DIpil Das

Source: Company reports/Coresight Research[/caption]

1H19 Results

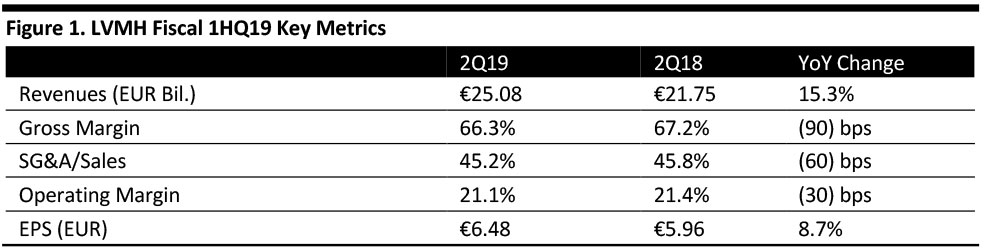

LVMH reported fiscal 1H19 EPS of €6.48, up 8.7% from €5.96 in the year-ago period and shy of the €6.86 consensus estimate. Total revenues were €25.08 billion, up 15.3% year over year and above the €24.83 consensus estimate. Organic sales growth was 12%.

Source: Company reports/Coresight Research[/caption]

1H19 Results

LVMH reported fiscal 1H19 EPS of €6.48, up 8.7% from €5.96 in the year-ago period and shy of the €6.86 consensus estimate. Total revenues were €25.08 billion, up 15.3% year over year and above the €24.83 consensus estimate. Organic sales growth was 12%.

Gross margin contracted 90 bps to 66.3% of sales as LVMH lapped a non-recurring hedging gain that was partly offset by a 60 bps decrease in the SG&A expense ratio, to 45.2%, reflecting the leveraging of administrative costs that rose less rapidly than sales.

By Maison, Fashion & Leather Goods set the pace with 21% growth, to €10.43 billion (up 18% organically), followed by the Selective Retailing group, where sales rose 12% (8% organically) to €7.10 billion and Perfumes & Cosmetics, which grew 12% (9% organically) to €3.24 billion. Watches & Jewelry trailed the group, with an 8% sales gain (4% organically) to €2.14 billion.

Operating margins declined modestly in all Maisons except Selective Retail, where the operating margin expanded 40 bps to 10.1%. Despite a 110 bp decline in the operating margin in Fashion & Leather Goods, the Maison had the best operating margin, at 31.2% of sales. Wines & Spirits was a close second, at 31.1% of sales, and down 90 bps.

Regionally, there was strong growth in Asia, the US and Europe, particularly in France, which saw a rebound in Q2.

Asia (ex Japan) is LVMH’s largest region at 33% of 1H19 sales, and it grew at the fastest pace, up 18%, followed by Europe and Japan at 10% growth, and the US trailed with 8% sales growth.

China Update:

Louis Vuitton experienced a noticeable improvement among Chinese customers in Q2 over Q1. Givenchy had success with its makeup line in Asia, particularly China, as well as its fragrance, L’Interdit, and the brand also launched its first digital transparency and product traceability platform. Benefit is developing its Eyebrow Collection, which includes Gimme Brow and Precisely, and rolled out additional brow bars in China. LVMH’s jewelry houses, Chaumet and Hublot, will open flagship locations on the 1881 Heritage site in Hong Kong, while Zenith and Fred will increase its presence in China.

Outlook

The company did not provide quantitative guidance for FY19.