albert Chan

Introduction

Differentiation has become one of the biggest problems for luxury brands in this ever-changing industry. Having an appropriate point of differentiation is key to becoming an industry leader. This report will dig into three strategic approaches luxury can take to tap into changing tastes of younger luxury consumers: social values, sustainability and limited-run collaborations.

Size-inclusive collection

Size-inclusive collection

Source: 11honore.com[/caption] Versace is another example of a luxury brand embracing diversity and inclusion. The company brought together 54 models for its fall 2018 campaign featuring famous faces such as half-Palestinian catwalk stars Bella and Gigi Hadid, Nora Attal and Egyptian-Moroccan model Imaan Hammam, as well as Kaia Gerber, Stella Maxwell and Adut Akech Bior. [caption id="attachment_87926" align="aligncenter" width="502"] Magazine covers demonstrate more size inclusitivity and diversity

Magazine covers demonstrate more size inclusitivity and diversity

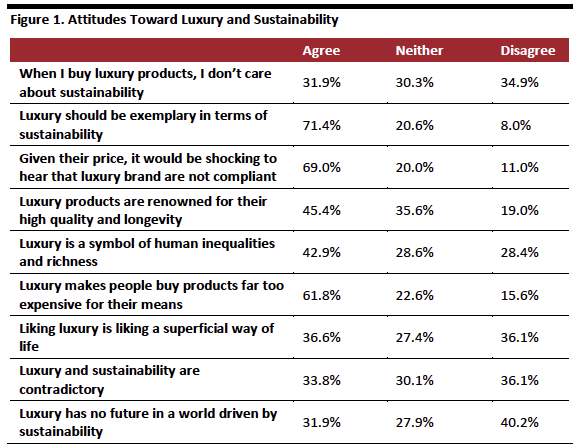

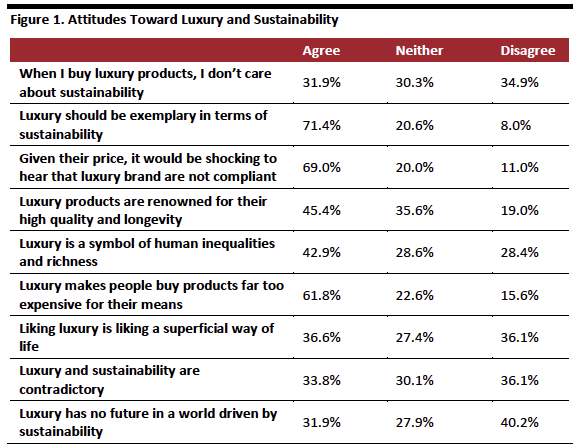

Source: Vogue/Allure[/caption] A Common Future for Luxury and Sustainability Shoppers increasingly expect brands to be environmentally friendly – and luxury is no exception. According to a Cotton Inc. Supply Chain Insights report released in May 2018, around half of US consumers said they paid more to buy clothing made from natural fibers. In fact, luxury’s higher price tag means consumers actually expect more in terms of sustainability and social responsibility: In a survey of luxury shoppers, Jean-Noël Kapferer from Northwestern University found 71.4% of respondents agree with the statement that luxury should be exemplary in terms of sustainability, while some 69.0% said they would be shocked if luxury brands weren’t sustainable given their price. [caption id="attachment_87927" align="aligncenter" width="574"] Base: 966 US luxury consumers, surveyed in 2012

