DIpil Das

On September 25, 2019, Coresight Research attended a conference titled LuxeCX/AMCX: The Role of Customer Experience in Business in New York City. Luxury brands and retailers, service providers and researchers discussed the role of customer service as a key determinant for consumers when making shopping and buying decisions.

Executives from Altiant, Apple, Christie’s Americas, Forrester, IBM, IHG, Luxury Institute, The Pierre, UBS Financial Services and others spoke. Key insights include:

Luxury brands have true differentiators in their heritage, flagship locations, artisan traditions and service components that new upstart digitally native brands lack. Luxury brands should leverage these assets. Heritage is a story and can be emotionally compelling, which is foundational to customer loyalty.

Personalization works: Heritage assets alone aren’t enough in an omnichannel age with digital shoppers. Millennials want to feel known as individuals, not as a statistic, this means personalization strategies work. Similarly, millennial investors want to invest in companies whose values they share, making environmental, social and governance (ESG) strategies, or doing well by doing good, more important than for other generations.

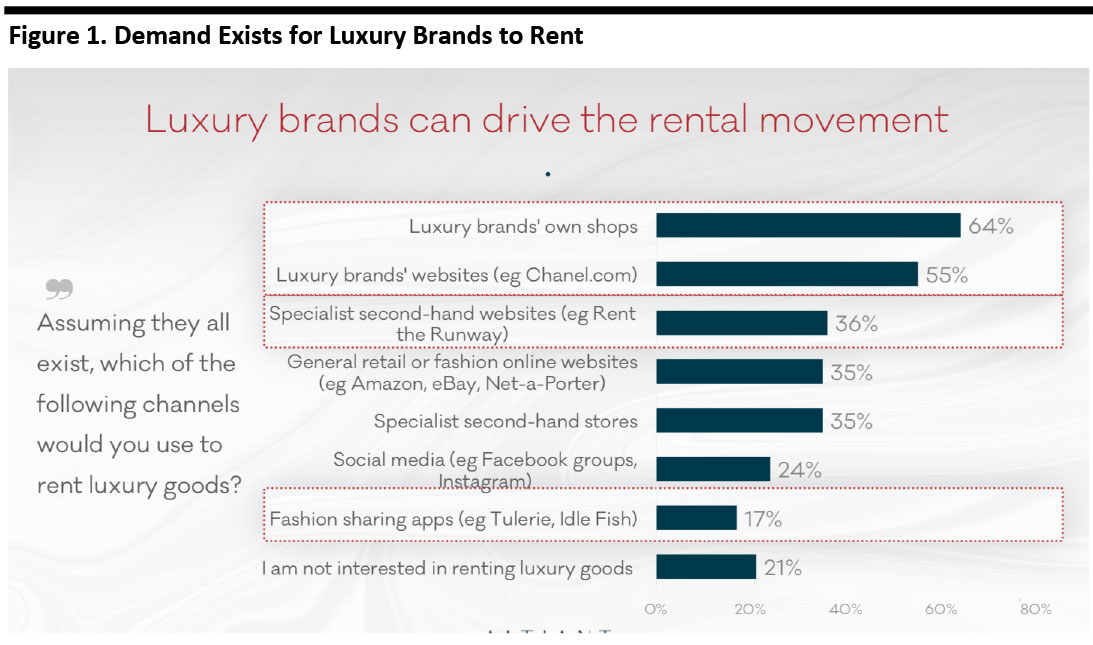

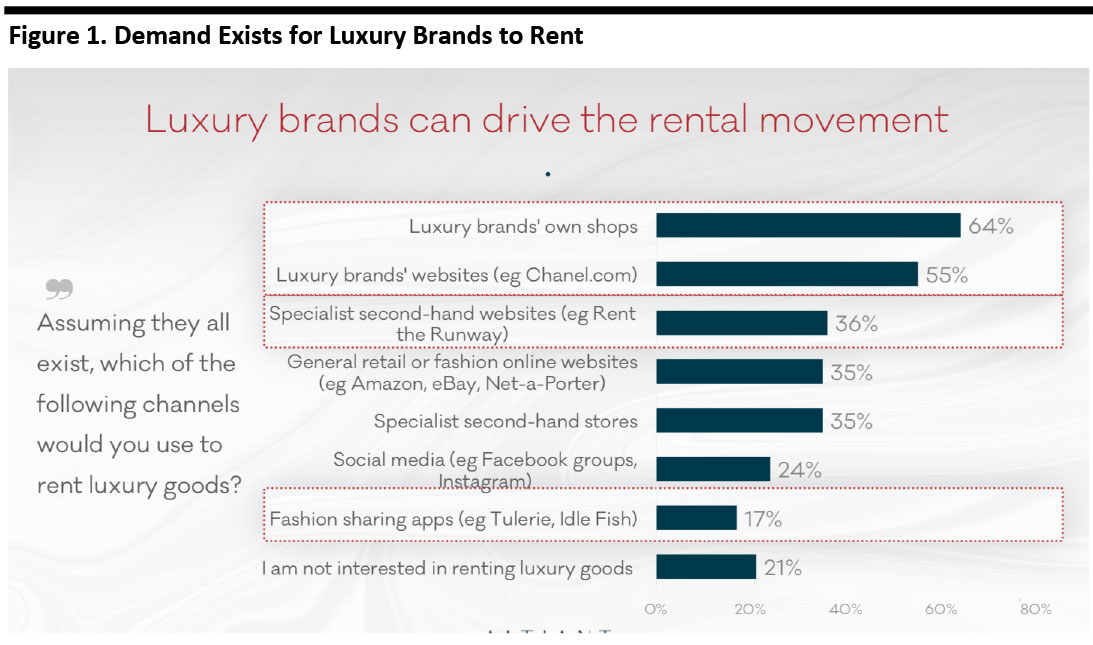

Know your customer is even more important in luxury. The motto has long been the mandate for brands and retailers regardless of the income level of the customer. For luxury consumers, this is paramount. And luxury shoppers are changing: A younger shopper with new attitudes about ownership and shared services is coming of age. Altiant spoke of the concept of ownership transitioning to the idea of experiencing luxury ownership for shorter periods time, in effect, choosing the parts of a luxury lifestyle you want to live or experience and renting it, everything from homes to handbags. This could open new business models for luxury brands similar to the flurry of subscription and rental offerings we are seeing among specialty retailers such as American Eagle, Ann Taylor, Banana Republic and Urban Outfitters (including Anthropologie and Free People).

Data and social media are playing an increasingly larger role in the customer experience. The Pierre hotel gathers facts about guests from social media posts, by understanding what matters they can better deliver the service expected. IBM spoke to high quality data making a difference in increasing revenue and creating differentiated omnichannel customer experiences. After IBM transformed Tiffany’s web user experience and modernized the web experience, cart conversion rose 36% and users browsing the Tiffany site for more than ten minutes increased 23% according to IBM. A comprehensive view of the customer was enabled, and IBM had the tools to interpret the data.

Post-purchase consumer perceptions are more important that pre-purchase perception. Forrester told the audience retailers are focusing on the wrong parts of the shopping journey. Discover, explore and buy are important and necessary – but what happens after the sale is even more important. The customer experience continues after the purchase, when a product is used when a brand can reach out and communicate about the usage experience and engage the shopper. Brands should exercise their follow-up muscles to help the buying cycle to begin again with deeper customer understanding.

[caption id="attachment_97480" align="aligncenter" width="700"] Source: Luxury Opinions/Altiant[/caption]

Source: Luxury Opinions/Altiant[/caption]

Source: Luxury Opinions/Altiant[/caption]

Source: Luxury Opinions/Altiant[/caption]