DIpil Das

Introduction

What’s the Story? Over the last two years, we have seen a flurry of interesting acquisitions and investments in the global luxury market. From LVMH’s acquisition of jeweler Tiffany & Co and a majority stake in fashion label Off-White to Richemont’s investment in e-commerce marketplace Farfetch to Kering’s investment in rental platform Cocoon, there have been many power plays for expansion. We identify the current areas of growth in the luxury market through M&A and detail recent major acquisitions by luxury players as well as the investments made by selected luxury companies to expand their business. We discuss the implications of these growth strategies for the future of the luxury market. We provide a full list of M&A and private placement transactions from 2019 to late January 2022 in the appendix at the end of this report. Why It Matters The Covid-19 pandemic has destabilized operations and upended supply chains across retail. The luxury market, however, has been somewhat resilient compared to others and has posted a strong recovery since the second quarter of 2021. As consumer sentiment improves, luxury businesses need to prepare for renewed vigor in shopping and purchases. They can strengthen their position by catering to the new luxury consumer that has emerged amid pandemic recovery. Acquisitions and investments build scale, diversify business offerings and bring in innovation, and can help businesses consolidate their positions quicker than organic growth.M&A in the Global Luxury Market: Coresight Research Analysis

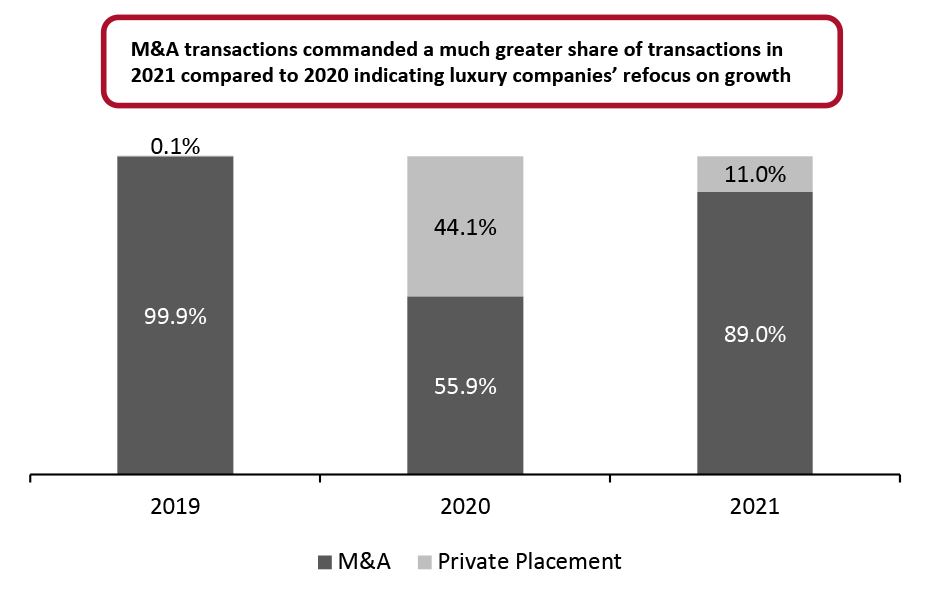

In 2021, the global luxury M&A market totaled around $2.8 billion in disclosed value, Coresight Research calculates. This may seem small compared to other sectors—for example, there were transactions worth $16.2 billion in US apparel retail in the first four months of 2021 alone. However, there were 27 transactions closed in 2021, four more than in 2020, indicating a slow rise in consolidation activity. Following pandemic-led disruption, luxury firms are rethinking whether safeguarding their independence is a viable strategy in the context of a volatile environment. In fact, designer Giorgio Armani told Vogue in March 2021 that going it alone was “not so strictly necessary” and “one could think of a liaison with an important Italian company.” Exor, the owner of Ferrari, which has stakes in Christian Louboutin and acquired Hermes-backed Shang Xia, approached Armani for a deal, but those talks did not materialize. Although that did not come to fruition, it does indicate that legacy houses such as Armani are open to diversification and expansion. In 2019, luxury M&A transactions, which totaled $31.7 billion in disclosed value, were dominated by LVMH’s announcement of its $18.9 billion acquisition of Tiffany & Co., and JAB Cosmetics’ acquisition of an approximate 60% stake in Coty for $10.1 billion. Excluding these, the transactions for which the values were disclosed amounted to $2.7 billion. In 2020, total disclosed transaction value was $4.3 billion, and we saw a greater emphasis on private placements—funding raised by companies through private capital raising events. Major highlights were Dragoneer Investment and Tencent’s investments in Farfetch, amounting to $250 million, and later investments in the platform by Alibaba, Artemis and Richemont totaling $650 million. Investment company KKR announced close to $1 billion in investments in Coty, representing another major transaction in this segment. In 2021, we observed a shift back to mergers or acquisitions of stakes by luxury companies, suggesting a wish to grow or integrate their positioning—primarily in the beauty sector. Estée Lauder increased its stake in affordable-beauty company Deciem from 29% to 76% for around $1 billion in February 2021, indicating the acquiring company’s ambition to grow its market positioning in the cult beauty segment.Figure 1. Global Luxury Market: Breakdown of M&A and Private Placements, by Disclosed Transaction Value (% of Total Market) [caption id="attachment_140385" align="aligncenter" width="700"]

