that customer is. The goal of the loyalty program is to reach, target, and retain users.

[caption id="attachment_103372" align="aligncenter" width="700"] Source: Company reports[/caption]

2. Curate Quality Fashion by Focusing on the Younger Consumer, Growing Four Private Label Brands to 25% by 2025 and Reinventing Ready-to-Wear

Source: Company reports[/caption]

2. Curate Quality Fashion by Focusing on the Younger Consumer, Growing Four Private Label Brands to 25% by 2025 and Reinventing Ready-to-Wear

Patti Ongman, Chief Merchandising Officer, presented the Polaris merchandising strategy, which includes curating quality fashion, identifying fashion categories and brands that consumers are interested at the best value.

[caption id="attachment_103373" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

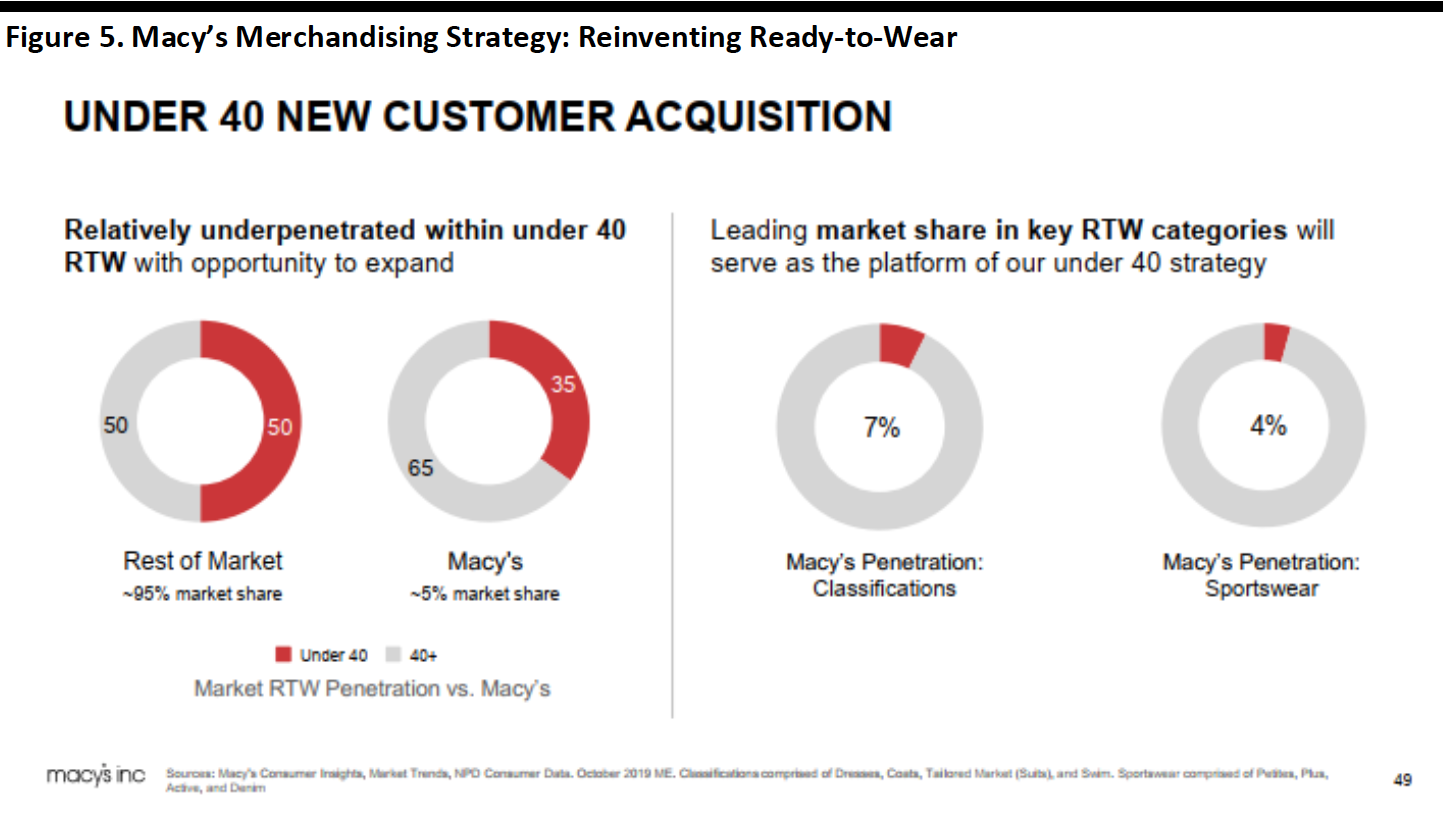

Macy’s conducted in-depth customer research in 2019 to determine in which product categories customers are most interested. Ongman said that “reinvention of ready-to-wear” was one of the company’s greatest opportunities based on the study, particularly for the younger consumer. Macy's ready-to-wear holds the number two market share behind Walmart, at about 5%. However, for under 40 customers, the company has just a 3% share. In total ready-to-wear, Macy’s over penetrates in dresses, coats, suits, petites and plus at about 7% and underpenetrates in casual sportswear businesses, such as active, swim and denim. Given these findings, the company is focusing on reinventing its ready-to-wear strategy to be more important to the younger customer.

[caption id="attachment_103375" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Second, the company plans to raise its penetration of private brands to 25% by 2025 by continuing to build four private brands—INC, Alfani, Style & Co and Charter Club—into billion-dollar brands. Macy’s will add two private brands and a third exclusive market brand to appeal to the younger consumer.

3. Accelerate Digital Growth: Improve Digital Experience and Consolidate the IT TeamJill Ramsey, Chief Digital Officer, presented Macy’s digital growth strategy which includes enhancing the consumer’s digital experience, investing in online capabilities, growing the number of digital consumers, using technology to deliver a seamless customer experience and streamlining Macy’s information technology centers.

[caption id="attachment_103376" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

