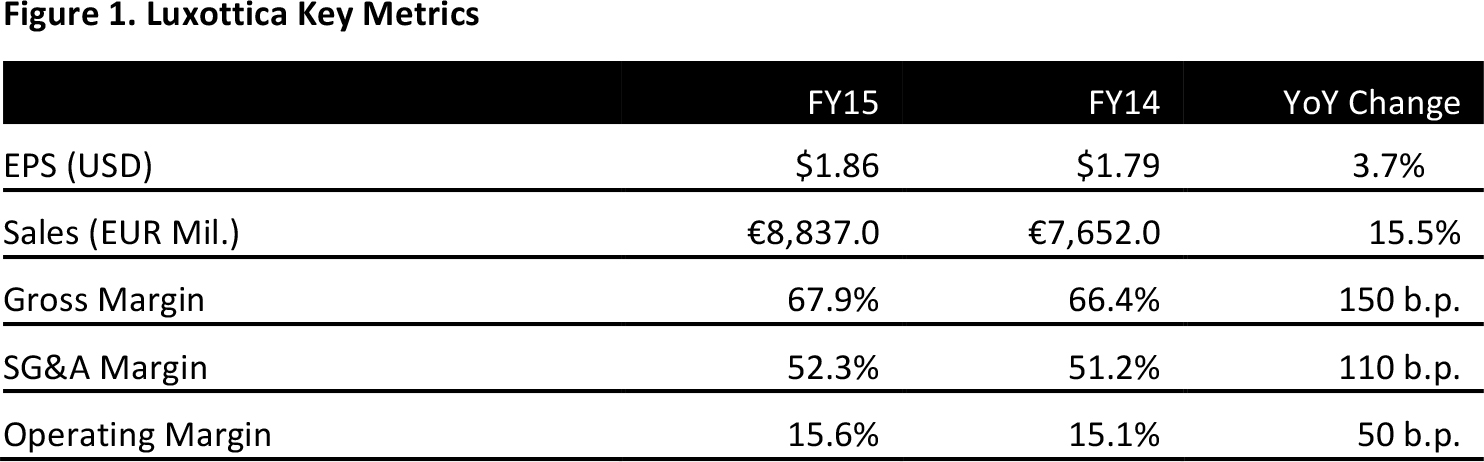

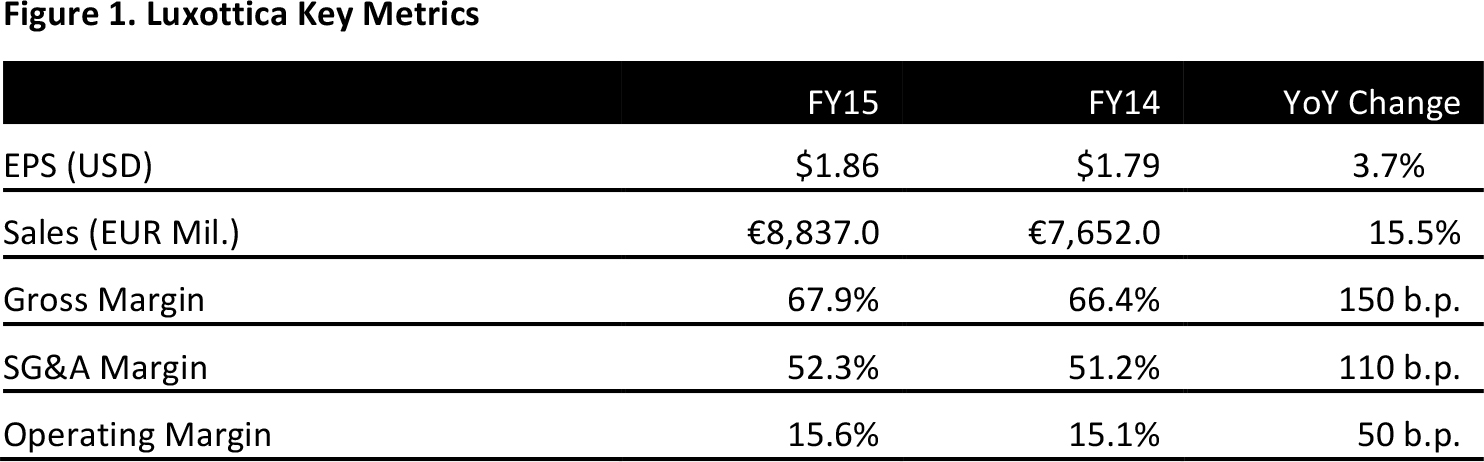

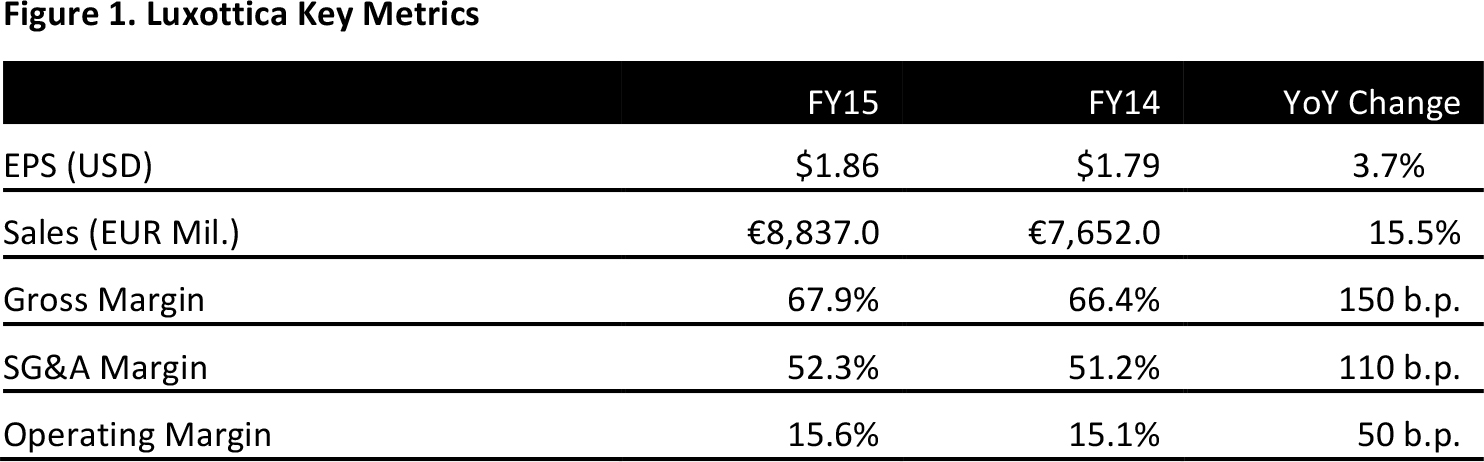

Source: Company reports

Luxottica, an Italy-based manufacturer and distributor of fashion, luxury, sport and performance eyewear, reported a FY15 revenue increase of 15.5%, to €8.8 billion, below the consensus estimate of €8.9 billion.

Net income increased by 25.1%, to €804.1 million, below consensus of €855.1 million. EPS was US$1.86, an increase of 3.7% versus FY14, but below consensus of US$1.95.

Luxottica reported an increase of 22.5% in adjusted EBIT, to €1.4 billion, below the consensus estimate of €1.5 billion.

Profitability decreased in 4Q15. The company highlighted how a slowdown in tourism in North America during the last three months of 2015 negatively affected retail sales in the region.

RETAIL DIVISION

The retail division generated revenue of €5.2 billion in FY15, an increase of 17.6% year over year. Sunglass Hut sales were up 24.6% in FY15.

SALES BY GEOGRAPHY

Sales in North America were up 22.9% in FY15, with comps of Luxottica’s retail chains up 3.9%. This includes LensCrafters’ and Sunglass Hut, whose US comps were up 4.3% and 4.7%, respectively. Sales in Europe increased by 7.8% in FY15. The retail division in Europe grew by 24.9%, with Sunglass Hut recording double-digit growth in comps and net openings of approximately 50 new stores.

