Nitheesh NH

What’s the Story?

US retail has been heavily impacted by the Covid-19 pandemic. Some sectors, such as food, health and wellness, and e-commerce marketplaces saw sustained consumer demand for essentials. However, nonessential retail, including apparel and luxury retailers, were negatively impacted by store closures and major declines in discretionary spending. Consumer demand is now gradually recovering, supported by the US government’s fiscal stimulus, vaccination rollouts and an improved economic environment. Many brand owners and retailers are rethinking their strategies and business models to recover from the crisis and thrive going forward. Mergers and acquisitions (M&A) provide a strong option for value creation. Special purpose acquisition companies (SPACs) and initial public offerings (IPOs) also offer retailers an alternative to M&A deals as an exit path.Why It Matters

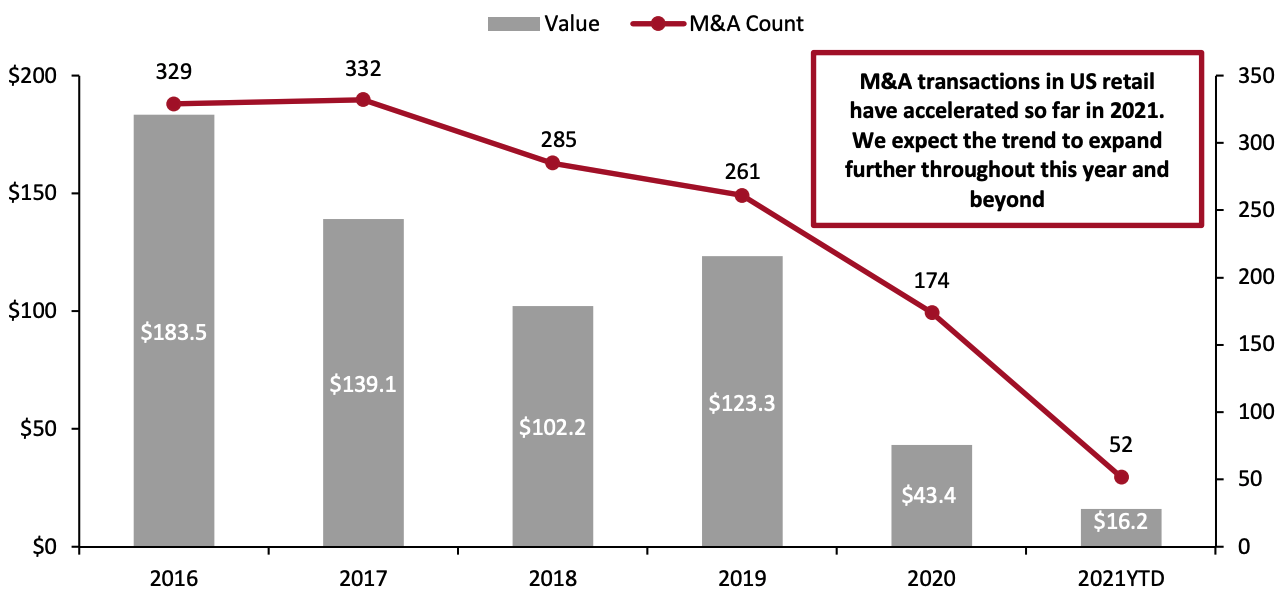

In 2020, there were a total of 174 completed M&A transactions in the retail and consumer goods industry, valued at $43.4 billion, versus 261 in 2019, valued at $123.3 billion, according to Coresight Research analysis of S&P Capital IQ data. In 2020, the US retail M&A market was disrupted by the pandemic, particularly in the second quarter, which saw just 18 retail and consumer goods M&A completed transactions, raising $2.0 billion. However, things began to turn around in the third quarter, which witnessed 37 M&A completed transactions, raising $6.1 billion. Furthermore, the M&A in retail trend accelerated in the fourth quarter of 2020, which saw 74 completed transactions, valued at $28.8 billion. In 2021, the rate of M&A transactions in US retail has accelerated so far. As of April 30, 2021, 52 retail and consumer goods M&A transactions have completed in the US, raising $16.2 billion—higher than the 49 M&A completed transactions in the equivalent period last year, valued at just $6.6 billion. We expect this trend to further accelerate throughout this year and beyond. The M&A transactions in 2020 and 2021 so far included companies in the consumer discretionary and consumer staples sectors, such as apparel and footwear specialty stores, automotive retailers, breweries, consumer electronics manufacturers, food retailers, furniture, home-furnishing and garden supply retailers, Internet and direct marketing retailers, packaged foods manufacturers, personal care products manufacturers, restaurants, sporting goods retailers, and software retailers, among others.Figure 1. The US: Value of Completed M&A Transactions in the Retail and Consumer Goods Industry (Left Axis; USD Bil.) and Total Count (Right Axis) [caption id="attachment_129925" align="aligncenter" width="700"]