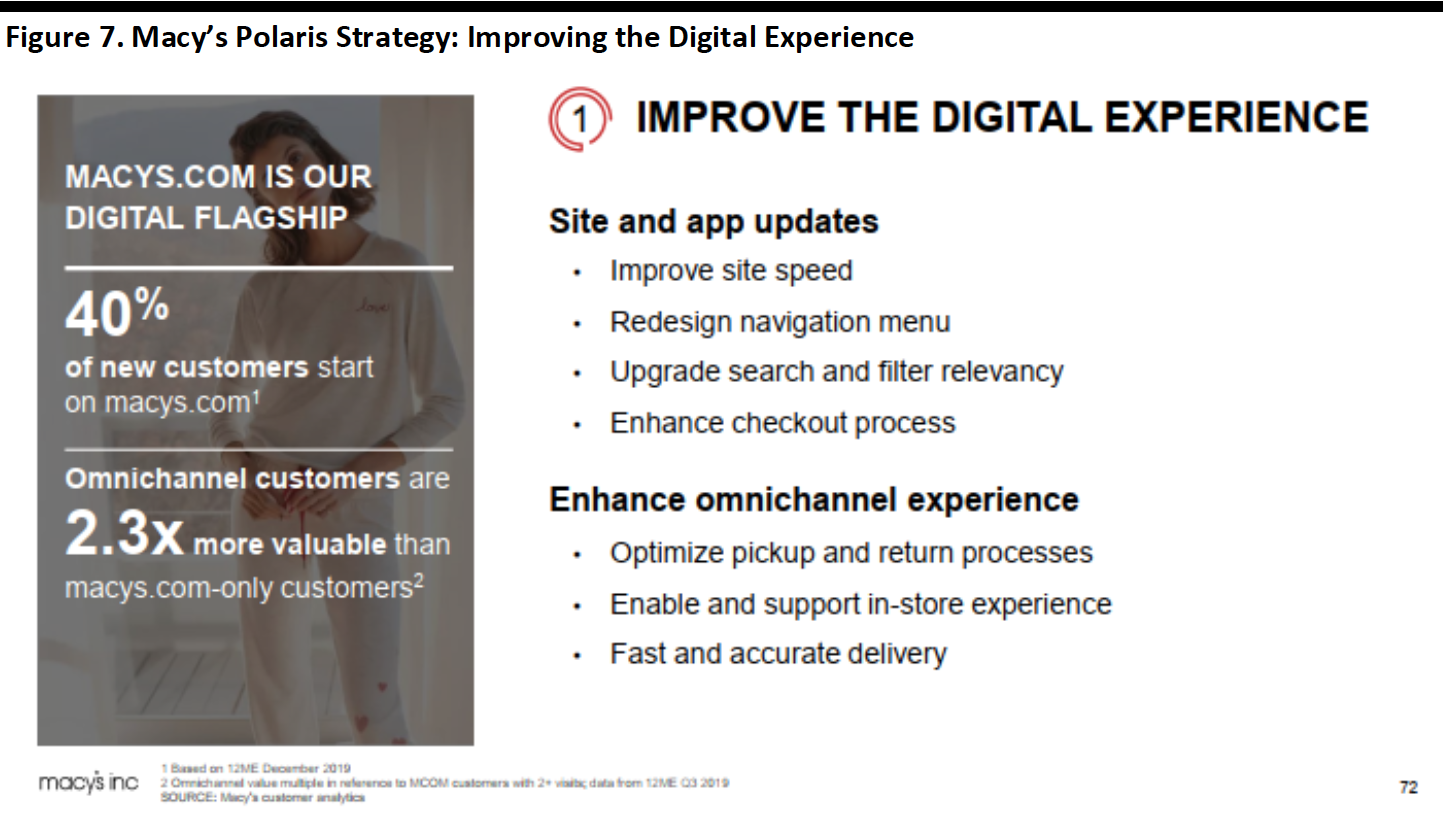

Macy's digital revenues are one of its key growth engines, bringing in $5 billion in revenue via macys.com—some 25% of the Macy's brand total. Over the last decade, macy's.com revenue has grown at a 24% CAGR, with two-thirds of Macy’s traffic and over half of the company’s sales coming through macys.com. Macy’s aims to both improve the digital experience and grow the omni-customer base.

The company estimates 40% of new customers begin their shopping journey on macys.com, and the omnichannel shopper spends 2.3 times more than a single channel shopper.

[caption id="attachment_103377" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Macy’s is streamlining its digital operations teams and shifting resources from San Francisco to New York and Atlanta.

