DIpil Das

What’s the Story?

The pandemic has shaken up the global M&A market, leading companies to reevaluate their M&A plans. The beauty industry is no exception, having seen softness in M&A activity last year, particularly in the second quarter. However, the market has proven to be resilient and has rebounded quickly in recent months. In this report, we discuss the soft performance of 2020 and highlight notable deals that are kickstarting the market in 2021. We also summarize the major global deals that closed in 2020 and year-to-date 2021.Why It Matters

Despite the pandemic and economic uncertainty, the beauty industry proved to be relatively resilient, especially in two of its largest markets—China and the US:- US consumer spending on beauty categories increased slightly, by 0.6%, in 2020, according to the US Bureau of Economic Analysis.

- China’s National Bureau of Statistics reported that beauty retailers saw year-over-year growth of 9.5% last year.

M&A in Beauty: In Detail

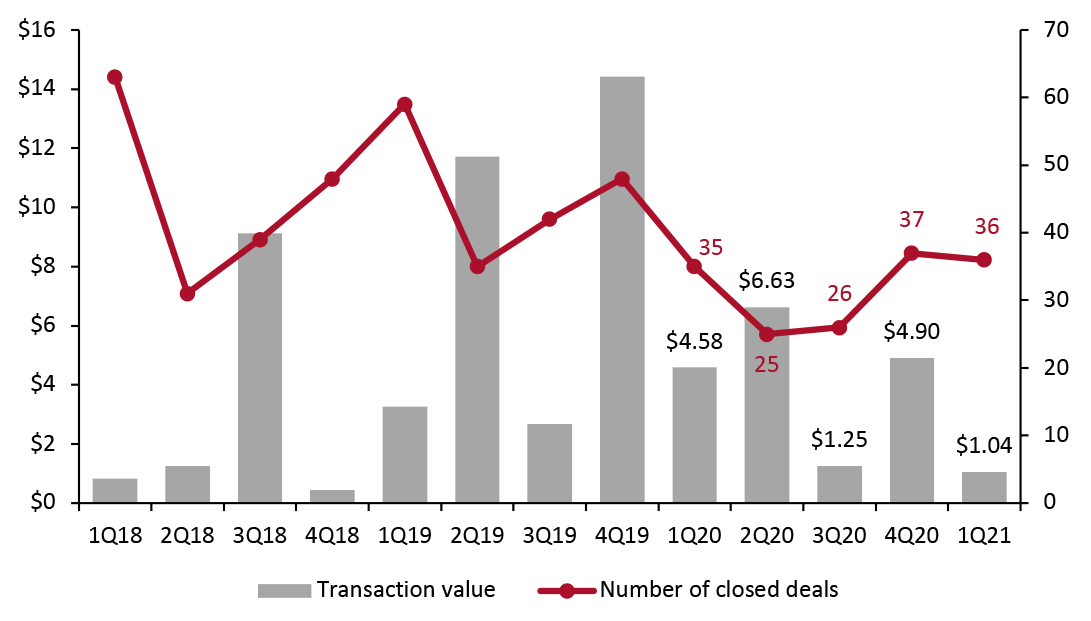

Fewer Deals in 2020 The pandemic resulted in a contraction of the financing markets, business closures, longer processing and approval times and restrictions on in-person meetings—thus significantly impacting the beauty M&A market last year. There were 35 transactions in the first quarter of 2020—24 fewer than in the year-ago period—and a further significant drop in volume in the second quarter, which represented a year-over-year decline of 28.6%. However, even though the second quarter had the lowest total number of deals of any period in 2020, it saw plenty of high-profile M&A transactions by beauty conglomerates, resulting in the highest quarterly transaction value of the year, at $6.6 billion (see Figure 1). The number of closed deals remained depressed in the third quarter, with a decline of 38.1% year over year. With a more favorable economic backdrop in the fourth quarter—such as low interest rates that allow for cheaper debt—interest in M&A activity was renewed, and 2020 closed with a total of 123 deals.Figure 1. M&A Closed Deals in Beauty: Transaction Value in Beauty Care Products (USD Bil., Left Axis) and Number of Deals (Right Axis) [caption id="attachment_126414" align="aligncenter" width="725"]

Source: S&P Capital IQ/Coresight Research[/caption]

A Strong Start to 2021: Notable Global Deals

So far in 2021, as of mid-April, we have already seen activity around eight beauty M&A deals (see Figure 2 later in this report), with the negative impact of Covid-19 gradually waning and business improving. Of those, three are notable billion-dollar deals, which we explore below.

