DIpil Das

Introduction

What’s the Story? In recent years, we have seen interesting M&A in the US jewelry retail market. From mass-market jewelry retailer Signet Jewelers’ acquisition of direct-to-consumer (DTC) jewelry retailer Diamonds Direct and jewelry rental subscription platform Rocksbox to luxury conglomerate LVMH’s acquisition of Tiffany & Co, there have been many power plays for expansion. In this report, we identify the current focus areas of growth in the jewelry retail market through M&A and detail recent major acquisitions by jewelry players and investment companies to expand their businesses and diversify their offerings. We also discuss the implications of these growth strategies for the future of the US jewelry industry. Why It Matters The Covid-19 pandemic has destabilized operations and upended supply chains across retail. The jewelry industry, however, has been relatively more resilient and posted strong growth in 2021—jewelry was a great beneficiary of increased disposable income from stimulus checks, income support and restrictions on travel. In 2022 and beyond, as consumer sentiment improves further, jewelry brands and retailers need to rethink their strategies and business models to cater to the new jewelry shoppers that have emerged amid pandemic recovery. M&A provide strong options for value creation by building scale and driving transformation and innovation; they can also help businesses consolidate their positions more quickly than organic growth.M&A in the US Jewelry Retail Market: Coresight Research Analysis

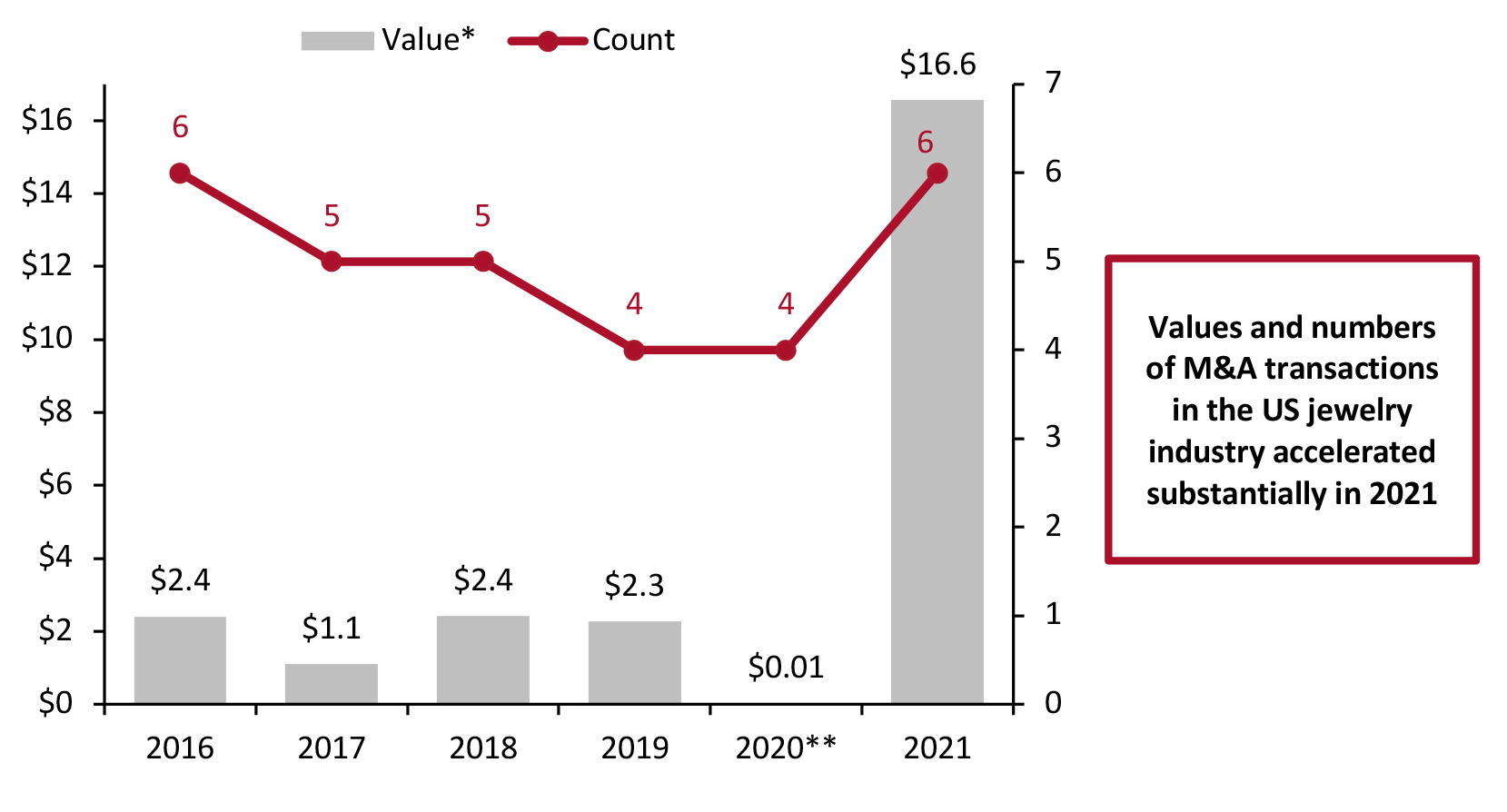

The US jewelry retail market is highly fragmented, with the top five players accounting for around 20% of total sales in 2021. We believe that the market is ripe for consolidation. In 2021, there were a total of six completed M&A transactions in the US jewelry industry, which totaled $16.6 billion in disclosed value, versus four in 2020, valued at just $3.3 million, according to Coresight Research analysis of S&P Capital IQ data. 2021’s disclosed value was dominated by LVMH’s $15.8 billion acquisition of Tiffany & Co. Excluding this, the transactions for which the values were disclosed amounted to $760.4 million. We expect the strong M&A trends in the US jewelry industry to continue in 2022, with brands and retailers looking to create value through acquisition in growing categories, channels and markets.Figure 1. US: Value of Completed M&A Transactions in the US Jewelry Industry (Left Axis; USD Bil.) and Total Count (Right Axis) [caption id="attachment_145870" align="aligncenter" width="700"]

