DIpil Das

Lululemon Shares its Vision to be an Experiential Brand for People Living the Sweatlife

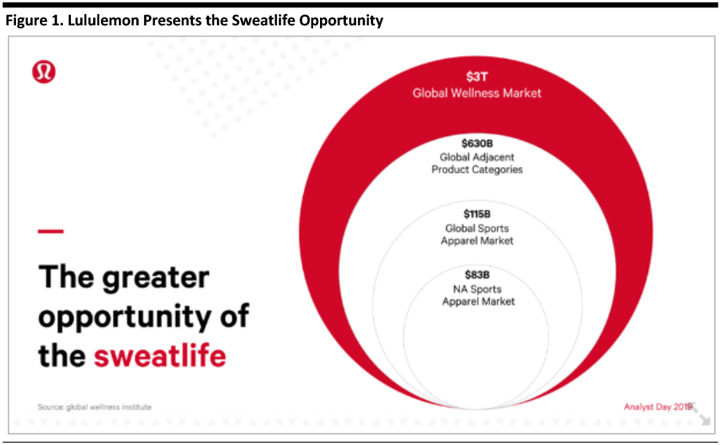

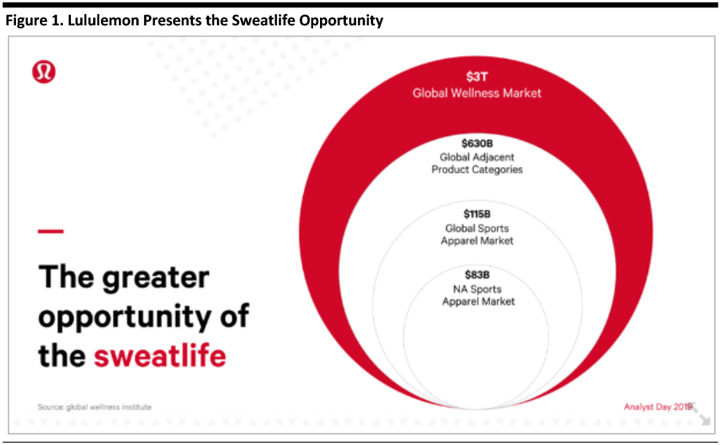

CEO Calvin McDonald shared the company’s vision “to be the experiential brand that ignites a community of people living the sweatlife through sweat, grow and connect.” Management commented that it sees a $3 trillion potential total addressable global market opportunity through its “sweatlife” pillars and adjacent product categories, which include sports apparel, adjacent product categories and the global wellness market.

[caption id="attachment_85380" align="aligncenter" width="720"] Source: Company reports [/caption]

Lululemon Finishes 2018 Crossing $3 Billion

Management opened the investor day with an overview of its 2018 financial results and highlighted the company’s achievements. The company reached 24% revenue growth, 90% GAAP EPS growth, $3.3 billion in revenue and 45% e-commerce comps. Management stated that it had over seven million guests in 2018, and had a 92% high-value guest retention rate – meaning that customers in the top 20% of spend have a 92% engagement rate – highlighting that its most loyal customers are very loyal.

[caption id="attachment_85383" align="aligncenter" width="720"]

Source: Company reports [/caption]

Lululemon Finishes 2018 Crossing $3 Billion

Management opened the investor day with an overview of its 2018 financial results and highlighted the company’s achievements. The company reached 24% revenue growth, 90% GAAP EPS growth, $3.3 billion in revenue and 45% e-commerce comps. Management stated that it had over seven million guests in 2018, and had a 92% high-value guest retention rate – meaning that customers in the top 20% of spend have a 92% engagement rate – highlighting that its most loyal customers are very loyal.

[caption id="attachment_85383" align="aligncenter" width="720"] Source: Company reports [/caption]

Lululemon Plans to Grow Core Categories and Expand into New Categories Including Selfcare and Footwear

Management stated it is looking to expand its existing core women’s product categories and new product lines supporting yoga, running and training. In 2018, women’s core categories comprised 70% of Lululemon’s revenue, with women’s bottoms driving the core of the company’s business. Management commented the company is looking to expand its core categories to drive even more business. Two categories they highlighted were bras and outerwear. The company is currently looking to redesign the bra concept – so the bra becomes as popular as the pant and the bra customer becomes as loyal as the bottoms customer. To that end, the company is designing running bras, support bras and variations on the “strappy yoga bra.”