YTD as of April 30, 2021

YTD as of April 30, 2021Source: S&P Capital IQ/Coresight Research[/caption]

M&A in US Retail: A Deep Dive

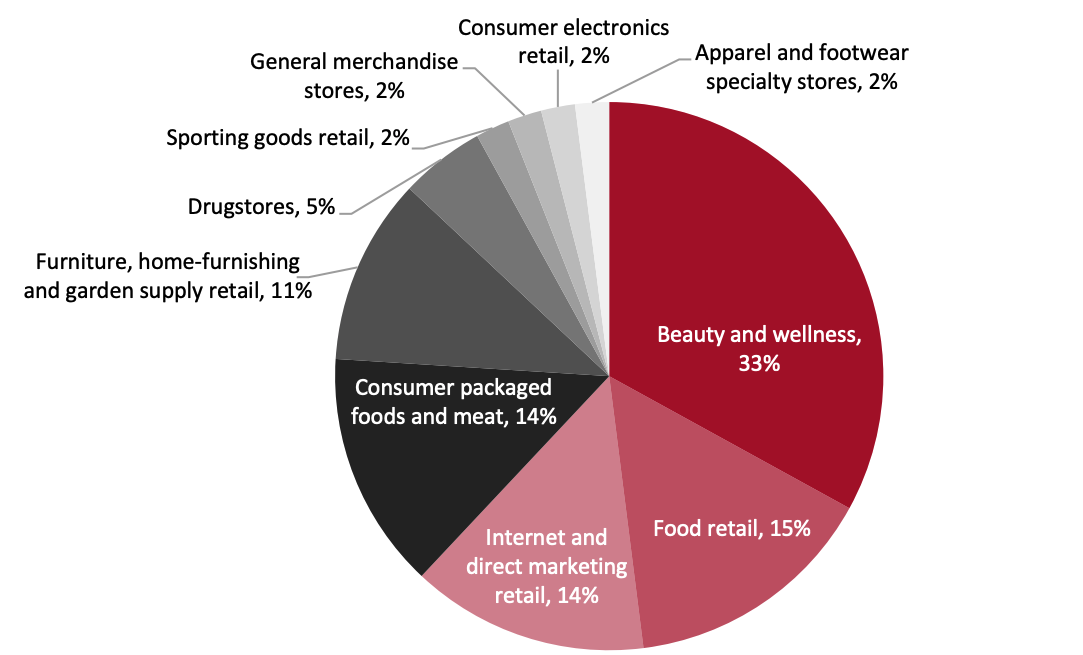

Key Retail Sectors and Areas Witnessing M&A Activity Between January 1, 2020, and April 30, 2021, the beauty and wellness category witnessed the highest number of M&A transactions—accounting for 33% of the total number in the retail sector. Consumer packaged foods and meat, food retail, furniture, home furnishing and garden supply retail, and Internet and direct marketing retail all had a substantial number, each between 10% and 15% of total completed M&A transactions in the sector. Combined, these industries contributed more than 80% of M&A transactions (both in terms of M&A count and valuation) in the sector during the period in question, according to Coresight Research analysis of S&P Capital IQ data. This excludes M&A in the automotive retail, breweries, software retail and restaurants sectors, which were part of total completed M&A transactions shown above in Figure 1. Below we analyze four key sectors and areas witnessing M&A activity. Beauty and Wellness Beauty and wellness witnessed highest number of M&A transactions in the US retail sector, between January 1, 2020, and April 30, 2021. We believe ethical consumerism and an increased focus on personal wellbeing are causing an uptick in M&A activity involving clean and sustainable beauty and wellness brands. In 2021 (January 1, 2021, to April 30, 2021), the beauty and wellness sector accounted for 43% of the total completed retail-focused M&A, notably higher than 31% in the equivalent period last year. We expect M&A activity in beauty and wellness to accelerate throughout 2021 and beyond. In the next two sections of the report, we discuss in detail three recent noteworthy M&A transactions involving beauty and wellness companies:- Coty Inc.’s acquisitions of KKW Beauty

- e.l.f. Beauty acquisition of W3LL People

- Estée Lauder’s increased Stake in DECIEM (yet to be completed)

- Ahold Delhaize USA’s acquisition of Fresh Direct

- Murphy USA’s acquisition of QuickChek Corporation

- Nestlé USA’s acquisition of Freshly

- 7-Eleven’s Acquisition of Speedway (yet to be completed)

