DIpil Das

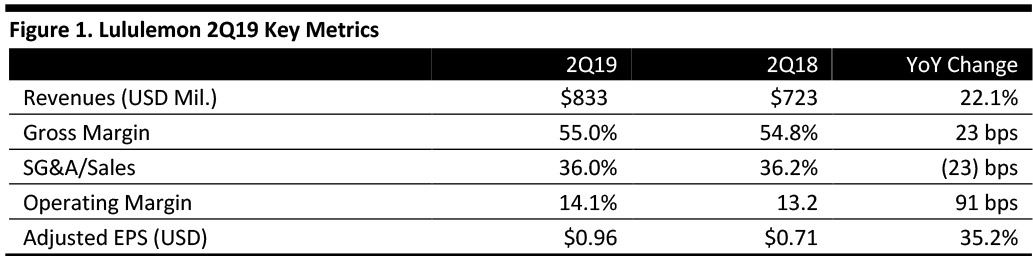

[caption id="attachment_95823" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Lululemon’s 2Q19 revenues grew 22.1% year over year to $833 million, beating the consensus estimate of $845.6 million. The company reported 2Q19 EPS of $0.96, up 35.2% from the year-ago period and ahead of the consensus estimate of $0.89.

Consolidated comparable sales grew 17% on a constant-currency basis, compared to the consensus estimate of 12.2%.

Management attributed the brand’s traffic increases and positive conversions to three things. First, the athletics space is healthy relative to other sectors in apparel and retail in general. Second, the brand has fewer seasonal fluctuations and enjoys a healthy core business. Third, the company uses data analytics and digital marketing to test, learn and adapt to leverage strengths in the business.

In the women's business, comps grew 13% as bottoms remained strong, driven by both pants and shorts. Men's outperformed women's: Comps grew 27% with strength in both tops and bottoms. Management said both men’s and women’s growth was driven by shorts.

Management commented that its Selfcare product category has exceeded expectations and it expects to expand the product line by the end of the fiscal year.

In July, Lululemon opened an experiential store in Lincoln Park, Chicago, that offers a dedicated studio space for sweat classes and meditation; a locker room for showers; a fuel bar for refreshments; a community space just to foster connection; and, an elevated shopping experience. The store also has 45 local ambassadors and holds 6-10 classes per day.

Lululemon plans two more experiential stores, in the Mall of America (near Minneapolis) and one in New York City near Rockefeller Center to open in November.

Revenue in North America increased 21% and the company reported customers continue to respond well to the merchandise assortment, engaging store environment and unique brand activations. During the second quarter, Lululemon opened one new store in the US, and remains on track to open 15 to 20 more this year.

In 2Q19, Lululemon’s international business also witnessed strong performance. Total revenue in Europe grow 35%. The company hosted its Annual Sweatlife Festival in London, which brought together educators, ambassadors and other members of the local community for a weekend of sweat classes, yoga, personal development and meditation. In August, Lululemon hosted Sweatlife Berlin for the second time, and in October, Lululemon will bring the event to Paris for the first time. In the Asia Pacific region, total revenue grew 33% with particular strength in China which grew 68%. Lululemon opened two new locations in China, its fourth store in Singapore and is on track to open approximately 15 stores in China this year, almost doubling its store count compared to the end of 2018. In China, e-commerce comps were over 70%, and new local sites in Korea and Japan are exceeding initial expectations.

The company reported the product team continues to develop and innovate in the bra category and sees white space in this category, but cautioned it is very early and developing the category will be a multi-quarter, multi-year investment as the company tests, learns and continues to make investments in this category.

On tariffs, management said that its direct exposure to China is relatively small with approximately 6% of finished goods in scope for US tariffs, which the company achieved by diversifying its vendor base.

Stores: The company opened five new stores in the first quarter, completed eight optimizations and ended the quarter with 460 stores. Lululemon expects to open approximately 45-50 company-operated stores in 2019. This includes approximately 30 stores in international markets and represents a square footage percentage increase in the mid- to high teens range.