Base: 966 US luxury consumers, surveyed in 2012

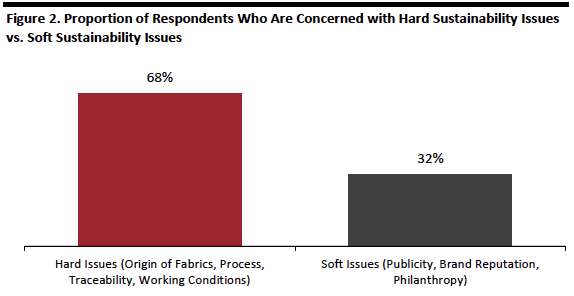

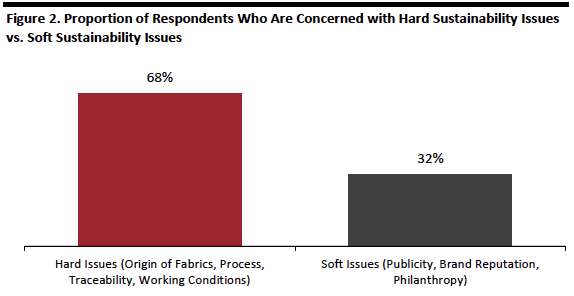

Source: Luxury Research Journal[/caption] The good news is, luxury brands are responding to changing consumer tastes. National Chamber of Italian Fashion (the government body of the Italian fashion industry) explored the question of sustainability with buyers from over 80 department stores spanning 25 countries in March 2019. Collectively, buyers expect to nearly double total spend on sustainable products in the next five years, to 42%. Some 25% of respondents indicated they have eliminated at least one brand because of sustainability concerns. More than two-thirds of respondents said they are concerned with sustainbility’s “hard issues,” such as fabric origin, process, traceability and factory working conditions. (See Figure 2) [caption id="attachment_87928" align="aligncenter" width="574"] Source: National Chamber of Italian Fashion[/caption]

What Luxury Brands are Doing in Sustainability

Changing consumer preferences have actively inspired brands to re-examine their sustainability profiles – and in many cases take steps to enhance their positions.

LVMH’s program LIFE 2020, launched in 2015, outlines a course in four strategic areas: the environmental footprint of the products, sustainable procurement, greenhouse gas emissions and the environmental impact of production facilities and stores. In LVMH’s 2017 Environmental Report (the latest year available), the company reported a 1% reduction in energy consumption in stores, an 11% reduction in greenhouse gas emissions and a 51% reduction in water pollution.

A pioneer in sustainability, Kering Group sets sustainable annual development goals, including environmental profit and loss statements (EP&L), evaluating fabric suppliers, eliminating hazardous chemicals, focusing on energy conservation and emissions reductions. Data from Kering’s 2017 (the most recent year available) EP&L report indicates an 11% reduction in wool use, a 27% cut in cashmere use and 45% in cotton. (Figures are for average percentage savings relative to conventional practices with EP&L)

John Hardy’s eco-friendly Bali Oasis jewelry shop in Bali seeks to connect with local communities. The brand has established a school in Bali, committed to educating students on sustainability through purpose-driven curriculums.

Named designer of the year in 2019 by American Apparel & Footwear Association (AAFA), Eileen Fisher has created an enviable $450 million apparel company. In 2009, Eileen Fisher started a take-back program, part of a circular system designed to recycle products. The company has since collected over 1.3 million garments, designating pieces beyond repair as raw material for Waste No More, an experimental design studio based in Irvington, New York. Fisher has also used recycled fibers and sought wool from sustainable sources. The company is now working on a chlorine-free wool – an additive needed to reduce itchiness, shrinkage and pilling but which also contaminates the waste water.

