DIpil Das

Introduction

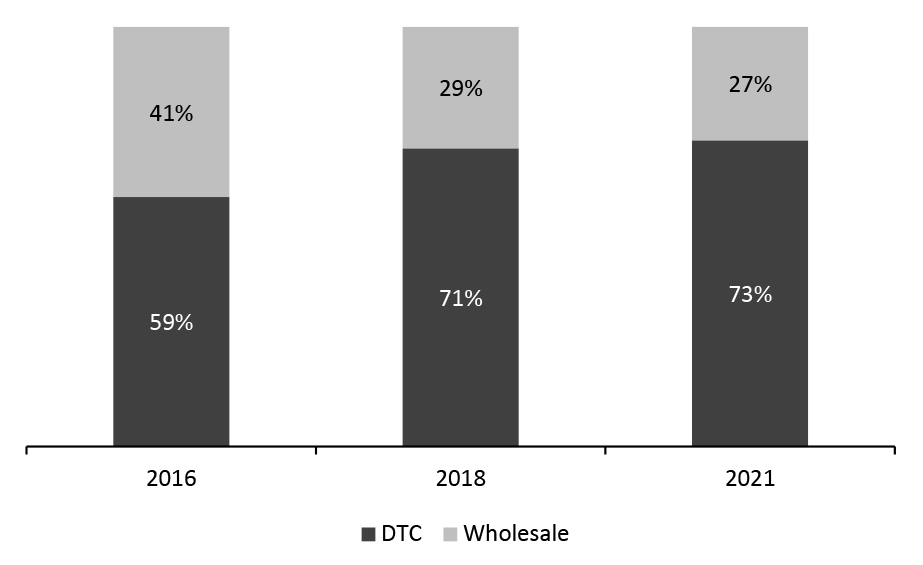

What’s the Story? Many luxury brands have been gravitating toward the DTC model in recent years, and the shift accelerated amid the pandemic, as stores facing forced closures and loss of revenue turned brands’ focus to selling directly to consumers. In this report, we examine the DTC model in luxury retail, comprising sales made directly to consumers either via brands’ own stores or webshops with no intermediary. We cover DTC in established luxury houses as well as digitally native DTC luxury brands. Why It Matters Brands typically favor the DTC channel over wholesale as it affords greater control over brand perception, customer relationships and profits. As such, DTC in luxury has grown considerably in recent years. Based on our analysis of selected major global luxury brands, DTC retail revenue comprised the majority share of total luxury revenue in 2021. We expect this channel to expand further as brands become increasingly familiar with selling directly to consumers and consumers become more used to buying directly from brands.Figure 1. Luxury: Selected Major Companies’ DTC Retail and Wholesale Revenue Split [caption id="attachment_143238" align="aligncenter" width="700"]

Source: Company reports/Coresight Research [/caption]

Source: Company reports/Coresight Research [/caption]

