DIpil Das

On February 4, 2020, Macy’s outlined a new three-year strategy to stabilize profitability and “position the company for growth,” which the company refers to as the Polaris plan. It focuses on the following areas:

Source: Company reports[/caption]

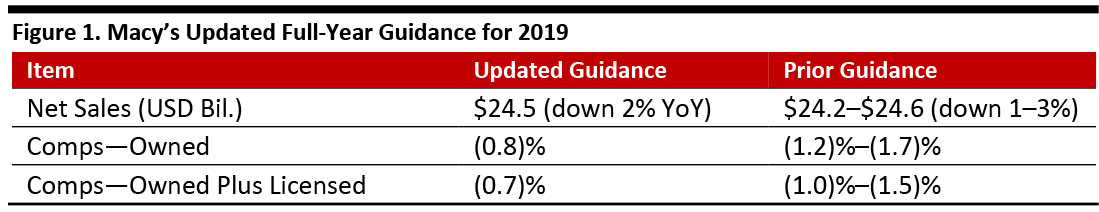

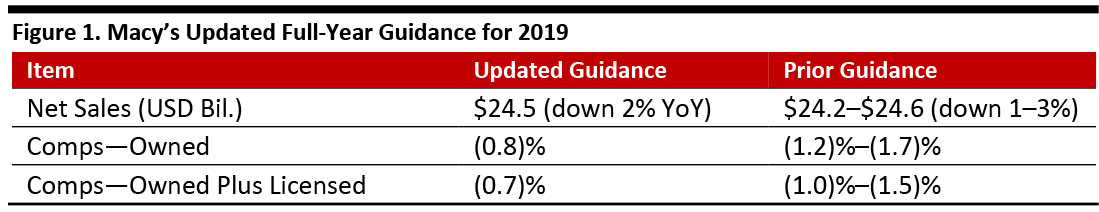

The company also expects 2019 EPS near the high end of the $2.57–2.77 range.

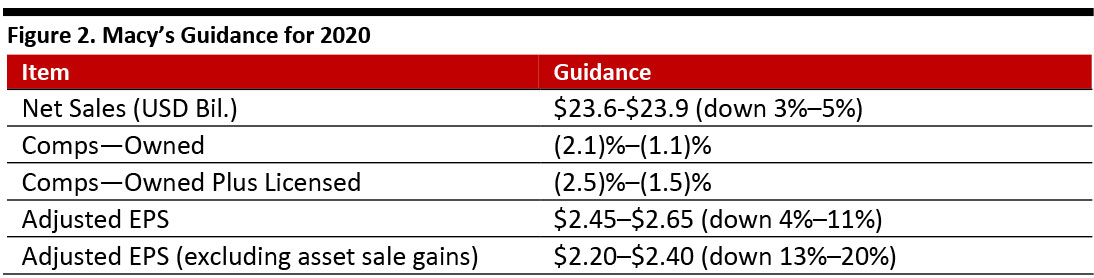

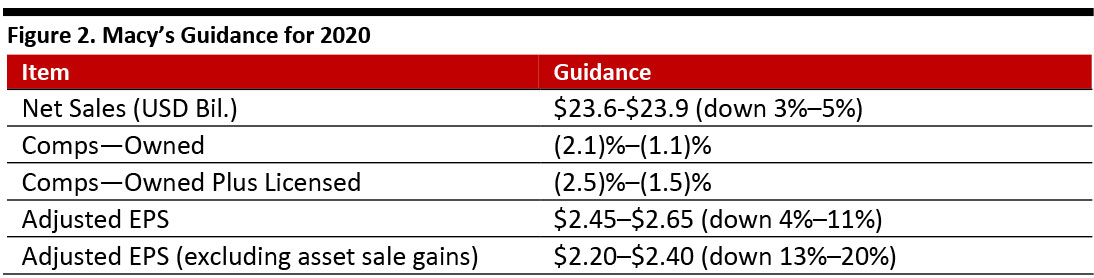

Macy’s also provided guidance for 2020:

[caption id="attachment_103250" align="aligncenter" width="700"]

Source: Company reports[/caption]

The company also expects 2019 EPS near the high end of the $2.57–2.77 range.

