Nitheesh NH

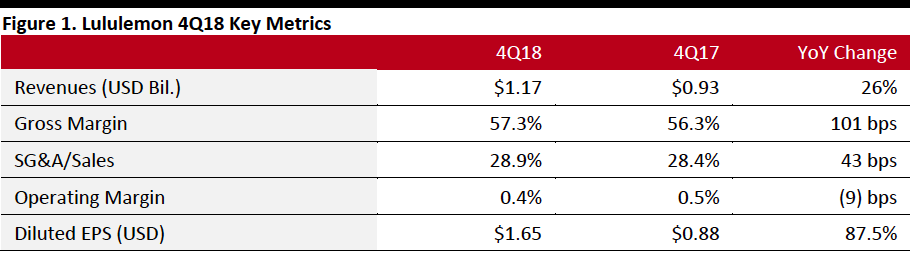

[caption id="attachment_81953" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

Lululemon 4Q18 revenues were $1.17 billion, up 26% year over year and beating the consensus estimate of $1.15 billion. For the full fiscal year, revenue increased 25% on a constant-dollar basis to $3.3 billion from the year ago period. The company reported 4Q18 EPS of $1.65, up 87.5% from the year ago period.

For the quarter, the company saw consolidated comparable sales growth of 17% on a constant-dollar basis, compared to the consensus estimate of 16.9%, and beating the company’s guidance of mid to high teens. For the year, the company’s comparable store sales increased 8% on a constant-dollar basis.

Management reported its direct-to-consumer business increased 39% on a constant-dollar basis, and that company-operated stores that have been open for at least one year averaged sales per square foot of $1,579.

Management reported that consumers responded favorably to the 2018 merchandise holiday assortment. The company tested buy online, pick up in store in 35 doors for 2018, and plans to execute to all of its stores for holiday 2019.

Management said it expects Lululemon can be a dual-gender brand, saying its men’s business is one of its largest areas of future growth. Management commented that men’s pants is one of the fastest growing categories and comped at 20%; outerwear is another “success story” for the men’s business. When the company doubled the men’s store footprint in its Mall of America location, the productivity of its men’s sales increased 80%.

Management said international business saw strong performance in 4Q18, particularly in China. The company saw market growth in Asia over 70% and Europe grew by almost 60%. In China, e-commerce increased over 140% in 4Q18. The company opened its first locations in Osaka, Japan, and Macau during the quarter, and its first airport location in Hong Kong. In Europe, the company opened an stores in Berlin and Amsterdam. The company ended the quarter with 440 stores, opening 38 stores and closing three over the year.

Stores: Management expects to open 12 new stores in the first quarter. For the full fiscal year, management plans to open 40-50 company-operated stores, which includes 25-30 stores in international markets and represents a square footage increase in the mid-teens range.

Outlook

For 1Q19, the company expects revenues to be in the range of $740-750 million and a comparable sales percentage increase in the low double digits. The company expects diluted EPS in the first quarter to be in the range of $0.68 to $0.70 versus EPS of $0.55 a year ago.

For the full year 2019, management expects revenue to be in the range of $3.7 billion to $3.74 billion. This is based on a comparable sales percentage increase in the low double digits on a constant-dollar basis. The company expects FY19 diluted EPS to be in the range of $4.48-4.55, above the consensus estimate of $4.41.

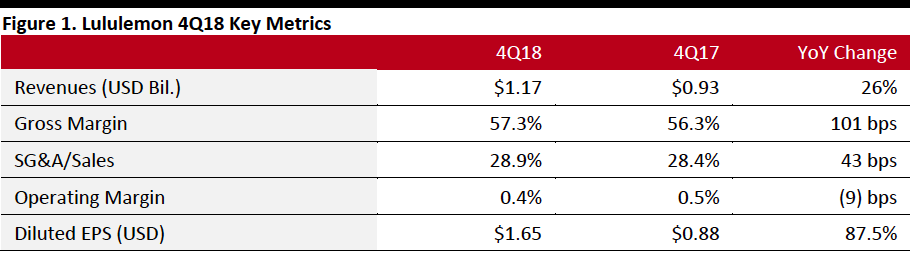

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Lululemon 4Q18 revenues were $1.17 billion, up 26% year over year and beating the consensus estimate of $1.15 billion. For the full fiscal year, revenue increased 25% on a constant-dollar basis to $3.3 billion from the year ago period. The company reported 4Q18 EPS of $1.65, up 87.5% from the year ago period.

For the quarter, the company saw consolidated comparable sales growth of 17% on a constant-dollar basis, compared to the consensus estimate of 16.9%, and beating the company’s guidance of mid to high teens. For the year, the company’s comparable store sales increased 8% on a constant-dollar basis.

Management reported its direct-to-consumer business increased 39% on a constant-dollar basis, and that company-operated stores that have been open for at least one year averaged sales per square foot of $1,579.

Management reported that consumers responded favorably to the 2018 merchandise holiday assortment. The company tested buy online, pick up in store in 35 doors for 2018, and plans to execute to all of its stores for holiday 2019.

Management said it expects Lululemon can be a dual-gender brand, saying its men’s business is one of its largest areas of future growth. Management commented that men’s pants is one of the fastest growing categories and comped at 20%; outerwear is another “success story” for the men’s business. When the company doubled the men’s store footprint in its Mall of America location, the productivity of its men’s sales increased 80%.

Management said international business saw strong performance in 4Q18, particularly in China. The company saw market growth in Asia over 70% and Europe grew by almost 60%. In China, e-commerce increased over 140% in 4Q18. The company opened its first locations in Osaka, Japan, and Macau during the quarter, and its first airport location in Hong Kong. In Europe, the company opened an stores in Berlin and Amsterdam. The company ended the quarter with 440 stores, opening 38 stores and closing three over the year.