To DTC or Not To DTC: Coresight Research Analysis

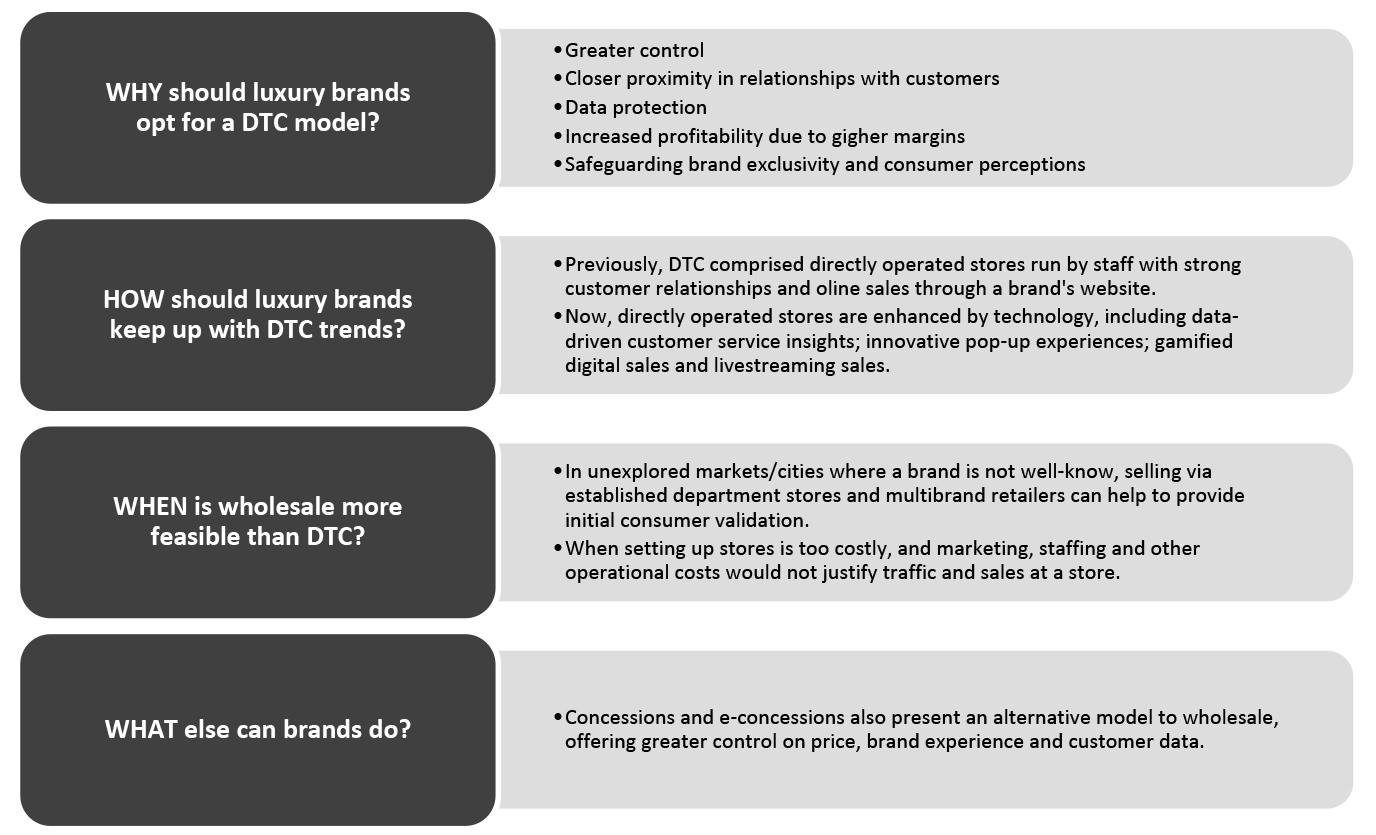

As sales channels, DTC and wholesale provide a brand with varying degrees of autonomy on prices, marketing and customer experiences. To help luxury brands and retailers better understand how the DTC model would work for them, we explore the why, how, when and what (else) of DTC in luxury.Figure 2. Examining the DTC Model [caption id="attachment_143239" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Why Should Luxury Brands Opt for a DTC Model?

Exclusivity and superior customer service are the markers of a successful luxury brand and these can only be completely guaranteed if a brand sells directly rather than through an intermediary.

Key advantages of selling directly to customers include:

Source: Coresight Research[/caption]

Why Should Luxury Brands Opt for a DTC Model?

Exclusivity and superior customer service are the markers of a successful luxury brand and these can only be completely guaranteed if a brand sells directly rather than through an intermediary.

Key advantages of selling directly to customers include:

- Control: The DTC channel affords brands greater control of the process from warehouse to customer. For instance, within a retail store, the retailer decides the visual merchandising strategy and thus dictates where products are placed within the space, which brands are promoted and which staff sell those brands.

- Proximity: Selling directly to customers allows brands to get to know their customers better and build brand loyalty. Contrastingly, at a department store, products may be sold by store staff and not brand personnel, unless they are sold via concessions, thereby distancing the relationship between the brand and its customer.

- Data protection: With a DTC model, a brand tends to have complete ownership over customer data whereas with a wholesale model retailers also gain access to a brand’s price and sales data.

- Profitability: As brands control retail sales price of their products when selling directly to consumers, they retain higher profits versus wholesale, where the retailer (the wholesale buyer) determines the price. As shown in Figure 3, many luxury brands that increased their portfolios of directly operated stores (DOS) grew their gross margins between 2016 and 2020, indicating that they were able to retain a greater share of profits as a result. Although the growth in store numbers is not directly proportionate to gross margin growth—likely due to a disproportionate rise in the cost of goods sold and unequal revenues from stores—we believe there is a valid correlation.

