Lululemon Athletica Inc.

Sector: Apparel specialty retail

Countries of operation: Australia, Canada, China, France, Germany, Ireland, Japan, Malaysia, the Netherlands, New Zealand, Norway, South Korea, Sweden, Switzerland, the UK and the US

Key product categories: Accessories, apparel and footwear designed for athletic activities such as fitness, running and yoga

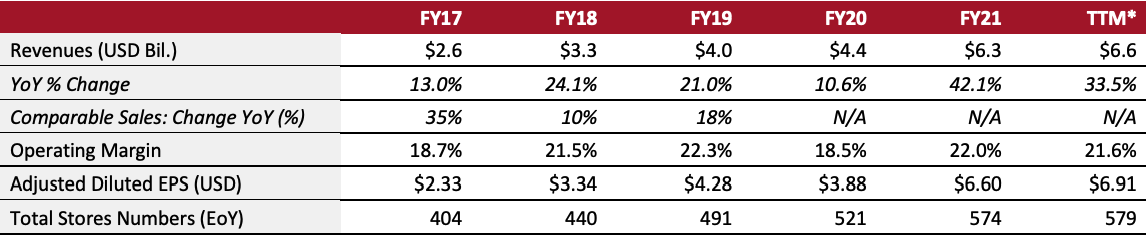

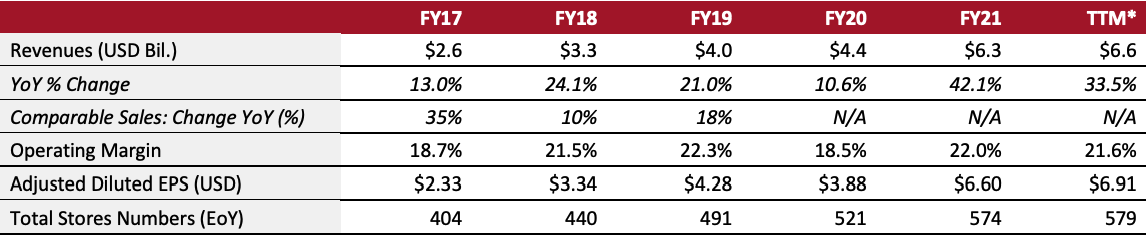

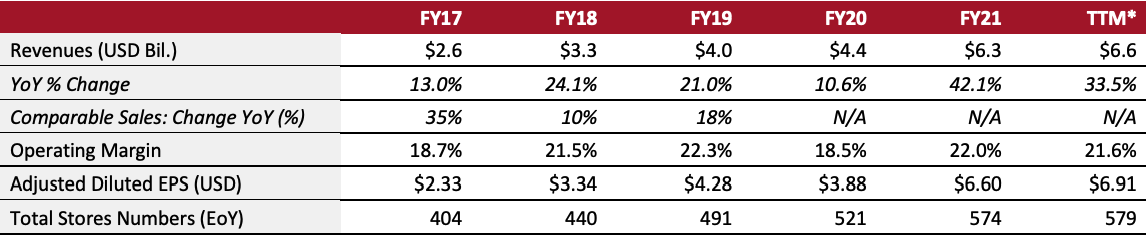

Annual Metrics

[caption id="attachment_151438" align="aligncenter" width="700"]

Fiscal year ends on January 31 of the following calendar year

Fiscal year ends on January 31 of the following calendar year

*Trailing 12 months ended May 1, 2022[/caption]

Summary

Founded in 1998 and based in Vancouver, Canada, Lululemon is an athletic apparel company. It offers a range of apparel, such as jackets, pants, shorts and tops, designed for athletic activities, including fitness, running and yoga. It also sells fitness-related accessories, including bags, socks, underwear, water bottles and yoga equipment.

The company sells through company-operated stores and outlets, as well as warehouse sales and wholesale businesses such as fitness centers, health clubs and yoga studios. It also sells through supply arrangements and showrooms, and directly to consumers through its mobile app and its online store at Lululemon.com. As of May 1, 2022, Lululemon has 579 company-operated stores.

