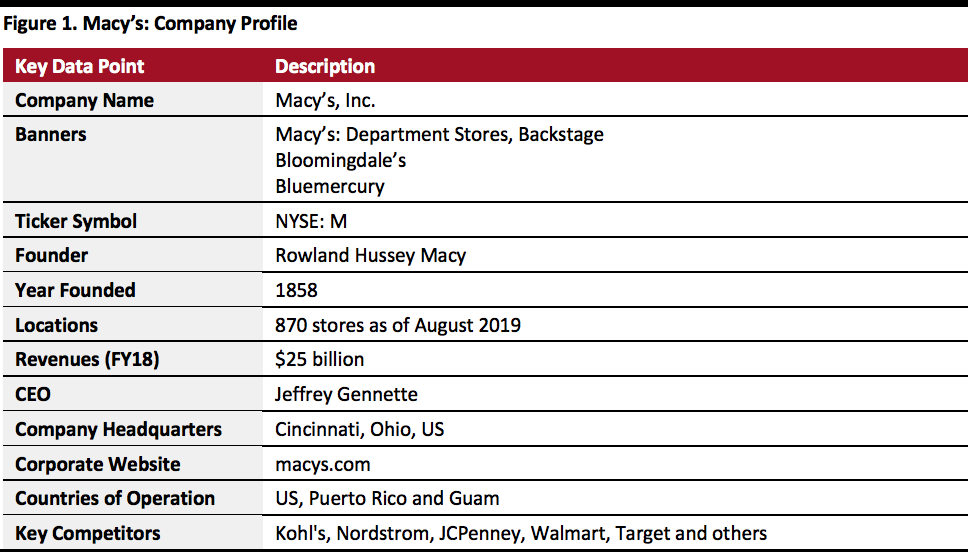

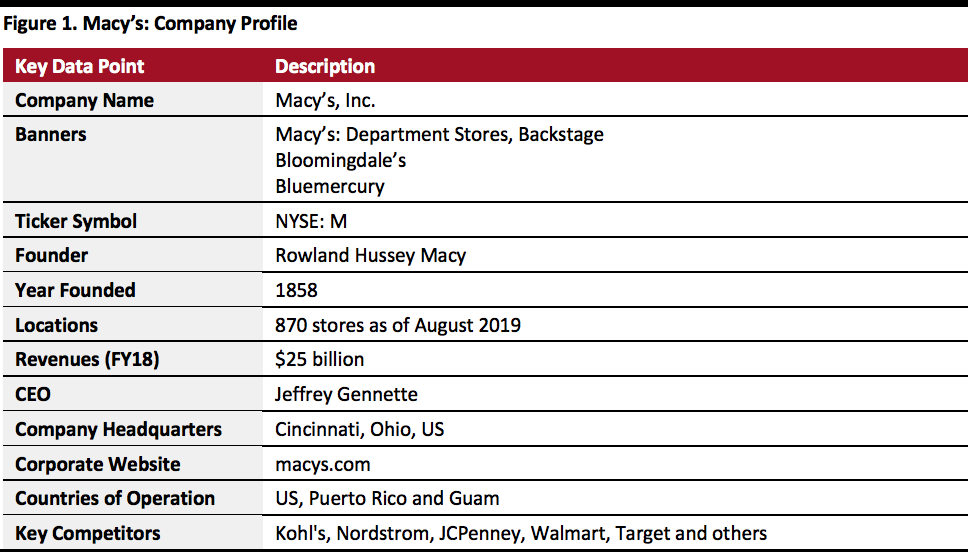

Macy’s: Company Description

Macy’s is a US-that sells a range of products such as apparel, accessories, shoes, cosmetics, home furnishings and other consumer goods. The company operates under the banners Macy’s, Bloomingdale’s and Bluemercury; and including Bloomingdale’s The Outlet and Macy’s Backstage and STORY.

Macy’s operates approximately 870 stores in 43 states, the District of Columbia, Guam and Puerto Rico. The retailer sells through its websites, including macys.com, bloomingdales.com and bluemercury.com. Bloomingdale’s in Dubai, UAE, and Al Zahra, Kuwait, are operated under a license agreement with Al Tayer Insignia, a company of Al Tayer Group, LLC.

[caption id="attachment_97950" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

Key Events Overview: 2009-2019

2017-2019: In the last two and a half years, Macy’s has made several strategic alliances and focused on

introducing new experiential concepts and technological innovations.

In August 2019, Macy’s began a pilot with fashion resale marketplace ThredUP in 40 Macy’s stores across the country. As sustainability is a growing consideration for today’s consumers, the retail industry is looking to respond to interest in fashion resale. Management therefore emphasized that the partnership with ThredUP gives Macy’s the opportunity to reach new customers and achieve return business through an ever-changing selection of styles and brands that the company does not typically carry.

