DIpil Das

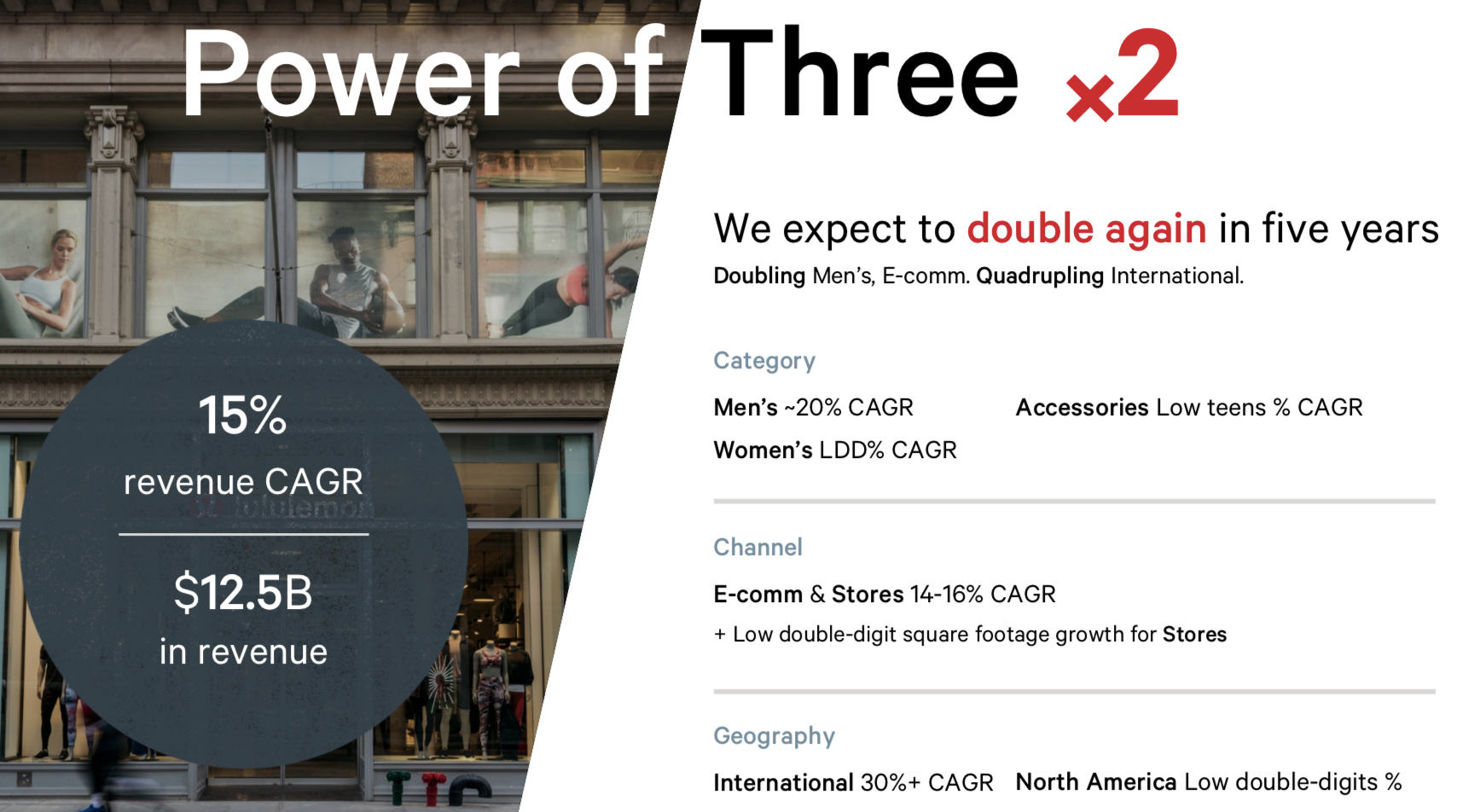

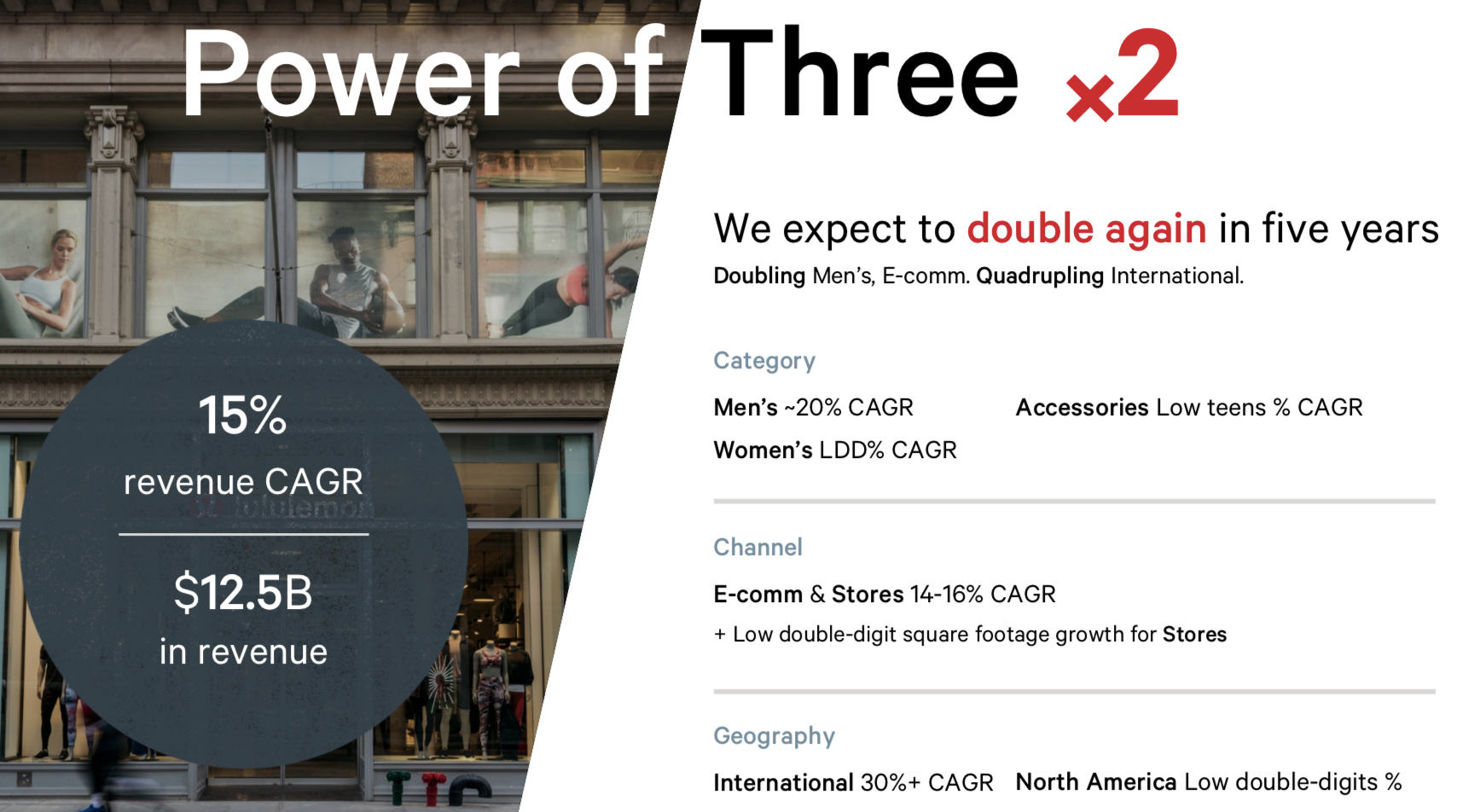

On April 20, 2022, Lululemon Athletica hosted its Analyst Day in New York City. The company focused on its Power of Three x2 strategy, its five-year plan to double total revenues.

