albert Chan

The Tiffany acquisition jumpstarts LVMH’s global presence in the fine jewelry market.

Tiffany & Co is a valuable addition to the LVMH portfolio, given its rich brand history, glamourous yet functional heritage, global reach and focus on sustainability. LVMH’s jewelry sales will grow from around 9% of total revenues to an estimated 16%.

LVMH’s marketing and branding prowess will extend to the Tiffany brand and potentially re-accelerate sales growth from Tiffany’s recent lackluster sales trends. Improved customer relationship management programs will likely better engage today’s high-touch luxury shopper. Tiffany’s watch business was highlighted as a category ripe for rapid growth by leveraging LVMH’s existing expertise through Bulgari and Louis Vuitton.

Tiffany’s store fleet of 321 stores speak to global reach, yet with only 11% of the brand’s sales derived in Europe, LVMH’s homeland should provide for market penetration while the LVMH group should see additional growth opportunities in Asia. For Tiffany, the deal will leverage LVMH’s presence globally to further the brand’s expansion, especially in China, where the companies will look to bring more of their goods to mainland consumers in an effort to tap into their growing spending power.

The deal is LVMH’s largest in its history and is expected to close in the middle of 2020.

The acquisition of Tiffany represents an equity value of $16.2 billion ($16.9 billion for enterprise value, taking into account the company's debt), and is the largest transaction in LVMH's Group history. The closing of this transaction is expected to occur in the second half of 2020, following approval from Tiffany’s shareholders and receipt of antitrust approvals.

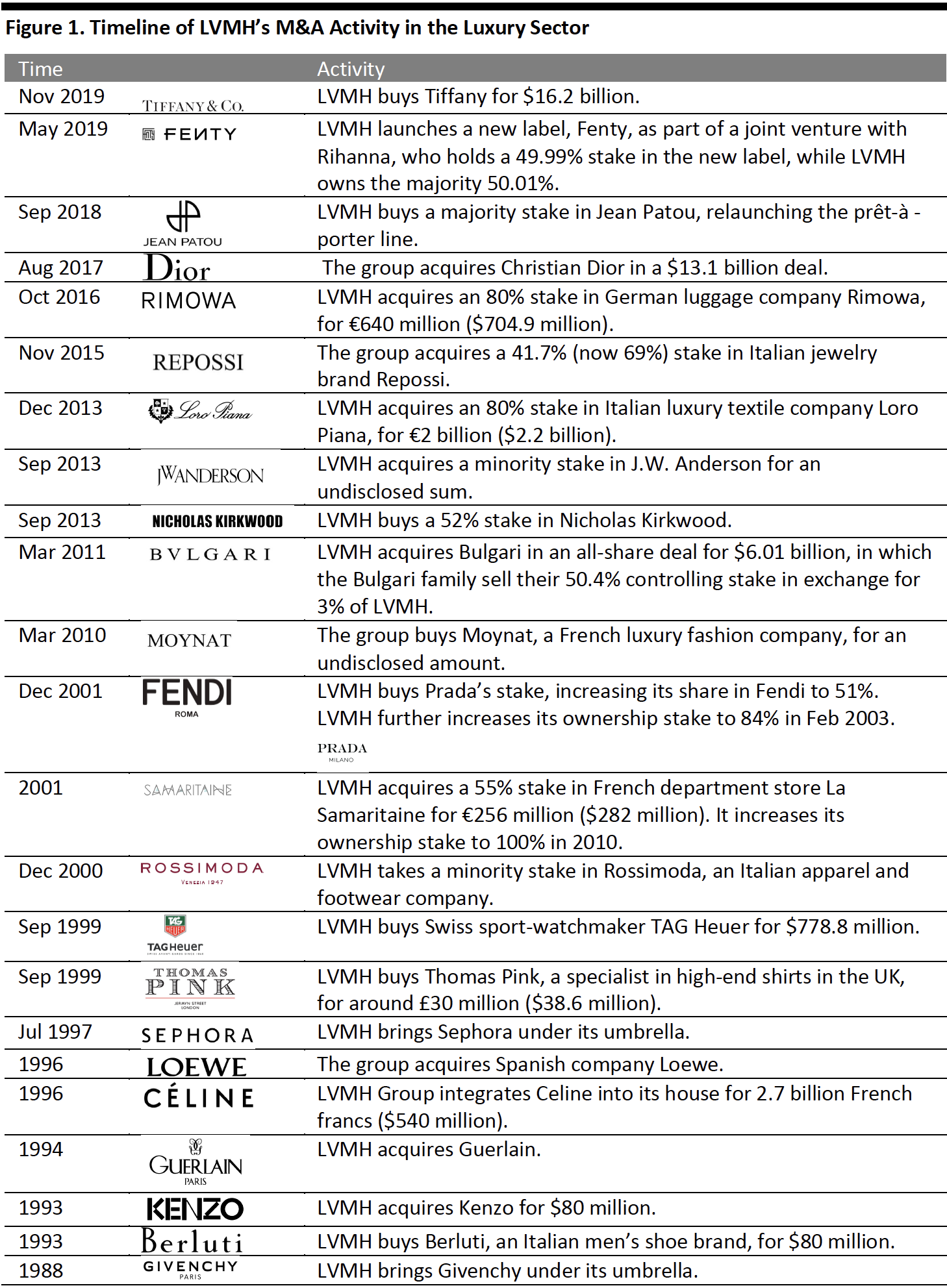

[caption id="attachment_100358" align="aligncenter" width="700"] Notes: The timeline excludes companies that have been acquired but sold eventually.

Notes: The timeline excludes companies that have been acquired but sold eventually.Source: Company reports[/caption]

The deal also comes as global demand for jewelry is resurging.

Jewelry is one of the most vibrant categories in luxury, with women making purchases for themselves throughout the year, the occurrence of category hopping among luxury shoppers and an expanding base of new luxury shoppers.

Casualization and the collaboration of streetwear with luxury brands have brought a new younger consumer to luxury brands, but in doing so, the average price points of ready-to-wear apparel (RTW) have dropped—for example, the cost of a designer hoodie could be $1,700 compared to a designer dress at $8,000. In addition, the success of luxury resale and rental is impacting both luxury RTW and handbags. Sales of luxury footwear are strong, with designer sneakers being the current must-have accessory, replacing handbags. Management consultancy Bain & Company expects the global personal luxury goods market to post 4–6% growth in 2019 to €271–276 billion ($298.5–304 billion), up from €260 billion ($286.4 billion) in 2018.

We believe that the fine jewelry market will enjoy outsized growth, reflecting the growing purchasing power of young Chinese consumers and a growing base of luxury shoppers globally.