LVMH Moët Hennessy Louis Vuitton S.E.

Sector: Luxury

Countries of operation: China, France, Japan, the US and over 76 other countries

Key product categories: Apparel, cosmetics, leather goods, jewelry, perfumes, watches, and wines and spirits

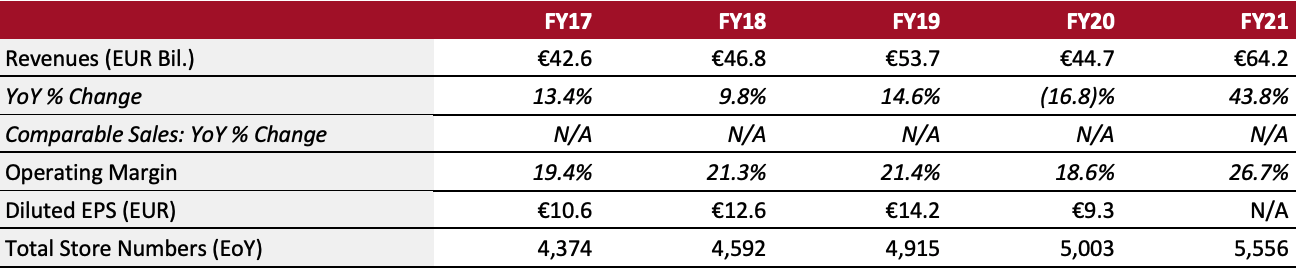

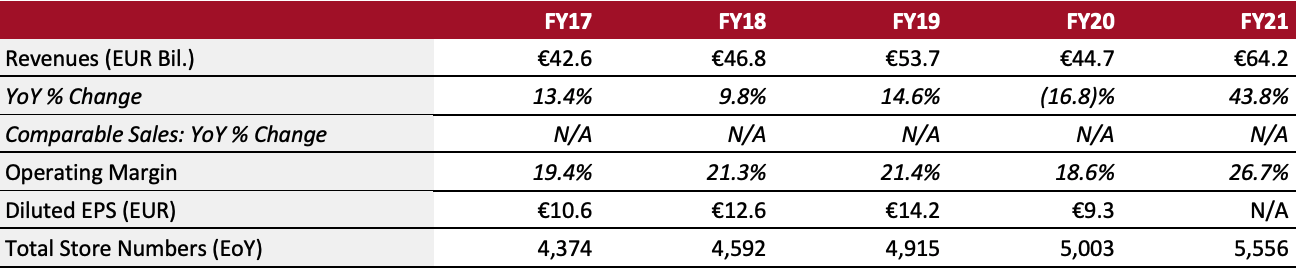

Annual Metrics

[caption id="attachment_143877" align="aligncenter" width="700"]

Last fiscal year ended December 31, 2021

Last fiscal year ended December 31, 2021[/caption]

Summary

LVMH is a luxury goods company headquartered in Paris. The company was formed in 1987 from the merger of fashion house Louis Vuitton (founded in 1854) with Moët Hennessy, itself formed in a 1971 merger between champagne producer Moët & Chandon (founded in 1743) and cognac manufacturer Hennessy (1765). LVMH’s five operating verticals are Wines and Spirits, Fashion and Leather Goods, Perfumes and Cosmetics, Watches and Jewelry, and Selective Retailing and Other Activities. The company owns around 75 brands globally, including Berluti, Bulgari, Christian Dior, Dom Perignon, Givenchy, Glenmorangie, Guerlain, Hennessy, Louis Vuitton, Marc Jacobs, Moët & Chandon and Sephora. It operates 5,409 stores as of June 30, 2021.

Company Analysis

Coresight Research insight: LVMH is the world’s largest luxury conglomerate. It is the obvious leader in luxury due to the sheer scale of its revenues and operations—as well as the number of brands under its wing. The conglomerate also operates with a richer legacy and deeper expertise than its closest competitors, such as Kering. While it was initially significantly disrupted by the pandemic, reporting fiscal 2020 total annual revenues of €44.7 billion ($52.1 billion)—down 16.8% from 2019—its revenues remained far ahead of Kering at $13.1 billion in revenue.