1. Estée Lauder Increases Its Stake in Deciem

On February 23, 2021, Estée Lauder agreed to buy a majority stake in Canada-based company Deciem, the parent company of popular brand The Ordinary. After investing in the company in 2017, Estée Lauder owned a 29% stake in Deceim. Under the terms of the new deal, Estée Lauder will pay approximately $1 billion to increase its ownership to 76%, reflecting Deciem’s valuation of $2.2 billion. The transaction is expected to close in the second quarter of 2021. Estée Lauder plans to buy the rest of the company in three years.

Deciem’s portfolio currently includes The Ordinary, an affordable skincare brand that recently dipped its toes into color cosmetics; higher-end skincare line NIOD; haircare brand Hif; and functional skincare brands Abnomaly, Hylamide and The Chemistry Brand. In 2020, the company doubled its sales to $460 million, driven by The Ordinary. Although The Ordinary sells low-price products, it operates via prestige channels and specialty retailers such as Sephora and Ulta Beauty. Deciem operates 40 of its own retail stores, and direct-to-consumer sales (including e-commerce) represent roughly half of its sales, according to the company.

[caption id="attachment_126415" align="aligncenter" width="480"]

Source: S&P Capital IQ/Coresight Research[/caption]

A Strong Start to 2021: Notable Global Deals

So far in 2021, as of mid-April, we have already seen activity around eight beauty M&A deals (see Figure 2 later in this report), with the negative impact of Covid-19 gradually waning and business improving. Of those, three are notable billion-dollar deals, which we explore below.

1. Estée Lauder Increases Its Stake in Deciem

On February 23, 2021, Estée Lauder agreed to buy a majority stake in Canada-based company Deciem, the parent company of popular brand The Ordinary. After investing in the company in 2017, Estée Lauder owned a 29% stake in Deceim. Under the terms of the new deal, Estée Lauder will pay approximately $1 billion to increase its ownership to 76%, reflecting Deciem’s valuation of $2.2 billion. The transaction is expected to close in the second quarter of 2021. Estée Lauder plans to buy the rest of the company in three years.

Deciem’s portfolio currently includes The Ordinary, an affordable skincare brand that recently dipped its toes into color cosmetics; higher-end skincare line NIOD; haircare brand Hif; and functional skincare brands Abnomaly, Hylamide and The Chemistry Brand. In 2020, the company doubled its sales to $460 million, driven by The Ordinary. Although The Ordinary sells low-price products, it operates via prestige channels and specialty retailers such as Sephora and Ulta Beauty. Deciem operates 40 of its own retail stores, and direct-to-consumer sales (including e-commerce) represent roughly half of its sales, according to the company.

[caption id="attachment_126415" align="aligncenter" width="480"] The Ordinary’s products

