Introduction

What’s the Story?

In 2021, the apparel, footwear and accessories sectors in the US and the UK saw strong recoveries from the Covid-19 pandemic. We expect some momentum to continue this year, particularly in first half. Many apparel and footwear brand owners and retailers are rethinking their strategies and business models to recover further and thrive going forward.

Mergers and acquisitions (M&A) provide a strong option for value creation. In this report, we analyze 2021 apparel and footwear-focused M&A activity in the US and the UK, and we discuss the prospects for, and drivers of, M&A growth in 2022 and beyond.

Why It Matters

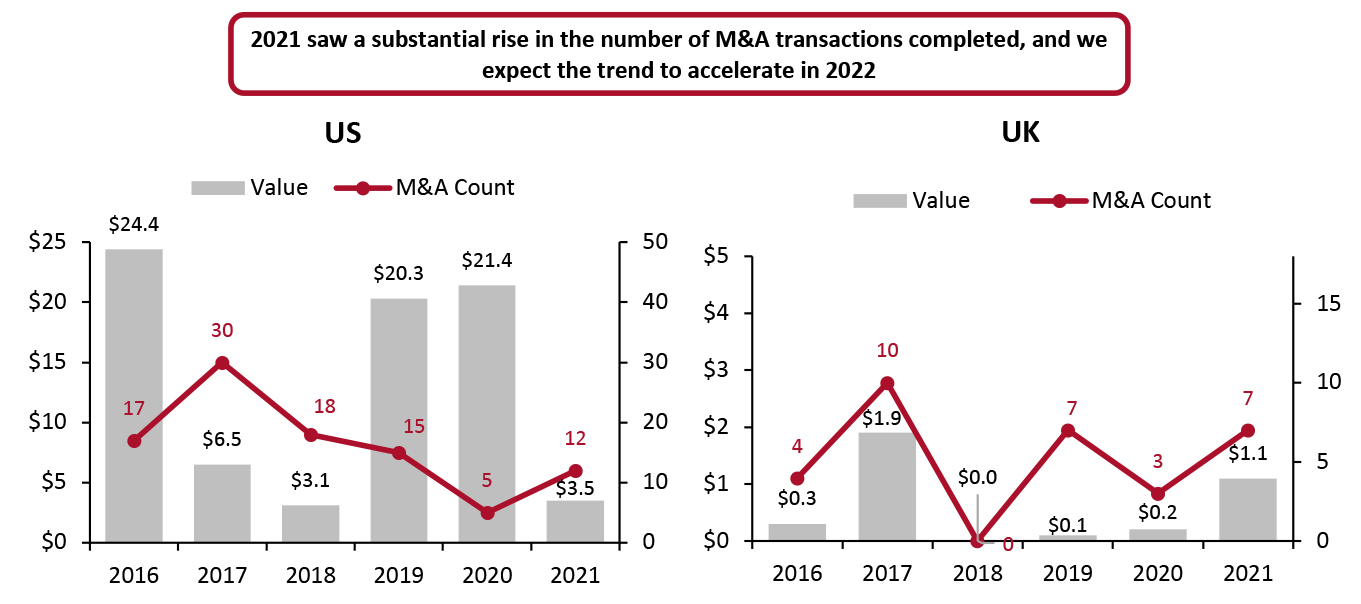

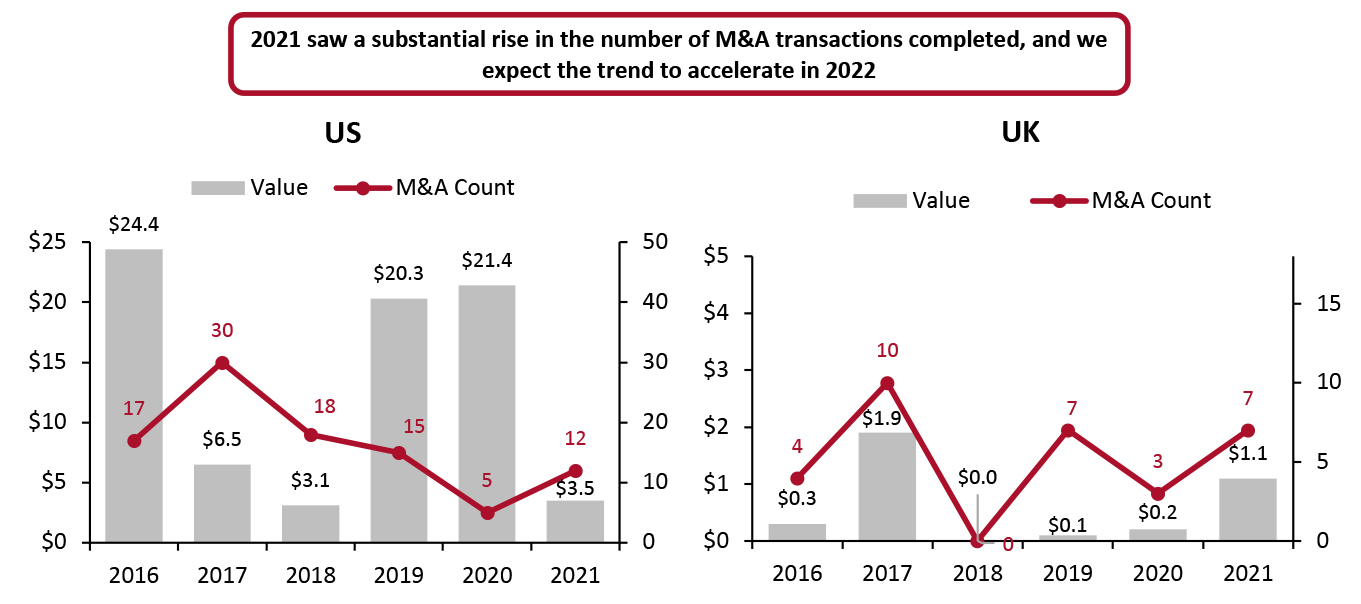

