*On reported basis.

Source: Company reports

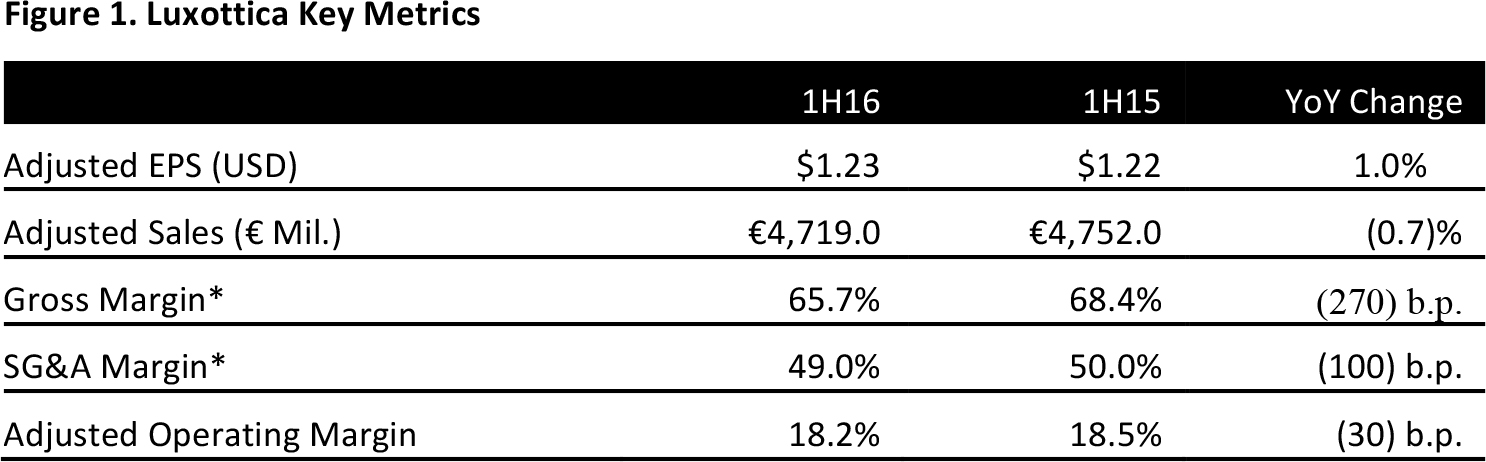

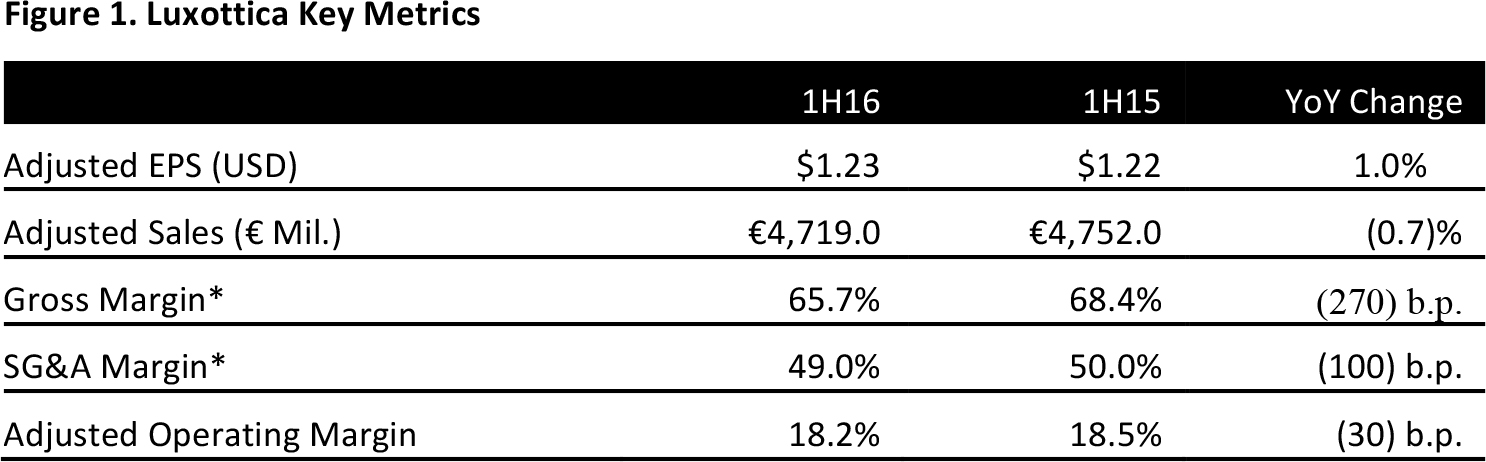

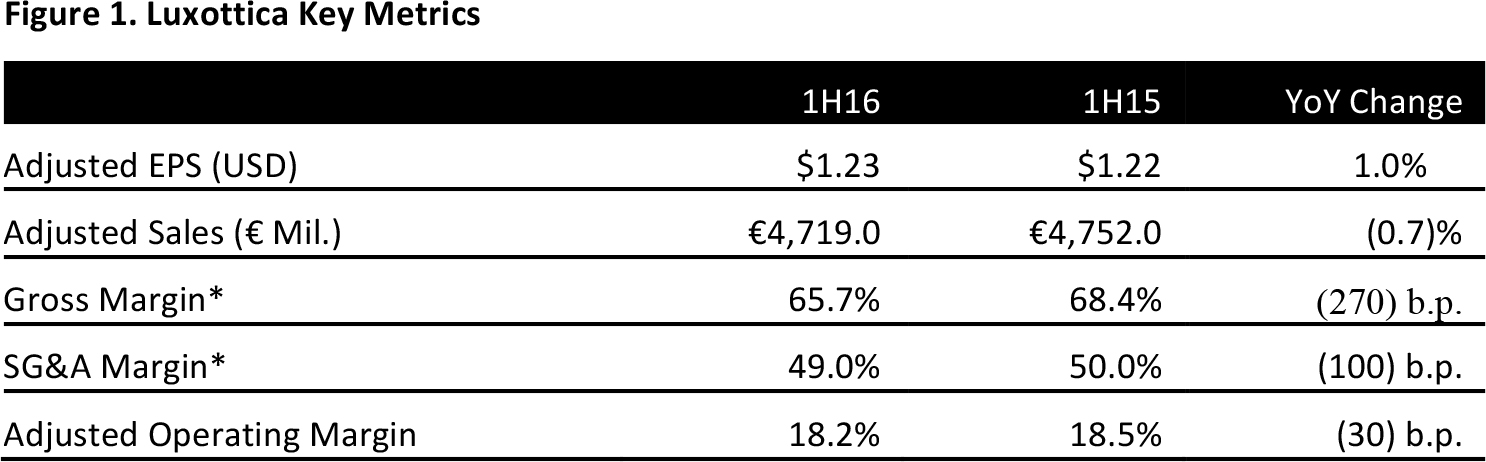

Luxottica, an Italy-based manufacturer and distributor of fashion, luxury, sport and performance eyewear, reported a 1H16 adjusted revenue decrease of 0.7% (+1.6% at constant currency), to €4.7 billion, below the consensus estimate of €4.8 billion.

Adjusted net income increased by 1.3%, to €532 million, above consensus of €511.5 million. Adjusted EPS was US$1.23, an increase of 1% versus 1H15, and above consensus of US$1.17.

Luxottica reported a decrease of 2.5% in adjusted EBIT, to €857 million, yet above the consensus estimate of €853.2 million.

The company said results were impacted by paring down its distribution network and poor weather in its largest market, North America.

RETAIL DIVISION

The retail division generated adjusted revenue of €2.8 billion in 1H16, an increase of 1.9% year over year at constant currency rates. Sunglass Hut comps were 1.5% in 1H16.

SALES BY GEOGRAPHY

Adjusted sales in North America were up 0.5% at constant currency in 1H16. North American wholesale sales were down 1.6% and retail sales increased 1% at constant currencies. LensCrafters’ comps increased 1.3% in 1H16 and licensed brands comps increased 3.7%. Comps at Sunglass Hut showed signs of improvement that rebounded in 2Q16 and have been sharply rising since June 2016.

Adjusted net sales in Europe increased by 4.6% in 1H16. Sunglass Hut in Europe reported significant growth in comps and net openings of approximately 26 new stores in the Galeries Lafayette chain in France.

Adjusted sales in the Asia-Pacific region decreased by 0.8% at constant currency rates in 1H16.

Adjusted sales in Latin America were up 13% in constant currency during 1H16, driven by Mexico, Peru and Columbia.

Comps in Australia increased by 2.7%.

2Q16 RESULTS

Luxottica’s group revenue increased by 1.4% at constant currencies during 2Q16, to €2.5 billion, in line with the consensus estimate of €2.5 billion.

GUIDANCE

For FY16, Luxottica lowered sales and profitability guidance and now expects revenues to grow by 2%–3% at constant exchange rates, with EBIT and net income growing roughly in line with revenue. The company had previously estimated 5%–6% revenue growth at constant exchange rates and profits to grow at 1.5x sales for FY16.

Prior to the 1H16 earnings results announcement, analysts had estimated that Luxottica will generate €9.2 billion in sales in FY16, with €1.5 billion in EBIT and €890 million in net income.