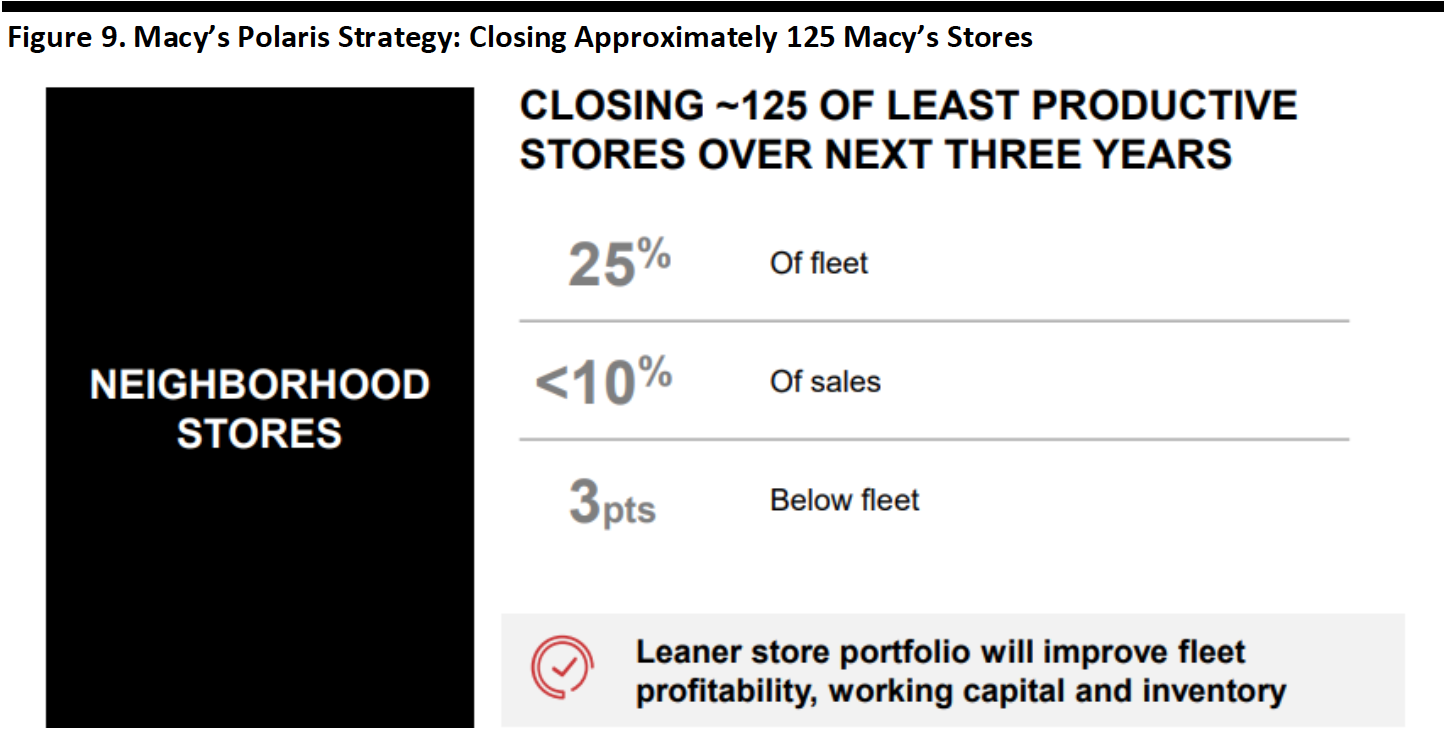

4. Optimize Store Portfolio: Adjust the Number of Stores and Staff, Test New, Smaller Formats in Off-Mall LocationsCEO Gennette and Douglas Sesler, Senior Vice President of Real Estate, presented the store portfolio optimization portion of Polaris, which includes focusing on Macy’s most productive stores, closing 125 stores in underperforming malls, expanding off-mall locations and focusing on off-price such as Backstage.

[caption id="attachment_103378" align="aligncenter" width="1444"] Source: Company reports[/caption]

Source: Company reports[/caption]

The plan identifies 125 “neighborhood stores” for closure over the next three years; 29 of which are in the closure process now. The stores represent 25% of Macy’s store count but less than 10% of sales volume and are located mainly in C and D malls or in markets in which Macy's has multiple stores in close proximity. Most also have comparable sales growth on average three percentage points below the rest of the fleet over the past two years.

[caption id="attachment_103379" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Michelle Israel, Senior Vice President Off-Price, outlined growth plans for Macy’s off-price brand, Backstage, which it launched in 2015 with six freestanding locations. At the end of 2019, Macy’s store fleet comprised six freestanding locations and 211 store-in-store Backstage locations. Of those that have been open for at least one, comp growth came in at more than 5% in 2019. Approximately 20% of store-in-store customers are under 40, cross-shop, visit six times a year and spend about $78 per visit. Due to its success, Macy’s plans to expand Backstage to 50 store-in-stores, bringing the total count to 261 plus seven freestanding stores in 2020.

[caption id="attachment_103380" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

The company will open its first lifestyle store concept, Market by Macy’s, in 2020. The concept test stores are smaller than an average Macy's and located off-mall and in lifestyle centers. They feature a mix of Macy's merchandise, local goods and community-oriented events. The first Market by Macy's opened in Southlake, Texas, on February 6. The company plans to roll out Market by Macy’s to three cities in which Macy’s does not have a strong presence: Washington, DC; Dallas; and, Atlanta.

5. Reset the Cost Base: Right-Size the Organization, Balance Sales and Profit, Improve Productivity of Working CapitalPaula Price, Chief Financial Officer, outlined the financial impact of the Polaris plan and provided 2020 guidance. Price emphasized that 2020 will be a transition year for Macy’s.