In 2021, we witnessed a substantial acceleration in M&A trends among apparel and footwear retailers and brand owners across the US and the UK.

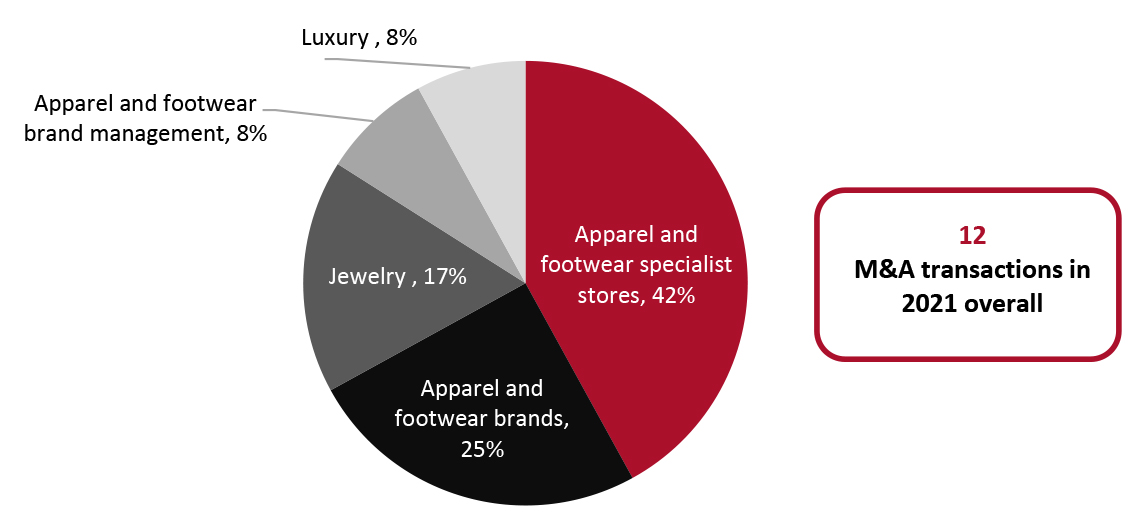

US: The number of M&A transactions in the accessories, apparel and footwear sector accelerated substantially in 2021, although the total value of the transactions declined notably as most of the transactions were of a lower value. In 2021, 12 apparel and footwear M&A transactions were completed in the US, totaling $3.5 billion, compared to five completed transactions in 2020, valued at $21.4 billion, according to Coresight Research analysis of S&P Capital IQ data. We expect the strong M&A trends to accelerate in 2022, fueled by ample investment capital and an ongoing rebound in the apparel and footwear sector.