Outlook

For the third quarter of fiscal 2019, management expects revenue to be in the range of $880-890 million versus the consensus estimate of $865.5 million, and EPS to be $0.90-0.92, in line with the consensus estimate of $0.90.

For FY19, the company raised guidance and now expects revenues of $3.80-3.84 billion versus prior guidance of $3.73-3.77 billion and compared to the consensus of $3.81, and EPS of $4.63-4.70 versus the prior guidance of $4.51-4.58 and compared to the consensus of $4.64.

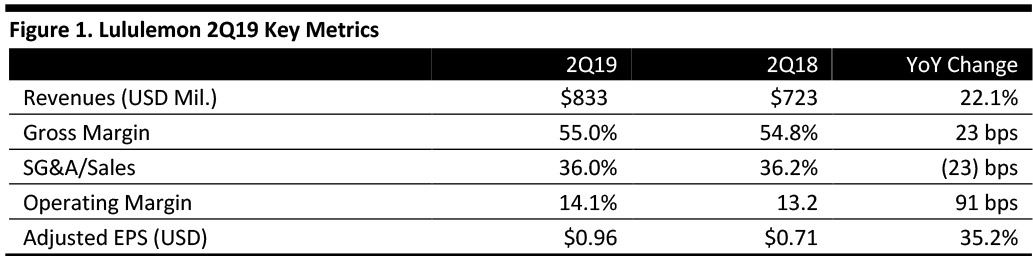

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Lululemon’s 2Q19 revenues grew 22.1% year over year to $833 million, beating the consensus estimate of $845.6 million. The company reported 2Q19 EPS of $0.96, up 35.2% from the year-ago period and ahead of the consensus estimate of $0.89.

Consolidated comparable sales grew 17% on a constant-currency basis, compared to the consensus estimate of 12.2%.

Management attributed the brand’s traffic increases and positive conversions to three things. First, the athletics space is healthy relative to other sectors in apparel and retail in general. Second, the brand has fewer seasonal fluctuations and enjoys a healthy core business. Third, the company uses data analytics and digital marketing to test, learn and adapt to leverage strengths in the business.

In the women's business, comps grew 13% as bottoms remained strong, driven by both pants and shorts. Men's outperformed women's: Comps grew 27% with strength in both tops and bottoms. Management said both men’s and women’s growth was driven by shorts.

Management commented that its Selfcare product category has exceeded expectations and it expects to expand the product line by the end of the fiscal year.

In July, Lululemon opened an experiential store in Lincoln Park, Chicago, that offers a dedicated studio space for sweat classes and meditation; a locker room for showers; a fuel bar for refreshments; a community space just to foster connection; and, an elevated shopping experience. The store also has 45 local ambassadors and holds 6-10 classes per day.

Lululemon plans two more experiential stores, in the Mall of America (near Minneapolis) and one in New York City near Rockefeller Center to open in November.

Revenue in North America increased 21% and the company reported customers continue to respond well to the merchandise assortment, engaging store environment and unique brand activations. During the second quarter, Lululemon opened one new store in the US, and remains on track to open 15 to 20 more this year.

In 2Q19, Lululemon’s international business also witnessed strong performance. Total revenue in Europe grow 35%. The company hosted its Annual Sweatlife Festival in London, which brought together educators, ambassadors and other members of the local community for a weekend of sweat classes, yoga, personal development and meditation. In August, Lululemon hosted Sweatlife Berlin for the second time, and in October, Lululemon will bring the event to Paris for the first time. In the Asia Pacific region, total revenue grew 33% with particular strength in China which grew 68%. Lululemon opened two new locations in China, its fourth store in Singapore and is on track to open approximately 15 stores in China this year, almost doubling its store count compared to the end of 2018. In China, e-commerce comps were over 70%, and new local sites in Korea and Japan are exceeding initial expectations.

The company reported the product team continues to develop and innovate in the bra category and sees white space in this category, but cautioned it is very early and developing the category will be a multi-quarter, multi-year investment as the company tests, learns and continues to make investments in this category.