The day featured many management presentations, including those by Cavin McDonald, CEO; Meghan Frank, CFO; Michelle Choe, Chief Product Officer; Nicole Neuburger, Chief Brand Officer; and Andre Maestrini, EVP of International.

Source: Company reports [/caption]

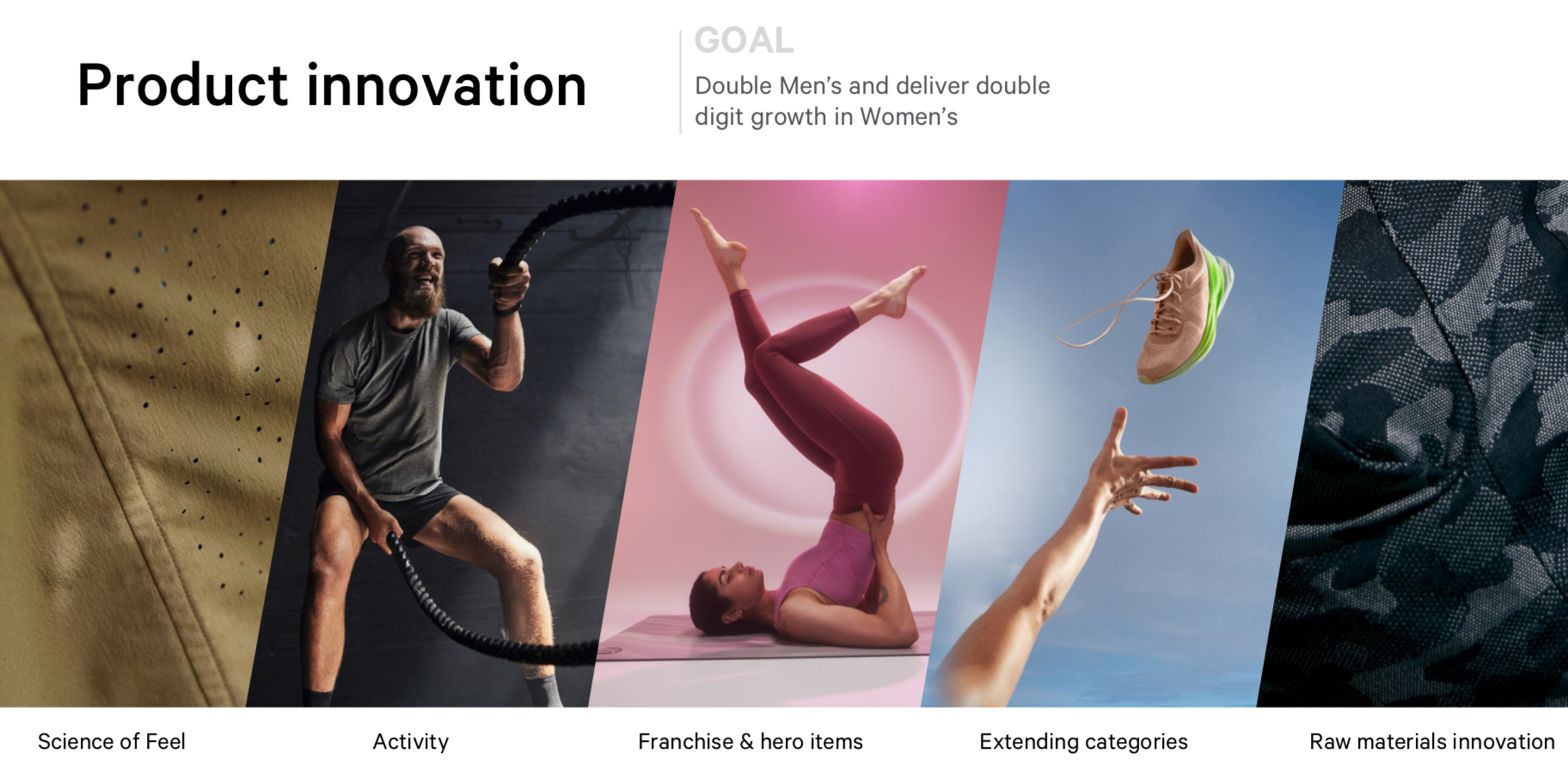

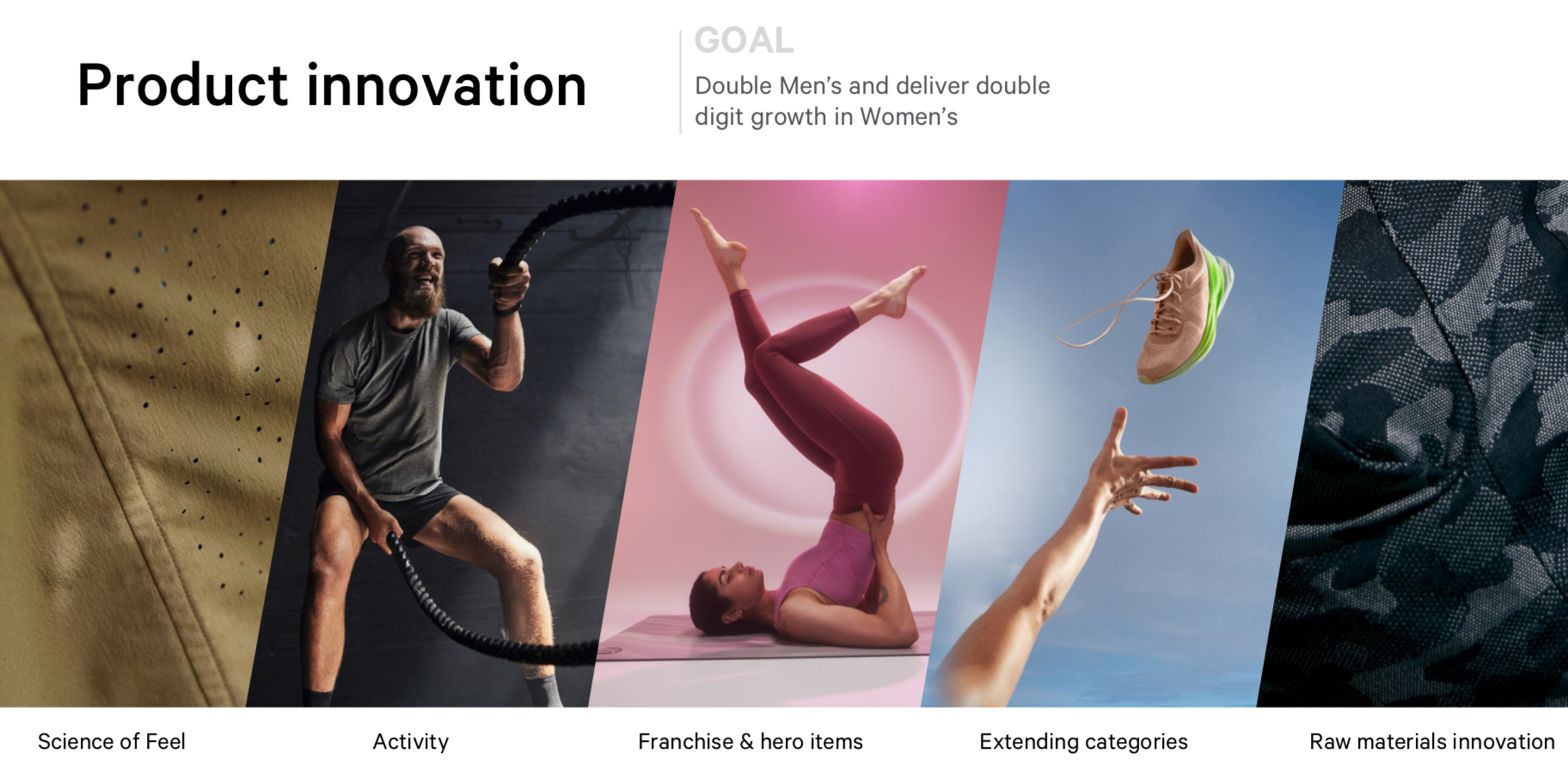

1. Double Men’s Business Sales and Continue Ongoing Women’s Business Expansion

Lululemon Athletica has doubled its men’s business in the last three years to $1.5 billion in FY21, and the company plans to further double its men’s business to about $3.1 billion by FY26, at a sales CAGR of nearly 20%. This will make the company’s men’s business larger than its women’s business was in FY20 at $3.0 billion. Furthermore, Lululemon Athletica noted that it will continue its ongoing expansion of its women’s business, which stood at $4.2 billion as of FY21. Between FY21 and FY26, the company expects its women’s business sales CAGR to be in the low double digits.

The company plans to achieve these targets by fueling product newness, extending product categories and boosting raw material innovation. Lululemon Athletica noted that it will continue to gain market share in its core activities of training, running and yoga, while expanding its newer categories, including golf apparel and footwear. In March 2022, the company launched Blissfeel, Lululemon Athletica’s first-ever owned sneakers for women—available across selected stores in the US, the UK and China. Moreover, Lululemon Athletica plans to launch men’s Blissfeel shoes in 2023.

The company also looks to capitalize on strong franchise opportunities in its men’s business, which would drive Lululemon Athletica’s commission revenues in the next couple of years. Additionally, Lululemon Athletica noted that it will enhance the customer experience by innovating with its current raw materials, including plant-based nylon fabrics and the Ventlight technology used in its men’s clothing. The company also plans to add new raw materials and technology in its other clothing and footwear products going forward.