Here Comes the Resale Empire

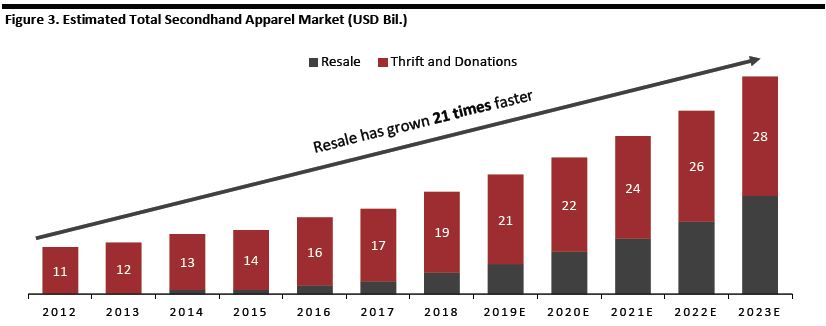

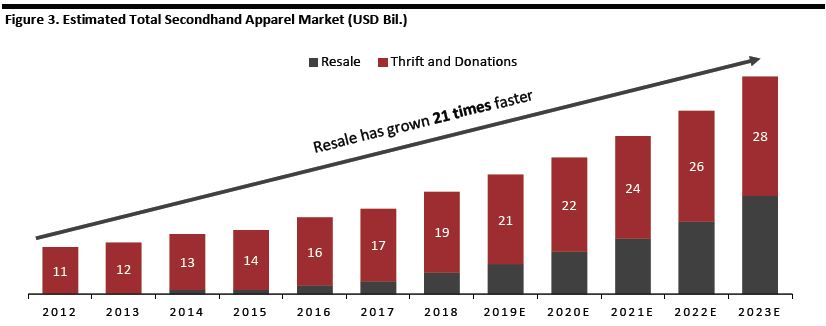

Another trend once anathema to luxury but which fits nicely with sustainability is the growing popularity of second-hand luxury goods, whose market is growing rapidly. Donation/thrift and resale are the two sectors included in the market. The ThredUP 2019 Resale Report predicts the total secondhand apparel market will double in size in five years, with resale driving the growth. Over the past three years, resale has grown 21 times faster than the overall retail apparel market, according to ThredUP.

[caption id="attachment_87929" align="aligncenter" width="700"]

Source: National Chamber of Italian Fashion[/caption]

What Luxury Brands are Doing in Sustainability

Changing consumer preferences have actively inspired brands to re-examine their sustainability profiles – and in many cases take steps to enhance their positions.

LVMH’s program LIFE 2020, launched in 2015, outlines a course in four strategic areas: the environmental footprint of the products, sustainable procurement, greenhouse gas emissions and the environmental impact of production facilities and stores. In LVMH’s 2017 Environmental Report (the latest year available), the company reported a 1% reduction in energy consumption in stores, an 11% reduction in greenhouse gas emissions and a 51% reduction in water pollution.

A pioneer in sustainability, Kering Group sets sustainable annual development goals, including environmental profit and loss statements (EP&L), evaluating fabric suppliers, eliminating hazardous chemicals, focusing on energy conservation and emissions reductions. Data from Kering’s 2017 (the most recent year available) EP&L report indicates an 11% reduction in wool use, a 27% cut in cashmere use and 45% in cotton. (Figures are for average percentage savings relative to conventional practices with EP&L)

John Hardy’s eco-friendly Bali Oasis jewelry shop in Bali seeks to connect with local communities. The brand has established a school in Bali, committed to educating students on sustainability through purpose-driven curriculums.

Named designer of the year in 2019 by American Apparel & Footwear Association (AAFA), Eileen Fisher has created an enviable $450 million apparel company. In 2009, Eileen Fisher started a take-back program, part of a circular system designed to recycle products. The company has since collected over 1.3 million garments, designating pieces beyond repair as raw material for Waste No More, an experimental design studio based in Irvington, New York. Fisher has also used recycled fibers and sought wool from sustainable sources. The company is now working on a chlorine-free wool – an additive needed to reduce itchiness, shrinkage and pilling but which also contaminates the waste water.

Here Comes the Resale Empire

Another trend once anathema to luxury but which fits nicely with sustainability is the growing popularity of second-hand luxury goods, whose market is growing rapidly. Donation/thrift and resale are the two sectors included in the market. The ThredUP 2019 Resale Report predicts the total secondhand apparel market will double in size in five years, with resale driving the growth. Over the past three years, resale has grown 21 times faster than the overall retail apparel market, according to ThredUP.