On tariffs, management said that its direct exposure to China is relatively small with approximately 6% of finished goods in scope for US tariffs, which the company achieved by diversifying its vendor base.

Stores: The company opened five new stores in the first quarter, completed eight optimizations and ended the quarter with 460 stores. Lululemon expects to open approximately 45-50 company-operated stores in 2019. This includes approximately 30 stores in international markets and represents a square footage percentage increase in the mid- to high teens range.

Outlook

For the third quarter of fiscal 2019, management expects revenue to be in the range of $880-890 million versus the consensus estimate of $865.5 million, and EPS to be $0.90-0.92, in line with the consensus estimate of $0.90.

For FY19, the company raised guidance and now expects revenues of $3.80-3.84 billion versus prior guidance of $3.73-3.77 billion and compared to the consensus of $3.81, and EPS of $4.63-4.70 versus the prior guidance of $4.51-4.58 and compared to the consensus of $4.64.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Lululemon’s 2Q19 revenues grew 22.1% year over year to $833 million, beating the consensus estimate of $845.6 million. The company reported 2Q19 EPS of $0.96, up 35.2% from the year-ago period and ahead of the consensus estimate of $0.89.

Consolidated comparable sales grew 17% on a constant-currency basis, compared to the consensus estimate of 12.2%.

Management attributed the brand’s traffic increases and positive conversions to three things. First, the athletics space is healthy relative to other sectors in apparel and retail in general. Second, the brand has fewer seasonal fluctuations and enjoys a healthy core business. Third, the company uses data analytics and digital marketing to test, learn and adapt to leverage strengths in the business.

In the women's business, comps grew 13% as bottoms remained strong, driven by both pants and shorts. Men's outperformed women's: Comps grew 27% with strength in both tops and bottoms. Management said both men’s and women’s growth was driven by shorts.

Management commented that its Selfcare product category has exceeded expectations and it expects to expand the product line by the end of the fiscal year.

In July, Lululemon opened an experiential store in Lincoln Park, Chicago, that offers a dedicated studio space for sweat classes and meditation; a locker room for showers; a fuel bar for refreshments; a community space just to foster connection; and, an elevated shopping experience. The store also has 45 local ambassadors and holds 6-10 classes per day.

Lululemon plans two more experiential stores, in the Mall of America (near Minneapolis) and one in New York City near Rockefeller Center to open in November.

Revenue in North America increased 21% and the company reported customers continue to respond well to the merchandise assortment, engaging store environment and unique brand activations. During the second quarter, Lululemon opened one new store in the US, and remains on track to open 15 to 20 more this year.

In 2Q19, Lululemon’s international business also witnessed strong performance. Total revenue in Europe grow 35%. The company hosted its Annual Sweatlife Festival in London, which brought together educators, ambassadors and other members of the local community for a weekend of sweat classes, yoga, personal development and meditation. In August, Lululemon hosted Sweatlife Berlin for the second time, and in October, Lululemon will bring the event to Paris for the first time. In the Asia Pacific region, total revenue grew 33% with particular strength in China which grew 68%. Lululemon opened two new locations in China, its fourth store in Singapore and is on track to open approximately 15 stores in China this year, almost doubling its store count compared to the end of 2018. In China, e-commerce comps were over 70%, and new local sites in Korea and Japan are exceeding initial expectations.

The company reported the product team continues to develop and innovate in the bra category and sees white space in this category, but cautioned it is very early and developing the category will be a multi-quarter, multi-year investment as the company tests, learns and continues to make investments in this category.

On tariffs, management said that its direct exposure to China is relatively small with approximately 6% of finished goods in scope for US tariffs, which the company achieved by diversifying its vendor base.

Stores: The company opened five new stores in the first quarter, completed eight optimizations and ended the quarter with 460 stores. Lululemon expects to open approximately 45-50 company-operated stores in 2019. This includes approximately 30 stores in international markets and represents a square footage percentage increase in the mid- to high teens range.

