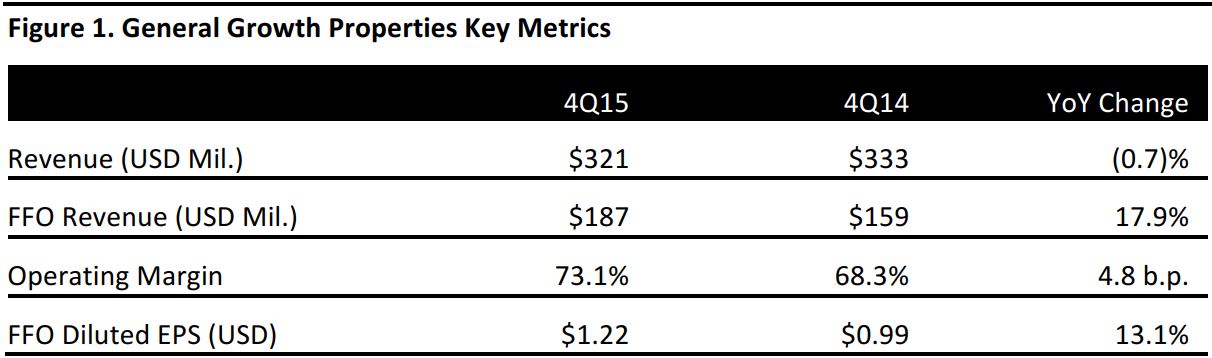

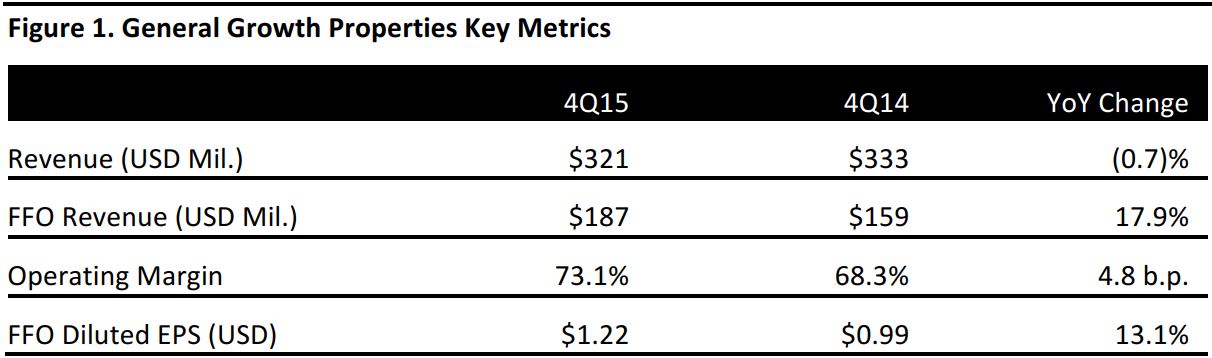

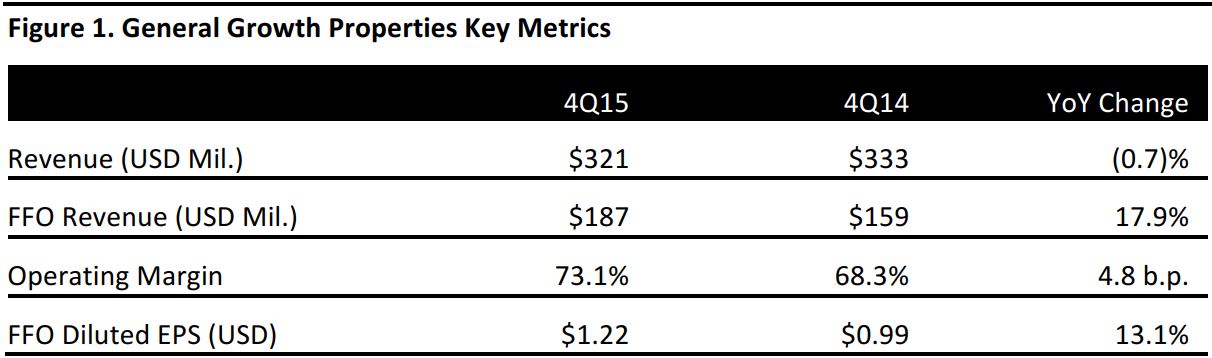

Source: Company reports

Quarterly FFO increased 17.9% to $187 million, or $1.22 cents per share. The real estate investment trust said its revenues were down 0.6% year over year, to$321 million, missing the consensus estimate of $333million.FFO is a closely watched measure in the REIT industry that takes net income and adds back items such as depreciation and amortization.

The company reported Net Operating Income (same center) of $235.4 million, compared to $221.2 million in the year-ago quarter.

The increase was driven by the increase of mall tenant sales per square foot, which increased 8.2% for the year ended December 31, 2015, to $635 compared to $587 for the year ended December 31, 2014. The releasing spreads for the year were up 14.2%. Mall portfolio occupancy was 96.1% for FY15, compared to 95.8% in FY14.

For the full year, Macerich reported funds from operations of $666 million, or $3.95 per share. Revenue was reported as $1.29 billion.

In October 2015 and January 2016, the Company closed on joint ventures totaling $5.4 billion with two intuitional investors. Cash proceeds to the Company from the ventures and related financing total $2.3 billion.

Guidance

The company projects FFO of $4.05–$4.15 a share, compared with the consensus estimate of $4.03.