[caption id="attachment_87929" align="aligncenter" width="700"] Thrift and Donations: A sector of the broader “secondhand” market that includes traditional options such as Goodwill, Salvation Army and yard sales. These secondhand options are primarily, but not exclusively, offline.

Thrift and Donations: A sector of the broader “secondhand” market that includes traditional options such as Goodwill, Salvation Army and yard sales. These secondhand options are primarily, but not exclusively, offline.

Resale: A sector of the broader “secondhand” market that includes more curated product assortments, often well merchandised and/or higher end. Examples include thredUP and TheRealReal, as well as upscale physical players such as Buffalo Exchange. These secondhand options are primarily, but not exclusively, online.

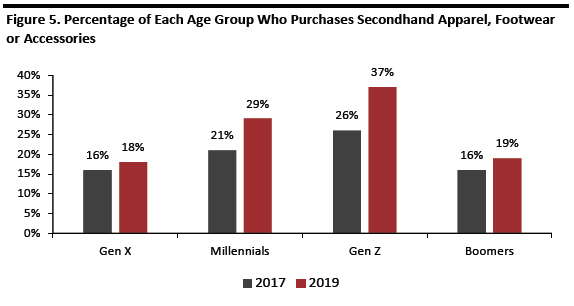

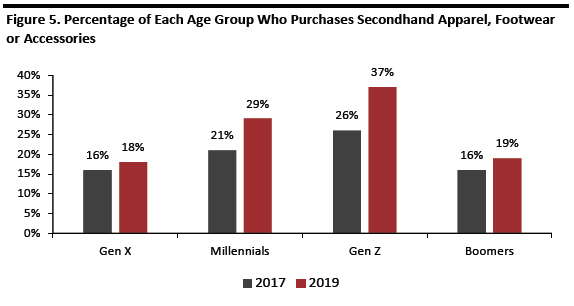

Source: ThredUP[/caption] Surprisingly, 64% of women are now willing to buy secondhand products, with millennials most willing to go the thrift route (33%) and baby boomers next (at 31%). Some 74% of 18-29 year olds said they prefer to buy from sustainably conscious brands, according to ThredUP. [caption id="attachment_87931" align="aligncenter" width="570"] Source: ThredUP[/caption]

[caption id="attachment_87932" align="aligncenter" width="574"]

Source: ThredUP[/caption]

[caption id="attachment_87932" align="aligncenter" width="574"] Source: ThredUP[/caption]

Resale pioneer The RealReal states that 95% of clothing could be reused or reworn. To publicize the sustainability aspects of consigning clothing, The RealReal rolled out its first consumer-facing sustainability calculator in 2018, which allows consignors see the environmental impact of consigning clothes for sale in terms of emissions and other pollution avoided by not creating a new product.

Limited-Run Collaboration Brought Mutual Benefit

Luxury brands are also collaborating to create new products, offering traditional luxury brands access to new consumer segments as they unite seemingly disparate brands, offering mutual benefit and bringing superior marketing effects, which is 1+1=4.

The Louis Vuitton X Supreme was a great hit. Supreme is a US street brand established in 1994. It is a representative of skateboarding and hip-hop fashion culture, and has a large number of fans among young people. The collaboration resulted in products featuring the Supreme bright red and LV's "presbyopia" combination, catching the eye of young people. The hoodies, purses and suitcases in the series have become fashion items sought after by hipsters.

[caption id="attachment_87933" align="aligncenter" width="506"]

Source: ThredUP[/caption]

Resale pioneer The RealReal states that 95% of clothing could be reused or reworn. To publicize the sustainability aspects of consigning clothing, The RealReal rolled out its first consumer-facing sustainability calculator in 2018, which allows consignors see the environmental impact of consigning clothes for sale in terms of emissions and other pollution avoided by not creating a new product.