[caption id="attachment_103381" align="aligncenter" width="700"] Source: Company reports[/caption]

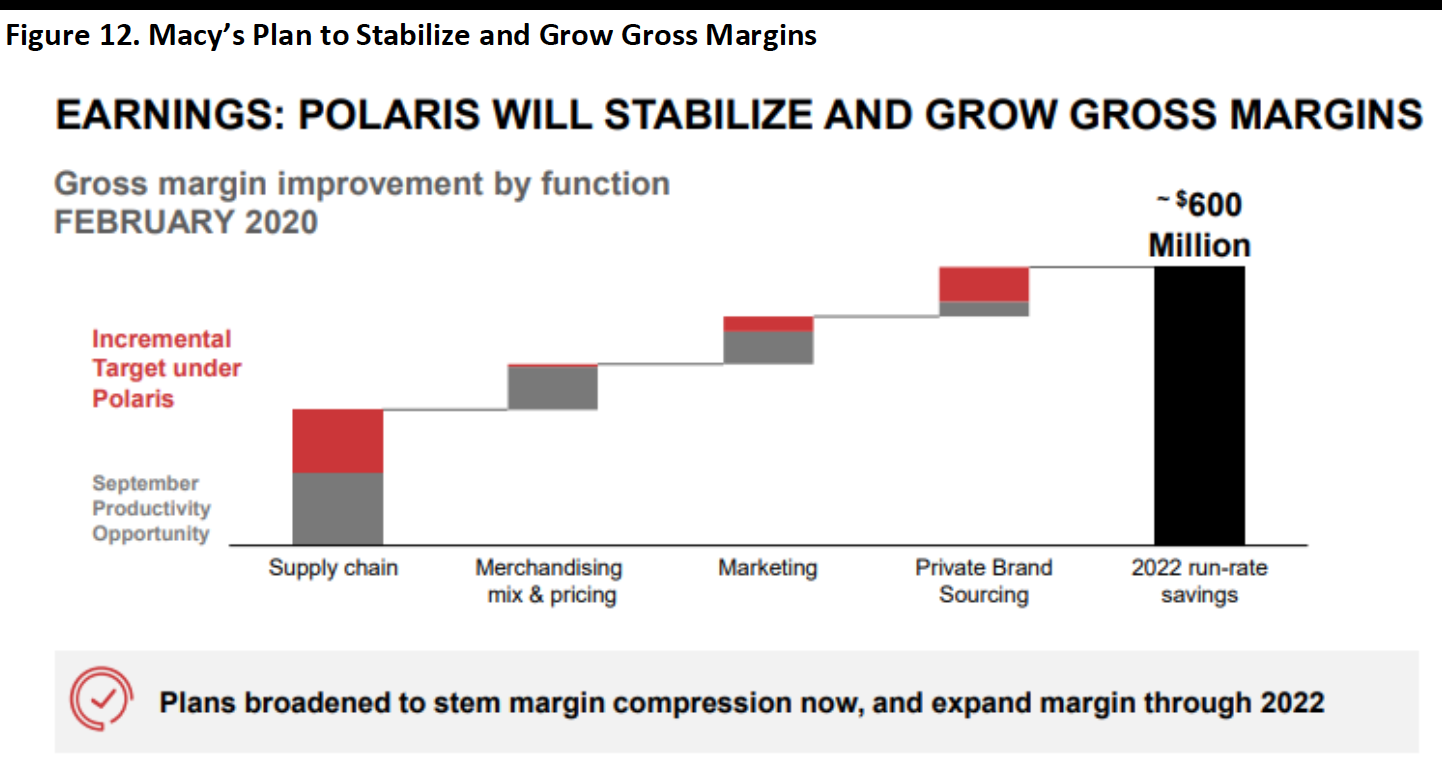

The company expects the Polaris strategy to deliver total savings of approximately $1.5 billion between 2020 and year-end 2022, of which $600 million will be realized in 2020—some of which will flow to the bottom line to stabilize operating margin.

[caption id="attachment_103382" align="aligncenter" width="700"]

Source: Company reports[/caption]

The company expects the Polaris strategy to deliver total savings of approximately $1.5 billion between 2020 and year-end 2022, of which $600 million will be realized in 2020—some of which will flow to the bottom line to stabilize operating margin.