- The sale of Kraft Heinz’s nuts business to Hormel Foods (yet to be completed)

Figure 2: US: Number of Completed Retail-Focused M&A Transactions by Target Industry, Jan 1, 2020–Apr 30, 2021 [caption id="attachment_129926" align="aligncenter" width="700"]

The chart excludes M&A deals in automotive retail, breweries, restaurants and software retail sectors

The chart excludes M&A deals in automotive retail, breweries, restaurants and software retail sectorsSource: S&P Capital IQ/Coresight Research[/caption] Recent Noteworthy M&A Completed Transactions Below, we provide case examples for seven completed retail-focused M&A transactions from January 1, 2020, to April 30, 2021, organized via sector. Please see the appendix for a full list of the 87 noteworthy, completed retail-focused M&A transactions in the US during the period. The appendix excludes M&A transactions in the automotive retail, breweries, restaurants and software retail sectors, which were part of total completed M&A transactions shown above in Figure 1. Beauty and Wellness

- Coty Inc.’s acquisitions of KKW Beauty: In January 2021, Coty acquired a 20% stake in KKW Beauty, Kim Kardashian West’s beauty business, for $200 million. Through this acquisition both companies target to enter new beauty categories and expand beyond current product lines. Plans include manufacturing a skincare line expected to be launched in fiscal 2022. As part of the acquisition deal, Coty will oversee KKW’s portfolio development, including haircare, personal care and skincare products. Coty plans to sell these products through leading luxury beauty retailers, along with its owned digital channels.

- e.l.f. Beauty’s acquisition of W3LL People: In February 2020, e.l.f. Beauty acquired cruelty-free, clean beauty brand W3LL People for $27 million in cash. e.l.f. Beauty expects W3LL People to contribute about $7 million in sales and $0.01 to its adjusted EPS in fiscal 2021. e.l.f. Beauty’s CEO Tarang Amin stated, “Clean beauty is a strategically important segment given consumer sentiment and strong growth rates. W3LL People’s brand values and market opportunity align closely with e.l.f. and we believe there are a number of synergies to be realized on both the cost and distribution fronts.”

- Ahold Delhaize USA’s acquisition of Fresh Direct: Grocery company Ahold Delhaize USA and private equity firm Centerbridge Partners acquired leading US-based online grocer FreshDirect in January 2021. Ahold Delhaize holds a majority share in FreshDirect, while Centerbridge holds a 20% stake, according to the alliance. As part of the deal, FreshDirect will retain its brand name and will continue to operate independently. Ahold Delhaize expects the transaction to bolster the company’s sales growth going forward. Ahold Delhaize’s CEO Frans Muller stated, “This leading local online brand [FreshDirect] with a large and loyal following will help us reach additional customers in the New York trade area and further propel our omnichannel evolution.” Ahold Delhaize also owns Peapod, a US-based pioneering pure-play online grocer. Combined with the FreshDirect acquisition, Ahold Delhaize expects to realize a number of synergies, on costs and distribution.

- Murphy USA’s acquisition of QuickChek Corporation: Gas station and convenience store chain Murphy USA completed the acquisition of convenience store chain QuickChek for $645 million in February 2021. Through the acquisition, Murphy USA added 157 stores located in the Northeast region, increasing its total store count to over 1,650. Murphy USA’s CEO Andrew Clyde expects the transaction to bolster its food and beverage offerings, at existing sites and those in the future. Clyde has stated that the acquisition of QuickChek has already enabled the company “to obtain the capabilities we needed immediately and accelerate by turning up the learning curve while leveraging a unique and distinctive brand in a new geography with a similar culture and aligned aspirations for future growth.”

- Nestlé USA’s acquisition of Freshly: In October 2020, food and beverage giant Nestlé USA acquired online food delivery company Freshly for $1.5 billion—$950 million plus potential earnouts of up to $550 million contingent on its future business growth. Freshly ships over one million freshly prepared meals per week to customers in 48 US states, and the company’s 2020 estimated sales stands at $430 million. With this acquisition, Nestlé expects Freshly’s specialized consumer analytics platform and distribution network to fuel growth opportunities across Nestlé’s portfolio. Freshly’s CEO Michael Wystrach expects the acquisition to help Freshly by gaining access to Nestlé’s research and development, resources and years of experience, which the company can tap into to bolster its growth plans. Nestlé has also been making similar acquisitions of UK-based direct-to-consumer (DTC) food companies to bolster its food retail offerings in the UK and Ireland. In November 2020, Nestlé entered into an agreement to acquire a majority stake in the UK-based recipe and meal kit delivery company Mindful Chef. Similarly, in February 2021, Nestlé entered into an agreement to purchase subscription-based recipe box service provider SimplyCook.