Limited-Run Collaboration Brought Mutual Benefit

Luxury brands are also collaborating to create new products, offering traditional luxury brands access to new consumer segments as they unite seemingly disparate brands, offering mutual benefit and bringing superior marketing effects, which is 1+1=4.

The Louis Vuitton X Supreme was a great hit. Supreme is a US street brand established in 1994. It is a representative of skateboarding and hip-hop fashion culture, and has a large number of fans among young people. The collaboration resulted in products featuring the Supreme bright red and LV's "presbyopia" combination, catching the eye of young people. The hoodies, purses and suitcases in the series have become fashion items sought after by hipsters.

[caption id="attachment_87933" align="aligncenter" width="506"] The LV X Supreme collaboration

The LV X Supreme collaboration

Source: LV/Supreme[/caption] Hodinkee also secured positive market response with its 10th anniversary joint watch series with Swatch and Omega, both in 2018. The company later worked with Hermès, in which all watches are hand-crafted in Hermès' Swiss studio, each with a separate number as the first commemorative certification for the two units. Strategic alliances and limited-run joint products could be the response of today’s luxury brands to an increasingly competitive global market. When looking at a limited-run collaboration, luxury brands should consider their crossover partners, objectives and time needed to bring the partnership to fruition. Limited numbers, buzz of crossover, uniqueness and innovation of design are consumers’ major motivation to buy. Purpose-Oriented Brands are Gaining Social Recognition Purpose-oriented brands are gaining popularity among consumers, and third-party entities are emerging that verify sustainability claims. One is Positive Luxury, whose Butterfly Mark is awarded to brands that meet specific criteria around governance, social performance, environmental performance, community investment and innovation. The process is updated every two years in partnership with a sustainability council, as well as external institutional partners, companies, NGOs and retailers. MICHI (a high-end active wear brand for sports, travel, leisure) was recently awarded the butterfly mark for its measurable impact and company-wide commitment to sustainability. Biotherm was award the prize in 2018 for its strong sustainability commitments including improving the biodegradability of its cosmetics formulas, using renewable materials, optimizing its packaging. LVMH is also one member of the butterfly mark families. [caption id="attachment_87934" align="aligncenter" width="243"] The Positive Luxury Butterfly Mark

The Positive Luxury Butterfly Mark

Source: Positive Luxury[/caption] Another important social recognition prize is the Sustainable Quality Award (SQA). The award assesses applicant’s performance in innovation, commitment and documented results. This year, Tradesy, the online peer-to-peer resale marketplace for women’s luxury and designer contemporary fashion, won the prize. Key Insights

- Social values in the luxury industry now include greater accessibility, gender equality, size inclusion and design diversity. Luxury brands have to navigate the fine line of greater inclusivity while maintaining elements of exclusivity.

- Many consumers today are willing to pay more for sustainable products, especially millennials, who are social media disrupters and are gradually becoming the main force of luxury consumption. Sustainable luxury is far more than environmental protection: It promotes innovation, creativity and social contribution.

- In today's luxury business, limited-run collaborations are becoming an increasingly important tool for branding. Limited-run collaboration let seemingly disparate brands share the benefits – and carry greater consumer appeal due to their limited nature.

Size-inclusive collection

Size-inclusive collectionSource: 11honore.com[/caption] Versace is another example of a luxury brand embracing diversity and inclusion. The company brought together 54 models for its fall 2018 campaign featuring famous faces such as half-Palestinian catwalk stars Bella and Gigi Hadid, Nora Attal and Egyptian-Moroccan model Imaan Hammam, as well as Kaia Gerber, Stella Maxwell and Adut Akech Bior. [caption id="attachment_87926" align="aligncenter" width="502"]