[caption id="attachment_146223" align="aligncenter" width="700"]

Source: Company reports [/caption]

1. Double Men’s Business Sales and Continue Ongoing Women’s Business Expansion

Lululemon Athletica has doubled its men’s business in the last three years to $1.5 billion in FY21, and the company plans to further double its men’s business to about $3.1 billion by FY26, at a sales CAGR of nearly 20%. This will make the company’s men’s business larger than its women’s business was in FY20 at $3.0 billion. Furthermore, Lululemon Athletica noted that it will continue its ongoing expansion of its women’s business, which stood at $4.2 billion as of FY21. Between FY21 and FY26, the company expects its women’s business sales CAGR to be in the low double digits.

The company plans to achieve these targets by fueling product newness, extending product categories and boosting raw material innovation. Lululemon Athletica noted that it will continue to gain market share in its core activities of training, running and yoga, while expanding its newer categories, including golf apparel and footwear. In March 2022, the company launched Blissfeel, Lululemon Athletica’s first-ever owned sneakers for women—available across selected stores in the US, the UK and China. Moreover, Lululemon Athletica plans to launch men’s Blissfeel shoes in 2023.

The company also looks to capitalize on strong franchise opportunities in its men’s business, which would drive Lululemon Athletica’s commission revenues in the next couple of years. Additionally, Lululemon Athletica noted that it will enhance the customer experience by innovating with its current raw materials, including plant-based nylon fabrics and the Ventlight technology used in its men’s clothing. The company also plans to add new raw materials and technology in its other clothing and footwear products going forward.

[caption id="attachment_146223" align="aligncenter" width="700"] Source: Company reports [/caption]