UK: In 2021, the number of M&A transactions in the accessories, apparel and footwear sector accelerated substantially: Seven apparel and footwear M&A transactions completed in the UK in 2021, valued at $1.1 billion, compared to three completed transactions in 2020, valued at just $200 million, according to Coresight Research analysis of S&P Capital IQ data. We expect this strong M&A trend in the UK to accelerate in 2022, with ongoing recovery in the apparel and footwear sector.

In Figure 1, we provide the numbers and values of M&A transactions from 2016 to 2021, across sectors such as apparel, accessories, luxury goods, footwear and specialty retail (includes specialists in apparel and footwear, and jewelry).

Figure 1. The US and the UK: Completed M&A Transactions in the Apparel, Footwear and Accessories Sector—Value (Left Axis; USD Bil.) and Total Number of Deals (Right Axis)

[caption id="attachment_140566" align="aligncenter" width="700"]

Source: S&P Capital IQ/Coresight Research

Source: S&P Capital IQ/Coresight Research[/caption]

M&A in Apparel and Footwear Retail: Coresight Research Analysis

US: Key Areas of M&A Activity

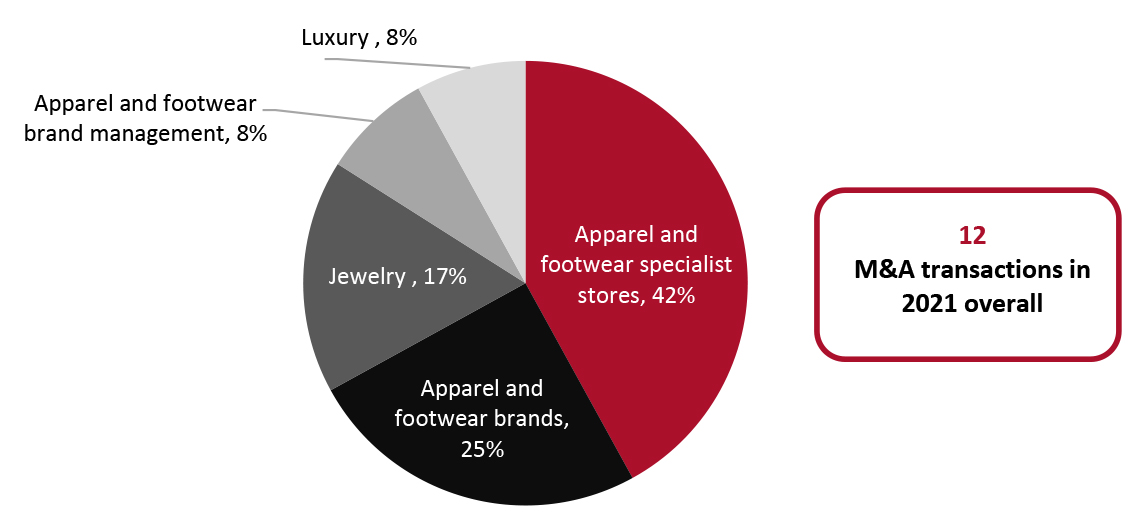

In 2021, in the accessories, apparel and footwear sector, apparel and footwear specialist stores witnessed the highest number of M&A transactions—accounting for 42% of the total 12 transactions in the sector. Apparel and footwear brands saw the second-highest number of M&A transactions, at 25%. Combined, these industries contributed over 65% of M&A transactions both in terms of number and valuation in the sector last year, according to Coresight Research analysis of S&P Capital IQ data.

Figure 2: US Apparel, Footwear and Accessories Sector: Total Completed M&A Transactions by Subsector, 2021

[caption id="attachment_140567" align="aligncenter" width="700"]

Source: S&P Capital IQ/Coresight Research

Source: S&P Capital IQ/Coresight Research[/caption]

Below, we analyze the seven largest M&A transactions of 2021 in detail, broken down by subsector.

Apparel and Footwear Specialty Retail

- Foot Locker Acquires Eurostar (WSS)

In September 2021, apparel and footwear specialty retailer Foot Locker acquired Eurostar (WSS), a US-based athletic apparel and footwear retailer, for $750 million. The acquisition helps Foot Locker further enhance its presence in the growing athleisure category and bolster its customer base. In the press release, Foot Locker’s CEO Richard Johnson said, “WSS brings an expanded and differentiated customer base rooted in the rapidly growing Hispanic community, diversifies and enhances our product mix, and strengthens our footprint with a 100% off-mall store fleet located in key markets.”