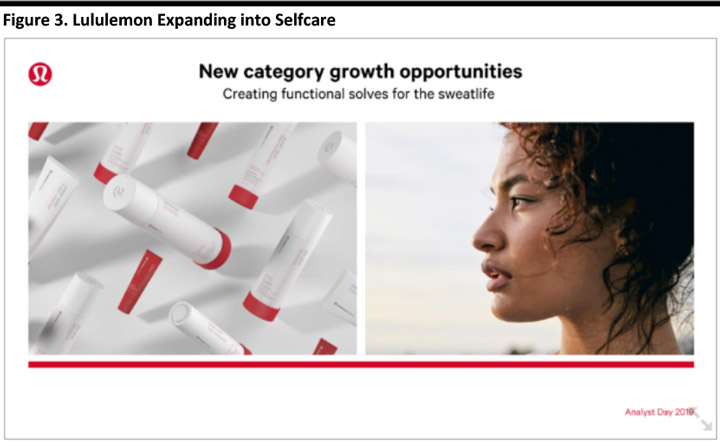

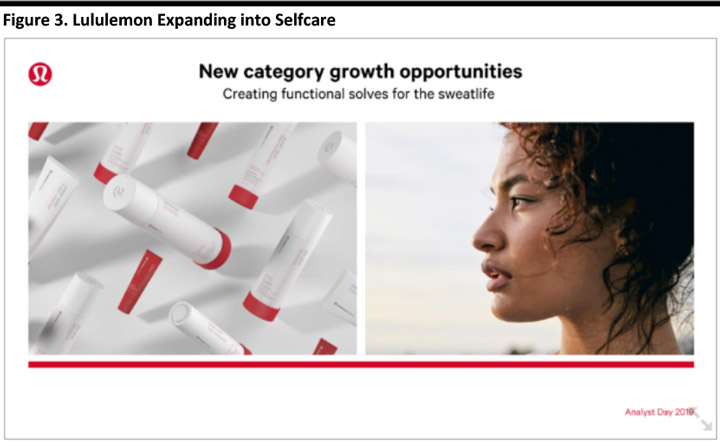

The company said it is expanding into new categories: selfcare and footwear. The company tested selfcare in four markets over the past year, including the following products: deodorant, dry shampoo, facial moisturizer and lip balm. Management said they believe the customer “trusts Lululemon” as a provider of these products and that initial feedback was positive. The company will roll out these initial products to 50 doors and online in June 2019.

Lululemon said it used a “touch and feel” approach to developing the new products – using soft packaging. Management said the lip balm has a different feel that others currently available. The company also has future plans to enter the footwear market, but said it will take a methodical approach to market entry and share detailed plans at a later date, promising something “unique, defined, and focused.” Management said the new categories are not material to its five-year projections.

[caption id="attachment_85384" align="aligncenter" width="720"]

Source: Company reports [/caption]

Lululemon Plans to Grow Core Categories and Expand into New Categories Including Selfcare and Footwear

Management stated it is looking to expand its existing core women’s product categories and new product lines supporting yoga, running and training. In 2018, women’s core categories comprised 70% of Lululemon’s revenue, with women’s bottoms driving the core of the company’s business. Management commented the company is looking to expand its core categories to drive even more business. Two categories they highlighted were bras and outerwear. The company is currently looking to redesign the bra concept – so the bra becomes as popular as the pant and the bra customer becomes as loyal as the bottoms customer. To that end, the company is designing running bras, support bras and variations on the “strappy yoga bra.”

The company said it is expanding into new categories: selfcare and footwear. The company tested selfcare in four markets over the past year, including the following products: deodorant, dry shampoo, facial moisturizer and lip balm. Management said they believe the customer “trusts Lululemon” as a provider of these products and that initial feedback was positive. The company will roll out these initial products to 50 doors and online in June 2019.

Lululemon said it used a “touch and feel” approach to developing the new products – using soft packaging. Management said the lip balm has a different feel that others currently available. The company also has future plans to enter the footwear market, but said it will take a methodical approach to market entry and share detailed plans at a later date, promising something “unique, defined, and focused.” Management said the new categories are not material to its five-year projections.

