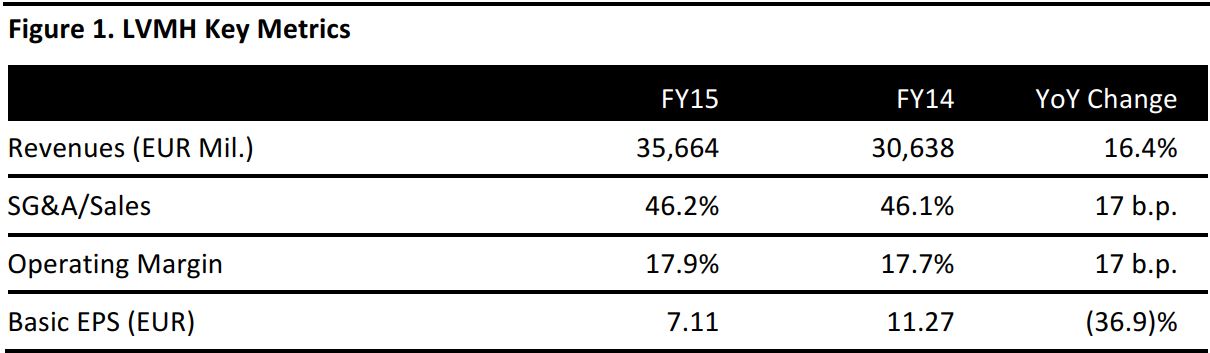

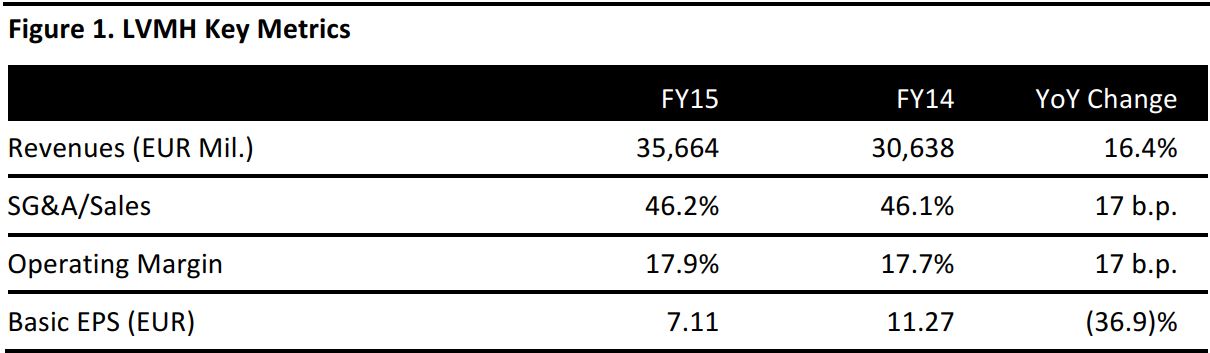

Source: Company reports

LVMH reported total revenue growth of 16.4% for the year ending December 31, 2015. Revenue of €35,664 million was fractionally above the consensus estimate of €35,566 million, according to S&P Capital IQ.

Profit from recurring operations was up 16%. A 53% jump in recurring operating profit in the Watches & Jewelry segment and a 26% increase in the Perfume & Cosmetics segment contributed. The company noted a much lower, 6% increase in recurring operating profit in Selective Retailing, well below segment revenue growth of 18%.

Basic EPS of €7.11 was below the consensus estimate of €7.31 recorded by S&P Capital IQ.

The company said organic revenue growth for the year was 6%.

GROWTH BY SEGMENT

Overall, LVMH noted “strong progress” in Europe, the US, and Japan.

- In its Wines & Spirits business, revenues grew by 16% in total (6% organic). The segment saw an “excellent performance” in Europe, the US and Japan, and a rebound in China in the second half of the year.

- In Fashion & Leather Goods, total revenues grew by 14% (4% organic). For this, and most of the following segments, the company offered no comment on regional performance. Louis Vuitton had a “remarkable year” and Fendi recorded “exceptional growth,” the company said.

- In the Perfume & Cosmetics business, revenues grew by 15% (7% organic). Christian Dior “accelerated its growth.”

- In Watches & Jewelry, revenues increased by 19% (8% organic). Bulgari had “an excellent year.”

- In Selective Retailing, revenues grew by 18% (5% organic). Currency and geopolitical changes contributed to an uncertain environment in Asia, which in turn impacted DFS, the company said, but Japan gained from a boom in Chinese tourism. Sephora had “an excellent year.”

GROWTH BY QUARTER

Organic growth in the fourth quarter was 5%;it was 7% in the third quarter, 9% in the second quarter and 3% in the first quarter.