The acquisition of Eurostar followed Foot Locker’s earlier acquisition of Japan-based digitally led apparel and footwear retailer Text Trading Company, K.K. (Atmos), for $360 million in August 2021. Through this acquisition, Foot Locker is looking to accelerate its global reach with a highly strategic foothold in Japan while extending Foot Locker’s top-tier and premium offering.

In March 2021, JD Sports acquired US-based athletic footwear retailer DTLR for $495 million, of which about $100 million will be used to repay DTLR’s existing debts. With this acquisition, JD Sports looks to further expand its presence in the US footwear space. As of February 1, 2021, DTLR owned and operated 247 stores across 19 states, mainly in the Eastern and Northern US.

Prior to this deal, JD Sports had acquired US-based footwear retailer Shoe Palace for $325 million in December 2020, providing the British retailer with a robust geographical footprint in the Western US through a network of 167 stores. JD Sports’ push into the US footwear retail market began in 2018 through the $558 million acquisition of athletic footwear retailer Finish Line.

Apparel and Footwear Brands

- Levi Strauss & Co. Acquires Beyond Yoga

In September 2021, Levi Strauss & Co. completed the $403 million acquisition of the US-based athletic and lifestyle brand Beyond Yoga. Levi Strauss & Co. noted that the acquisition will allow its entry into the activewear category, complementing the company’s growing women’s business and providing an opportunity to expand its men’s business. In the press release, the company’s CEO, Chip Bergh, said, “This acquisition establishes LS&Co.’s presence in the fast-growing activewear segment with a brand with tremendous growth potential. Beyond Yoga will become a powerful growth engine for LS&Co. and will help drive our strategic priorities. Beyond Yoga’s values-led approach to business, centered on inclusivity and authenticity, makes it a natural fit to our company portfolio.”

[caption id="attachment_140568" align="aligncenter" width="700"]

Levi Strauss & Co.’s management expects the acquisition of Beyond Yoga to generate strong financial and operational synergies

Levi Strauss & Co.’s management expects the acquisition of Beyond Yoga to generate strong financial and operational synergies

Source: Levi Strauss & Co. [/caption]

- Rocky Brands Acquires Key Brand Portfolio from Honeywell International

In March 2021, apparel and footwear brand Rocky Brands completed the acquisition of the lifestyle and performance footwear brand portfolio of Honeywell International, including The Original Muck Boot Company and XTRATUF footwear brands, for $230 million.

The acquired brand portfolio generated revenues of about $205 million and EBITDA of about $24.5 million in 2020. In the company’s press release, Rocky Brands’ CEO, Jason Brooks, said, “The Original Muck Boot Company, XTRATUF, Servus, NEOS and Ranger brands are great additions to our existing portfolio, while the total business nearly doubles the size of Rocky Brands’ annual revenues. We look forward to capitalizing on the many opportunities we believe exist to drive strong growth, increased earnings power and enhanced stakeholder value over the near and long term.”

Apparel and Footwear Brand Management

- Lacer Capital Acquires Iconix Brand Group

In August 2021, private equity firm Lacer Capital acquired apparel and footwear brand management company Iconix Brand Group for $656 million, including debt. Iconix Brands owns Candie’s, London Fog, Ocean Pacific Umbro, Zoo York and Starter, among other brands. Upon completion of the transaction, Iconix became a private company. In the press release, Iconix Brands’ CEO, Bob Galvin, said, “The transaction with Lancer provides the best value for our stockholders. We expect that Iconix will continue developing its brands and supporting its partners as a private company.”

