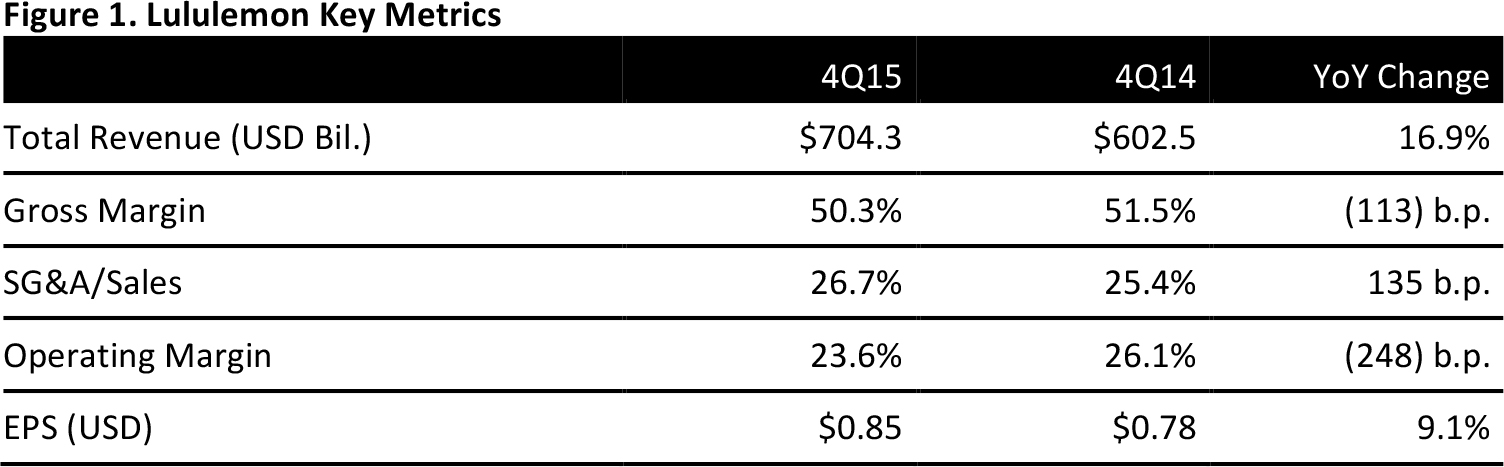

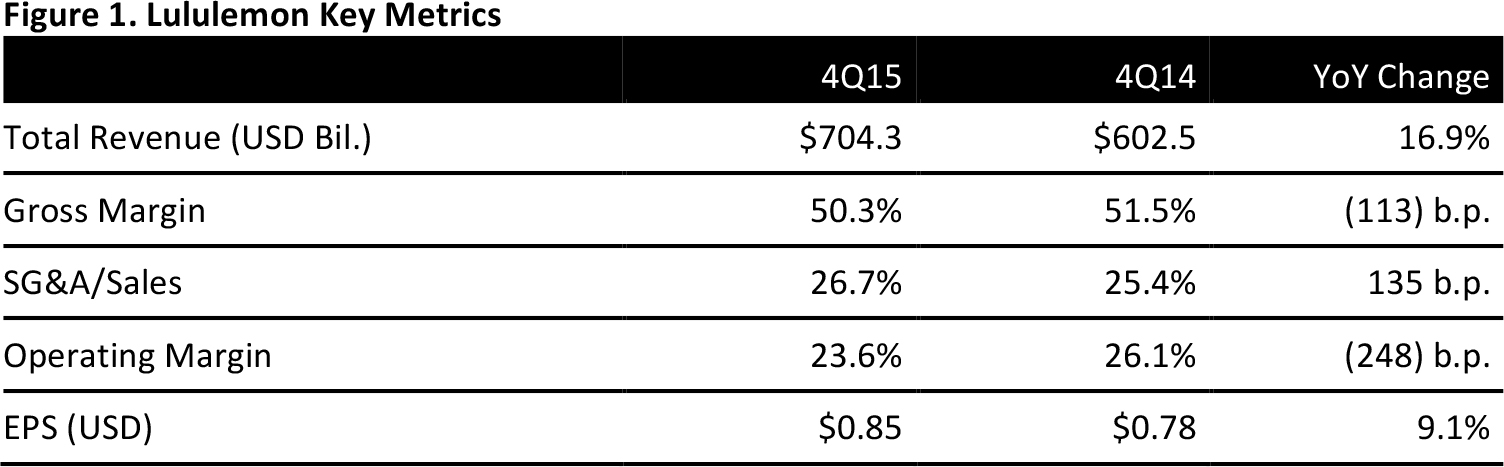

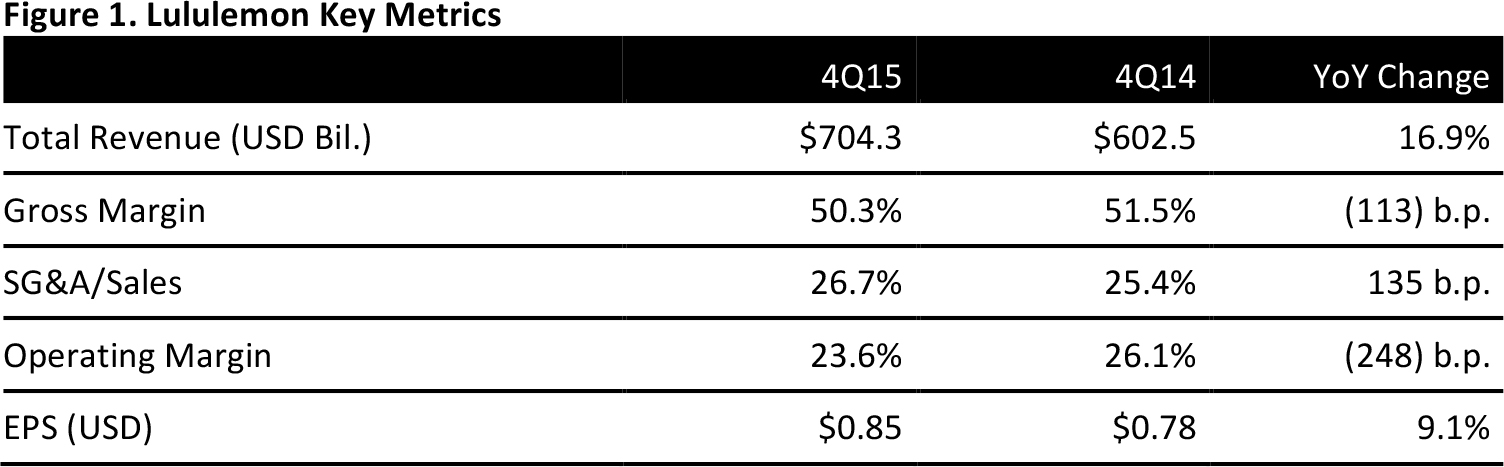

Source: Company reports

4Q15 RESULTS

Lululemon’s 4Q15 net sales were $704.3 million, up 16.9% year over year. Total comparable sales were up 11%, driven by a 33% increase in sales from the direct-to-consumer channel and a 5% increase from comparable-store sales.

The company delivered another quarter of solid sales figures, including some full-price sell-through during key holiday weeks. Its e-commerce business increased 33% for the quarter, over the 20% growth from the previous quarter. While inventory is still a concern, it is below management’s previous estimates.

Women’s categories saw strong performance in 4Q, with bottoms delivering double-digit comps. Men’s categories continued to outpace the overall business growth, reporting a 24% increase in comps, driven by sweat category.

Management also identified three growth areas: product innovation, North America store expansion, and digital culture development.

2015 RESULTS

Net revenue was $2.1 billion, up 14.7% from 2014. Comparable-store sales increased 4%, driven by an increase in direct-to-consumer sales of 30%. Reported EPS for 2016 was $1.89, compared to $1.66 in the prior year. Management called 2015 a “pivotal year,” in which comps growth accelerated and some infrastructure was established.

Excluding a $7.4 million net income tax recovery related to the Company’s transfer pricing arrangements and related interest adjustments and adjusting the effective tax rate for certain adjustments would decrease 2015 EPS by $0.03 and raise 2014 EPS by $0.23.

OUTLOOK

For 2016, the company expects net revenue of about $2.3 billion, with mid-single digit growth. As e-commerce becomes one of its focus areas, the company expects its online business to be 25% of overall sales by 2020, up from the current 19.5%.

For Q1, the company guided for net revenue to be $483 million to $488 million, with a total comps sales growth increase in the mid-single digits. EPS is expected to be $0.28 to $0.30.