Bloomingdale’s is tapping a new market through “My List at Bloomingdale’s,” an online subscription service costing $149 per month that was launched in September 2019. My List will initially stock women’s ready-to-wear apparel from more than 60 brands, withover 100 exclusive pieces. With this move, the company has became the only department store to offer a full-fledged subscription service. Bloomingdale’s is aiming to capitalize on the growing popularity of subscription boxes and generate a steady revenue stream.

In early 2019, Bloomingdale’s unveiled a new beauty department spanning over 36,000 square feet at its New York flagship, through which the company aims to capitalize on the growing popularity of high-end cosmetics. This bold move is part of Bloomingdale’s flagship renovation program, which began in 2018. To entice in-store shoppers, the beauty department has a fragrance hall, spa rooms, interactive displays and other services. The beauty floor will boost customer experience with technological enhancements and the latest installations, according to Stacie Borteck, Vice President of cosmetics and fragrances at Bloomingdale’s New York.

In 2018, Macy’s attempted to transform customer experience across various channels, by launching The Market @ Macy’s, acquiring STORY and deploying in-store virtual reality (VR) experiences with Marxent, a 3D-product visualization platform. Its strategic alliance with Marxent, which began in October 2018, has seen Macy’s roll out VR installations in 70 stores nationwide. The VR headsets help consumers visualize furniture selections before buying, so they are able to make informed purchasing decisions. Across three pilot stores, VR-influenced furniture sales grew more than 60% compared to their non-VR counterparts and cut returns to less than 2%.

To compete against online retailers such as Amazon and eBay, Macy’s rolled out the “Vendor Direct” feature on its e-commerce platform in April 2018. The program allows third-party brands to sell and ship directly to customers. In addition, third-party brands can also send the items to Macy’s stores, which double as delivery hubs. Vendor Direct is driving the company’s e-commerce growth and now contributes about 10% to the company’s total sales.

In the second quarter of fiscal year 2019, Jeffrey Gennette, CEO at Macy’s, said that the company has aggressively grown its stock keeping units (SKUs) and the number of brands it offers on macy.com through Vendor Direct. The company had added 450 new vendors and 640,000 new SKUs through Vendor Direct by June 2019, and plans to reach a total of 1 million vendor-direct SKUs by the end of the year.

In keeping with the drive to enhance its omnichannel capabilities, Macy’s launched buy online, pick up in store (BOPIS) and same-day delivery services in 2014. As of May 2019, BOPIS accounted for more than 10% of the company’s total digital demand, compared to just 3.5% one year before.

Facing competition from online rivals, Macy’s revamped its customer loyalty rewards program in September 2017. Macy’s Star Rewards membership program drove up “platinum” loyalty spending by 10% in 2018. Platinum customers generate about 30% of the company’s total sales. In 2018, Macy’s also launched a tender-neutral option as part of its loyalty program, which added 3 million new members. This option allows customers to participate in the loyalty program without a Macy’s credit card.