Magazine covers demonstrate more size inclusitivity and diversity

Magazine covers demonstrate more size inclusitivity and diversitySource: Vogue/Allure[/caption] A Common Future for Luxury and Sustainability Shoppers increasingly expect brands to be environmentally friendly – and luxury is no exception. According to a Cotton Inc. Supply Chain Insights report released in May 2018, around half of US consumers said they paid more to buy clothing made from natural fibers. In fact, luxury’s higher price tag means consumers actually expect more in terms of sustainability and social responsibility: In a survey of luxury shoppers, Jean-Noël Kapferer from Northwestern University found 71.4% of respondents agree with the statement that luxury should be exemplary in terms of sustainability, while some 69.0% said they would be shocked if luxury brands weren’t sustainable given their price. [caption id="attachment_87927" align="aligncenter" width="574"]

Base: 966 US luxury consumers, surveyed in 2012

Base: 966 US luxury consumers, surveyed in 2012Source: Luxury Research Journal[/caption] The good news is, luxury brands are responding to changing consumer tastes. National Chamber of Italian Fashion (the government body of the Italian fashion industry) explored the question of sustainability with buyers from over 80 department stores spanning 25 countries in March 2019. Collectively, buyers expect to nearly double total spend on sustainable products in the next five years, to 42%. Some 25% of respondents indicated they have eliminated at least one brand because of sustainability concerns. More than two-thirds of respondents said they are concerned with sustainbility’s “hard issues,” such as fabric origin, process, traceability and factory working conditions. (See Figure 2) [caption id="attachment_87928" align="aligncenter" width="574"]

Source: National Chamber of Italian Fashion[/caption]

What Luxury Brands are Doing in Sustainability

Changing consumer preferences have actively inspired brands to re-examine their sustainability profiles – and in many cases take steps to enhance their positions.

LVMH’s program LIFE 2020, launched in 2015, outlines a course in four strategic areas: the environmental footprint of the products, sustainable procurement, greenhouse gas emissions and the environmental impact of production facilities and stores. In LVMH’s 2017 Environmental Report (the latest year available), the company reported a 1% reduction in energy consumption in stores, an 11% reduction in greenhouse gas emissions and a 51% reduction in water pollution.

A pioneer in sustainability, Kering Group sets sustainable annual development goals, including environmental profit and loss statements (EP&L), evaluating fabric suppliers, eliminating hazardous chemicals, focusing on energy conservation and emissions reductions. Data from Kering’s 2017 (the most recent year available) EP&L report indicates an 11% reduction in wool use, a 27% cut in cashmere use and 45% in cotton. (Figures are for average percentage savings relative to conventional practices with EP&L)

John Hardy’s eco-friendly Bali Oasis jewelry shop in Bali seeks to connect with local communities. The brand has established a school in Bali, committed to educating students on sustainability through purpose-driven curriculums.

Named designer of the year in 2019 by American Apparel & Footwear Association (AAFA), Eileen Fisher has created an enviable $450 million apparel company. In 2009, Eileen Fisher started a take-back program, part of a circular system designed to recycle products. The company has since collected over 1.3 million garments, designating pieces beyond repair as raw material for Waste No More, an experimental design studio based in Irvington, New York. Fisher has also used recycled fibers and sought wool from sustainable sources. The company is now working on a chlorine-free wool – an additive needed to reduce itchiness, shrinkage and pilling but which also contaminates the waste water.

Here Comes the Resale Empire

Another trend once anathema to luxury but which fits nicely with sustainability is the growing popularity of second-hand luxury goods, whose market is growing rapidly. Donation/thrift and resale are the two sectors included in the market. The ThredUP 2019 Resale Report predicts the total secondhand apparel market will double in size in five years, with resale driving the growth. Over the past three years, resale has grown 21 times faster than the overall retail apparel market, according to ThredUP.

[caption id="attachment_87929" align="aligncenter" width="700"]

Source: National Chamber of Italian Fashion[/caption]

What Luxury Brands are Doing in Sustainability

Changing consumer preferences have actively inspired brands to re-examine their sustainability profiles – and in many cases take steps to enhance their positions.