Macy’s also provided guidance for 2020:

[caption id="attachment_103250" align="aligncenter" width="700"] Note: EPS change assumes adjusted EPS of $2.75

Note: EPS change assumes adjusted EPS of $2.75

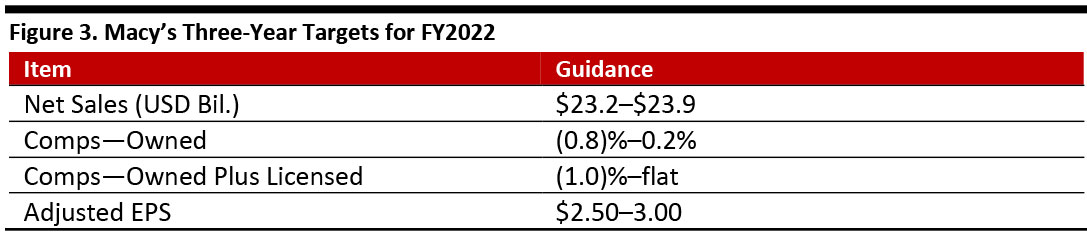

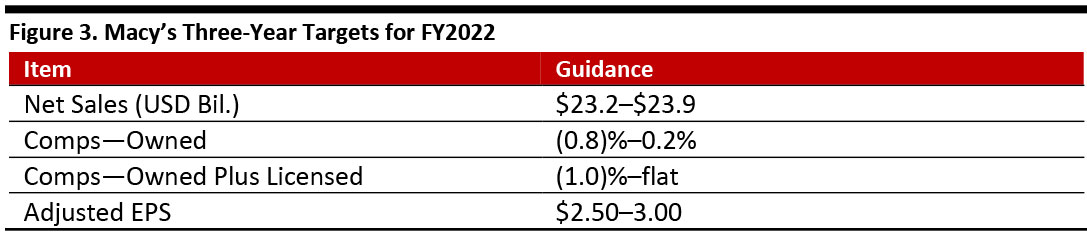

Source: Company reports [/caption] Macy’s also provided a three-year target for fiscal 2022. [caption id="attachment_103251" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

- Strengthening customer relationships: Build long-term customer relationships, accelerate personalization and monetization loyalty programs.

- Curating quality fashion: Expand the product assortment and offer exclusive, trendy products at great value, including a plan to build four, $1 billion brands.

- Accelerating digital growth: Continue investing in websites and digital apps to deliver a seamless buying experience.

- Optimizing the store portfolio: Adjust the number of stores and staffing, and test new, smaller store formats located off-mall in lifestyle centers.

- Resetting the cost base: Streamline the organization with a net reduction in corporate and support function headcount of 9%, or about 2,000 positions.

- Revenues: $8.3 billion (down 2%).

- Comps: (0.6%) for owned properties.

- Comps: (0.5%) for owned and licensed.

Source: Company reports[/caption]

The company also expects 2019 EPS near the high end of the $2.57–2.77 range.

Macy’s also provided guidance for 2020:

[caption id="attachment_103250" align="aligncenter" width="700"]

Source: Company reports[/caption]

The company also expects 2019 EPS near the high end of the $2.57–2.77 range.

Macy’s also provided guidance for 2020:

[caption id="attachment_103250" align="aligncenter" width="700"] Note: EPS change assumes adjusted EPS of $2.75

Note: EPS change assumes adjusted EPS of $2.75 Source: Company reports [/caption] Macy’s also provided a three-year target for fiscal 2022. [caption id="attachment_103251" align="aligncenter" width="700"]

Source: Company reports[/caption]

Source: Company reports[/caption]