*Disclosed values only; financial details of some transactions were not disclosed

*Disclosed values only; financial details of some transactions were not disclosed **Disclosed value of M&A transaction given to two decimal places

Source: S&P Capital IQ/Coresight Research [/caption] Below, we present the current focus areas for growth through M&A in the jewelry industry, with examples of recent transactions.

Figure 2. Key Focus Areas for Growth Through M&A in the Jewelry Industry [caption id="attachment_145871" align="aligncenter" width="701"]

Source: Coresight Research[/caption]

1. Penetrate New Consumer Markets and Expand Revenue Share

US retailers are ramping up M&A activities to penetrate new consumer markets, both domestic and international, as well as expand their revenue share.

In November 2021, mass-market jewelry retailer Signet Jewelers acquired US-based DTC jewelry brand Diamonds Direct for $490 million in an all-cash transaction. Through this acquisition, Signet Jewelers is looking to capitalize on Diamonds Direct’s distinct bridal focus shopping experience, differentiated value proposition and younger target audience to expand in the bridal jewelry market.

US-based jewelry retailers often rely substantially on the wedding trade since couples spend a notable amount on their wedding jewelry—in 2021, US couples on average spent $6,000 on engagement rings versus $5,500 in 2020, according to a December 2021 study by wedding planning company The Knot. We expect spending on bridal jewelry to increase in 2022 with the surge in weddings due to pent-up demand from canceled wedding events amid the pandemic. In 2022, about 2.5 million couples in the US are expected to tie the knot, with an average spend of $24,300, up from 1.9 million weddings at an average spend of $22,500 in 2021, according to a June 2021 survey of 2,229 consumers and 283 businesses by wedding research company The Wedding Report.

[caption id="attachment_145872" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Penetrate New Consumer Markets and Expand Revenue Share

US retailers are ramping up M&A activities to penetrate new consumer markets, both domestic and international, as well as expand their revenue share.

