Nitheesh NH

[caption id="attachment_71979" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

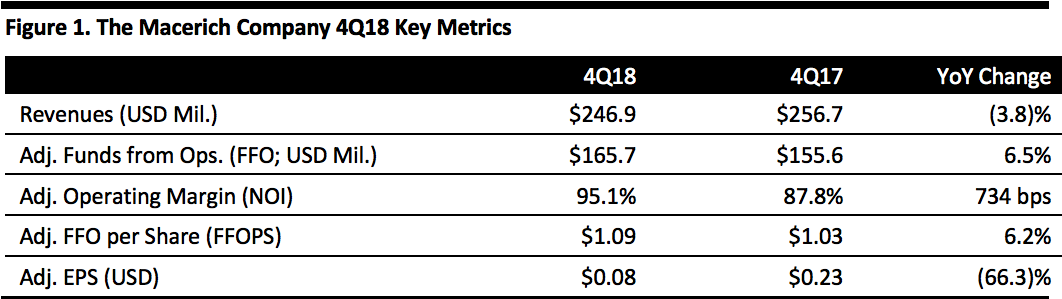

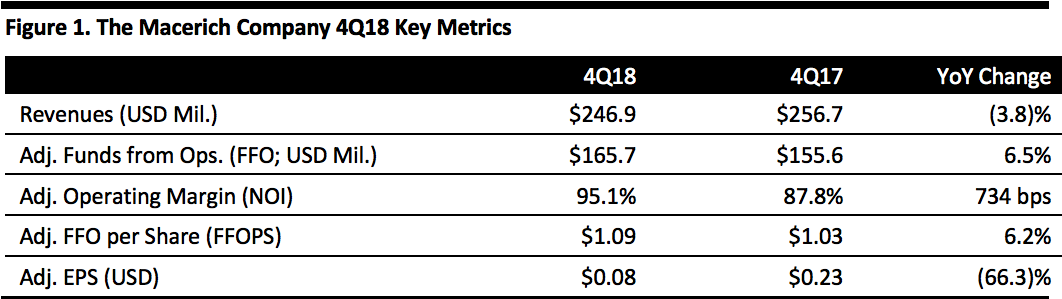

Macerich reported 4Q18 revenues of $246.9 million, down 3.8% but beating the $244.1 million consensus estimate. Adjusted EPS was $0.08, compared to $0.23 in the year-ago quarter.

Adjusted FFOPS was $1.09, in line with the consensus estimate.

Management offered positive comments about the quarter, citing strong occupancy levels, good tenant sales growth and improved same-center earnings growth.

FY18 Results

Full-year revenues were $960.4 million, down 3.4% from the prior year.

Adjusted FFO was $583.8 million, flat with the prior year, or $1.09 per share, up 6.2% from the prior year.

Adjusted EPS was $0.42, down 66.3% from the prior year.

Highlights for the year include the following:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Macerich reported 4Q18 revenues of $246.9 million, down 3.8% but beating the $244.1 million consensus estimate. Adjusted EPS was $0.08, compared to $0.23 in the year-ago quarter.

Adjusted FFOPS was $1.09, in line with the consensus estimate.

Management offered positive comments about the quarter, citing strong occupancy levels, good tenant sales growth and improved same-center earnings growth.

FY18 Results

Full-year revenues were $960.4 million, down 3.4% from the prior year.

Adjusted FFO was $583.8 million, flat with the prior year, or $1.09 per share, up 6.2% from the prior year.

Adjusted EPS was $0.42, down 66.3% from the prior year.

Highlights for the year include the following:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Macerich reported 4Q18 revenues of $246.9 million, down 3.8% but beating the $244.1 million consensus estimate. Adjusted EPS was $0.08, compared to $0.23 in the year-ago quarter.

Adjusted FFOPS was $1.09, in line with the consensus estimate.

Management offered positive comments about the quarter, citing strong occupancy levels, good tenant sales growth and improved same-center earnings growth.

FY18 Results

Full-year revenues were $960.4 million, down 3.4% from the prior year.

Adjusted FFO was $583.8 million, flat with the prior year, or $1.09 per share, up 6.2% from the prior year.

Adjusted EPS was $0.42, down 66.3% from the prior year.

Highlights for the year include the following:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Macerich reported 4Q18 revenues of $246.9 million, down 3.8% but beating the $244.1 million consensus estimate. Adjusted EPS was $0.08, compared to $0.23 in the year-ago quarter.

Adjusted FFOPS was $1.09, in line with the consensus estimate.

Management offered positive comments about the quarter, citing strong occupancy levels, good tenant sales growth and improved same-center earnings growth.

FY18 Results

Full-year revenues were $960.4 million, down 3.4% from the prior year.

Adjusted FFO was $583.8 million, flat with the prior year, or $1.09 per share, up 6.2% from the prior year.

Adjusted EPS was $0.42, down 66.3% from the prior year.

Highlights for the year include the following:

- Mall tenant annual sales per square foot increased 10.0% to $726, compared to $660 in the prior year.

- Re-leasing spreads increased 11.1%.

- Mall portfolio occupancy was 95.4% at the end of the year, compared to 95.0% at the end of the prior year.

- Average rent per square foot increased to $59.09, up 3.7% from $56.97 in the prior year.

- Same-center net operating income (excluding lease termination revenue) grew 4.2% compared to the year-ago quarter.

- The Company’s joint venture in One Westside (formerly known as Westside Pavilion) in Los Angeles, entered into a lease with Google for the entirety of its 584,000-square foot office campus.

- The company’s joint venture in Country Club Plaza in Kansas City entered into a lease with Nordstrom.

- The company continues its redevelopment of Scottsdale Fashion Square, where a flagship Apple store opened in September 2018.

- Redevelopment continues on Fashion District Philadelphia, a four-level retail hub in Center City spanning over 800,000 square feet across three city blocks, with access to a mass transit hub.

- In September 2018, the company announced a 50/50 joint venture with Simon to create Los Angeles Premium Outlets. The outlet is designed to open with approximately 400,000 square feet, followed by an additional approximately 165,000 square feet in the second phase.

- The company closed on a $300 million, 12-year loan on Fashion Outlets of Chicago, with a fixed interest rate of 4.58%. The proceeds were used to refinance an existing $200 million floating-rate loan and to repay a portion of the company’s revolving line of credit.

- As of the end of 2018, several Sears stores have closed, however, none of the company’s leases with Sears have been rejected, and the company is assuming rents for only the month of January for those closed locations. This assumption will ultimately depend on the actions of the bankruptcy judge.

- In 4Q18, the company closed the acquisition of Forest City Realty Trust, a high-quality portfolio of operating and development assets in high-barrier-to-entry markets in the U.S. Management believes that the combination with its existing office, multifamily, retail and development platforms should enable Macerich to deliver above-average returns an otherwise core-plus asset.

- EPS of $0.33-0.41 (below $0.24 in 2018).

- FFOPS of $3.50-3.58 (below $3.73 in 2018).

- Adjusted FFOPS of $3.65-3.73 (below $3.85 in 2018).