Outlook

For the third quarter of fiscal 2019, management expects revenue to be in the range of $880-890 million versus the consensus estimate of $865.5 million, and EPS to be $0.90-0.92, in line with the consensus estimate of $0.90.

For FY19, the company raised guidance and now expects revenues of $3.80-3.84 billion versus prior guidance of $3.73-3.77 billion and compared to the consensus of $3.81, and EPS of $4.63-4.70 versus the prior guidance of $4.51-4.58 and compared to the consensus of $4.64.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Lululemon’s 2Q19 revenues grew 22.1% year over year to $833 million, beating the consensus estimate of $845.6 million. The company reported 2Q19 EPS of $0.96, up 35.2% from the year-ago period and ahead of the consensus estimate of $0.89.

Consolidated comparable sales grew 17% on a constant-currency basis, compared to the consensus estimate of 12.2%.

Management attributed the brand’s traffic increases and positive conversions to three things. First, the athletics space is healthy relative to other sectors in apparel and retail in general. Second, the brand has fewer seasonal fluctuations and enjoys a healthy core business. Third, the company uses data analytics and digital marketing to test, learn and adapt to leverage strengths in the business.

In the women's business, comps grew 13% as bottoms remained strong, driven by both pants and shorts. Men's outperformed women's: Comps grew 27% with strength in both tops and bottoms. Management said both men’s and women’s growth was driven by shorts.

Management commented that its Selfcare product category has exceeded expectations and it expects to expand the product line by the end of the fiscal year.

In July, Lululemon opened an experiential store in Lincoln Park, Chicago, that offers a dedicated studio space for sweat classes and meditation; a locker room for showers; a fuel bar for refreshments; a community space just to foster connection; and, an elevated shopping experience. The store also has 45 local ambassadors and holds 6-10 classes per day.

Lululemon plans two more experiential stores, in the Mall of America (near Minneapolis) and one in New York City near Rockefeller Center to open in November.

Revenue in North America increased 21% and the company reported customers continue to respond well to the merchandise assortment, engaging store environment and unique brand activations. During the second quarter, Lululemon opened one new store in the US, and remains on track to open 15 to 20 more this year.

In 2Q19, Lululemon’s international business also witnessed strong performance. Total revenue in Europe grow 35%. The company hosted its Annual Sweatlife Festival in London, which brought together educators, ambassadors and other members of the local community for a weekend of sweat classes, yoga, personal development and meditation. In August, Lululemon hosted Sweatlife Berlin for the second time, and in October, Lululemon will bring the event to Paris for the first time. In the Asia Pacific region, total revenue grew 33% with particular strength in China which grew 68%. Lululemon opened two new locations in China, its fourth store in Singapore and is on track to open approximately 15 stores in China this year, almost doubling its store count compared to the end of 2018. In China, e-commerce comps were over 70%, and new local sites in Korea and Japan are exceeding initial expectations.

The company reported the product team continues to develop and innovate in the bra category and sees white space in this category, but cautioned it is very early and developing the category will be a multi-quarter, multi-year investment as the company tests, learns and continues to make investments in this category.

On tariffs, management said that its direct exposure to China is relatively small with approximately 6% of finished goods in scope for US tariffs, which the company achieved by diversifying its vendor base.

Stores: The company opened five new stores in the first quarter, completed eight optimizations and ended the quarter with 460 stores. Lululemon expects to open approximately 45-50 company-operated stores in 2019. This includes approximately 30 stores in international markets and represents a square footage percentage increase in the mid- to high teens range.

Outlook

For the third quarter of fiscal 2019, management expects revenue to be in the range of $880-890 million versus the consensus estimate of $865.5 million, and EPS to be $0.90-0.92, in line with the consensus estimate of $0.90.

For FY19, the company raised guidance and now expects revenues of $3.80-3.84 billion versus prior guidance of $3.73-3.77 billion and compared to the consensus of $3.81, and EPS of $4.63-4.70 versus the prior guidance of $4.51-4.58 and compared to the consensus of $4.64.