In November 2021, mass-market jewelry retailer Signet Jewelers acquired US-based DTC jewelry brand Diamonds Direct for $490 million in an all-cash transaction. Through this acquisition, Signet Jewelers is looking to capitalize on Diamonds Direct’s distinct bridal focus shopping experience, differentiated value proposition and younger target audience to expand in the bridal jewelry market.

US-based jewelry retailers often rely substantially on the wedding trade since couples spend a notable amount on their wedding jewelry—in 2021, US couples on average spent $6,000 on engagement rings versus $5,500 in 2020, according to a December 2021 study by wedding planning company The Knot. We expect spending on bridal jewelry to increase in 2022 with the surge in weddings due to pent-up demand from canceled wedding events amid the pandemic. In 2022, about 2.5 million couples in the US are expected to tie the knot, with an average spend of $24,300, up from 1.9 million weddings at an average spend of $22,500 in 2021, according to a June 2021 survey of 2,229 consumers and 283 businesses by wedding research company The Wedding Report.

[caption id="attachment_145872" align="aligncenter" width="700"] Signet Jewelers successfully integrated Diamonds Direct in November 2021

Signet Jewelers successfully integrated Diamonds Direct in November 2021 Source: Signet Jewelers [/caption] Similarly, Signet Jewelers’ acquisition of US-based jewelry rental subscription platform Rocksbox in April 2021 has helped Signet Jewelers to generate a new steady revenue stream in the form of subscriptions. The acquisition has also enabled Signet Jewelers to grow its jewelry services, including piercing and repair and warranty services, among others. In the acquisition press release, Signet Jewelers CEO Virginia Drosos said, “Rocksbox has revolutionized the jewelry rental subscription marketplace by delivering personalized, online and data-driven customer experiences for jewelry lovers who prioritize fashion, online convenience and sustainability.” Signet Jewelers plans to capitalize on Rocksbox’s shoppers’ data to enhance personalization and customization offered to its customers, which continues to be a roaring trend, particularly within Signet Jewelers’ key bridal jewelry category. Around 80% of bridal customers seek some level of personalization and wedding ring customization, according to Signet Jewelers’ September 2021 survey. Moreover, the acquisition of Rocksbox is helping Signet Jewelers offer a growing range of cross-banner promotions. For example, the company’s brand Jared offered its customers a free two-month subscription to Rocksbox when shoppers purchased a Jared piece and then provided a bounce-back coupon to customers who activated a Rocksbox subscription. In 2017, Signet Jewelers acquired online jewelry retailer JamesAllen.com for $328 million in cash to enhance its innovation and digital capabilities. Prior to the acquisition, James Allen’s sales grew 50% to $288 million in 2016. Similarly, Denmark-based mass-market jewelry company Pandora is looking for a massive expansion in the US jewelry retail market through recent acquisitions and strategic partnerships. In March 2022, Pandora acquired 37 franchise locations in North America from US-based luxury jewelry retailer Ben Bridge Jeweler. The franchise stores include five Pandora-owned stores in Canada, which opened on February 25, 2022. Pandora expects this acquisition to grow its presence in the US West Coast region and bolster its omnichannel offering in North America. In addition, in February 2022, Pandora entered a partnership with US department store chain Macy’s to expand Pandora shop-in-shops in an additional 28 US locations by the end of 2022, from five currently. Pandora expects this partnership to enhance the jewelry retailer’s accessibility in the US and accelerate its footprint growth. 2. Access New Production and Distribution Facilities Through acquisitions, retailers are accessing new production and distribution facilities for the development of new product lines or expansion of existing ones. This is because acquiring an existing outside business may be a more cost-effective alternative to internally expanding operations. For instance, in January 2021, French luxury conglomerate LVMH completed the acquisition of one of the leading US jewelry specialists, Tiffany & Co., for $15.8 billion, substantially expanding the former’s addressable market in the US through access to Tiffany & Co.’s products and distribution capabilities. We believe LVMH viewed Tiffany & Co.’s relatively low-priced jewelry products as a great means to attract younger customers—who may become wealthier as they age and eventually pay up for LVMH’s high-end jewelry products. Luxury is one of the fast-growing jewelry segments in the US. The US luxury jewelry market is set to grow strongly in the next five years, from $9.2 billion in 2021 to $12.5 billion by 2026—at a sales CAGR of 6.3%, according to Euromonitor International. Since the acquisition, LVMH has orchestrated a major overhaul of Tiffany & Co.’s business. This has included appointing new C-suite executives and revamping stores. The business has also expanded its merchandise lineup to increase the focus on gold and precious gems and took its high-margin silver jewelry category—mainly targeted at younger consumers—upmarket. LVMH is also boosting social media marketing campaigns to make Tiffany & Co. more appealing to younger audiences, particularly millennials. For instance, in September 2021, Tiffany & Co. launched its “About Love” campaign featuring US celebrities Beyoncé and Jay-Z. As of April 12, 2022, Beyoncé had 249 million followers on Instagram, while Jay-Z remains inactive on the social media platforms. LVMH is pushing Tiffany & Co. to sell more high-end jewelry, such as a necklace featuring 180-carat diamonds valued at over $20 million, which was unveiled in Dubai in November 2021—the most expensive in Tiffany & Co.’s 184-year history. We believe that the change in Tiffany & Co.’s brand identity and substantial transformation is earning impressive traction among Tiffany & Co. fans and helping LVMH to bolster its Watches and Jewelry division’s sales—which grew 161% year over year to €9.0 ($10.1 billion) in 2021. Additionally, in its fiscal 2021 earnings call held in January 2022, LVMH noted that Tiffany & Co. brought in $800 million in operating profit for fiscal 2021. LVMH’s CEO Bernard Arnault said that LVMH is massively benefitting from Tiffany & Co.’s iconic lines, including the T line, the Knot line and the HardWear line. [caption id="attachment_145873" align="aligncenter" width="699"]