Source: Company reports/S&P Capital IQ/Coresight Research [/caption]

Below, we present the current focus areas for growth through M&A in the luxury market, with examples of recent transactions.

Source: Company reports/S&P Capital IQ/Coresight Research [/caption]

Below, we present the current focus areas for growth through M&A in the luxury market, with examples of recent transactions.

Figure 2. Key Focus Areas for Growth in the Luxury Market [caption id="attachment_140386" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Large Luxury Companies

We have seen large companies focus on increasing their market share in specific categories and making investments that introduce them to new categories. Acquiring established brands can help luxury firms expand their product assortment or diversify their portfolio and the consumer segments they serve.

Acquisitions for Category Expansion

Source: Coresight Research[/caption]

1. Large Luxury Companies

We have seen large companies focus on increasing their market share in specific categories and making investments that introduce them to new categories. Acquiring established brands can help luxury firms expand their product assortment or diversify their portfolio and the consumer segments they serve.

Acquisitions for Category Expansion

- LVMH Acquires Tiffany & Co and a Stake in Off-White

- Richemont Acquires Delvaux

Figure 3. M&A and Private Placements Announced by Major Luxury Companies, 2021 [wpdatatable id=1654 table_view=regular]

N/A indicates transactions for which the deal value is unavailable or undisclosed by the company Source: Company reports/S&P Capital IQ/Coresight Research 2. Small Luxury Companies Small luxury companies have looked to expand their reach and build scale with acquisitions. In December 2020, Moncler announced the acquisition of Italian fashion house Stone Island for $1.5 billion. It first acquired a 70% stake in December 2020 and completed the acquisition in February 2021 by acquiring the remaining 30%. In a company statement, Moncler said, “With this transaction, united by their ‘beyond fashion, beyond luxury’ philosophy, these two Italian brands will strengthen indeed their ability to interpret the evolving cultural codes of the new generations, reinforcing their positioning within the new luxury segment.” Moncler is famous for its puffy outdoor jackets while Stone Island is known for men’s apparel and outwear. Their combination can help widen their product offerings, design and manufacture at scale, and reach a larger customer base. In 2021, Aeffe SPA, the owner of Italian fashion label Alberta Ferreti, increased its stake from 70% to 100% in Moschino. The company said that the move is part of “the strategy related to the Moschino brand, which aims at the process of future integration of the women’s apparel collections into Aeffe Group to enhance their potential thanks to the exploitation of synergies.” Formerly, the company had licensed the making and distribution of the Love Moschino label to another company and now wants to bring it in-house.

Figure 4. M&A and Private Placements Announced by Smaller Luxury Companies in 2021 [wpdatatable id=1655 table_view=regular]

Source: Company reports/S&P Capital IQ/Coresight Research 3. Private Equity Firms Private equity firms are investing in luxury brands that show promise to become larger brands or those that are in need of a turnaround, preparing them for acquisition. LVMH-linked private equity firm L Catterton acquired a majority stake in Italian fashion house Etro in July 2021. In a statement, L Catterton Managing Partner and Europe Head Luigi Feola said, “We are honored to welcome such a respected and iconic fashion brand into the L Catterton family and are delighted to partner with the Etro family for the next phase of [Etro’s] evolution. We are confident that with our broad global network and experience building fashion brands, Etro will be well positioned to become an international powerhouse and a leader in its category.” For 55 years, Etro has been a family-run business. Bringing in fresh capital, outside thinking and new ideas will help the company navigate the changing luxury market. Etro has a strong position in multiple categories and can provide sizeable returns on investment to Catterton. In July 2021, Italy-based luxury apparel brand Zegna, owned by luxury group Ermenegildo Zegna, announced a reverse merger (a transaction through which a privately held company acquires a public firm to go public) to combine with US special purpose acquisition company (SPAC) Investindustrial Acquisition Corp to enter the US public market. The deal values the combined company at $3.2 billion and it went public on the New York Stock Exchange on December 20, 2021. This is one of the biggest global SPAC merger transactions in the apparel/luxury space to date. Zegna hopes to use the funds to expand business in the US and China.