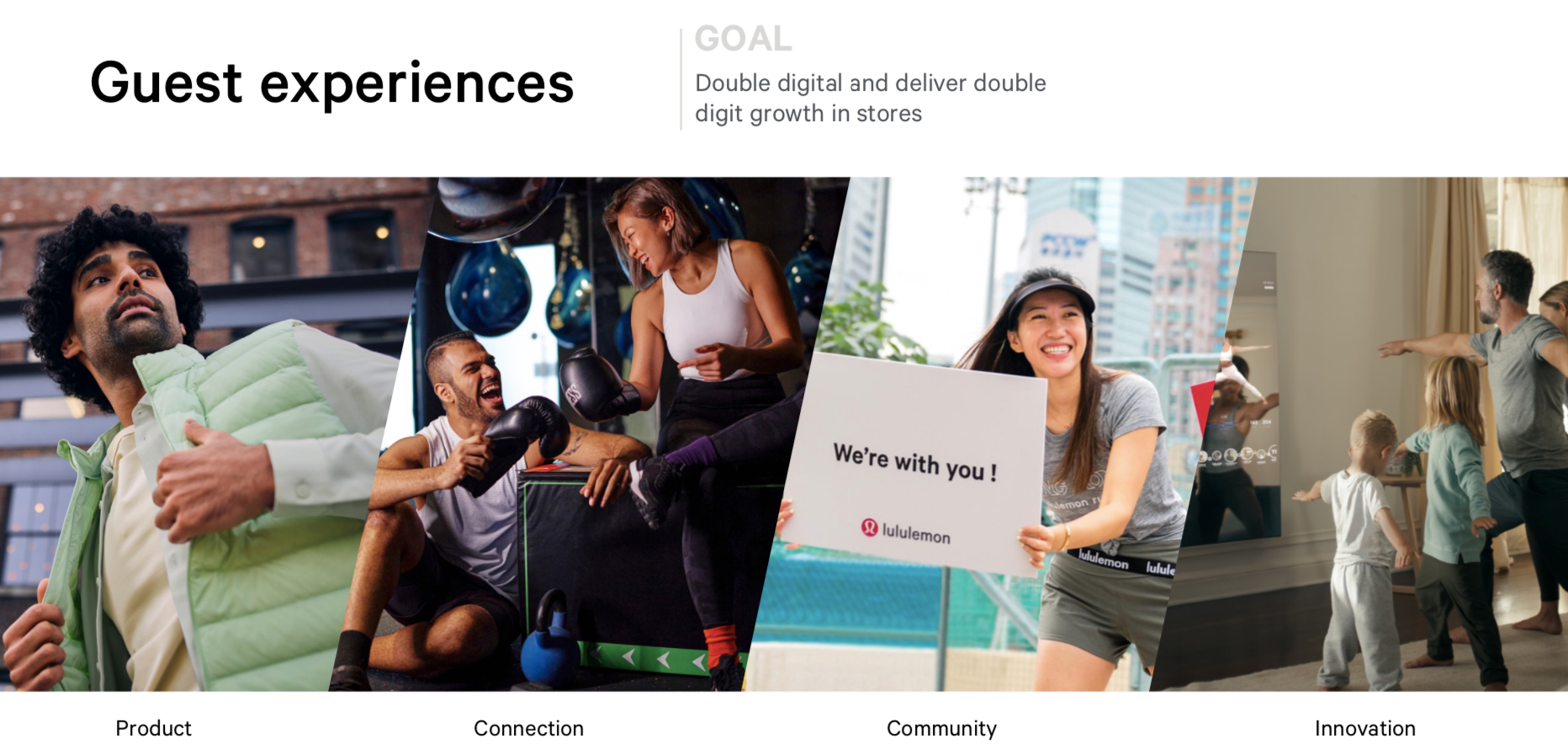

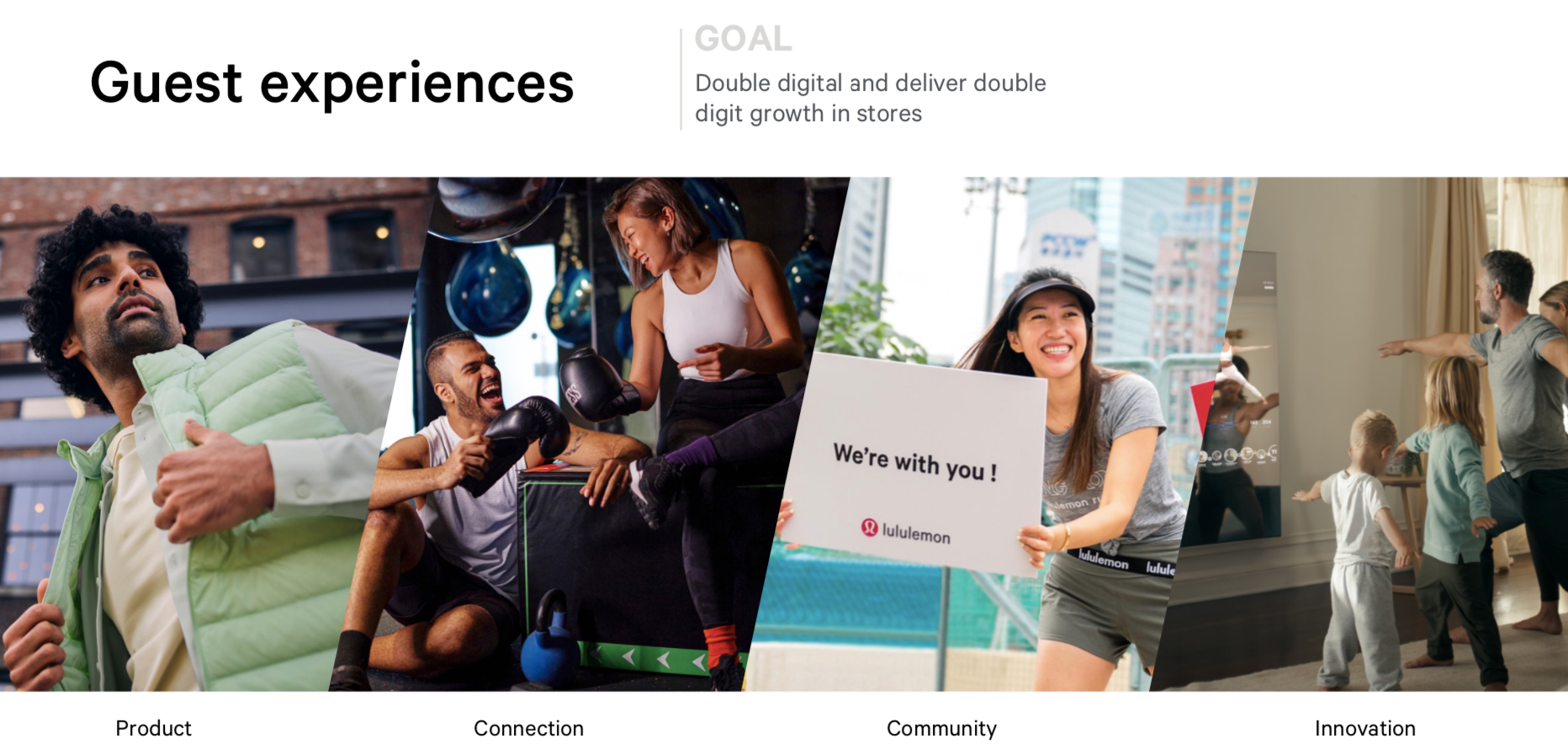

2. Double E-commerce Sales and Achieve Double-Digit Growth in Stores

In the past three years, Lululemon Athletica has tripled its e-commerce sales to $2.8 billion in FY21, representing 44% e-commerce penetration, versus just 28% in FY18. Furthermore, the company plans to double its e-commerce sales to about $5.6 billion by FY26, implying an e-commerce penetration rate of 45%.

To bolster its e-commerce capabilities, Lululemon Athletica plans to ramp up its investments in its payment infrastructure, as well as enhance consumer online experience by focusing on its product detail page and elevating product storytelling. The company also plans to launch a new, multi-tiered loyalty program later this year to build stronger consumer engagement with its brand, products and community across both online and offline channels. In the next five years, the company expects nearly 80% of its customers to be part of at least one of its membership programs.

Moreover, the company plans to replatform its radio frequency identification (RFID) program to a cloud-based program to elevate its omnichannel experience and capitalize on its online and store-based experience together. Additionally, Lululemon Athletica will capitalize on artificial intelligence (AI) and machine learning to ensure data-driven inventory management, personalization and marketing.

Furthermore, the company plans to grow its store numbers in the double digits annually from FY21 to FY26, with square footage growth at a 5% CAGR. As of January 30, 2022, Lululemon Athletica operated 574 stores in 17 countries across the globe, and the company noted that store productivity and traffic were trending above 2019 levels.

[caption id="attachment_146224" align="aligncenter" width="699"]

Source: Company reports [/caption]

2. Double E-commerce Sales and Achieve Double-Digit Growth in Stores

In the past three years, Lululemon Athletica has tripled its e-commerce sales to $2.8 billion in FY21, representing 44% e-commerce penetration, versus just 28% in FY18. Furthermore, the company plans to double its e-commerce sales to about $5.6 billion by FY26, implying an e-commerce penetration rate of 45%.

To bolster its e-commerce capabilities, Lululemon Athletica plans to ramp up its investments in its payment infrastructure, as well as enhance consumer online experience by focusing on its product detail page and elevating product storytelling. The company also plans to launch a new, multi-tiered loyalty program later this year to build stronger consumer engagement with its brand, products and community across both online and offline channels. In the next five years, the company expects nearly 80% of its customers to be part of at least one of its membership programs.

Moreover, the company plans to replatform its radio frequency identification (RFID) program to a cloud-based program to elevate its omnichannel experience and capitalize on its online and store-based experience together. Additionally, Lululemon Athletica will capitalize on artificial intelligence (AI) and machine learning to ensure data-driven inventory management, personalization and marketing.

Furthermore, the company plans to grow its store numbers in the double digits annually from FY21 to FY26, with square footage growth at a 5% CAGR. As of January 30, 2022, Lululemon Athletica operated 574 stores in 17 countries across the globe, and the company noted that store productivity and traffic were trending above 2019 levels.