Jewelry

- Signet Jeweler Acquires Diamond Direct

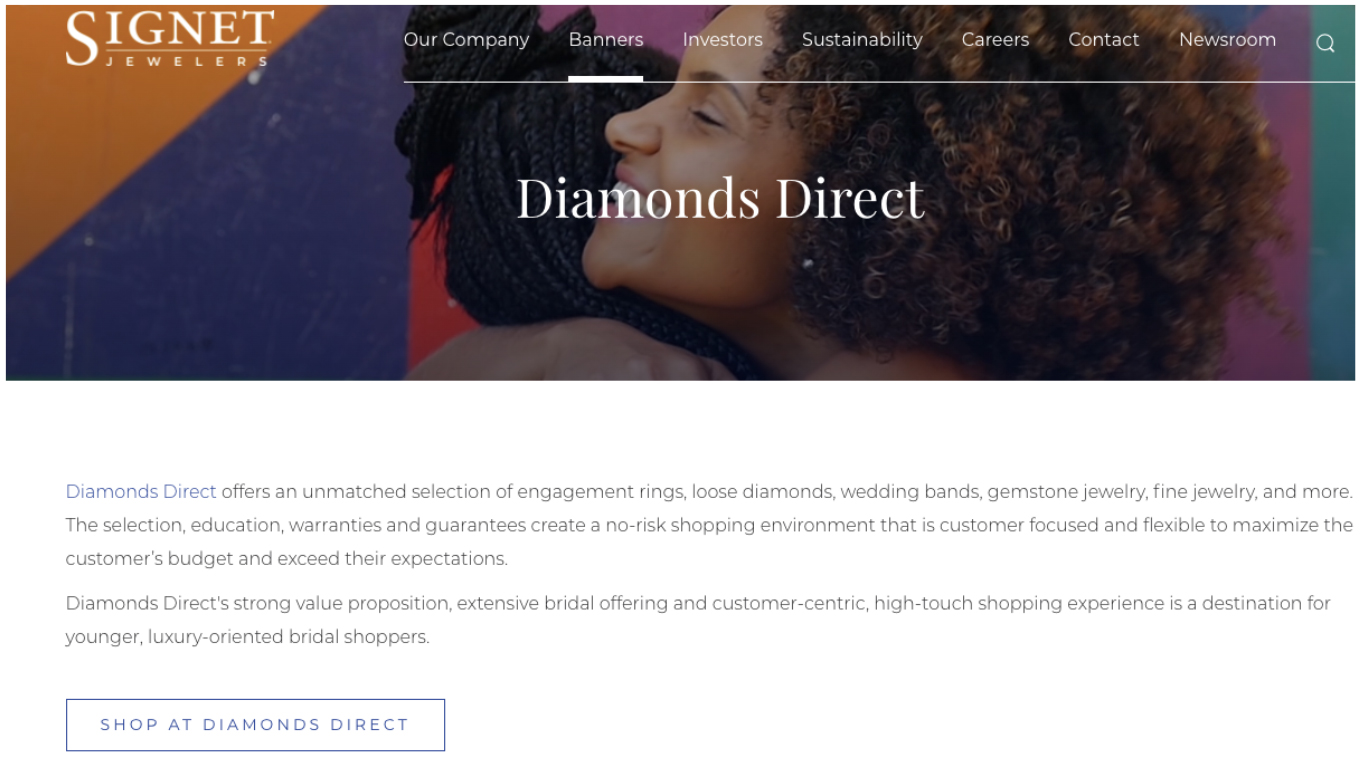

In November 2021, Signet Jewelers acquired the US-based direct-to-consumer (DTC) jewelry brand Diamonds Direct for $490 million in an all-cash transaction.

Diamonds Direct mainly attracts younger, luxury-oriented bridal consumers through its value proposition, extensive bridal offering and customer-centric, high-touch shopping experience. Through this acquisition, Signet aims to gain operating synergies by capitalizing scale in purchasing, targeted marketing, jewelry services and Signet’s ongoing “Connected Commerce” strategy. Signet CEO Virginia Drosos said, “The accretive addition of Diamonds Direct to our portfolio will further drive shareholder value with its distinct bridal-focused shopping experience and add a new entry point as we build lifetime customer relationships and strive to reach our $9 billion revenue goal over time.”

[caption id="attachment_140569" align="aligncenter" width="700"]

Signet Jewelers successfully integrated Diamond Direct in November 2021

Signet Jewelers successfully integrated Diamond Direct in November 2021

Source: Signet Jewelers [/caption]

- Compassed Diversified Acquires Lugano Diamonds & Jewelry

In September 2021, investment and holding company Compass Diversified acquired Lugano Diamonds & Jewelry, a manufacturer and retailer of high-end jewelry, for $267.6 million, including working capital and certain other adjustments.

