DIpil Das

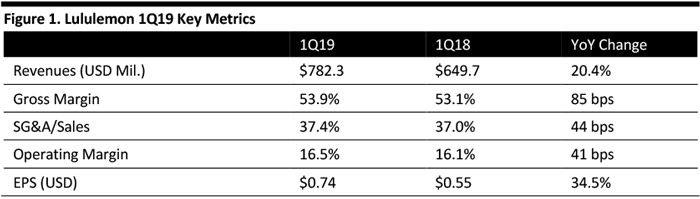

[caption id="attachment_90579" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Lululemon 1Q19 revenues were $782.3 million, up 20% year over year and beating the consensus estimate of $756.1 million. The company reported 1Q19 EPS of $0.74, up 34.5% from the year-ago period.

For the quarter, the company saw consolidated comparable sales growth of 16% on a constant-dollar basis, compared to the consensus estimate of 11.5%, and beating the company’s guidance of low-double digits.

Management reported that revenues from its direct-to-consumer business increased 35% on a constant-dollar basis and contributed 27% of the company’s total revenues in 1Q19, up from 24% in 1Q18. The company’s digital business grew 35%, more than doubling in the last two years.

Lululemon expanded its buy online, pick up in store (BOPIS) offering from 35 stores in 4Q18 to 150 stores in 1Q19. Management said about 80% of BOPIS orders are ready for customer pick up in one hour. The company plans to implement this service to all of its stores by the end of the third quarter of fiscal 2019.

Management commented that men’s pants is one of the fastest growing categories and comped at 26%. In the next five years, management expects annual growth in the company’s core women’s business to be in the low double digits, but forecasts its men’s business to grow 20% per year.

In 1Q19, Lululemon’s international business witnessed strong performance, particularly in China, which grew 70% supported by three new stores in the quarter. The company remained on track to open 10-15 stores in China in fiscal 2019. In both Asia and Europe, Lululemon witnessed growth of 40%.

Stores: The company opened 15 new stores in the first quarter, ending the quarter with 455 stores. Lululemon expects to open five new stores in the second quarter. For the full fiscal year, the company reiterated its plan to open 40-50 company-operated stores, including 25-30 stores in international markets, representing a square footage percentage increase in the mid-teens range.

Outlook

For 2Q19, the company expects revenues to be in the range of $825-835 million and a comparable sales percentage increase in the low-double digits. The company expects diluted EPS in the second quarter to be in the range of $0.86 to $0.88 versus EPS of $0.71 a year ago.

For the full year 2019, management revised guidance upward and now expects revenues to be in the range of $3.73 billion to $3.77 billion versus the prior expectation of $3.70 billion to $3.74 billion. The revenue guidance is based on a comparable sales percentage increase in the low-double digits on a constant-dollar basis. The company now expects FY19 diluted EPS to be in the range of $4.51-4.58, above the consensus estimate of $4.62.

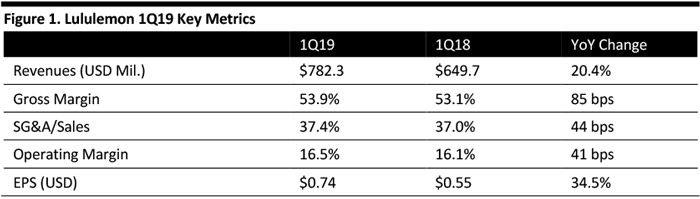

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Lululemon 1Q19 revenues were $782.3 million, up 20% year over year and beating the consensus estimate of $756.1 million. The company reported 1Q19 EPS of $0.74, up 34.5% from the year-ago period.

For the quarter, the company saw consolidated comparable sales growth of 16% on a constant-dollar basis, compared to the consensus estimate of 11.5%, and beating the company’s guidance of low-double digits.

Management reported that revenues from its direct-to-consumer business increased 35% on a constant-dollar basis and contributed 27% of the company’s total revenues in 1Q19, up from 24% in 1Q18. The company’s digital business grew 35%, more than doubling in the last two years.

Lululemon expanded its buy online, pick up in store (BOPIS) offering from 35 stores in 4Q18 to 150 stores in 1Q19. Management said about 80% of BOPIS orders are ready for customer pick up in one hour. The company plans to implement this service to all of its stores by the end of the third quarter of fiscal 2019.

Management commented that men’s pants is one of the fastest growing categories and comped at 26%. In the next five years, management expects annual growth in the company’s core women’s business to be in the low double digits, but forecasts its men’s business to grow 20% per year.

In 1Q19, Lululemon’s international business witnessed strong performance, particularly in China, which grew 70% supported by three new stores in the quarter. The company remained on track to open 10-15 stores in China in fiscal 2019. In both Asia and Europe, Lululemon witnessed growth of 40%.

Stores: The company opened 15 new stores in the first quarter, ending the quarter with 455 stores. Lululemon expects to open five new stores in the second quarter. For the full fiscal year, the company reiterated its plan to open 40-50 company-operated stores, including 25-30 stores in international markets, representing a square footage percentage increase in the mid-teens range.