[caption id="attachment_146224" align="aligncenter" width="699"] Source: Company reports [/caption]

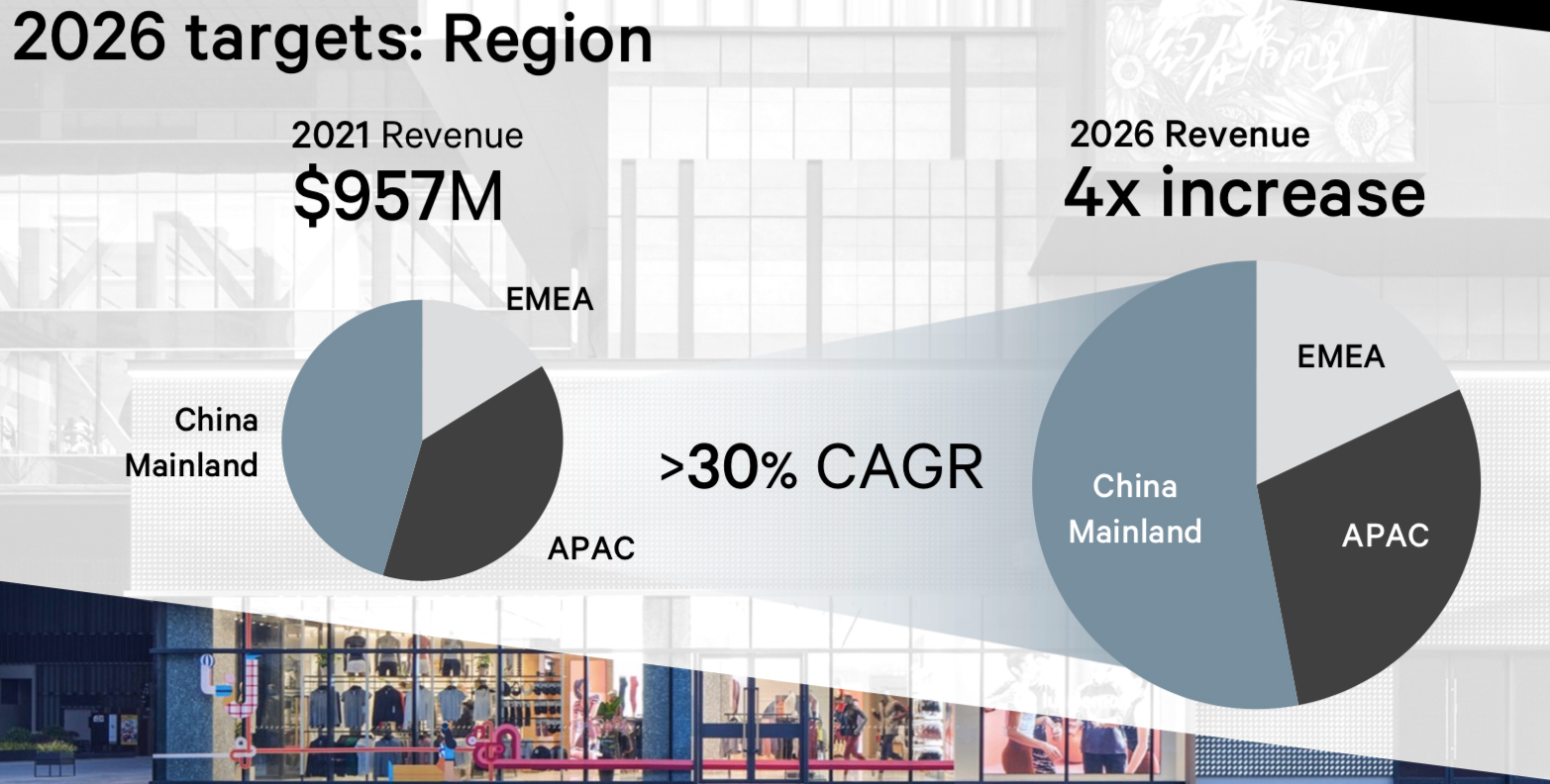

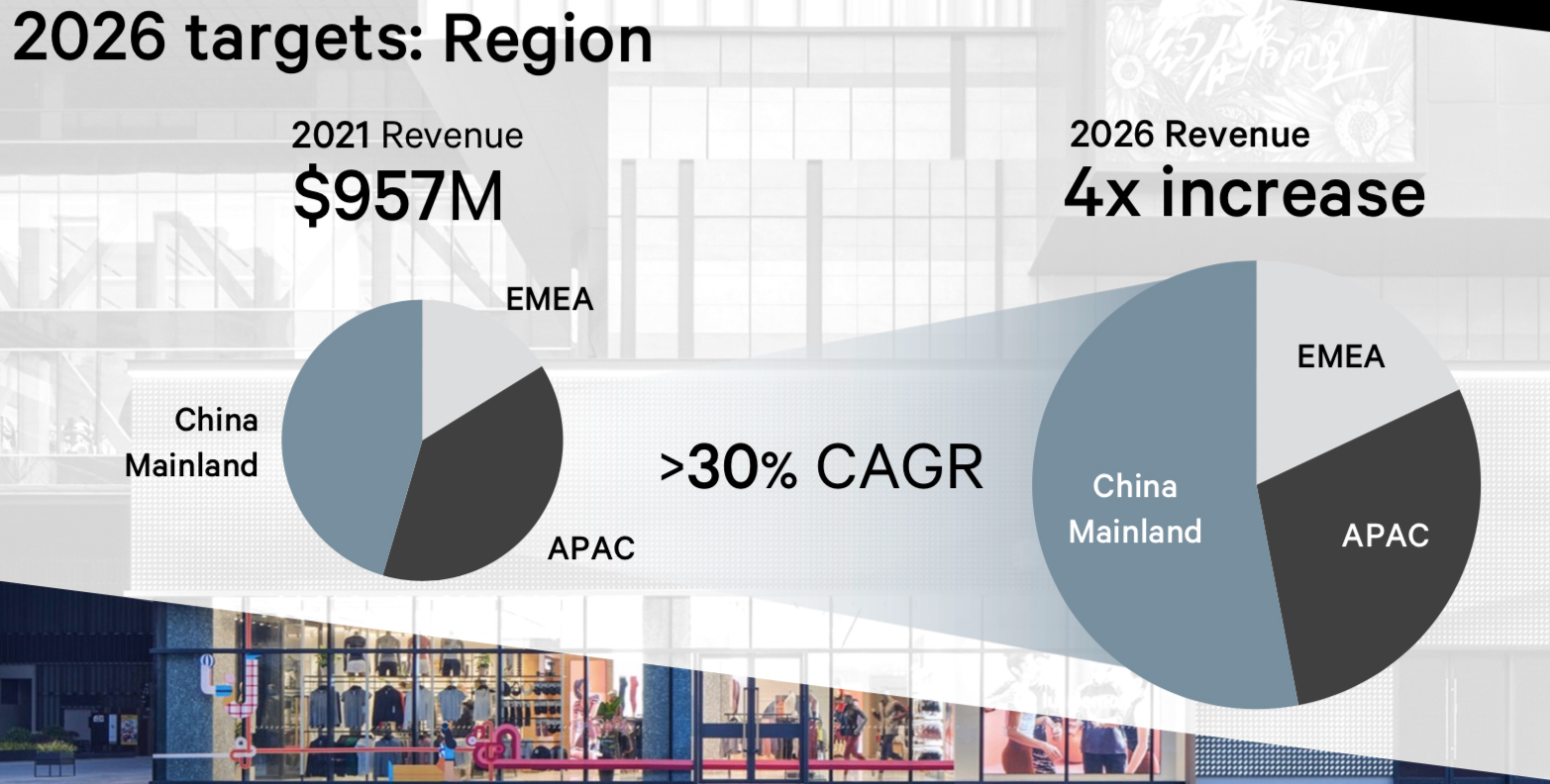

3. Quadruple International Business

Andre Maestrini, EVP of International, said that Lululemon Athletica is on track to quadruple its international business to nearly $4 billion by FY26, from $957 million in FY21, at a sales CAGR of 30%. On the hand, the company expects its North America sales to grow at a low-double-digit CAGR between FY21 and FY26.