- Amazon’s acquisition of Zoox: In June 2020, Amazon entered the autonomous vehicle market through the acquisition of US-based autonomous vehicle company Zoox for $1.3 billion. Amazon has previously invested in self-driving vehicle startups, including Aurora and Rivian—however, this is the retailer’s first acquisition in the space. In June 2020, Jeff Wilke, then CEO of Amazon Worldwide Consumer, stated: Zoox is working to imagine, invent, and design a world-class autonomous ride-hailing experience. Like Amazon, Zoox is passionate about innovation and about its customers, and we’re excited to help the talented Zoox team to bring their vision to reality in the years ahead. We believe this acquisition deal will help validate the autonomous vehicle delivery space. Although Amazon already has an internal automation team, Zoox’s acquisition provides Amazon an instant lift in operational efficiencies, scale and sophistication. Zoox’s acquisition will likely increase automation in the company’s distribution network, mainly its last-mile delivery system. This complements Amazon’s existing initiatives, including its drone delivery system Amazon Air.

- JD Sports Fashion’s acquisition of DTLR Villa: In March 2021, UK-based sportswear and footwear retailer JD Sports Fashion acquired US-based athletic apparel and footwear retailer DTLR Villa for $495 million, of which about $100 million will be used to repay DTLR’s existing debts. As of February 1, 2021, DTLR owned and operated 247 stores across 19 states, mainly in eastern and northern US. Earlier in December 2020, JD Sports acquired US-based footwear retailer Shoe Palace for $325 million, providing the British retailer a robust geographical footprint in the western US through a network of 167 stores. JD Sports’ push into the US market commenced in 2018 through the $558 million acquisition of athletic apparel and footwear retailer Finish Line.

- Estée Lauder’s increased stake in DECIEM: In February 2021, Estée Lauder entered into an agreement to increase its stake from 29% to 79% in the Canada-based, vertically integrated, multi-brand beauty company DECIEM Beauty Group, for $1.0 billion. The transaction is expected to close in DECIEM’s second quarter, ending June 30, 2021. Estée Lauder will purchase the remaining stake in DECIEM after a three-year period. DECIEM generated sales of about $460 million for the year ended January 31, 2021.

- 7-Eleven’s acquisition of Speedway: In August 2020, convenience store chain 7-Eleven entered an agreement to acquire convenience store and gas station chain Speedway for $21 billion, from Marathon Petroleum Corp. The acquisition deal is subject to customary regulatory approvals from the US Federal Trade Commission (FTC) and is expected to be completed in 2021. According to the deal, 7-Eleven will acquire 4,000 Speedway stores across 35 states in the US, increasing 7-Eleven’s total store count to 20,000 and enhancing its presence in 47 metropolitan areas in the US. 7-Eleven noted that the acquisition will help the company to grow and diversify its presence in the US, mainly on the East Coast and in the Midwest. Meanwhile in April 2021, 7-Eleven entered an agreement to sell 106 stores to the convenience-store wholesaler and retailer CrossAmerica Partners for $263 million. The deal comprises company-operated sites that 7-Eleven is divesting in connection with its pending acquisition of Speedway (to comply with FTC’s divestiture guidelines for M&A transactions). 7-Eleven expects to close the sale of its 106 stores on a rolling basis, beginning 60–90 days after closing its acquisition of Speedway.

- The sale of Kraft Heinz’s nuts business to Hormel Foods: In February 2021, food and beverage company Kraft Heinz entered into an agreement to sell its nuts business to Hormel Foods Corporation, a manufacturer and retailer of consumer-branded food and meat products, for $3.35 billion. The deal is set to be completed by the end of 2021, subject to customary regulatory approvals. The sale is a part of Kraft Heinz’s multiyear turnaround effort to trim less-popular products from its lineup. Through the sale of its nuts business, Kraft Heinz expects to sharpen its focus on areas with higher growth prospects and attain a competitive edge for its most popular brands, such as P3 and Lunchables. The nuts business contributed $1.1 billion to Kraft Heinz’s sales in its fiscal 2020 (ended December 26, 2020) mainly in the US.