Sales in the Asia-Pacific region grew by 12.2% in FY15. The retail division grew by 6.9%. Sunglass Hut opened a total of 42 stores in Mainland China and Thailand during the year. Comps within the retail division in Australia were up 1.5% in FY15.

Sales in Latin America were up 7.3% during the year, driven by Mexico, Chile and Colombia.

4Q15 RESULTS

During 4Q15, Luxottica’s group revenue increased by 7.9%, to €2.0 billion, below the consensus estimate of €2.1 billion. Adjusted EBIT decreased by 1.2%, to €213 million, below the consensus estimate of €227 million. Net income increased by 13.4%, to €99 million, but decreased by 1.0% in adjusted terms and was below consensus of €129.8 million. EPS was US$0.23, down 1.2% and below the consensus estimate of US$0.30.

GUIDANCE

For FY16, Luxottica expects continued organic growth and improvement of profitability. In particular, the group expects sales to grow by 5%–6% at constant exchange rates, with EBIT and net income growing roughly in line with revenue.

The group also plans to increase investment—it plans to invest more than €1.5 billion over the next three years—which should generate mid- to high-single-digit growth in sales at constant exchange rates.

Analysts estimate that Luxottica will generate €9.5 billion in sales in FY16, with €1.6 billion in EBIT and €971.2 million in net income.