Nitheesh NH

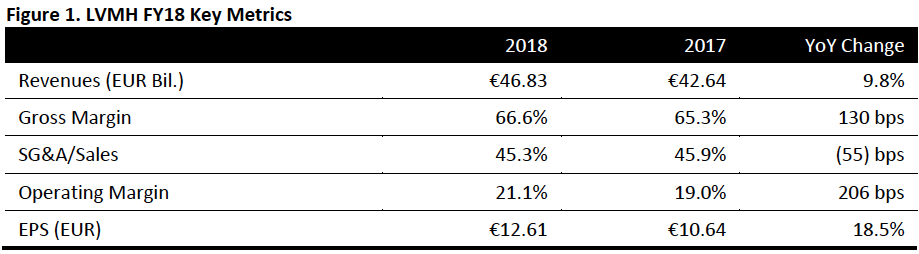

[caption id="attachment_68900" align="aligncenter" width="600"] Source: Company reports/Coresight Research[/caption]

A Robust Finish to 2018: Momentum Continues into 2019 at LVMH

LVMH full-year sales rose 9.8% to €46.8 billion. Currency exchange rates adversely impacted full year sales results by (400) bps. Online sales rose approximately 27-28%, to €3.7 billion and now represent 8% of consolidated 2018 revenues.

Fashion and leather goods set the sales pace, achieving 15% organic growth in 2018. The Louis Vuitton brand has surpassed €10 billion annually and the fashion and leather goods segment now represents 39% of consolidated 2018 revenues, up from 36% in 2017.

Sales by segment: Wines and spirits €5.1 billion, up 1.2% (up 5% excluding currency impact); fashion and leather goods €18.5 billion, up 19.3% (15% organic growth); perfume and cosmetics €6.1 billion, up 9.6% (a 14% increase excluding currency); watches and jewelry €4.1 billion, up 8.4% (or 12% on a constant currency basis); and, selective retailing revenues increased 3.2% (or 6% on a constant currency basis).

By region of delivery, Asia (excluding Japan) was the largest market in 2018, at 29% of total revenues, up from 28% in 2017, while the U.S. declined one percentage point year over year, to 24% in 2018. All other regions remained static: Europe (excluding France) at 19%, France at 10%, Japan at 7% and other markets at 11%.

Operating profit rose 21.7% to €9.87 billion. For the year, the consolidated operating margin was 21.1%, up 206 bps, reflecting margin expansion in every segment: margins were up 110 bps to 31.7% in wines and spirits; up 50 bps to 32.2% in fashion and leather goods; up 30 bps in perfumes and cosmetics to 11.1%; up 360 bps in watches and jewelry to 17.1%; and, up 200 bps in selective retailing to 10.1%.

EPS rose 18.5% to €12.61 in 2018.

4Q18 sales rose 9.2% to €13.7 billion (organic sales growth of 10.2%) with luxury and leather goods again pacing the quarter with a 16.6% increase to €5.4 billion; wines and spirits up 0.5% to €1.6 billion; up 12.5% in perfumes and cosmetics to €1.7 billion; up 8.5% in watches and jewelry to €1.1 billion and up 3.2% in selective retail to €4.1 billion.

Commenting about Chinese consumers at Louis Vuitton, management said the second half of 2018 enjoyed sustained business with continued growth in China, but saw declining sales in many popular tourist regions of the world – especially in the U.S. However, there was no slowdown in the U.S. attributed to domestic consumers. Growth in China in the fashion and leather goods segment accelerated at the end of 2018 and continues into 2019.

Management considers its acquisition of Belmond, with its portfolio of 30 luxury hotels, to be a real opportunity. Belmond gives LVMH access to the internal workings of luxury hospitality and the ability to amplify its luxury brands with lifestyle and experiential facets that hotels and hospitality provide. The Louis Vuitton brand began in travel.

Outlook

The company did not provide quantitative guidance for 2019.