Figure 3. Luxury: Selected Major Companies’ DOS Portfolios and Gross Margins [wpdatatable id=1810]

Source: Company reports/Coresight Research

- Safeguarding brand exclusivity/consumer perception:DTC brands choose how their selling space—physical and online—is designed, in order to best capture customers’ attention and provide exclusive brand experiences. Chanel, for example, does not list the price of some of its products on its website. It instead encourages shoppers to contact its customer service or visit the store to enquire and purchase the product, creating an opportunity for in-person interaction where there are greater chances of converting consumer interest into a purchase.

Moreover, if a customer is unsatisfied with the product or service they receive, a brand has greater capacity to address the issue and possibly minimize any damage when selling directly. In a multibrand retail store, staff are likely to be less invested in a brand and customers have easy access to switch to other brands.

[caption id="attachment_143240" align="aligncenter" width="700"] Chanel’s Flap Bag from its Métiers D’Art 2020/21 collection.

Chanel’s Flap Bag from its Métiers D’Art 2020/21 collection. Source: Company reports/Coresight Research [/caption] How Should Luxury Brands Keep Up with DTC Trends? Whether through physical stores or online, the DTC channel has transformed from merely being a means to get a product to consumers into an engaging brand storytelling experience.

- Previously: DTC comprised directly operated stores run by staff with strong customer relationships, and online sales through the brand’s own site or app.

- Today: DTC still includes directly operated stores, but brands focus on data-driven insights to provide an enhanced level of customer service. Digital sales can now be made through livestreaming, social media and video calls, increasing the touchpoints for brands to directly interact with consumers. In addition, brands are enhancing these communication channels and incentivizing engagement through gamification.

For physical sales, brands are focusing on immersive experiences. Many brands run pop-up stores to generate excitement with a lower expenditure than setting up a fully fledged store, or those with established stores set up limited-time experiences to attract customer attention.

To promote its 2021 outdoor collection, Prada built in-store landscape installations with beach, lawn or mountain themes to showcase new products in several locations including Australia, China, Japan, Hong Kong, Korea, Singapore, Sweden, the UAE and the US. [caption id="attachment_143241" align="aligncenter" width="700"] Prada’s 2021 Outdoor collection showcased with in-store installations

Prada’s 2021 Outdoor collection showcased with in-store installations Source: Prada [/caption] When Is Wholesale More Feasible than DTC? While DTC has its many benefits, there are times when wholesale may be a more feasible channel for getting product to consumers. We present these scenarios below.

- For new brands, setting up their own stores could incur high investments whereas selling online or through a retailer involves smaller upfront costs.

- When new and established brands wish to enter new markets, selling through an existing retailer may be more cost effective than setting up a standalone store as the traffic to the store and sales made may not justify the input costs.

- For emerging brands, being sold at reputed retailers could be a form of validation from known retailers that have established themselves over time as household names.

- Multibrand retail stores enable strong brand search and discovery. Up-and-coming brands could benefit from the visibility of being stationed alongside known brands within the same department store, as a standalone store or promotions can provide only limited visibility.

Selfridges’ promotions of Farai London’s pop-up store on its Instagram account

Selfridges’ promotions of Farai London’s pop-up store on its Instagram account Source: Selfridges [/caption]

- When consumers are not traveling to tourist-heavy cities where luxury brands’ own stores typically tend to be based, wholesalers or brand stockists are a suitable alternative. Anish Melwani, North American President and CEO of LVMH, told analysts at Nordstrom’s Investor Day in February 2021, that LVMH looks for retail partners with an extensive physical reach. This helps LVMH sell to customers in places such as Troy, Michigan or Austin, Texas, as they shopped “closer to home” due to the travel and movement restrictions in cities like New York and Los Angeles.