The Ordinary’s products Source: Deciem [/caption] The new deal will provide Deciem with access to Estée Lauder’s vast resources. According to Nicola Kilner, Co-founder and CEO of Deciem, the company plans to draw on Estée Lauder’s expertise in global expansion to consider entering markets such as India and the Middle East. In 2021, the company also expects to expand with Sephora and Ulta Beauty (particularly through the companies’ partnerships with Kohl’s and Target, respectively), as well as launch more color cosmetics products. For Estée Lauder, the acquisition will enrich its brand portfolio, which primarily comprises prestige and luxury brands that are sold in department stores and specialty beauty retailers. The prestige beauty market was particularly hard hit by the pandemic. According to NPD data, US prestige beauty fell 19% year over year in 2020, with makeup down 34% and skin care down 11%. Deciem’s brands represent the “masstige” beauty segment, which is a coined word from “mass” and “prestige,” generally meaning products that have benefits similar to premium skin care but at a more affordable price point. The segment is gaining traction, accelerated by the pandemic, as consumers become more price-sensitive. The addition of Deciem also increases Estée Lauder’s relevance to young consumers. Today’s Gen Z consumers are very much “skintellectuals,” shoppers who are knowledgeable about the ingredients and benefits of skincare products: The Ordinary’s products, which focus on simple and effective ingredients, resonate well with this demographic. According to a fall 2020 survey conducted by investment bank Piper Sandler, The Ordinary is the fourth favorite skincare brand of Gen Z female consumers in the US. Following the announcement of increasing its stake in Deciem, Estée Lauder revealed on February 24 that it plans to close its makeup brand Becca Cosmetics in September. The closure is part of Estée Lauder’s Post-Covid Business Acceleration Program, which includes shutting down underperforming retail locations, counters in travel retail and locations in Latin America. The makeup category was struggling even before the pandemic, but the company’s sales from makeup have continued to shrink in fiscal 2021 (ending June 2021), with year-over-year declines of 32% and 25% in the first and second quarters, respectively. 2. L’Oréal Acquires Japanese Beauty Company Takami L’Oréal announced on December 23, 2020 that it entered into an agreement to acquire Japanese beauty company Takami Co. and finalized the acquisition on February 1, 2021, for an undisclosed amount. Takami is a premium skincare brand founded and owned by dermatologist Dr. Hiroshi Takami. As part of the transaction, L’Oréal signed a long-term brand-licensing agreement with Dr. Takami and a collaboration contract with his clinics. The Takami brand is popular in Asia, notably China, and sells primarily online and through subscription services, as well as through selective specialty distribution. The brand is best known for its skin peel pre-serum. In 2019, Takami generated sales of roughly €50 million ($61.2 million) and continued its growth in 2020 despite the Covid-19 headwind. Cyril Chapuy, President of L’Oréal Luxe, said that Takami’s expertise in prestigious beauty treatments and omnichannel distribution fit well within L’Oréal Luxe. [caption id="attachment_126416" align="aligncenter" width="435"]

Takami’s iconic skin peel pre-serum (known as “little blue bottle”)

Takami’s iconic skin peel pre-serum (known as “little blue bottle”) Source: L’Oréal [/caption] While Takami is a small brand in terms of revenue, the strategic acquisition should complement L’Oréal’s core growth.

- Takami strengthens L’Oréal’s skincare portfolio. Pre-serum is a niche category that is under-represented in the company’s other skincare brands. In the company’s fourth-quarter 2020 earnings call in February 2021, CFO Christophe Babule stated that skin care is growing in all divisions. L’Oréal’s skincare category rose by 8.7% in 2020 and now accounts for almost 40% of the company’s total sales, versus 35% in 2019.

- The appeal of Takami in Asia Pacific will support L’Oréal’s growth in the region. Asia Pacific was the only region that returned to positive growth last year, with sales increasing by 1.5%, driven by Mainland China. In 2020, Asia Pacific accounted for the largest share of L’Oréal’s total sales, at 35%.

- Takami’s subscription-driven distribution approach is unique compared to L’Oréal’s existing portfolio.

Eve Lom’s best-selling balm cleanser

Eve Lom’s best-selling balm cleanser Source: Eve Lom [/caption] We believe the acquisitions of Eve Lom and Galénic will help Yatsen expand into premium skin care, which is a sector in which Chinese consumers prefer international brands over domestic brands. The acquisitions also improve Yatsen’s research and development capabilities, as well as its access to a global distribution network. Beauty M&A Activity in 2020 and 2021 YTD Pandemic-led changes in consumer behavior—such as increased interest in holistic wellness, skin care and self-care, plus a shift to the online channel—have had huge impacts on the focus areas of buyers and investors. In Figure 2, we summarize the major global deals that closed in 2020 and year-to-date 2021. We can see that natural and clean beauty is one of the most popular categories, having seen strong demand from health-conscious consumers during the pandemic. Beauty companies including L’Oréal, Estée Lauder and e.l.f Beauty, as well as some private equity firms, have acquired niche clean beauty brands. Prestige beauty also gathered great interest from investors, especially in Asia.

Figure 2. Major Global Beauty M&A Deals in 2020 and 2021 YTD* [wpdatatable id=892 table_view=regular]

*As of April 16, 2021 Source: Company reports