Source: Company reports/Fung Global Retail & Technology

FY16 Results

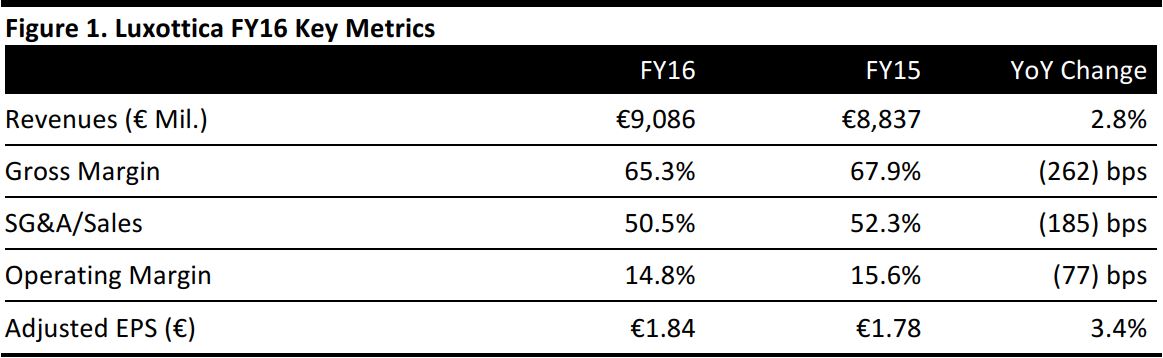

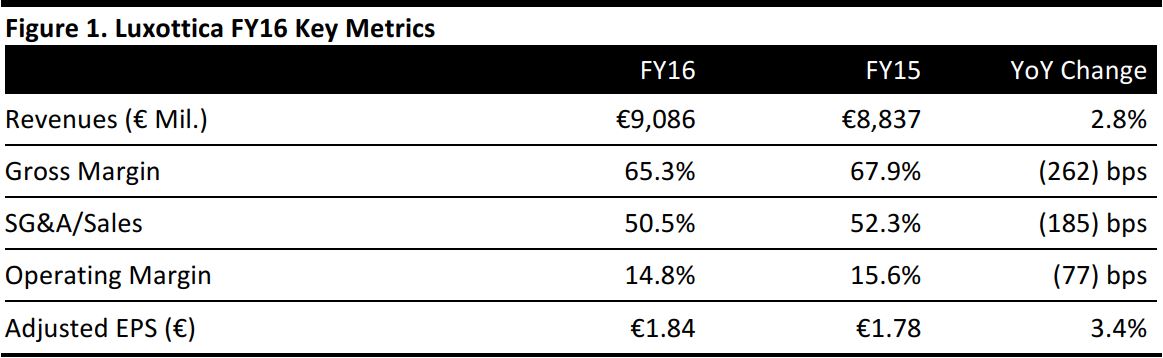

Luxottica reported that FY16 operating income fell by 2.3%, to €1,345 million; at constant exchange rates, operating income fell by 0.6%. The company noted the impact of organizational simplification and restructuring costs on profitability. Adjusted for reorganization costs, nonrecurring expenses and nonrecurring income, operating income fell by 0.7%, and rose by 0.8% at constant exchange rates.

Gross profit declined by 1.1%, equating to a contraction of 262 basis points in gross margin. Selling, general and administrative expenses fell by 0.8%.

Net income increased by 5.8% as reported, while adjusted net income rose by 3.3% as reported. Adjusted EPS increased by 3.4%, to €1.84, ahead of the consensus estimate of €1.80.

Revenues of €9,086 million were up 2.8% as reported and up 3.9% at constant exchange rates. 4Q16 revenues were up 6.3% as reported and up 5.2% at constant exchange rates. The company had already reported its sales performance for the fourth quarter and full year, and readers can find our coverage of that trading update at

bit.ly/LuxFY16.

Operational Highlights

The company highlighted its efforts to “improve the quality of sales” in the past year. These included introducing a “minimum advertised price policy” in the US, “cleaning up” distribution channels in China, harmonizing prices across regions and sharply reducing promotions.

The group’s e-commerce platforms posted a 24% increase in sales for the year.

The company acquired Salmoiraghi & Vigano, an optical retail brand in Italy, toward the end of 2016. In January 2017, Luxottica and French ophthalmic lens manufacturer Essilor announced their intention to merge; Luxottica provided no meaningful update on that merger.

Outlook

In FY17, the company expects sales growth in the low- to mid-single-digit range at constant exchange rates. It expects adjusted operating income of 0.8–1.0 times sales, adjusted net income of 1.0 times sales and a net debt/EBITDA ratio of approximately 0.5 times.

For FY17, analysts expect Luxottica to grow sales by 6.4% and EBIT by 9.9%. Consensus is for adjusted EPS to climb 9.4%, to €1.97. Consensus estimates were collated before the latest results were released.