Company Analysis

Coresight Research insight: Lululemon was initially known for its yoga product lines but has expanded in recent years as a broader lifestyle-inspired athletic apparel retailer. It now carries offerings for fitness, running and other activities. In March 2022, the company launched Blissfeel, Lululemon Athletica’s first-ever owned sneakers for women—available across selected stores in the US, the UK and China. Moreover, Lululemon Athletica plans to launch men’s Blissfeel shoes in 2023. We believe that Lululemon Athletica’s plan to extend its core and new product categories, such as golf apparel and footwear, and double its men’s business between fiscal 2021 and fiscal 2026 will substantially expand its total addressable market and will give Lululemon Athletica an edge against competitors, mainly those retailers that primarily focus on women’s business and do not maintain versatility.

Lululemon Athletica remains relatively underpenetrated in the international market and the company’s considerate and aggressive approach to geographic expansion—particularly in the China market through opening new stores and boosting its presence on the Chinese e-commerce platforms, such as Alibaba and JD.com—will position it for success. Furthermore, we see Lululemon Athletica’s push toward digital capabilities expansion, such as ramping up its investments in its payment infrastructure, and technological innovations, including replatforming its radio frequency identification (RFID) program to a cloud-based program, as steps in the right direction to drive sales as we expect many consumers to cement pandemic-driven online shopping habits in 2022 and beyond. Furthermore, we believe that the company’s upcoming multi-tier loyalty program (to be launched by the end of 2022) will help Lululemon Athletica to generate brand awareness and enhance consumer engagement across channels.

| Tailwinds |

Headwinds |

- Continued strength of athleisure, which was growing even before the coronavirus pandemic

- Continued secular trends in the digital channel

- Ongoing synergies from the company’s 2020 strategic acquisition of at-home fitness company MIRROR

- Robust international growth opportunities, particularly in China

- Strong expansion prospects in men’s business and new product categories, such as golf apparel and footwear

- More than 50% of the company’s stores are located off-malls, which are witnessing higher traffic than enclosed mall locations

|

- Strong competition from other athletic apparel retailers, such as Academy Sports and Outdoor and Dick’s Sporting Goods in the US

- Volatility in the foreign exchange rate

- Elevated supply chain costs amid high inflation

|

Strategy

On April 20, 2022, Lululemon Athletica hosted its Analyst Day and unveiled its Power of Three x2 strategy, which focuses on four key areas:

1. Double men’s business sales and continue ongoing women’s business epansion

- Double its men’s business to $3.1 billion by fiscal 2026, from $1.5 billion in fiscal 2021, at a sales CAGR of nearly 20%

- Continue the ongoing expansion of its women’s business, which stood at $4.2 billion as of fiscal 2021. Between fiscal 2021 and fiscal 2026, the company expects its women’s business sales CAGR to be in the low double digits.

- Continue to gain market share in its core activities of training, running and yoga, while expanding its newer categories, including golf apparel and footwear

- Capitalize on strong franchise opportunities in its men’s business, which would drive Lululemon Athletica’s commission revenues in the next couple of years

- Enhance the customer experience by innovating with its current raw materials, including plant-based nylon fabrics and the Ventlight technology used in its men’s clothing. Add new raw materials and technology in its other clothing and footwear products going forward.

2. Double e-commerce sales and achieve double-digit growth in stores

- Double its e-commerce sales to $5.6 billion by fiscal 2026, from $2.8 billion in fiscal 2021, implying an e-commerce penetration rate of 45%

- Ramp up investments in its payment infrastructure, as well as enhance the online consumer experience by focusing on its product detail page and elevating product storytelling

- Launch a new, multi-tiered loyalty program by the end of 2022 to build stronger consumer engagement with its brand, products and community across both online and offline channels. In the next five years, the company expects nearly 80% of its customers to be part of at least one of its membership programs.