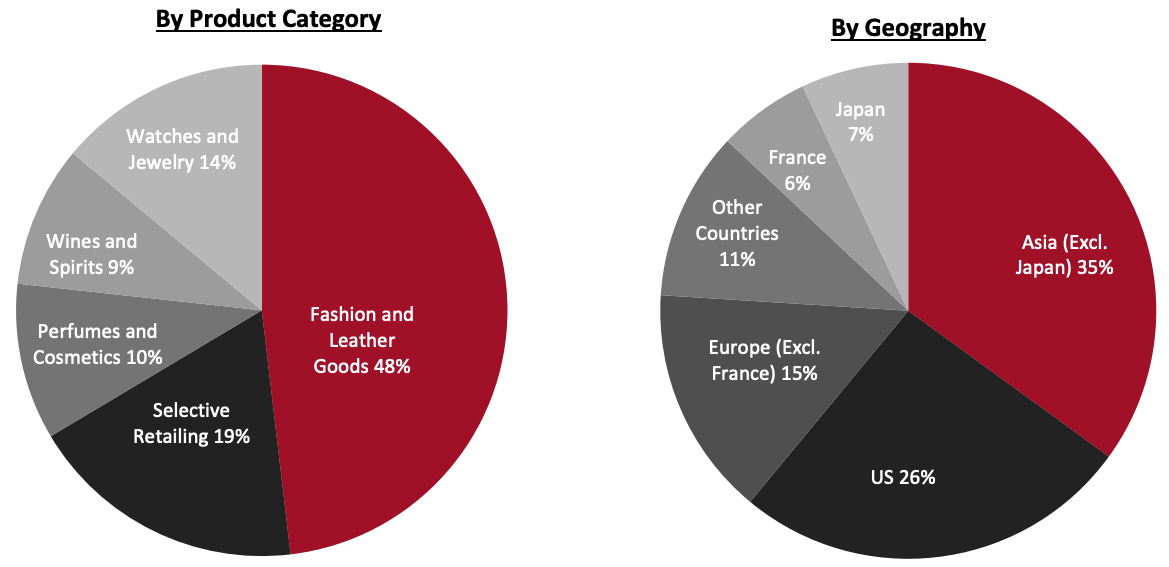

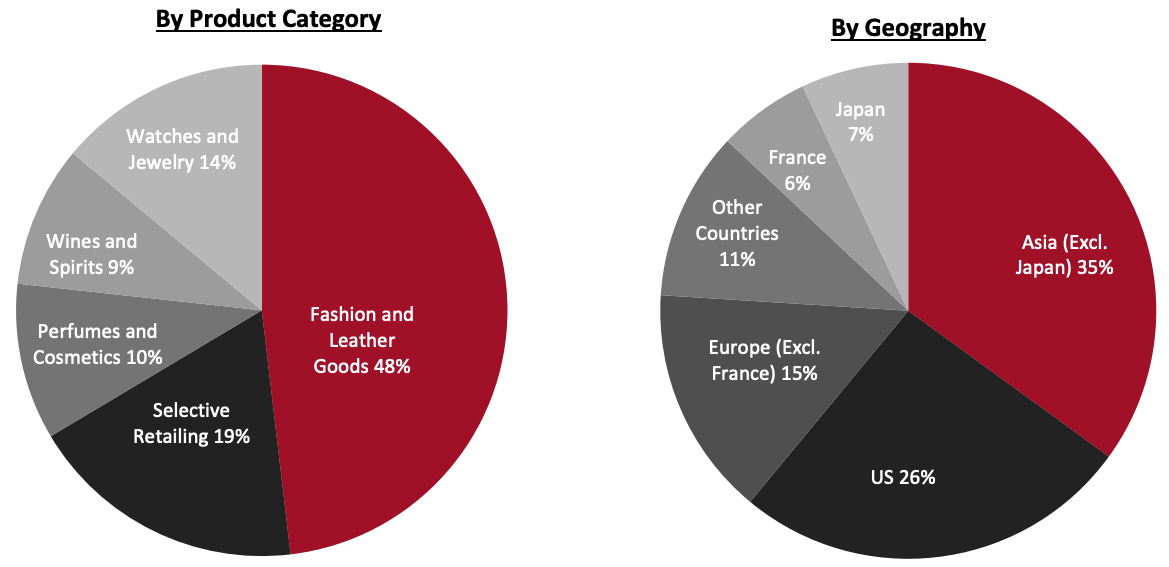

In fiscal 2021, LVMH posted a strong recovery from the crisis—witnessing a 43.8% year-over-year increase in revenues to €64.2 billion ($73.1 billion), up 19.6% versus 2019. Asia’s burgeoning luxury market is significant for the company and the region accounted for over a third of LVMH’s revenues during the period, while the US was around 26%. Both regions posted strong growth on a two-year basis. By segment, Fashion and Leather Goods is LVMH’s largest, at 48.1% of 2021 revenues.

We believe that LVMH’s scale, diversity of businesses, reputation and legacy will continue to keep the company at the number one position in luxury in the future.

| Tailwinds |

Headwinds |

- Pent-up demand for luxury

- Enhanced digital channels enabling better customer experience

- Easing of travel restrictions and pent-up demand for travel

- Rising consumer income in high-growth markets

|

- Economic uncertainty across global markets

- Competition from niche luxury brands

- Rise of conscious shopping causing a decline in discretionary purchases

- Varying lockdown restrictions resulting in store closures

- Supply-side disruptions and input cost inflation

|

Strategy

LVMH outlined six objectives for 2022:

- Vigilance: Maintain vigilance in terms of recovery from the pandemic.

- Confidence: Continue the strong growth momentum of LVMH’s fashion houses and build their desirability over the long term.

- Creativity and excellence: Remain true to LVMH’s values and focus on creativity, quality and distribution of its products.

- Digitalization: Pursue further digitalization of its fashion houses to enrich the online and in-store customer experience.

- Commitment: Continue to execute the group’s commitments to preserve the environment and corporate responsibility.