Maestrini said that the company plans to massively grow its store numbers in mainland China in the next five years, from 70 stores in FY21 to 220 stores by FY26, making the country its second-largest market after North America by FY26. In China, Lululemon Athletica plans to open big flagship stores, mainly focusing on Tier 1 cities, which will represent about 40% of the company’s network in China by FY26. Furthermore, Lululemon Athletica plans to intensify its e-commerce presence in China by capitalizing on its recent success on Alibaba’s Tmall platform and diversifying by entering the JD.com marketplace. The company also plans to tap into the social commerce opportunity in China through WeChat Mini programs and develop its dot cn (the country code top-level domain for China). Additionally, Lululemon Athletica plans to substantially expand its product assortments in China, including developing local capsules.

In addition, Lululemon Athletica plans to double down on its other key international markets, including Australia, Germany, Japan, South Korea and the UK—both through store expansion and ramping up its e-commerce operations. The company also plans to open its first stores in Italy, Spain and Thailand in the coming months.

[caption id="attachment_146225" align="aligncenter" width="700"]

Source: Company reports [/caption]

3. Quadruple International Business

Andre Maestrini, EVP of International, said that Lululemon Athletica is on track to quadruple its international business to nearly $4 billion by FY26, from $957 million in FY21, at a sales CAGR of 30%. On the hand, the company expects its North America sales to grow at a low-double-digit CAGR between FY21 and FY26.

Maestrini said that the company plans to massively grow its store numbers in mainland China in the next five years, from 70 stores in FY21 to 220 stores by FY26, making the country its second-largest market after North America by FY26. In China, Lululemon Athletica plans to open big flagship stores, mainly focusing on Tier 1 cities, which will represent about 40% of the company’s network in China by FY26. Furthermore, Lululemon Athletica plans to intensify its e-commerce presence in China by capitalizing on its recent success on Alibaba’s Tmall platform and diversifying by entering the JD.com marketplace. The company also plans to tap into the social commerce opportunity in China through WeChat Mini programs and develop its dot cn (the country code top-level domain for China). Additionally, Lululemon Athletica plans to substantially expand its product assortments in China, including developing local capsules.

In addition, Lululemon Athletica plans to double down on its other key international markets, including Australia, Germany, Japan, South Korea and the UK—both through store expansion and ramping up its e-commerce operations. The company also plans to open its first stores in Italy, Spain and Thailand in the coming months.

[caption id="attachment_146225" align="aligncenter" width="700"] Source: Company reports [/caption]

4. Sustainability Remains a Priority

Lululemon Athletica continues to prioritize sustainable initiatives and described its two key environmental plans.

Source: Company reports [/caption]

4. Sustainability Remains a Priority

Lululemon Athletica continues to prioritize sustainable initiatives and described its two key environmental plans.

Source: Company reports [/caption]

Source: Company reports [/caption]

Lululemon Athletica Analyst Day 2022: Coresight Research Insights

Lululemon Athletica Outperformed Target in FY21 and Plans To Double Revenues to $12.5 Billion By FY26 Lululemon Athletica announced its five-year plan to double its revenue to $12.5 billion by FY26, at a 15% CAGR. Lululemon Athletica aims to achieve this growth rate by doubling its men’s segment and online business sales and quadrupling its international sales. The company also reported that it had outperformed the $6.0 billion goal (set in 2018) by achieving $6.3 billion in revenue in FY21, at a 24% CAGR. [caption id="attachment_146222" align="aligncenter" width="701"] Source: Company reports [/caption]

1. Double Men’s Business Sales and Continue Ongoing Women’s Business Expansion

Lululemon Athletica has doubled its men’s business in the last three years to $1.5 billion in FY21, and the company plans to further double its men’s business to about $3.1 billion by FY26, at a sales CAGR of nearly 20%. This will make the company’s men’s business larger than its women’s business was in FY20 at $3.0 billion. Furthermore, Lululemon Athletica noted that it will continue its ongoing expansion of its women’s business, which stood at $4.2 billion as of FY21. Between FY21 and FY26, the company expects its women’s business sales CAGR to be in the low double digits.

The company plans to achieve these targets by fueling product newness, extending product categories and boosting raw material innovation. Lululemon Athletica noted that it will continue to gain market share in its core activities of training, running and yoga, while expanding its newer categories, including golf apparel and footwear. In March 2022, the company launched Blissfeel, Lululemon Athletica’s first-ever owned sneakers for women—available across selected stores in the US, the UK and China. Moreover, Lululemon Athletica plans to launch men’s Blissfeel shoes in 2023.

The company also looks to capitalize on strong franchise opportunities in its men’s business, which would drive Lululemon Athletica’s commission revenues in the next couple of years. Additionally, Lululemon Athletica noted that it will enhance the customer experience by innovating with its current raw materials, including plant-based nylon fabrics and the Ventlight technology used in its men’s clothing. The company also plans to add new raw materials and technology in its other clothing and footwear products going forward.

[caption id="attachment_146223" align="aligncenter" width="700"]

Source: Company reports [/caption]

1. Double Men’s Business Sales and Continue Ongoing Women’s Business Expansion

Lululemon Athletica has doubled its men’s business in the last three years to $1.5 billion in FY21, and the company plans to further double its men’s business to about $3.1 billion by FY26, at a sales CAGR of nearly 20%. This will make the company’s men’s business larger than its women’s business was in FY20 at $3.0 billion. Furthermore, Lululemon Athletica noted that it will continue its ongoing expansion of its women’s business, which stood at $4.2 billion as of FY21. Between FY21 and FY26, the company expects its women’s business sales CAGR to be in the low double digits.

The company plans to achieve these targets by fueling product newness, extending product categories and boosting raw material innovation. Lululemon Athletica noted that it will continue to gain market share in its core activities of training, running and yoga, while expanding its newer categories, including golf apparel and footwear. In March 2022, the company launched Blissfeel, Lululemon Athletica’s first-ever owned sneakers for women—available across selected stores in the US, the UK and China. Moreover, Lululemon Athletica plans to launch men’s Blissfeel shoes in 2023.

The company also looks to capitalize on strong franchise opportunities in its men’s business, which would drive Lululemon Athletica’s commission revenues in the next couple of years. Additionally, Lululemon Athletica noted that it will enhance the customer experience by innovating with its current raw materials, including plant-based nylon fabrics and the Ventlight technology used in its men’s clothing. The company also plans to add new raw materials and technology in its other clothing and footwear products going forward.

[caption id="attachment_146223" align="aligncenter" width="700"] Source: Company reports [/caption]

2. Double E-commerce Sales and Achieve Double-Digit Growth in Stores

In the past three years, Lululemon Athletica has tripled its e-commerce sales to $2.8 billion in FY21, representing 44% e-commerce penetration, versus just 28% in FY18. Furthermore, the company plans to double its e-commerce sales to about $5.6 billion by FY26, implying an e-commerce penetration rate of 45%.