LVMH’s program LIFE 2020, launched in 2015, outlines a course in four strategic areas: the environmental footprint of the products, sustainable procurement, greenhouse gas emissions and the environmental impact of production facilities and stores. In LVMH’s 2017 Environmental Report (the latest year available), the company reported a 1% reduction in energy consumption in stores, an 11% reduction in greenhouse gas emissions and a 51% reduction in water pollution.

A pioneer in sustainability, Kering Group sets sustainable annual development goals, including environmental profit and loss statements (EP&L), evaluating fabric suppliers, eliminating hazardous chemicals, focusing on energy conservation and emissions reductions. Data from Kering’s 2017 (the most recent year available) EP&L report indicates an 11% reduction in wool use, a 27% cut in cashmere use and 45% in cotton. (Figures are for average percentage savings relative to conventional practices with EP&L)

John Hardy’s eco-friendly Bali Oasis jewelry shop in Bali seeks to connect with local communities. The brand has established a school in Bali, committed to educating students on sustainability through purpose-driven curriculums.

Named designer of the year in 2019 by American Apparel & Footwear Association (AAFA), Eileen Fisher has created an enviable $450 million apparel company. In 2009, Eileen Fisher started a take-back program, part of a circular system designed to recycle products. The company has since collected over 1.3 million garments, designating pieces beyond repair as raw material for Waste No More, an experimental design studio based in Irvington, New York. Fisher has also used recycled fibers and sought wool from sustainable sources. The company is now working on a chlorine-free wool – an additive needed to reduce itchiness, shrinkage and pilling but which also contaminates the waste water.

Here Comes the Resale Empire

Another trend once anathema to luxury but which fits nicely with sustainability is the growing popularity of second-hand luxury goods, whose market is growing rapidly. Donation/thrift and resale are the two sectors included in the market. The ThredUP 2019 Resale Report predicts the total secondhand apparel market will double in size in five years, with resale driving the growth. Over the past three years, resale has grown 21 times faster than the overall retail apparel market, according to ThredUP.

[caption id="attachment_87929" align="aligncenter" width="700"] Thrift and Donations: A sector of the broader “secondhand” market that includes traditional options such as Goodwill, Salvation Army and yard sales. These secondhand options are primarily, but not exclusively, offline.

Thrift and Donations: A sector of the broader “secondhand” market that includes traditional options such as Goodwill, Salvation Army and yard sales. These secondhand options are primarily, but not exclusively, offline.Resale: A sector of the broader “secondhand” market that includes more curated product assortments, often well merchandised and/or higher end. Examples include thredUP and TheRealReal, as well as upscale physical players such as Buffalo Exchange. These secondhand options are primarily, but not exclusively, online.

Source: ThredUP[/caption] Surprisingly, 64% of women are now willing to buy secondhand products, with millennials most willing to go the thrift route (33%) and baby boomers next (at 31%). Some 74% of 18-29 year olds said they prefer to buy from sustainably conscious brands, according to ThredUP. [caption id="attachment_87931" align="aligncenter" width="570"]

Source: ThredUP[/caption]

[caption id="attachment_87932" align="aligncenter" width="574"]

Source: ThredUP[/caption]

[caption id="attachment_87932" align="aligncenter" width="574"] Source: ThredUP[/caption]

Resale pioneer The RealReal states that 95% of clothing could be reused or reworn. To publicize the sustainability aspects of consigning clothing, The RealReal rolled out its first consumer-facing sustainability calculator in 2018, which allows consignors see the environmental impact of consigning clothes for sale in terms of emissions and other pollution avoided by not creating a new product.

Limited-Run Collaboration Brought Mutual Benefit

Luxury brands are also collaborating to create new products, offering traditional luxury brands access to new consumer segments as they unite seemingly disparate brands, offering mutual benefit and bringing superior marketing effects, which is 1+1=4.