In the press release, Compassed Diversified’s CEO, Elias Sabo, said, “Lugano is ideally positioned to benefit from the resources and access to capital that CODI [Compassed Diversified] will provide and build on the company’s vision and capabilities to become the next major jewelry brand. CODI intends to support further growth as Lugano invests in its merchandising strategy, including continuing its retail rollout and expanding its event-driven marketing efforts.”

Figure 3: US: Completed M&A Transactions in the Apparel, Footwear and Accessories Sector, 2021

[wpdatatable id=1673 table_view=regular]

Source: Company reports/S&P Capital IQ/Coresight Research

UK: Key Areas of M&A Activity

Unlike in the US, M&A transactions in the UK have been more concentrated: In 2021, apparel and footwear specialist stores accounted for 86% of the total seven completed deals in the accessories, apparel and footwear sector, while apparel and footwear brand owners comprised the remaining 14%, according to Coresight Research analysis of S&P Capital IQ data.

Figure 4. UK Apparel, Footwear and Accessories Sector: Total Completed M&A Transactions by Target Subsector, 2021

[caption id="attachment_140570" align="aligncenter" width="700"]

Source: S&P Capital IQ/Coresight Research

Source: S&P Capital IQ/Coresight Research[/caption]

Below, we analyze the largest M&A transactions across the two key subsectors in detail.

Apparel and Footwear Specialty Retail

- Wolverine Acquires Lady of Leisure InvestCo

In August 2021, Wolverine, an outdoor apparel retailer that operates a portfolio of footwear and lifestyle brands, acquired apparel and footwear company Lady of Leisure InvestCo (owner of activewear brand Sweaty Betty) for $422.9 million.

In its press release, Wolverine noted that over 80% of Sweaty Betty’s sales come from the DTC channel, mostly through e-commerce, and the acquisition fits well with Wolverine’s own recent push toward e-commerce. Wolverine CEO Blake Krueger said, “Sweaty Betty checks off all of our strategic criteria. The brand offers a spectrum of growth opportunity aligned with the tailwinds of prevailing consumer trends, especially in the performance product category. Sweaty Betty’s strength in DTC channels also aligns perfectly with our focus here.”

- ASOS Acquires Topshop, Topman, Miss Selfridge and HIIT of Arcadia Group

In February 2021, ASOS acquired UK-based apparel brands HIIT, Miss Selfridge, Topman and Topshop from Arcadia Group for £265 million ($362 million). While ASOS only acquired the e-commerce businesses and did not buy any of the brands’ physical stores, it is considering allowing Topshop’s flagship store in Oxford Circus to sell Topshop clothes through a third-party arrangement.

The four acquired brands reported combined revenue of £1.0 billion ($1.4 billion) in 2019 (pre-pandemic), primarily driven by growth in Germany. ASOS is looking to capitalize on this opportunity for further growth in Europe and the company expects the acquired brands to benefit from ASOS’s strength in other global territories where they were not previously available. In its earnings call for the first half of fiscal 2021 in April 2021, ASOS noted that it had seen a significant rise in site traffic since the acquisition, with 226% growth in traffic on launch day alone, driving strong sales momentum.

Apparel and Footwear Brands

- MSA Safety Acquires Bristol Uniforms

In January 2021, MSA Safety, a US-based manufacturer and retailer of safety equipment and gear, acquired UK-based manufacturer of protective apparel Bristol Uniforms for around $60 million. Bristol Uniforms earns annual revenue of roughly $40 million and employs about 200 people across its four UK locations. This acquisition strengthens MSA’s position in safety apparel products while providing an opportunity to grow its operations in the UK and major European markets.

Figure 5: UK: Completed M&A Transactions in the Apparel, Footwear and Accessories Sector, 2021

[wpdatatable id=1674 table_view=regular]

Source: Company reports/S&P Capital IQ/Coresight Research

Notable Upcoming Apparel and Footwear-Focused M&A Transactions

As apparel and footwear brand owners and retailers and private equity firms look to expand through M&A, we believe there will be a large number of acquisition targets in 2022. However, the abundance of M&A opportunities in the apparel and footwear sector will likely make investors more selective and price-sensitive.

Below, we examine two noteworthy upcoming US apparel and footwear-focused M&A transactions in 2022.