- Replatform its radio frequency identification (RFID) program to a cloud-based program to elevate its omnichannel experience and capitalize on its online and store-based experience together

- Capitalize on artificial intelligence (AI) and machine learning to ensure data-driven inventory management, personalization and marketing

- Grow its store numbers in the double digits annually from fiscal 2021 to fiscal 2026, with square footage growth at a 5% CAGR

3. Ramp Up International Business

- Quadruple its international business to nearly $4 billion by fiscal 2026, from $957 million in fiscal 2021, at a sales CAGR of 30%. The company expects its North America sales to grow at a low-double-digit CAGR between fiscal 2021 and fiscal 2026.

- Massively grow its store numbers in mainland China in the next five years, from 70 stores in fiscal 2021 to 220 stores by fiscal 2026, making the country its second-largest market after North America by fiscal 2026. In China, Lululemon Athletica plans to open big flagship stores, mainly focusing on Tier 1 cities, which will represent about 40% of the company’s network in China by fiscal 2026.

- Intensify its e-commerce presence in China by capitalizing on its recent success on Alibaba’s Tmall platform and recent entry into the JD.com marketplace. The company also plans to tap into the social commerce opportunity in China through WeChat Mini programs and develop its dot cn (the country code top-level domain for China). Additionally, Lululemon Athletica plans to substantially expand its product assortments in China, including developing local capsule collections.

- Double down on its other key international markets, including Australia, Germany, Japan, South Korea and the UK—both through store expansion and ramping up its e-commerce operations

4. Prioritize Sustainable Initiatives

- Ensure 100% of its products are made from sustainable materials and have end-of-use solutions by 2030. The company noted that it is 30% toward reaching its sustainable goal as of April 2022.

- Achieve net-zero carbon emission by 2050, in line with its commitment as part of the Paris Agreement to limit global warming to 1.5 degrees Celsius

