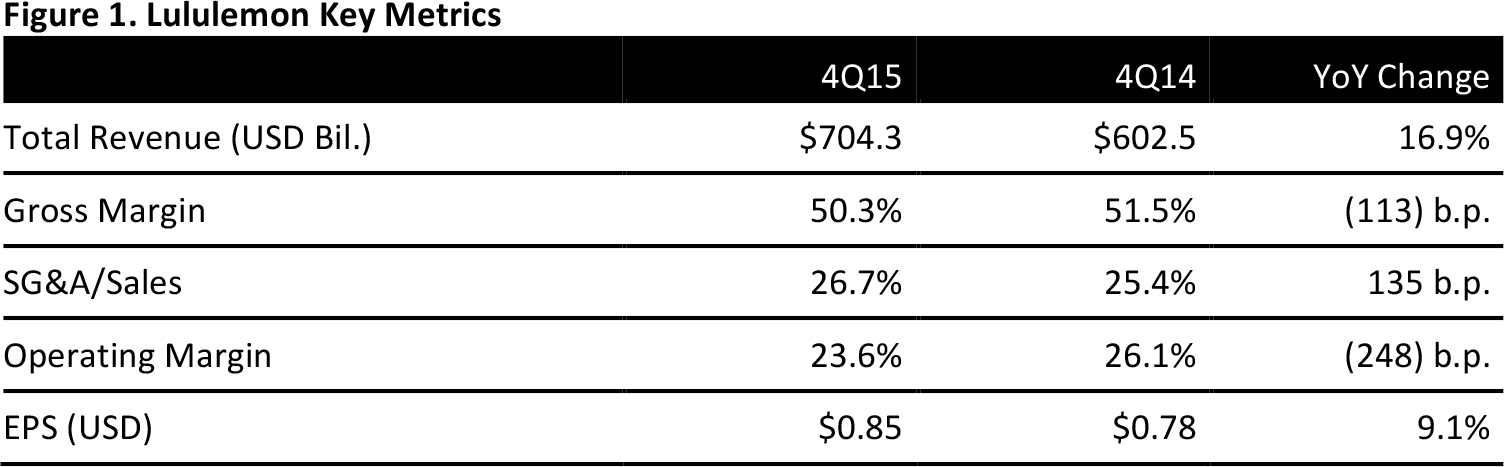

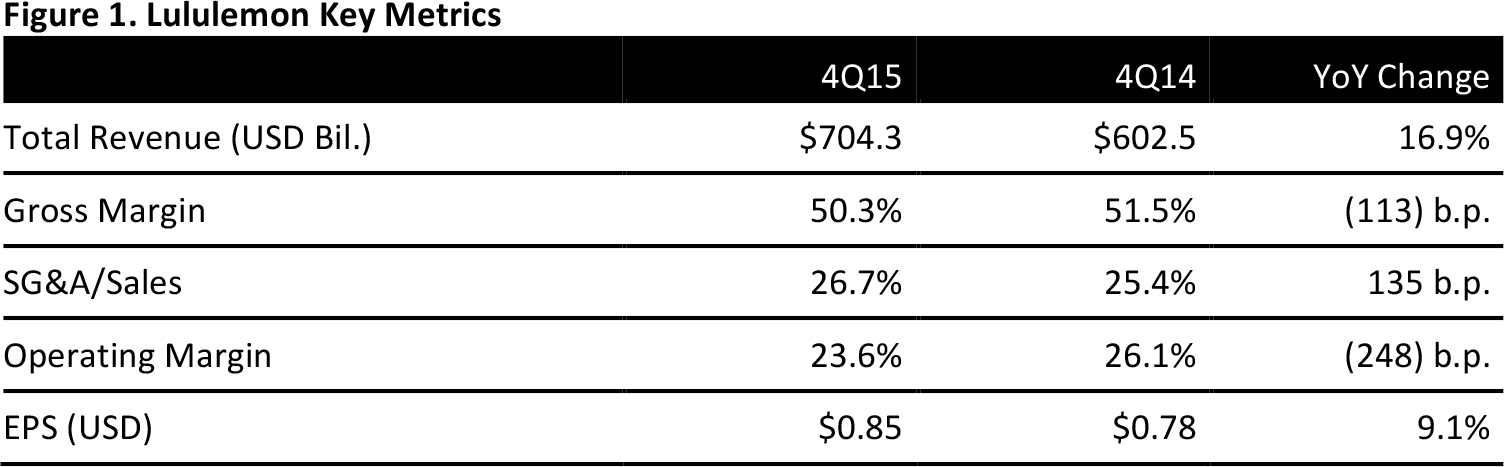

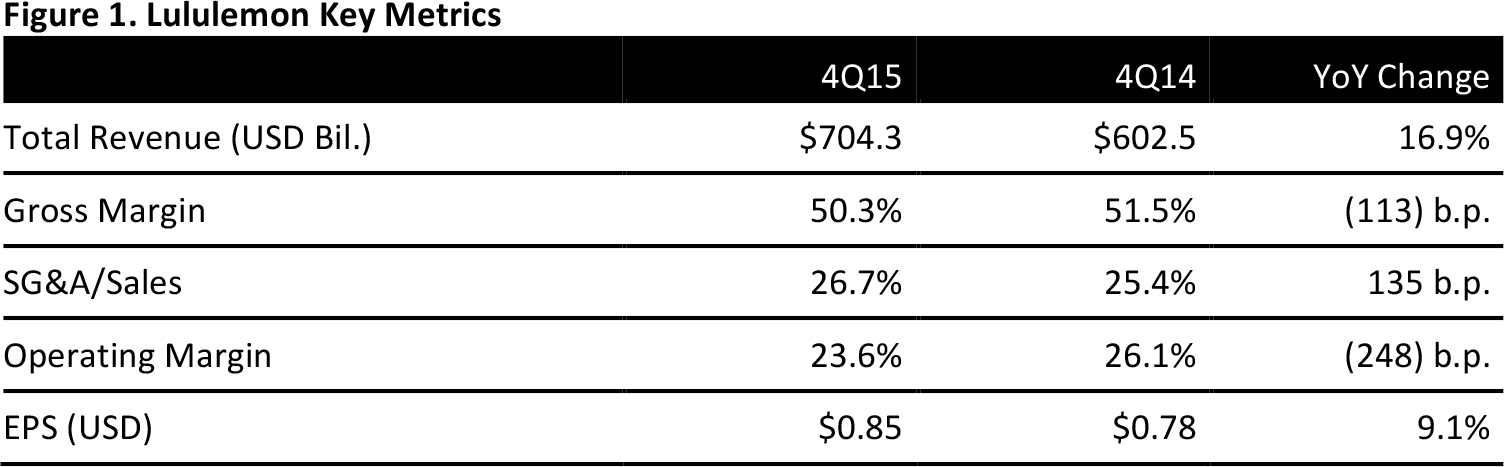

Source: Company reports/Fung Global Retail & Technology

2Q16 RESULTS

Athleisure brand Lululemon Athletica reported 2Q16 adjusted EPS of $0.38, in line with the consensus estimate and up 11.8% year over year.

The company posted 2Q16 revenues of $514.5 million, up 13.6% year over year and slightly below the consensus estimate. Revenues increased 15% excluding currency effects. The company’s direct to consumer revenue increased by 6%, though excluding the effects of a warehouse sale in 2Q15, direct to consumer would have increased by 16%.

Comparable store sales increased by 3%, or 4% excluding currency effects. Total comparable sales, including comparable store sales and direct to consumer, increased 4% or 5% excluding currency effects.

By Product Category

Lululemon saw sequential improvement in its bra and tank categories, which grew 13% and 3% respectively year over year, due in part to the large color assortment and growth in shortlist banks.

The company saw continued strength in menswear, with comparable sales in the mid-teens, driven by new product options and strong performance in the classics.

Within women’s tops, the company is focused on implementing new fabrics including natural and lightweight options.

�By Geography

In 2Q16, Lululemon opened its first ever shop-in-shop concept at Harrods in London, and its first “Maven” concept store in Europe at Spitalfields Market in London. By 4Q16 the company plans to open another store on Regent Street.

In Asia, the existing stores have performed well, with a second store opening in Japan. The company also saw positive sales through its partnership with Alibaba in China, with a brick-and-mortar store set to open in Beijing later this year. An additional two stores are set to open in Seoul by the end of the year.

2016 OUTLOOK

In 3Q16, the company expects revenues to be in the range of $535 million to $545 million based on total comparable sales in the mid-single digits. EPS is expected to be in the range of $0.42 to $0.44.

For the full fiscal year, Lululemon narrowed its 2016 outlook and expects net revenue to be in the range of $2.325 billion to $2.350 billion based on comparable sales in the mid-single digits; previously revenues were expected to be in the range of $2.305 billion to $2.345 billion. EPS are expected to be in a range of $2.11 to $2.19, or $2.07 to $2.15 normalized for the tax and related interest adjustments made during the first two quarters of FY16. Previous guidance was between $2.08 and $2.18, or $2.05 to $2.15 normalized for the tax and related interest adjustments.