The Louis Vuitton X Supreme was a great hit. Supreme is a US street brand established in 1994. It is a representative of skateboarding and hip-hop fashion culture, and has a large number of fans among young people. The collaboration resulted in products featuring the Supreme bright red and LV's "presbyopia" combination, catching the eye of young people. The hoodies, purses and suitcases in the series have become fashion items sought after by hipsters.

[caption id="attachment_87933" align="aligncenter" width="506"]

Source: ThredUP[/caption]

Resale pioneer The RealReal states that 95% of clothing could be reused or reworn. To publicize the sustainability aspects of consigning clothing, The RealReal rolled out its first consumer-facing sustainability calculator in 2018, which allows consignors see the environmental impact of consigning clothes for sale in terms of emissions and other pollution avoided by not creating a new product.

Limited-Run Collaboration Brought Mutual Benefit

Luxury brands are also collaborating to create new products, offering traditional luxury brands access to new consumer segments as they unite seemingly disparate brands, offering mutual benefit and bringing superior marketing effects, which is 1+1=4.

The Louis Vuitton X Supreme was a great hit. Supreme is a US street brand established in 1994. It is a representative of skateboarding and hip-hop fashion culture, and has a large number of fans among young people. The collaboration resulted in products featuring the Supreme bright red and LV's "presbyopia" combination, catching the eye of young people. The hoodies, purses and suitcases in the series have become fashion items sought after by hipsters.

[caption id="attachment_87933" align="aligncenter" width="506"] The LV X Supreme collaboration

The LV X Supreme collaborationSource: LV/Supreme[/caption] Hodinkee also secured positive market response with its 10th anniversary joint watch series with Swatch and Omega, both in 2018. The company later worked with Hermès, in which all watches are hand-crafted in Hermès' Swiss studio, each with a separate number as the first commemorative certification for the two units. Strategic alliances and limited-run joint products could be the response of today’s luxury brands to an increasingly competitive global market. When looking at a limited-run collaboration, luxury brands should consider their crossover partners, objectives and time needed to bring the partnership to fruition. Limited numbers, buzz of crossover, uniqueness and innovation of design are consumers’ major motivation to buy. Purpose-Oriented Brands are Gaining Social Recognition Purpose-oriented brands are gaining popularity among consumers, and third-party entities are emerging that verify sustainability claims. One is Positive Luxury, whose Butterfly Mark is awarded to brands that meet specific criteria around governance, social performance, environmental performance, community investment and innovation. The process is updated every two years in partnership with a sustainability council, as well as external institutional partners, companies, NGOs and retailers. MICHI (a high-end active wear brand for sports, travel, leisure) was recently awarded the butterfly mark for its measurable impact and company-wide commitment to sustainability. Biotherm was award the prize in 2018 for its strong sustainability commitments including improving the biodegradability of its cosmetics formulas, using renewable materials, optimizing its packaging. LVMH is also one member of the butterfly mark families. [caption id="attachment_87934" align="aligncenter" width="243"]

The Positive Luxury Butterfly Mark

The Positive Luxury Butterfly MarkSource: Positive Luxury[/caption] Another important social recognition prize is the Sustainable Quality Award (SQA). The award assesses applicant’s performance in innovation, commitment and documented results. This year, Tradesy, the online peer-to-peer resale marketplace for women’s luxury and designer contemporary fashion, won the prize. Key Insights

- Luxury has gradually transformed from an ethos of exclusivity and uniqueness to one of inclusivity, transparency and egalitarianism. Social values in the luxury industry now include greater accessibility, gender equality, size inclusion and design diversity.

- Consumers are paying increasing attention to sustainability, especially millennials, who are social media disrupters and are gradually becoming the main force in luxury consumption.

- Limited-run collaborations have become an increasingly important tool for successful branding. It allows seemingly disparate brands to share the prestige, image and popularity, while also improving both brands’ reputations.