January is off to a good start, said Chairman and CEO Bernard Arnault on the investor call on January 29, 2019. He anticipates the overall environment will remain buoyant but cautioned that rising interest rates in the U.S. were impacting listed companies, and that he believes a similar phenomenon will come to Europe in 2020 or 2021. However, Arnault qualified his comment saying, “we've seen across-the-board increases in people's purchasing power and our customers' living standards. That's going to continue. For the medium term, therefore, we can continue to be very optimistic.”

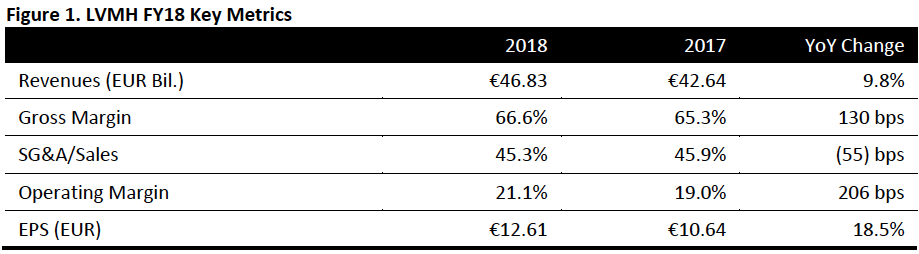

Source: Company reports/Coresight Research[/caption]

A Robust Finish to 2018: Momentum Continues into 2019 at LVMH

LVMH full-year sales rose 9.8% to €46.8 billion. Currency exchange rates adversely impacted full year sales results by (400) bps. Online sales rose approximately 27-28%, to €3.7 billion and now represent 8% of consolidated 2018 revenues.

Fashion and leather goods set the sales pace, achieving 15% organic growth in 2018. The Louis Vuitton brand has surpassed €10 billion annually and the fashion and leather goods segment now represents 39% of consolidated 2018 revenues, up from 36% in 2017.

Sales by segment: Wines and spirits €5.1 billion, up 1.2% (up 5% excluding currency impact); fashion and leather goods €18.5 billion, up 19.3% (15% organic growth); perfume and cosmetics €6.1 billion, up 9.6% (a 14% increase excluding currency); watches and jewelry €4.1 billion, up 8.4% (or 12% on a constant currency basis); and, selective retailing revenues increased 3.2% (or 6% on a constant currency basis).

By region of delivery, Asia (excluding Japan) was the largest market in 2018, at 29% of total revenues, up from 28% in 2017, while the U.S. declined one percentage point year over year, to 24% in 2018. All other regions remained static: Europe (excluding France) at 19%, France at 10%, Japan at 7% and other markets at 11%.

Operating profit rose 21.7% to €9.87 billion. For the year, the consolidated operating margin was 21.1%, up 206 bps, reflecting margin expansion in every segment: margins were up 110 bps to 31.7% in wines and spirits; up 50 bps to 32.2% in fashion and leather goods; up 30 bps in perfumes and cosmetics to 11.1%; up 360 bps in watches and jewelry to 17.1%; and, up 200 bps in selective retailing to 10.1%.

EPS rose 18.5% to €12.61 in 2018.

4Q18 sales rose 9.2% to €13.7 billion (organic sales growth of 10.2%) with luxury and leather goods again pacing the quarter with a 16.6% increase to €5.4 billion; wines and spirits up 0.5% to €1.6 billion; up 12.5% in perfumes and cosmetics to €1.7 billion; up 8.5% in watches and jewelry to €1.1 billion and up 3.2% in selective retail to €4.1 billion.

Commenting about Chinese consumers at Louis Vuitton, management said the second half of 2018 enjoyed sustained business with continued growth in China, but saw declining sales in many popular tourist regions of the world – especially in the U.S. However, there was no slowdown in the U.S. attributed to domestic consumers. Growth in China in the fashion and leather goods segment accelerated at the end of 2018 and continues into 2019.