- Entrepreneurial spirit: Nurture entrepreneurial spirit and develop the agility of the company.

Revenue Breakdown (FY21)

Company Developments

Company Developments

| Date |

Development |

| January 18, 2022 |

LVMH Luxury Ventures invests an undisclosed sum for a minority stake in New York-based streetwear brand Aimé Leon Dore. |

| January 13, 2022 |

LVMH Luxury Ventures, along with venture capital firm Antler, leads a $5 million investment in London-based mystery box startup Heat. |

| November 28, 2021 |

Virgil Abloh, the artistic director of Louis Vuitton’s men’s department, passes away. |

| October 5, 2021 |

LVMH acquires a majority stake in Parfumerie Amicale. The acquisition comes four years after the group’s initial investment in the perfumer, through its minority investment fund LVMH Luxury Ventures. |

| September 29, 2021 |

LVMH-owned Sephora acquires British online beauty pureplay company Feelunique from TheBigWebsite Limited for £132 million ($182 million). |

| July 20, 2021 |

LVMH acquires a 60% stake in label Off-White from founder and Louis Vuitton men’s artistic director Virgil Abloh. |

| June 18, 2021 |

LVMH acquires the remaining 33% stake in Emilio Pucci from the Pucci Family, bringing its ownership stake to 100%. |

| April 20, 2021 |

LVMH partners with Prada and Richemont to develop the Aura Blockchain Consortium, a private blockchain secured by ConsenSys technology and Microsoft. The blockchain platform will allow users to trace the lifecycle of a product, from raw material to purchase. |

| January 7, 2021 |

LVMH acquires Tiffany & Co. from BlackRock, Qatar Investment Authority and The Vanguard Group, among others. |

Management Team

- Bernard Arnault—Chairman and CEO

- Nicolas Bazire—Senior VP of Development and Acquisitions and Director

- Antonio Belloni—Group MD and Director

Source: Company reports/S&P Capital IQ

Last fiscal year ended December 31, 2021[/caption]