- Authentic Brands Group To Acquire Reebok

In August 2021, brand management company Authentic Brands Group announced that it will acquire sportswear brand Reebok from Adidas for €2.1 billion ($2.5 billion). The company expects to complete the deal by the end of the first quarter of 2022.

Lately, Authentic Brands has been acquiring renowned apparel and footwear brands and department stores to build its portfolio, including Eddie Bauer, Forever 21 and JCPenney. While filing for an IPO in July 2021, Authentic Brands noted that its roster of over 30 brands generates nearly $10 billion in annual gross merchandise value (GMV). The acquisition of Reebok further adds athletic gear to its growing portfolio. Authentic Brands plans to maintain Reebok’s footprints across e-commerce, retail and wholesale channels.

In December 2021, Authentic Brands entered into a strategic partnership with JD Sports to launch Reebok’s footwear collections in over 2,850 JD Sports stores across North America and Europe. All stores under the JD Sports banner (across brick-and-mortar and e-commerce channels)—including Finish Line, JD, DTLR, Shoe Palace, Size, Sprinter and SportZone—will start selling Reebok products from fall 2022. In the company’s press release, Authentic Brands’ CEO, Jamie Salter, said, “JD’s expanded support of Reebok, as well as their new commitment to carrying the brand in their stores in North America and Europe, speaks volumes to the brand’s cultural influence. This partnership solidifies Reebok’s position with an important global retailer.”

- Crocs To Acquire Hey Dude

In December 2021, US-based footwear company Crocs announced that it had entered into an agreement to acquire casual footwear brand Hey Dude. The deal is valued at $2.5 billion and is set to complete by the end of the first quarter of 2022. Through this acquisition, Crocs looks to diversify its portfolio and build upon its already strong digital penetration.

Once the transaction is complete, Hey Dude will operate independently, and Crocs will turn into a multibrand company. Crocs aims to build Hey Dude into a $1 billion annual sales-generating brand by 2024, a plan that complements Crocs’ existing goal to achieve $5 billion in sales by 2026.

Our Insights: Apparel and Footwear-Focused M&A Growth and Future Prospects

In 2022, we expect to see continued M&A activity as apparel and footwear brand owners and retailers take advantage of low valuations and grab shares in fast-growing markets.

Four Driving Forces

Below, we examine four factors that we believe will drive M&A activity in the apparel and footwear sector in 2022.

- Redefining Core Portfolios

The US and UK apparel and footwear sectors are witnessing strong recoveries from the impacts of the Covid-19 pandemic. With leading apparel brand owners and retailers looking to expand their portfolios, strong M&A activity in this industry will continue in 2022. Following the acquisition, the acquiring retailers and brand owners can channel resources into core/growing segments and key markets of the target company from non-core business segments and non-strategic markets.

- Building Operational Resilience and Transforming the Business

As many apparel and footwear retailers’ conventional business models are coming under threat due to rapid innovation, many companies are looking to M&A transactions to overhaul their businesses, including digitalizing, automating, integrating vertically and diversifying their supply chains.

- Private Equity Firms Seeking Value-Creation Opportunities in Carve-Outs

Between January 1, 2021, and November 23, 2021, private equity firms across the globe raised over $714 billion in “dry powder” (the amount of committed but unallocated capital firms have on hand), and this unspent capital is expected to rise further in 2022, according to UK-based data provider Preqin. Due to this increase in the reserve, we expect the next six to 12 months to involve a high level of M&A activity. We see apparel and footwear specialists and brand owners as likely points of interest for these private equity buyers.

- Environmental, Social and Governance (ESG)

ESG considerations may generate a lot of deal activity in 2022 and beyond as apparel and footwear companies look at their environmental footprint and consider acquiring, rationalizing or divesting assets. Furthermore, investors are likely to see ESG as a key element to build a more sustainable business, which can adapt well to potential market shifts.

Potential Headwinds

We believe the following two key factors could hinder M&A activity in the apparel and footwear sector in 2022.

- Rising Inflation and an Increase in Interest Rates

To counter inflation, on December 18, 2021, the US Central Bank announced that the government could bring the stimulus to an end in March 2022, after which the bank would raise the key interest rates. The Fed expects three interest rate increases in 2022, followed by three more in 2023. On December 16, 2021, the Bank of England hiked the key interest rate to 0.25% from 0.1%, to counter inflation.