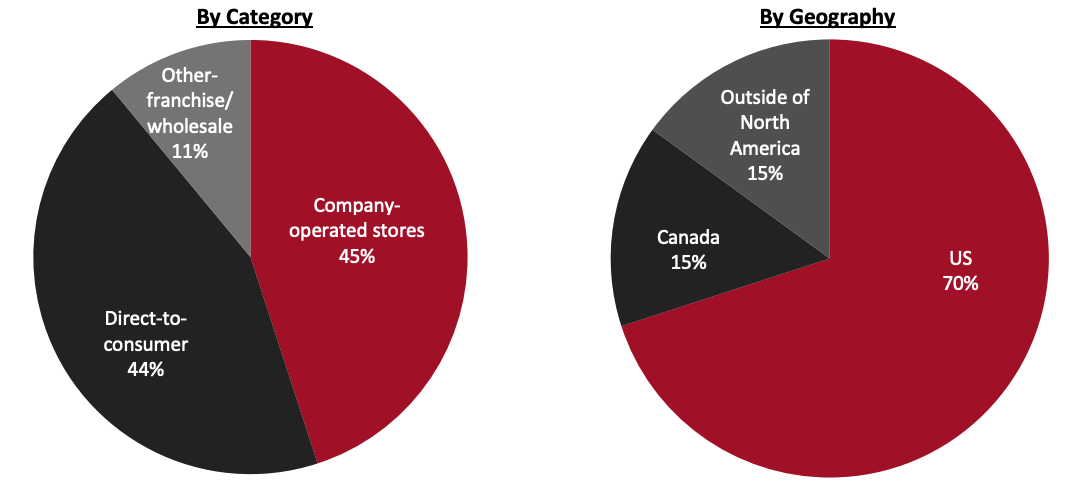

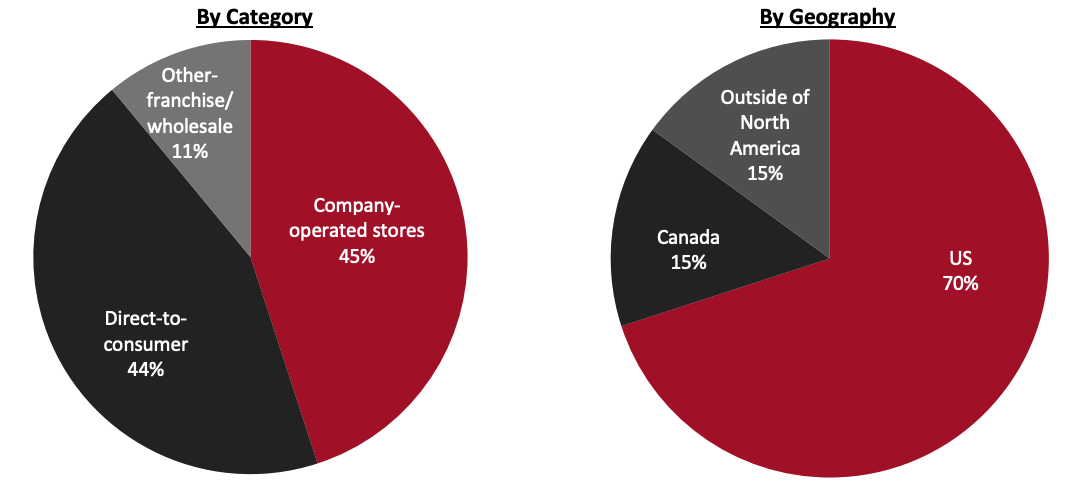

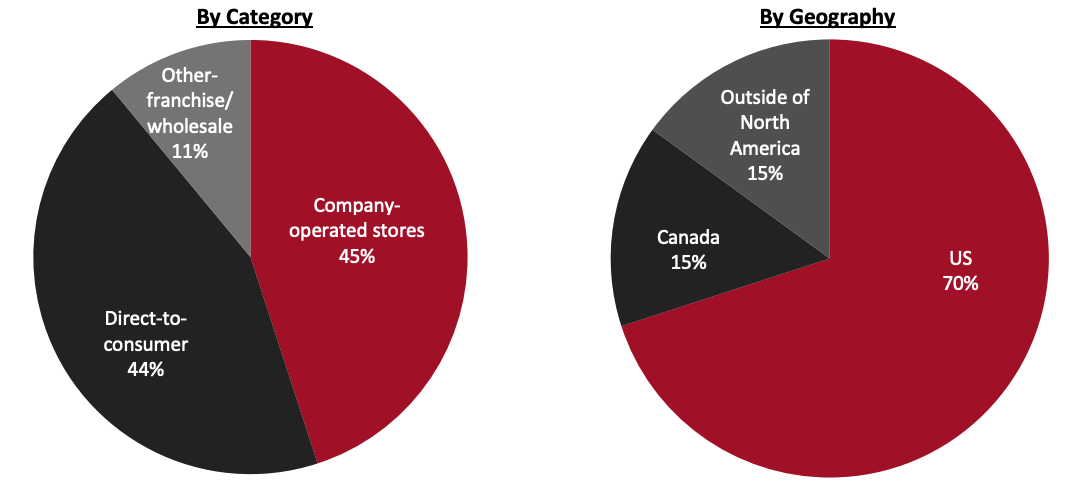

Revenue Breakdown (FY21)

Company Developments

Company Developments

| Date |

Development |

| June 14, 2022 |

Lululemon announces that it debuted hijabs on its website—a push towards greater inclusivity and customer reach. |

| April 22, 2022 |

Lululemon expands Lululemon Like New, the company’s first trade-in and resale program, across the US, following a successful two-state pilot in 2021. The program reinvests 100% of profits to support Lululemon’s sustainable commitments, including making 100% of products with sustainable materials and end-of-use solutions by 2030. |

| April 20, 2022 |

Lululemon announces its new Power of Three ×2 growth strategy—aiming to double its 2021 revenue of $6.25 billion to $12.50 billion by 2026 by enhancing customer experience, expanding target addressable markets and ramping up product innovations. |