Stores: Management expects to open 12 new stores in the first quarter. For the full fiscal year, management plans to open 40-50 company-operated stores, which includes 25-30 stores in international markets and represents a square footage increase in the mid-teens range.

Outlook

For 1Q19, the company expects revenues to be in the range of $740-750 million and a comparable sales percentage increase in the low double digits. The company expects diluted EPS in the first quarter to be in the range of $0.68 to $0.70 versus EPS of $0.55 a year ago.

For the full year 2019, management expects revenue to be in the range of $3.7 billion to $3.74 billion. This is based on a comparable sales percentage increase in the low double digits on a constant-dollar basis. The company expects FY19 diluted EPS to be in the range of $4.48-4.55, above the consensus estimate of $4.41.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Lululemon 4Q18 revenues were $1.17 billion, up 26% year over year and beating the consensus estimate of $1.15 billion. For the full fiscal year, revenue increased 25% on a constant-dollar basis to $3.3 billion from the year ago period. The company reported 4Q18 EPS of $1.65, up 87.5% from the year ago period.

For the quarter, the company saw consolidated comparable sales growth of 17% on a constant-dollar basis, compared to the consensus estimate of 16.9%, and beating the company’s guidance of mid to high teens. For the year, the company’s comparable store sales increased 8% on a constant-dollar basis.

Management reported its direct-to-consumer business increased 39% on a constant-dollar basis, and that company-operated stores that have been open for at least one year averaged sales per square foot of $1,579.

Management reported that consumers responded favorably to the 2018 merchandise holiday assortment. The company tested buy online, pick up in store in 35 doors for 2018, and plans to execute to all of its stores for holiday 2019.

Management said it expects Lululemon can be a dual-gender brand, saying its men’s business is one of its largest areas of future growth. Management commented that men’s pants is one of the fastest growing categories and comped at 20%; outerwear is another “success story” for the men’s business. When the company doubled the men’s store footprint in its Mall of America location, the productivity of its men’s sales increased 80%.

Management said international business saw strong performance in 4Q18, particularly in China. The company saw market growth in Asia over 70% and Europe grew by almost 60%. In China, e-commerce increased over 140% in 4Q18. The company opened its first locations in Osaka, Japan, and Macau during the quarter, and its first airport location in Hong Kong. In Europe, the company opened an stores in Berlin and Amsterdam. The company ended the quarter with 440 stores, opening 38 stores and closing three over the year.

Stores: Management expects to open 12 new stores in the first quarter. For the full fiscal year, management plans to open 40-50 company-operated stores, which includes 25-30 stores in international markets and represents a square footage increase in the mid-teens range.

Outlook

For 1Q19, the company expects revenues to be in the range of $740-750 million and a comparable sales percentage increase in the low double digits. The company expects diluted EPS in the first quarter to be in the range of $0.68 to $0.70 versus EPS of $0.55 a year ago.

For the full year 2019, management expects revenue to be in the range of $3.7 billion to $3.74 billion. This is based on a comparable sales percentage increase in the low double digits on a constant-dollar basis. The company expects FY19 diluted EPS to be in the range of $4.48-4.55, above the consensus estimate of $4.41.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Lululemon 4Q18 revenues were $1.17 billion, up 26% year over year and beating the consensus estimate of $1.15 billion. For the full fiscal year, revenue increased 25% on a constant-dollar basis to $3.3 billion from the year ago period. The company reported 4Q18 EPS of $1.65, up 87.5% from the year ago period.

For the quarter, the company saw consolidated comparable sales growth of 17% on a constant-dollar basis, compared to the consensus estimate of 16.9%, and beating the company’s guidance of mid to high teens. For the year, the company’s comparable store sales increased 8% on a constant-dollar basis.

Management reported its direct-to-consumer business increased 39% on a constant-dollar basis, and that company-operated stores that have been open for at least one year averaged sales per square foot of $1,579.

Management reported that consumers responded favorably to the 2018 merchandise holiday assortment. The company tested buy online, pick up in store in 35 doors for 2018, and plans to execute to all of its stores for holiday 2019.

Management said it expects Lululemon can be a dual-gender brand, saying its men’s business is one of its largest areas of future growth. Management commented that men’s pants is one of the fastest growing categories and comped at 20%; outerwear is another “success story” for the men’s business. When the company doubled the men’s store footprint in its Mall of America location, the productivity of its men’s sales increased 80%.

Management said international business saw strong performance in 4Q18, particularly in China. The company saw market growth in Asia over 70% and Europe grew by almost 60%. In China, e-commerce increased over 140% in 4Q18. The company opened its first locations in Osaka, Japan, and Macau during the quarter, and its first airport location in Hong Kong. In Europe, the company opened an stores in Berlin and Amsterdam. The company ended the quarter with 440 stores, opening 38 stores and closing three over the year.

Stores: Management expects to open 12 new stores in the first quarter. For the full fiscal year, management plans to open 40-50 company-operated stores, which includes 25-30 stores in international markets and represents a square footage increase in the mid-teens range.

Outlook

For 1Q19, the company expects revenues to be in the range of $740-750 million and a comparable sales percentage increase in the low double digits. The company expects diluted EPS in the first quarter to be in the range of $0.68 to $0.70 versus EPS of $0.55 a year ago.

For the full year 2019, management expects revenue to be in the range of $3.7 billion to $3.74 billion. This is based on a comparable sales percentage increase in the low double digits on a constant-dollar basis. The company expects FY19 diluted EPS to be in the range of $4.48-4.55, above the consensus estimate of $4.41.