An increase in interest rates could cool down M&A activity. However, the downward pressure could be avoided if acquiring retailers move up plans to lock in lower interest rates.

Similarly, while inflation could impact apparel and footwear companies, it generally puts market leaders into a better position to roll over higher prices to their customers, accelerating consolidation and transformation in the industry.

- Proposed Increase in the US Corporate Tax

In 2021, US President Joe Biden proposed an increase in various taxes in the US, including raising the corporate tax from 21% to 25%, to help finance the government’s infrastructure proposal. We believe the increase in the US corporate tax rate proposed by the president could decrease the attractiveness of investment into the US companies while leading to more investment overseas.

Nevertheless, the proposed tax changes are still under discussion and are heavily opposed by the US opposition party and business lobbies.

Key Considerations for Companies Entering M&A Transactions

Apparel and footwear retailers and brand owners may reach a point at which M&A becomes the most efficient way to expand operations, drive competitive advantage or save the company from going out of business.

However, like any other major financing transaction, M&A deals involve complex processes and ample due diligence—retailers should not underestimate the commitment required—such as the source of financing, asset versus stock deal decisions and tax implications. We discussed these three considerations, along with key benefits and challenges for acquirers and targets in M&A transactions, in detail in our

M&A in Retail report published in July 2021.

What We Think

In 2021, we saw a notable rise in M&A activity among the US and the UK apparel and footwear sectors, and we expect this trend to continue in 2022. We expect portfolio redefinitions to continue fueling M&A activity in apparel and footwear, with larger companies showing resilience and remaining focused on value creation strategies. Furthermore, we believe that

ongoing trends in the wider apparel and footwear market, such as digitalization and the convergence of technology with in-store experiences, will create opportunities for M&A deal activity as businesses look to acquire disruptors. Similarly, we expect high levels of liquidity through 2022 to continue to drive M&A activity. However, inflation and increase in interest rates remain key concerns.

In 2022, capability expansion will likely be a key focus as apparel and footwear retailers and brand owners enhance digital capabilities and logistics through M&A transactions, as well as expanding product offerings and geographical reach.

Implications for Retailers and Brand Owners

- Sound strategic planning is essential to maximizing merger benefits. As discussed in our Playbook on M&A in retail, outlining a structured approach that breaks down a complex M&A integration activity into defined phases, steps and deliverables can ensure efficiency, consistency and standardization in M&A outcomes. This includes selecting a team of experienced leaders and advisors who can communicate change effectively and establish a transparent process, work closely with the human resource department to build positive connections across functions and informal networks, and help culturally diverse employees navigate through the process.

- As the world of M&A is evolving, apparel and footwear retailers and brand owners should remain cognizant of the current trends prevailing in the global retail and retail-tech landscapes when devising their M&A strategies. In addition, developing a well-defined and comprehensive M&A tax strategy for each function and geography across the entire enterprise will be helpful to retailers to identify the overall deal’s cash and non-cash values.

- In case major restructuring of the target company is required after a merger, the acquirer and target company must discuss it beforehand to ensure that all stakeholders, including employees, investors and suppliers, agree on the defined strategies set by the acquiring company.

Source: S&P Capital IQ/Coresight Research[/caption]

Source: S&P Capital IQ/Coresight Research[/caption]

Source: S&P Capital IQ/Coresight Research[/caption]

Below, we analyze the seven largest M&A transactions of 2021 in detail, broken down by subsector.

Apparel and Footwear Specialty Retail

Source: S&P Capital IQ/Coresight Research[/caption]

Below, we analyze the seven largest M&A transactions of 2021 in detail, broken down by subsector.

Apparel and Footwear Specialty Retail

Levi Strauss & Co.’s management expects the acquisition of Beyond Yoga to generate strong financial and operational synergies

Levi Strauss & Co.’s management expects the acquisition of Beyond Yoga to generate strong financial and operational synergies  Signet Jewelers successfully integrated Diamond Direct in November 2021

Signet Jewelers successfully integrated Diamond Direct in November 2021  Source: S&P Capital IQ/Coresight Research[/caption]

Below, we analyze the largest M&A transactions across the two key subsectors in detail.

Apparel and Footwear Specialty Retail

Source: S&P Capital IQ/Coresight Research[/caption]

Below, we analyze the largest M&A transactions across the two key subsectors in detail.

Apparel and Footwear Specialty Retail