Outlook

For 2Q19, the company expects revenues to be in the range of $825-835 million and a comparable sales percentage increase in the low-double digits. The company expects diluted EPS in the second quarter to be in the range of $0.86 to $0.88 versus EPS of $0.71 a year ago.

For the full year 2019, management revised guidance upward and now expects revenues to be in the range of $3.73 billion to $3.77 billion versus the prior expectation of $3.70 billion to $3.74 billion. The revenue guidance is based on a comparable sales percentage increase in the low-double digits on a constant-dollar basis. The company now expects FY19 diluted EPS to be in the range of $4.51-4.58, above the consensus estimate of $4.62.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Lululemon 1Q19 revenues were $782.3 million, up 20% year over year and beating the consensus estimate of $756.1 million. The company reported 1Q19 EPS of $0.74, up 34.5% from the year-ago period.

For the quarter, the company saw consolidated comparable sales growth of 16% on a constant-dollar basis, compared to the consensus estimate of 11.5%, and beating the company’s guidance of low-double digits.

Management reported that revenues from its direct-to-consumer business increased 35% on a constant-dollar basis and contributed 27% of the company’s total revenues in 1Q19, up from 24% in 1Q18. The company’s digital business grew 35%, more than doubling in the last two years.

Lululemon expanded its buy online, pick up in store (BOPIS) offering from 35 stores in 4Q18 to 150 stores in 1Q19. Management said about 80% of BOPIS orders are ready for customer pick up in one hour. The company plans to implement this service to all of its stores by the end of the third quarter of fiscal 2019.

Management commented that men’s pants is one of the fastest growing categories and comped at 26%. In the next five years, management expects annual growth in the company’s core women’s business to be in the low double digits, but forecasts its men’s business to grow 20% per year.

In 1Q19, Lululemon’s international business witnessed strong performance, particularly in China, which grew 70% supported by three new stores in the quarter. The company remained on track to open 10-15 stores in China in fiscal 2019. In both Asia and Europe, Lululemon witnessed growth of 40%.

Stores: The company opened 15 new stores in the first quarter, ending the quarter with 455 stores. Lululemon expects to open five new stores in the second quarter. For the full fiscal year, the company reiterated its plan to open 40-50 company-operated stores, including 25-30 stores in international markets, representing a square footage percentage increase in the mid-teens range.

Outlook

For 2Q19, the company expects revenues to be in the range of $825-835 million and a comparable sales percentage increase in the low-double digits. The company expects diluted EPS in the second quarter to be in the range of $0.86 to $0.88 versus EPS of $0.71 a year ago.

For the full year 2019, management revised guidance upward and now expects revenues to be in the range of $3.73 billion to $3.77 billion versus the prior expectation of $3.70 billion to $3.74 billion. The revenue guidance is based on a comparable sales percentage increase in the low-double digits on a constant-dollar basis. The company now expects FY19 diluted EPS to be in the range of $4.51-4.58, above the consensus estimate of $4.62.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Lululemon 1Q19 revenues were $782.3 million, up 20% year over year and beating the consensus estimate of $756.1 million. The company reported 1Q19 EPS of $0.74, up 34.5% from the year-ago period.

For the quarter, the company saw consolidated comparable sales growth of 16% on a constant-dollar basis, compared to the consensus estimate of 11.5%, and beating the company’s guidance of low-double digits.

Management reported that revenues from its direct-to-consumer business increased 35% on a constant-dollar basis and contributed 27% of the company’s total revenues in 1Q19, up from 24% in 1Q18. The company’s digital business grew 35%, more than doubling in the last two years.

Lululemon expanded its buy online, pick up in store (BOPIS) offering from 35 stores in 4Q18 to 150 stores in 1Q19. Management said about 80% of BOPIS orders are ready for customer pick up in one hour. The company plans to implement this service to all of its stores by the end of the third quarter of fiscal 2019.

Management commented that men’s pants is one of the fastest growing categories and comped at 26%. In the next five years, management expects annual growth in the company’s core women’s business to be in the low double digits, but forecasts its men’s business to grow 20% per year.

In 1Q19, Lululemon’s international business witnessed strong performance, particularly in China, which grew 70% supported by three new stores in the quarter. The company remained on track to open 10-15 stores in China in fiscal 2019. In both Asia and Europe, Lululemon witnessed growth of 40%.

Stores: The company opened 15 new stores in the first quarter, ending the quarter with 455 stores. Lululemon expects to open five new stores in the second quarter. For the full fiscal year, the company reiterated its plan to open 40-50 company-operated stores, including 25-30 stores in international markets, representing a square footage percentage increase in the mid-teens range.

Outlook

For 2Q19, the company expects revenues to be in the range of $825-835 million and a comparable sales percentage increase in the low-double digits. The company expects diluted EPS in the second quarter to be in the range of $0.86 to $0.88 versus EPS of $0.71 a year ago.

For the full year 2019, management revised guidance upward and now expects revenues to be in the range of $3.73 billion to $3.77 billion versus the prior expectation of $3.70 billion to $3.74 billion. The revenue guidance is based on a comparable sales percentage increase in the low-double digits on a constant-dollar basis. The company now expects FY19 diluted EPS to be in the range of $4.51-4.58, above the consensus estimate of $4.62.