| March 22, 2022 |

Lululemon launches Blissfeel, its first-ever footwear collection—made for women, available online and in select stores across North America, Mainland China and the UK. The company also plans to launch men’s footwear in 2023. |

| January 27, 2022 |

Lululemon appoints Alison Loehnis, President of Luxury and Fashion at Yoox Net-a-Porter, as its Board of Directors, effective immediately. |

| January 6, 2022 |

Lululemon appoints Michael Aragon as CEO of MIRROR and Lululemon Digital Fitness, effective January 17, 2022. Aragon joins Lululemon from Amazon, where he served for five years as Chief Content Officer at Twitch, the live-streaming service. Previously, Aragon served as General Manager, VRV at video streaming service platform Ellation, Inc. (acquired by AT&T in 2017). |

| October 8, 2021 |

Lululemon launches Center for Social Impact program to boost equity in mental and physical wellbeing. The program supports Lululemon’s commitment to invest $75 million into equitable wellbeing by 2025, with an initial $5 million investment in local grassroots organizations. |

| October 7, 2021 |

Lululemon expands MIRROR, the company-owned in-home fitness platform for on-demand and live classes, in Canada with the launch in about 40 company-operated stores and online beginning on November 22. |

| September 23, 2021 |

Lululemon collaborates with the Canadian Olympic Committee (COC) and Canadian Paralympic Committee (CPC) and became an official outfitter of Team Canada through 2028. |

| August 18, 2021 |

Lululemon announces a multi-year partnership with sustainable materials provider Genomatica to bring renewably-sourced, bio-based materials into the retailer’s products. |

| April 20, 2021 |

Lululemon announces the launch of two new sustainable initiatives: Lululemon Like, the retailer’s first-ever recommerce program; and Earth Dye, a new, limited edition collection made from earth-friendly dyes. The new initiatives reinforce Lululemon’s focus on creating more environmentally friendly products. |

| February 21, 2021 |

Lululemon releases its first-ever Global Wellbeing Report, accelerating the company’s efforts to support the wellbeing of the communities, employees and its customers. |

| November 20, 2020 |

Lululemon announces the promotion of Meghan Frank to CFO, effective November 23, 2020. Frank becomes Lululemon’s first female CFO. |

| October 30, 2020 |

Lululemon announces key leadership appointments. Celeste Burgoyne becomes President of Lululemon’s Americas Operations and Global Guest Innovation. Stacia Jones becomes Vice President, Global Head of IDEA (Inclusion, Diversity, Equity and Action). |

| June 29, 2020 |

Lululemon enters into a $500 million agreement to acquire MIRROR, an in-home fitness platform for on-demand and live classes. The acquisition will help Lululemon to boost its digital “sweatlife” offerings and provide personalization in its in-home category. |

| January 8, 2020 |

Lululemon announces the appointment of Nikki Neuburger as Chief Brand Officer. Neuburger previously worked for NIKE for 14 years, most recently as the Global VP of NIKE Running. |

| June 18, 2019 |

Lululemon unveils its new personal care product line, including four products for women and men. The new line has received the “Clean at Sephora” seal, certifying that the products are free of ingredients such as parabens and sulfates. |

Management Team

- Calvin McDonald—CEO

- Meghan Frank—CFO

- Julie Averill—EVP and Chief Technology Officer

- Sun Choe—Chief Product Officer

- Ted Dagnese—Chief Supply Chain Officer

- Nikki Neuburger—Chief Brand Officer

- Michael Aragon—CEO of MIRROR and Lululemon Digital Fitness

Source: Company reports/S&P Capital IQ

Fiscal year ends on January 31 of the following calendar year

Fiscal year ends on January 31 of the following calendar year Company Developments

Company Developments

Fiscal year ends on January 31 of the following calendar year

Fiscal year ends on January 31 of the following calendar year Company Developments

Company Developments