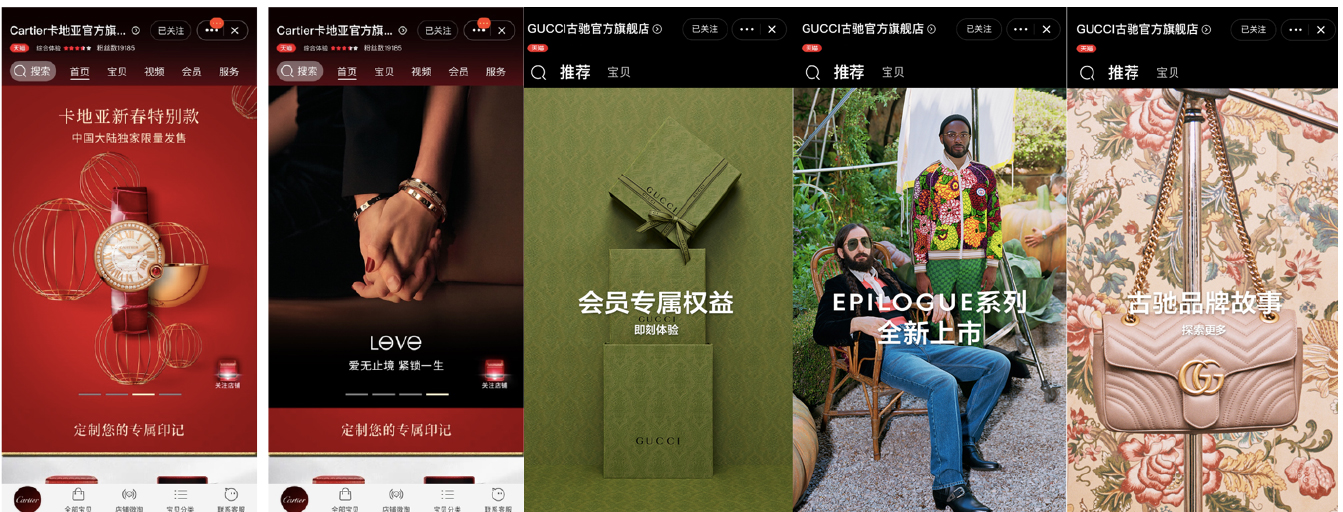

- Amazon Luxury Stores, Farfetch and Tmall Luxury Pavilion are pioneering the e-concession model in luxury: Cartier and Gucci stores on Tmall Luxury Pavilion are able to tailor their e-concessions spaces to make them unique, in a similar to physical concessions.

Cartier’s and Gucci’s stores on Tmall Luxury Pavilion

Cartier’s and Gucci’s stores on Tmall Luxury Pavilion Source: Alizila [/caption] The Rise of Digitally Native Luxury DTC Brands The ubiquity of e-commerce and growing sophistication of touchpoints, such as social platforms and chat applications, is providing DTC brands with a stronger competitive edge than ever before. Gen Z and millennials shoppers are leading the way in luxury and have a well-established desire for authenticity and digitally led experiences. The unique selling point of digitally native luxury DTC brands is that they have a singular focus on category/product, leading them to develop quality and expertise, and offer value and transparency. As consumers grow increasingly conscious of what they buy and seek authenticity and transparency, we think digitally native DTC brands will continue to grow and cater to this segment.

- Coral Chung and Wendy Wen, for example, found whitespace in the luxury handbag market that targets young working professionals, launching luxury brand Senreve.

Figure 4. Most Desirable Digitally Native DTC Luxury Brands, 2021 [wpdatatable id=1811]

Note: metrics include a combination of online traffic, social media audience and social media engagement Source: Luxe Digital Digitally native DTC brands may eventually look to open a store space to provide a physical touchpoint between the brand and consumers, providing learning and engagement opportunities. For luxury products, brands often need to go the extra mile to convince consumers that they should pay a premium to access their offerings. For example, premium home linen brand Brooklinen opened a storefront in New York in 2020. The company stated that the aim of the physical space is to help customers understand how the company has cut out the additional costs involved in running a fully fledged store and reallocated that sum to creating a luxurious product. Other luxury brands should help consumers understand the origins and craft that has gone into creating the product that they are buying, which they can demonstrate in store. [caption id="attachment_143245" align="aligncenter" width="700"]

Brooklinen’s storefront in Brooklyn, New York

Brooklinen’s storefront in Brooklyn, New York Source: Brooklinen [/caption]

What We Think

DTC provides an opportunity for brands to establish a strong relationship with new consumers and renew their relationships with existing ones. As consumers continue to shop online, brands should leverage the opportunity to connect directly via their own sites, social platforms and e-concessions. Implications for Brands/Retailers- Brands should leverage the various digital touchpoints that provide direct contact with consumers to build loyalty and capture insights to grow their DTC channel.

- To offset lost sales from store closures during pandemic-led lockdowns, brands should look to grow and expand their markets of operation, through online offerings in more countries and leverage established household-name retailers to reach new consumers.

- Concessions and e-concessions, in particular, allow retailers to leverage the advantages of wholesale while retaining the benefits of DTC.

- It may not be feasible for brands to entirely eliminate the wholesale channel, as there are many advantages to it. Multibrand retailers and wholesalers can help brands reach markets where they do not have a physical presence and provide new brands with a platform of repute to reach shoppers.