LVMH completed the acquisition of Tiffany & Co. in January 2021

LVMH completed the acquisition of Tiffany & Co. in January 2021 Source: LVMH [/caption] 3. Increase the Acquired Company’s Value Over Time and Sell at a Profit Private equity (PE) firms are acquiring jewelry brands that show promise to become larger brands or those that need a turnaround, preparing them for sale and earning a profit. In September 2021, private equity firm Compass Diversified acquired Lugano Diamonds & Jewelry, a manufacturer and retailer of high-end jewelry, for $267.6 million, including working capital and certain other adjustments. Compassed Diversified plans to grow Lugano’s capabilities by investing in the jewelry retailer’s merchandising strategy, including continuing to roll out retail stores and expand Lugano’s event-driven marketing efforts. Similarly, in December 2020, private equity firm Nonantum Capital Partners acquired US-based DTC jewelry company Ross-Simon for an undisclosed sum. In the press release, Nonantum stated that it will invest in Ross-Simon to help the jewelry company realize its full potential as a strong industry leader in customer service and quality. PE investors’ growing interest points to the solid growth potential of jewelry retailers in the US. Below, we provide a list of 31 noteworthy M&A transactions in the US jewelry retail market completed between January 1, 2016, and March 15, 2022. We found that M&A transactions were substantial across the industry—both in mass-market and luxury categories. Furthermore, we noticed that a substantial number of M&A deals were focused on new-age DTC jewelry companies, which are using data-driven technology to disrupt existing business models and grow rapidly. We believe that M&A deals involving DTC jewelry companies will continue to grow.

Figure 3: US: Completed M&A Transactions in the Jewelry Sector, January 1, 2016, to March 15, 2022 [wpdatatable id=1912]