To bolster its e-commerce capabilities, Lululemon Athletica plans to ramp up its investments in its payment infrastructure, as well as enhance consumer online experience by focusing on its product detail page and elevating product storytelling. The company also plans to launch a new, multi-tiered loyalty program later this year to build stronger consumer engagement with its brand, products and community across both online and offline channels. In the next five years, the company expects nearly 80% of its customers to be part of at least one of its membership programs.

Moreover, the company plans to replatform its radio frequency identification (RFID) program to a cloud-based program to elevate its omnichannel experience and capitalize on its online and store-based experience together. Additionally, Lululemon Athletica will capitalize on artificial intelligence (AI) and machine learning to ensure data-driven inventory management, personalization and marketing.

Furthermore, the company plans to grow its store numbers in the double digits annually from FY21 to FY26, with square footage growth at a 5% CAGR. As of January 30, 2022, Lululemon Athletica operated 574 stores in 17 countries across the globe, and the company noted that store productivity and traffic were trending above 2019 levels.

[caption id="attachment_146224" align="aligncenter" width="699"]

Source: Company reports [/caption]

2. Double E-commerce Sales and Achieve Double-Digit Growth in Stores

In the past three years, Lululemon Athletica has tripled its e-commerce sales to $2.8 billion in FY21, representing 44% e-commerce penetration, versus just 28% in FY18. Furthermore, the company plans to double its e-commerce sales to about $5.6 billion by FY26, implying an e-commerce penetration rate of 45%.

To bolster its e-commerce capabilities, Lululemon Athletica plans to ramp up its investments in its payment infrastructure, as well as enhance consumer online experience by focusing on its product detail page and elevating product storytelling. The company also plans to launch a new, multi-tiered loyalty program later this year to build stronger consumer engagement with its brand, products and community across both online and offline channels. In the next five years, the company expects nearly 80% of its customers to be part of at least one of its membership programs.

Moreover, the company plans to replatform its radio frequency identification (RFID) program to a cloud-based program to elevate its omnichannel experience and capitalize on its online and store-based experience together. Additionally, Lululemon Athletica will capitalize on artificial intelligence (AI) and machine learning to ensure data-driven inventory management, personalization and marketing.

Furthermore, the company plans to grow its store numbers in the double digits annually from FY21 to FY26, with square footage growth at a 5% CAGR. As of January 30, 2022, Lululemon Athletica operated 574 stores in 17 countries across the globe, and the company noted that store productivity and traffic were trending above 2019 levels.

[caption id="attachment_146224" align="aligncenter" width="699"] Source: Company reports [/caption]

3. Quadruple International Business

Andre Maestrini, EVP of International, said that Lululemon Athletica is on track to quadruple its international business to nearly $4 billion by FY26, from $957 million in FY21, at a sales CAGR of 30%. On the hand, the company expects its North America sales to grow at a low-double-digit CAGR between FY21 and FY26.

Maestrini said that the company plans to massively grow its store numbers in mainland China in the next five years, from 70 stores in FY21 to 220 stores by FY26, making the country its second-largest market after North America by FY26. In China, Lululemon Athletica plans to open big flagship stores, mainly focusing on Tier 1 cities, which will represent about 40% of the company’s network in China by FY26. Furthermore, Lululemon Athletica plans to intensify its e-commerce presence in China by capitalizing on its recent success on Alibaba’s Tmall platform and diversifying by entering the JD.com marketplace. The company also plans to tap into the social commerce opportunity in China through WeChat Mini programs and develop its dot cn (the country code top-level domain for China). Additionally, Lululemon Athletica plans to substantially expand its product assortments in China, including developing local capsules.

In addition, Lululemon Athletica plans to double down on its other key international markets, including Australia, Germany, Japan, South Korea and the UK—both through store expansion and ramping up its e-commerce operations. The company also plans to open its first stores in Italy, Spain and Thailand in the coming months.

[caption id="attachment_146225" align="aligncenter" width="700"]

Source: Company reports [/caption]

3. Quadruple International Business

Andre Maestrini, EVP of International, said that Lululemon Athletica is on track to quadruple its international business to nearly $4 billion by FY26, from $957 million in FY21, at a sales CAGR of 30%. On the hand, the company expects its North America sales to grow at a low-double-digit CAGR between FY21 and FY26.

Maestrini said that the company plans to massively grow its store numbers in mainland China in the next five years, from 70 stores in FY21 to 220 stores by FY26, making the country its second-largest market after North America by FY26. In China, Lululemon Athletica plans to open big flagship stores, mainly focusing on Tier 1 cities, which will represent about 40% of the company’s network in China by FY26. Furthermore, Lululemon Athletica plans to intensify its e-commerce presence in China by capitalizing on its recent success on Alibaba’s Tmall platform and diversifying by entering the JD.com marketplace. The company also plans to tap into the social commerce opportunity in China through WeChat Mini programs and develop its dot cn (the country code top-level domain for China). Additionally, Lululemon Athletica plans to substantially expand its product assortments in China, including developing local capsules.

In addition, Lululemon Athletica plans to double down on its other key international markets, including Australia, Germany, Japan, South Korea and the UK—both through store expansion and ramping up its e-commerce operations. The company also plans to open its first stores in Italy, Spain and Thailand in the coming months.

[caption id="attachment_146225" align="aligncenter" width="700"] Source: Company reports [/caption]