Management considers its acquisition of Belmond, with its portfolio of 30 luxury hotels, to be a real opportunity. Belmond gives LVMH access to the internal workings of luxury hospitality and the ability to amplify its luxury brands with lifestyle and experiential facets that hotels and hospitality provide. The Louis Vuitton brand began in travel.

Outlook

The company did not provide quantitative guidance for 2019.

January is off to a good start, said Chairman and CEO Bernard Arnault on the investor call on January 29, 2019. He anticipates the overall environment will remain buoyant but cautioned that rising interest rates in the U.S. were impacting listed companies, and that he believes a similar phenomenon will come to Europe in 2020 or 2021. However, Arnault qualified his comment saying, “we've seen across-the-board increases in people's purchasing power and our customers' living standards. That's going to continue. For the medium term, therefore, we can continue to be very optimistic.”

Source: Company reports/Coresight Research[/caption]

A Robust Finish to 2018: Momentum Continues into 2019 at LVMH

LVMH full-year sales rose 9.8% to €46.8 billion. Currency exchange rates adversely impacted full year sales results by (400) bps. Online sales rose approximately 27-28%, to €3.7 billion and now represent 8% of consolidated 2018 revenues.

Fashion and leather goods set the sales pace, achieving 15% organic growth in 2018. The Louis Vuitton brand has surpassed €10 billion annually and the fashion and leather goods segment now represents 39% of consolidated 2018 revenues, up from 36% in 2017.

Sales by segment: Wines and spirits €5.1 billion, up 1.2% (up 5% excluding currency impact); fashion and leather goods €18.5 billion, up 19.3% (15% organic growth); perfume and cosmetics €6.1 billion, up 9.6% (a 14% increase excluding currency); watches and jewelry €4.1 billion, up 8.4% (or 12% on a constant currency basis); and, selective retailing revenues increased 3.2% (or 6% on a constant currency basis).

By region of delivery, Asia (excluding Japan) was the largest market in 2018, at 29% of total revenues, up from 28% in 2017, while the U.S. declined one percentage point year over year, to 24% in 2018. All other regions remained static: Europe (excluding France) at 19%, France at 10%, Japan at 7% and other markets at 11%.

Operating profit rose 21.7% to €9.87 billion. For the year, the consolidated operating margin was 21.1%, up 206 bps, reflecting margin expansion in every segment: margins were up 110 bps to 31.7% in wines and spirits; up 50 bps to 32.2% in fashion and leather goods; up 30 bps in perfumes and cosmetics to 11.1%; up 360 bps in watches and jewelry to 17.1%; and, up 200 bps in selective retailing to 10.1%.

EPS rose 18.5% to €12.61 in 2018.

4Q18 sales rose 9.2% to €13.7 billion (organic sales growth of 10.2%) with luxury and leather goods again pacing the quarter with a 16.6% increase to €5.4 billion; wines and spirits up 0.5% to €1.6 billion; up 12.5% in perfumes and cosmetics to €1.7 billion; up 8.5% in watches and jewelry to €1.1 billion and up 3.2% in selective retail to €4.1 billion.

Commenting about Chinese consumers at Louis Vuitton, management said the second half of 2018 enjoyed sustained business with continued growth in China, but saw declining sales in many popular tourist regions of the world – especially in the U.S. However, there was no slowdown in the U.S. attributed to domestic consumers. Growth in China in the fashion and leather goods segment accelerated at the end of 2018 and continues into 2019.

Management considers its acquisition of Belmond, with its portfolio of 30 luxury hotels, to be a real opportunity. Belmond gives LVMH access to the internal workings of luxury hospitality and the ability to amplify its luxury brands with lifestyle and experiential facets that hotels and hospitality provide. The Louis Vuitton brand began in travel.

Outlook

The company did not provide quantitative guidance for 2019.