Source: Company reports/S&P Capital IQ/Coresight Research Jewelry Retail-Focused M&A Growth and Future Prospects In 2022 and beyond, we expect to see continued M&A activity as jewelry brands and retailers grab shares of the fast-growing market. Three Driving Forces Below, we examine three key factors that we believe will drive M&A activity in the jewelry retail sector in 2022 and beyond. 1. Expanding Core Portfolios With leading jewelry brands and retailers looking to expand their portfolios—for instance, Signet Jewelers is seeking to enlarge its bridal jewelry offerings and LVMH aims to grow the high-end offerings of Tiffany & Co.—strong M&A activity in the jewelry retail market will continue in 2022 and beyond. Following an acquisition, the acquiring brands and retailers can channel resources into core/growing segments and key markets of the target company. 2. Improving Operational Resilience and Business Transformation As many jewelry retailers’ conventional business models are coming under threat due to rapid innovation, companies are looking to M&A transactions to overhaul their businesses, including digitalizing, automating, integrating vertically and diversifying their supply chains. 3. Private Equity Firms Seeking Value-Creation Opportunities in Carve-Outs Private equity firms across the globe are looking for value-creation prospects in carve-outs—the partial divestitures of business units in which parent companies sell stakes of subsidiaries to outside private investors. Between January 1, 2021, and November 23, 2021, private equity firms across the globe raised over $714 billion in “dry powder” (the amount of committed but unallocated capital that firms have on hand), and this unspent capital is expected to rise further in 2022, according to UK-based data provider Preqin. Due to this increase in the reserve, we expect 2022 to involve a high level of M&A activity. We see jewelry brands and retailers as likely points of interest for these private equity buyers. Potential Headwinds We believe the following two key factors could hinder M&A activity in the US jewelry retail sector in 2022. 1. Rising Inflation and Interest Rates To counter inflation, in March 2022, the US Central Bank raised interest rates by 25 basis points (bps) to 0.5%—the first increase since 2018. Furthermore, the Central Bank signaled more interest rate increases to come in 2022. An increase in interest rates could cool down M&A activity as leveraged buyout is one of the most common strategies used in M&A, where the acquirer uses a significant amount of borrowed money to meet the cost of acquisition. However, the downward pressure could be avoided if acquiring companies move up plans in order to lock in lower interest rates. Rising inflation could also impact jewelry companies by accelerating consolidation and transformation in the industry, as the companies best placed to raise their prices are those that already have a dominant position in the market. 2. Proposed Increase in US Corporate Tax In September 2021, the Democrats in the US House of Representatives proposed an increase in the corporate tax rate to 26.5% from 21% and a change in the highest tax rate on long-term capital gains and dividends to 25% from 20%. We believe the increase in the US corporate tax rate proposed by the president could decrease the attractiveness of investment in US companies while leading to more investment overseas. Nevertheless, the proposed tax changes are still under discussion and are heavily opposed by Republicans and business lobbies.

What We Think

We think that M&A activity in the US jewelry retail—both mass-market and luxury—will remain strong in 2022 and beyond. We expect portfolio redefinitions to continue fueling M&A activity in jewelry retail, with larger companies showing resilience and remaining focused on value creation strategies. Similarly, we expect high levels of liquidity to drive M&A activity in 2022 and beyond. However, inflation and increase in interest rates remain key concerns. In the near future, we expect to see some consolidation in the US jewelry retail market—while Signet Jewelers, LVMH and Pandora will continue to hold the leading positions in the industry. We believe that M&A will help leading jewelry brands and retailers expand their customer base and services through technology and new product offerings. In 2022, capability expansion will likely be a key focus as jewelry brands and retailers enhance digital and data-driven operations through M&A transactions, as well as expanding product offerings and geographical reach. Implications for Brands/Retailers- We see e-commerce as a strong opportunity for US jewelry retailers to adjust product and service offerings and drive sales. Furthermore, we believe that growing online demand will drive consolidation in the industry, with leading players ramping up M&A activity to expand their digital businesses.

- As discussed in our Playbook on M&A in retail, outlining a structured approach that breaks down a complex M&A integration activity into defined phases, steps and deliverables can help retailers maximize M&A benefits—such as revenue and cost synergies, expansion of market share and enhanced customer bases—while minimizing risks, including diseconomies of scale.

- As the world of M&A is evolving, jewelry retailers and brands should remain cognizant of the current trends prevailing in the global jewelry landscapes when devising their M&A strategies. In addition, developing a well-defined and comprehensive M&A tax strategy for each function and geography across the entire enterprise will be helpful to retailers to identify the overall deal’s cash and non-cash values.

- In case a major restructuring of the target company is required after a merger, the acquirer and target company must discuss it beforehand to ensure that all stakeholders, including employees, investors and suppliers, agree on the defined strategies set by the acquiring company.