Figure 3: US: Key Benefits and Challenges for Acquirers in M&A Transactions

|

Attain cost and revenue synergies: Through M&A deals, businesses in the same sector or location can combine resources to reduce costs, remove duplicated facilities or departments and increase revenues. Furthermore, retailers may gain an advantage from each other’s intangible assets, such as goodwill and intellectual property. Access valuable assets for new development: Through acquisitions, retailers can access new production and distribution facilities for the development of new product lines or expansion of existing ones. Acquiring an existing outside business may be a more cost-effective alternative to internally expanding operations. From a financial point of view, it may make sense to acquire businesses that have large unused capacity and are only marginally profitable—meaning they are available for purchase at a small premium to their net asset value (total assets minus total liabilities). Expand customer base and grow market share: M&A transactions may help retailers penetrate new consumer markets, both domestic and international, as well as expanding their revenue share. |

|

Create diseconomies of scale: After an acquisition, a retailer may grow so large that it lacks the same degree of control over employees’ productivity and other factors of production. This may lead to lost synergies, both in terms of costs and revenues. Such challenges usually occur when the acquirer and acquired company have little in common in terms of businesses or operations. Create gaps in communication: Acquiring companies and their targets may have different organizational cultures, resulting in a communication gap between stakeholders including employees, investors and suppliers, impacting the overall performance of the acquirer or the newly formed company. Hamper strength of the acquirer’s brand: Though a newly acquired brand may be performing well in its key markets, underperformance in the acquirer’s dominant markets may negatively impact the strength of its existing brands, as well as upcoming ones. |

Source: Coresight Research

Figure 4: US: Key Benefits and Challenges for Target Companies in M&A Transactions

|

|

|

|

Source: Coresight Research

What We Think

The recovery of M&A activity in US retail that began in the second half of 2020 accelerated in early 2021. We expect the trend to continue accelerating throughout the remainder of 2021 and beyond. Additionally, we expect portfolio redefinitions to continue fueling M&A activity in retail, with larger companies showing resilience and remaining focused on value creation strategies. Trends such as digitalization, the convergence of technology with in-store experiences and contactless delivery options are also creating opportunities for M&A deal activity, as businesses look to acquire disruptors. Similarly, we expect high levels of liquidity through 2021 to continue to drive M&A activity. While for brands and retailers facing imminent distress, consolidation may be inevitable, for others, deal-making may be the best and fastest way to fill urgent gaps in resources, skills and technologies they need to create value going forward. In 2021, capability expansion will likely be a key focus as retailers and brand owners enhance digital capabilities, financial technology and logistics through M&A transactions, as well as expanding product offerings and geographical reach. In 2021 and beyond, we expect the retail and consumer goods M&A pipeline to broaden in terms of sector representation, including more sectors that are experiencing a strong recovery from the Covid-19 pandemic—such as apparel and footwear specialist stores. Implications for Retailers and Brand Owners- Sound strategic planning is essential to maximizing merger benefits. Prior to signing an acquisition agreement, retailers should develop a detailed road map for integrating the two companies’ operations. This includes selecting a team of experienced leaders and advisors who can communicate change effectively and establish a transparent process, work closely with the human resource department to build positive connections across functions and informal networks, and help culturally diverse employees navigate through the process.

- Retailers and brand owners looking to enter M&A transactions should thoroughly analyze the compatibility of corporate cultures, financial structures and customer bases of the participating companies (both acquirers and target companies). Incompatible ethics and goals between acquirer and target company can easily make a merger counterproductive.

- Retailers entering M&A deals should design and maintain a system of internal controls over human resource management, financial reporting, restructuring activities and tax implications.

- When conducting due diligence, besides accounting checks, retailers should try to access data for potential markets and talk with employees, investors and vendors. Accurate data and efficient forecasting techniques, such as financial modeling, can offer companies insights in order to evaluate the most effective strategy for entering a new market or a new product category, compare alternative M&A targets and avoid costly mistakes, including overestimation of potential synergies.

- To determine the right acquisition price, the acquirer must analyze cash flows, market position, performance, regulatory issues, technology, and future growth opportunities of the target companies. While determining the acquisition price, it is always advisable to take lessons from past acquisition deals (in case the company has executed in the past), look into industry benchmarks and learn from the experience of peers.

- In case major restructuring of target company is required after a merger, acquirer and target company must discuss it beforehand to ensure that all stakeholders, including employees, investors and suppliers, agree on the defined strategies set by the acquiring company.

- To ensure the effective integrations of the businesses, companies should invest in professional training and development for all employees so that they are well armed to handle their tasks in a newly formed post-merger company. Some important areas for growth include training on business processes, new systems and technologies.

Appendix

Appendix Figure 1: US Completed Retail-Focused M&A Transactions from January 1, 2020, to April 30, 2021 [wpdatatable id=1104]

*Acquirer information not available The table excludes M&A transactions in automotive retail, software retail, restaurants and breweries sectors Source: S&P Capital IQ/company reports/Coresight Research