Figure 5. Private Equity Investments and SPACs in Luxury, 2021 [wpdatatable id=1652 table_view=regular]

N/A indicates transactions for which the deal value is unavailable or undisclosed by the company Source: Company reports/S&P Capital IQ/Coresight Research 4. Supply Chains and Manufacturing Quality craftsmanship and exclusivity are the essence of luxury goods and brands take meticulous care to secure and safeguard the uniqueness of their supply chains. In 2021, Zegna partnered with Prada to acquire a stake in Italian cashmere supplier Filati Biagioli Modesto. Zegna also acquired a 60% stake in fine fabrics manufacturer Tessitura Ubertino, indicating that it is looking at multiple strategies, such as integration and business expansion, to consolidate its position in a highly competitive market. Chanel acquired a minority stake in textile manufacturer Paima in August 2021, but it is not new to such investments. It has strategically acquired stakes in several different business over the years, such as in shoemaker Nillab Manifatture Italiane and tannery Conceria Samanta, and backed companies that use green chemistry and sustainable manufacturing methods, such as Evolved by Nature and P2 Science.

Figure 6. Investments in Suppliers by Luxury Firms, 2021 [wpdatatable id=1657 table_view=regular]

N/A indicates transactions for which the deal value is unavailable or undisclosed by the company Source: Company reports/S&P Capital IQ/Coresight Research

M&A and Private Placements in 2022 and Beyond

Luxury has been quick to recover from the pandemic-induced slowdown. Pent-up demand is pushing sales up across regions. China, one of the markets that recovered earlier than other regions, is poised to drive growth in the sector. Brands should look to respond nimbly and effectively to the new luxury shopper who is hungry to consume luxury in new ways. Partnering with established brands in a segment or scaling capabilities are two strategies that can help them meet this fresh demand. The pandemic has also exposed vulnerabilities across the supply chain. Luxury brands should take a cue from companies like Chanel and Hermès and identify supply partners with whom they can establish exclusive working relationships. One risk of integrating the supply chain is a lack of flexibility, but as global retail markets begin to recover, luxury brands need to consider aspects that will give them an edge over competitors. M&A and private placements may not always be the ideal solutions. Luxury brands should look at alternative ways to partner with other stakeholders in the luxury ecosystem and diversify their offerings. For example, in April 2021, LVMH partnered with Prada and Richemont to develop the Aura Blockchain Consortium, a private blockchain secured by ConsenSys technology and Microsoft. The company has opened this platform to all luxury brands and not just those in the consortium. Retail conglomerates such as Lanvin Group (formerly Fosun Fashion Group) and Frasers Group that are established names in the retail sector and have capital for investment are typically on the lookout for potential targets in luxury. Lanvin has been vocal about its ambitions to build a portfolio of global luxury brands while Frasers has made its objectives clear by pruning away its unprofitable department store businesses and increasingly investing in luxury brands such as Hugo Boss and Mulberry. We could see more conglomerates make a play for luxury if groups such as Lanvin and Frasers up the ante in the sector with further acquisitions.What We Think

Large companies are looking to diversify while smaller companies are looking to scale capacity. Some luxury brands continue to strategically invest in product and materials suppliers and safeguard their supply. We think M&A activity will pick up pace as we head into 2022, as the market recovers further and becomes increasingly competitive. Implications for Brands/Retailers- Smaller brands should look to partner with larger luxury houses and develop synergies with them. Established luxury brands have funding, scale and expertise developed over the years while new brands can offer agility, freshness in ideas, and insights into a niche consumer base.

- Brands should continue to examine their supplier/vendor relationships and identify the ideal partners in terms of product quality and sustainability as consumers are increasingly conscious of their product choices.

- Vendors that offer a unique solution that cannot be imitated may be more attractive targets as luxury companies look to become ever more competitive and adapt to the new luxury consumer that has developed in the recovery from the pandemic. This consumer is increasingly reliant on technology.

- Since many shopping journeys continue to be digitally influenced, technology vendors that can help luxury firms turn these journeys into conversions in a compelling manner will be in great demand.

Appendix

Appendix Figure 1. M&A Deals and Private Placements in Luxury, January 1, 2019–January 27, 2022

[wpdatatable id=1658 table_view=regular]N/A indicates transactions for which the deal value is unavailable or undisclosed by the company Source: Company reports/S&P Capital IQ/Coresight Research