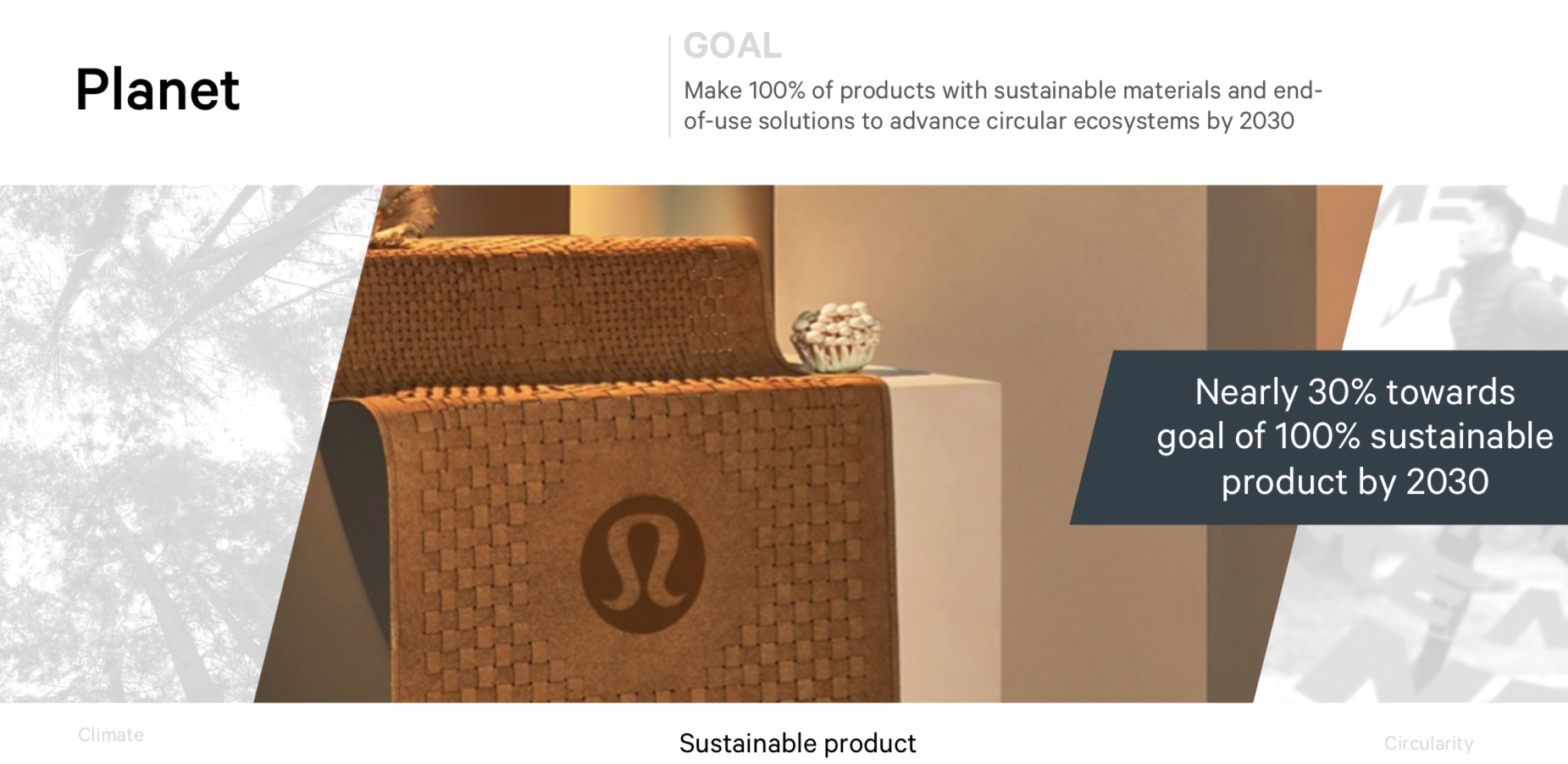

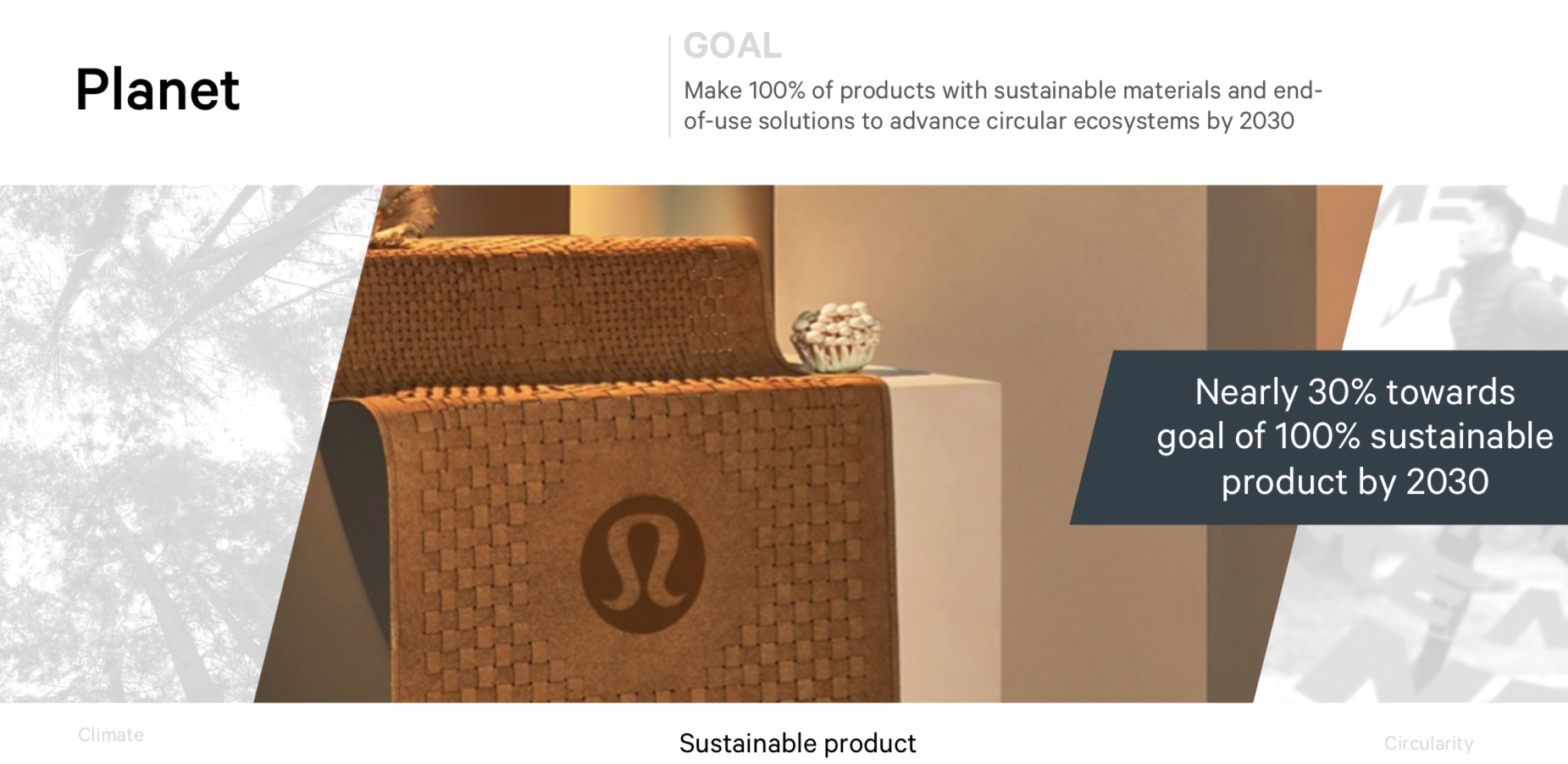

4. Sustainability Remains a Priority

Lululemon Athletica continues to prioritize sustainable initiatives and described its two key environmental plans.

Source: Company reports [/caption]

4. Sustainability Remains a Priority

Lululemon Athletica continues to prioritize sustainable initiatives and described its two key environmental plans.

- Ensure 100% of its products are made from sustainable materials and have end-of-use solutions by 2030. The company noted that it is about 30% toward reaching its sustainable goal as of April 2022.

- Achieve net-zero carbon emission by 2050, in line with its commitment as part of the Paris Agreement to limit global warming to 1.5 degrees Celsius.

Source: Company reports [/caption]

Source: Company reports [/caption]

What We Think

- We believe that Lululemon Athletica’s plan to double its men’s business while extending core and new product categories, such as golf apparel and footwear, will substantially expand its total addressable market and will give Lululemon Athletica an edge against competitors, mainly those retailers that primarily focus on women’s business and do not maintain versatility.

- We see Lululemon Athletica’s push toward digital capabilities expansion and technological innovations as steps in the right direction to drive sales as we expect many consumers to cement pandemic-driven online shopping habits in 2022 and beyond. Furthermore, we believe that the company’s upcoming multi-tier loyalty program will help Lululemon Athletica to generate brand awareness and enhance consumer engagement across channels.

- Lululemon Athletica remains relatively underpenetrated in the international market and the company’s considerate and aggressive approach to geographic expansion, particularly in the China market, will position it for success.

- We perceive risks to ethically positioned sportswear brands from increasing consumer awareness of the microplastic pollution created by artificial fibers. We therefore view Lululemon’s innovations in plant-based nylon fabrics positively and see the company’s proactive measures in sustainability as the right steps toward strengthening consumer trust and attracting investors and employees in a dynamic retail landscape.