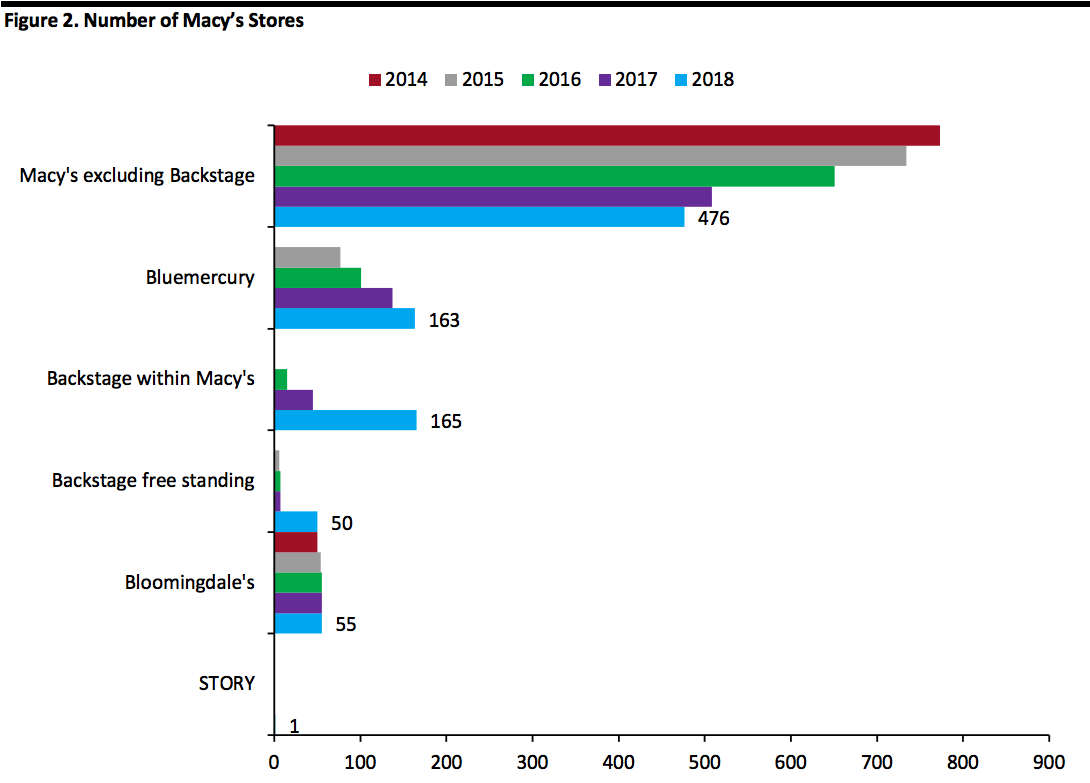

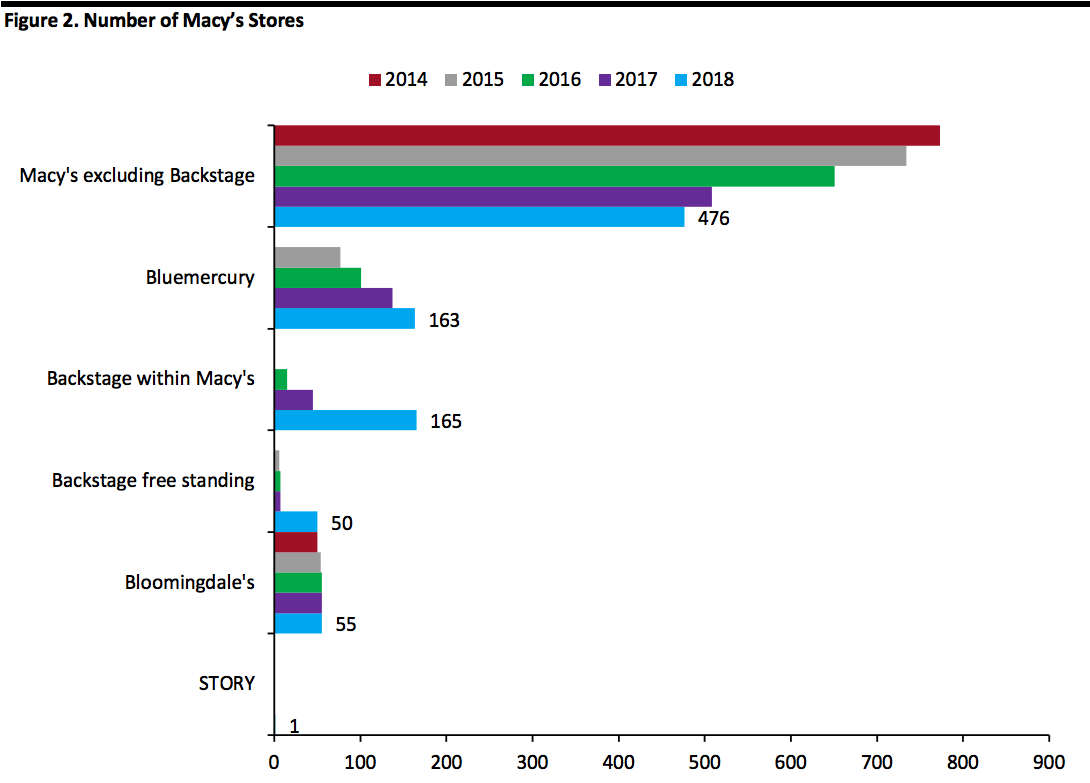

Macy’s Is Betting on Its Off-Price and Growth Stores

In September 2015, Macy’s began rolling out Backstage locations, its in-mall off-price option. Backstage helped Macy’s to repurpose unproductive space in mall-based stores with an off-price concept that has brought in new customers and encouraged existing customers to spend more time in stores. In 2018, Macy’s stores with Backstage outlets saw sales rise more than 5% versus comparable stores without the off-price option.

Over the course of 2019, Macy’s has been expanding Backstage to an additional 50 stores, with 47 of them already completed as of August 2019. There are more than 200 Backstage shops within Macy’s stores, and those that have been open for more than 12 months have comped in the mid-single digits.

In 2018, Macy’s relaunched its stores as part of its $200 million Growth 50 program, which includes physical upgrades such as new fitting rooms, lighting and designated spaces for in-store pickups and returns of online purchases. These Growth 50 stores also provide experiential shopping using VR for furniture purchases and virtual beauty departments.

Macy’s is now expanding its Growth 50 store-improvement concept to 100 more locations, which it expects will be completed ahead of the holiday season—amounting to 150 stores in total. These stores will comprise approximately 50% of the company’s brick-and-mortar sales, and management said it expects to see strong performance from these stores because customer engagement in Growth 50 stores is much higher than other Macy’s stores.

[caption id="attachment_97951" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

Macy’s: Events Timeline, 2009–2019

[wpdatatable id=25]

Source: Company reports/S&P Capital IQ/Coresight Research

Source: Company reports[/caption]

Source: Company reports[/caption]

Source: Company reports[/caption]

Macy’s: Events Timeline, 2009–2019

[wpdatatable id=25]

Source: Company reports[/caption]

Macy’s: Events Timeline, 2009–2019

[wpdatatable id=25]