[caption id="attachment_103382" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

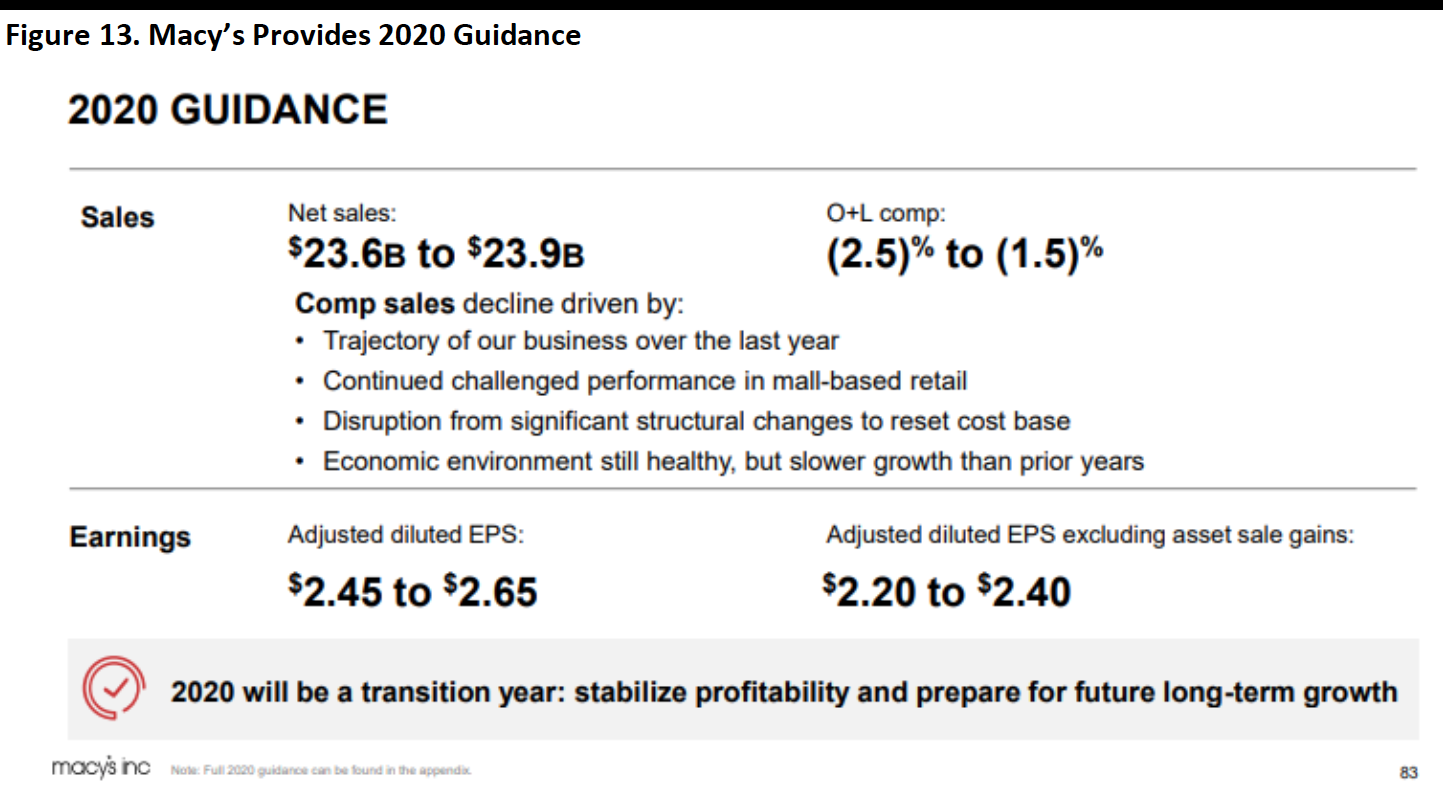

Management emphasized that 2020 will be a transition year as the company makes significant operational changes. It anticipates negative comparable sales in 2020 due to the trajectory of the business over the past six months, continued challenges in mall-based retail and disruption from the implementation of the Polaris strategy. The company also anticipates net sales to decline due to store closures. Macy’s provided annual guidance for 2020 as shown below.

[caption id="attachment_103383" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]