January is off to a good start, said Chairman and CEO Bernard Arnault on the investor call on January 29, 2019. He anticipates the overall environment will remain buoyant but cautioned that rising interest rates in the U.S. were impacting listed companies, and that he believes a similar phenomenon will come to Europe in 2020 or 2021. However, Arnault qualified his comment saying, “we've seen across-the-board increases in people's purchasing power and our customers' living standards. That's going to continue. For the medium term, therefore, we can continue to be very optimistic.”

Source: Company reports/Coresight Research[/caption]

A Robust Finish to 2018: Momentum Continues into 2019 at LVMH

LVMH full-year sales rose 9.8% to €46.8 billion. Currency exchange rates adversely impacted full year sales results by (400) bps. Online sales rose approximately 27-28%, to €3.7 billion and now represent 8% of consolidated 2018 revenues.

Fashion and leather goods set the sales pace, achieving 15% organic growth in 2018. The Louis Vuitton brand has surpassed €10 billion annually and the fashion and leather goods segment now represents 39% of consolidated 2018 revenues, up from 36% in 2017.

Sales by segment: Wines and spirits €5.1 billion, up 1.2% (up 5% excluding currency impact); fashion and leather goods €18.5 billion, up 19.3% (15% organic growth); perfume and cosmetics €6.1 billion, up 9.6% (a 14% increase excluding currency); watches and jewelry €4.1 billion, up 8.4% (or 12% on a constant currency basis); and, selective retailing revenues increased 3.2% (or 6% on a constant currency basis).

By region of delivery, Asia (excluding Japan) was the largest market in 2018, at 29% of total revenues, up from 28% in 2017, while the U.S. declined one percentage point year over year, to 24% in 2018. All other regions remained static: Europe (excluding France) at 19%, France at 10%, Japan at 7% and other markets at 11%.

Operating profit rose 21.7% to €9.87 billion. For the year, the consolidated operating margin was 21.1%, up 206 bps, reflecting margin expansion in every segment: margins were up 110 bps to 31.7% in wines and spirits; up 50 bps to 32.2% in fashion and leather goods; up 30 bps in perfumes and cosmetics to 11.1%; up 360 bps in watches and jewelry to 17.1%; and, up 200 bps in selective retailing to 10.1%.

EPS rose 18.5% to €12.61 in 2018.

4Q18 sales rose 9.2% to €13.7 billion (organic sales growth of 10.2%) with luxury and leather goods again pacing the quarter with a 16.6% increase to €5.4 billion; wines and spirits up 0.5% to €1.6 billion; up 12.5% in perfumes and cosmetics to €1.7 billion; up 8.5% in watches and jewelry to €1.1 billion and up 3.2% in selective retail to €4.1 billion.

Commenting about Chinese consumers at Louis Vuitton, management said the second half of 2018 enjoyed sustained business with continued growth in China, but saw declining sales in many popular tourist regions of the world – especially in the U.S. However, there was no slowdown in the U.S. attributed to domestic consumers. Growth in China in the fashion and leather goods segment accelerated at the end of 2018 and continues into 2019.

Management considers its acquisition of Belmond, with its portfolio of 30 luxury hotels, to be a real opportunity. Belmond gives LVMH access to the internal workings of luxury hospitality and the ability to amplify its luxury brands with lifestyle and experiential facets that hotels and hospitality provide. The Louis Vuitton brand began in travel.

Outlook

The company did not provide quantitative guidance for 2019.

January is off to a good start, said Chairman and CEO Bernard Arnault on the investor call on January 29, 2019. He anticipates the overall environment will remain buoyant but cautioned that rising interest rates in the U.S. were impacting listed companies, and that he believes a similar phenomenon will come to Europe in 2020 or 2021. However, Arnault qualified his comment saying, “we've seen across-the-board increases in people's purchasing power and our customers' living standards. That's going to continue. For the medium term, therefore, we can continue to be very optimistic.”