Summary

LVMH is a luxury goods company headquartered in Paris. The company was formed in 1987 from the merger of fashion house Louis Vuitton (founded in 1854) with Moët Hennessy, itself formed in a 1971 merger between champagne producer Moët & Chandon (founded in 1743) and cognac manufacturer Hennessy (1765). LVMH’s five operating verticals are Wines and Spirits, Fashion and Leather Goods, Perfumes and Cosmetics, Watches and Jewelry, and Selective Retailing and Other Activities. The company owns around 75 brands globally, including Berluti, Bulgari, Christian Dior, Dom Perignon, Givenchy, Glenmorangie, Guerlain, Hennessy, Louis Vuitton, Marc Jacobs, Moët & Chandon and Sephora. It operates 5,409 stores as of June 30, 2021.

Company Analysis

Coresight Research insight: LVMH is the world’s largest luxury conglomerate. It is the obvious leader in luxury due to the sheer scale of its revenues and operations—as well as the number of brands under its wing. The conglomerate also operates with a richer legacy and deeper expertise than its closest competitors, such as Kering. While it was initially significantly disrupted by the pandemic, reporting fiscal 2020 total annual revenues of €44.7 billion ($52.1 billion)—down 16.8% from 2019—its revenues remained far ahead of Kering at $13.1 billion in revenue.

In fiscal 2021, LVMH posted a strong recovery from the crisis—witnessing a 43.8% year-over-year increase in revenues to €64.2 billion ($73.1 billion), up 19.6% versus 2019. Asia’s burgeoning luxury market is significant for the company and the region accounted for over a third of LVMH’s revenues during the period, while the US was around 26%. Both regions posted strong growth on a two-year basis. By segment, Fashion and Leather Goods is LVMH’s largest, at 48.1% of 2021 revenues.

We believe that LVMH’s scale, diversity of businesses, reputation and legacy will continue to keep the company at the number one position in luxury in the future.

Last fiscal year ended December 31, 2021[/caption]

Summary

LVMH is a luxury goods company headquartered in Paris. The company was formed in 1987 from the merger of fashion house Louis Vuitton (founded in 1854) with Moët Hennessy, itself formed in a 1971 merger between champagne producer Moët & Chandon (founded in 1743) and cognac manufacturer Hennessy (1765). LVMH’s five operating verticals are Wines and Spirits, Fashion and Leather Goods, Perfumes and Cosmetics, Watches and Jewelry, and Selective Retailing and Other Activities. The company owns around 75 brands globally, including Berluti, Bulgari, Christian Dior, Dom Perignon, Givenchy, Glenmorangie, Guerlain, Hennessy, Louis Vuitton, Marc Jacobs, Moët & Chandon and Sephora. It operates 5,409 stores as of June 30, 2021.

Company Analysis

Coresight Research insight: LVMH is the world’s largest luxury conglomerate. It is the obvious leader in luxury due to the sheer scale of its revenues and operations—as well as the number of brands under its wing. The conglomerate also operates with a richer legacy and deeper expertise than its closest competitors, such as Kering. While it was initially significantly disrupted by the pandemic, reporting fiscal 2020 total annual revenues of €44.7 billion ($52.1 billion)—down 16.8% from 2019—its revenues remained far ahead of Kering at $13.1 billion in revenue.

In fiscal 2021, LVMH posted a strong recovery from the crisis—witnessing a 43.8% year-over-year increase in revenues to €64.2 billion ($73.1 billion), up 19.6% versus 2019. Asia’s burgeoning luxury market is significant for the company and the region accounted for over a third of LVMH’s revenues during the period, while the US was around 26%. Both regions posted strong growth on a two-year basis. By segment, Fashion and Leather Goods is LVMH’s largest, at 48.1% of 2021 revenues.

We believe that LVMH’s scale, diversity of businesses, reputation and legacy will continue to keep the company at the number one position in luxury in the future.

Company Developments

Company Developments