[caption id="attachment_85384" align="aligncenter" width="720"] Source: Company reports [/caption]

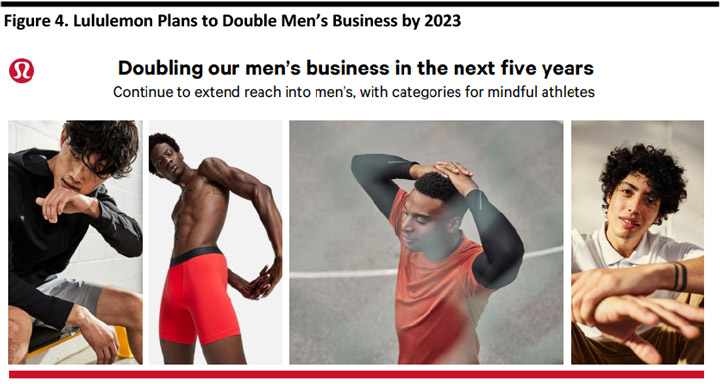

Lululemon Expects to Double its Men’s Business by 2023

Management said it hopes to double its men’s business by 2023. In 2018, 21% of its revenue was from its men’s category, a $690 million category today. Management highlighted that its brand has low awareness with men, which it believes provides a significant opportunity. The company is focusing on guest acquisition and building brand awareness, for example by:

Source: Company reports [/caption]

Lululemon Expects to Double its Men’s Business by 2023

Management said it hopes to double its men’s business by 2023. In 2018, 21% of its revenue was from its men’s category, a $690 million category today. Management highlighted that its brand has low awareness with men, which it believes provides a significant opportunity. The company is focusing on guest acquisition and building brand awareness, for example by:

Source: Company reports [/caption]

Lululemon Continues to Build its Community through Experiential Stores, Ambassadors and Events

Lululemon is rooted in an active ambassador program that has helped to create its community.

The company currently has over 2,000 ambassadors globally and 15,000 former ambassadors. A typical ambassador program with Lululemon lasts two years, but the company maintains the relationships afterwards.

Management reported that “community” is a trend in the marketplace: People participate in events and communities. The brand was founded on the principle of people getting together to do yoga, run and attend events. Management said its community actively influences the company’s product innovations and designs.

The company hosts over 4,000 events annually, and announced it will open a 20,000-square-foot experiential store in Lincoln Park, Chicago in July 2019. The store will offer all-day classes, provide a place for coffee, juices and smoothies, and will also host over 45 ambassadors when the store opens.

Lululemon Plans to Quadruple International Expansion Over the Next Five Years and Double Digital Expansion: China is a Huge Opportunity

In 2018, international revenues totaled $360 million. The company reported that it anticipates its international revenues will grow at a compound annual rate of 30%, quadrupling by 2023. The company is taking a balanced strategy between stores and online in China, skewed slightly more toward stores. The company reported that it is also investing in Korea and Japan. The company reported it expects its digital business to double by 2023, driven by website enhancements and the international market, particularly China.

[caption id="attachment_85386" align="aligncenter" width="720"]

Source: Company reports [/caption]

Lululemon Continues to Build its Community through Experiential Stores, Ambassadors and Events

Lululemon is rooted in an active ambassador program that has helped to create its community.

The company currently has over 2,000 ambassadors globally and 15,000 former ambassadors. A typical ambassador program with Lululemon lasts two years, but the company maintains the relationships afterwards.

Management reported that “community” is a trend in the marketplace: People participate in events and communities. The brand was founded on the principle of people getting together to do yoga, run and attend events. Management said its community actively influences the company’s product innovations and designs.

The company hosts over 4,000 events annually, and announced it will open a 20,000-square-foot experiential store in Lincoln Park, Chicago in July 2019. The store will offer all-day classes, provide a place for coffee, juices and smoothies, and will also host over 45 ambassadors when the store opens.

Lululemon Plans to Quadruple International Expansion Over the Next Five Years and Double Digital Expansion: China is a Huge Opportunity

In 2018, international revenues totaled $360 million. The company reported that it anticipates its international revenues will grow at a compound annual rate of 30%, quadrupling by 2023. The company is taking a balanced strategy between stores and online in China, skewed slightly more toward stores. The company reported that it is also investing in Korea and Japan. The company reported it expects its digital business to double by 2023, driven by website enhancements and the international market, particularly China.

[caption id="attachment_85386" align="aligncenter" width="720"] Source: Company reports [/caption]

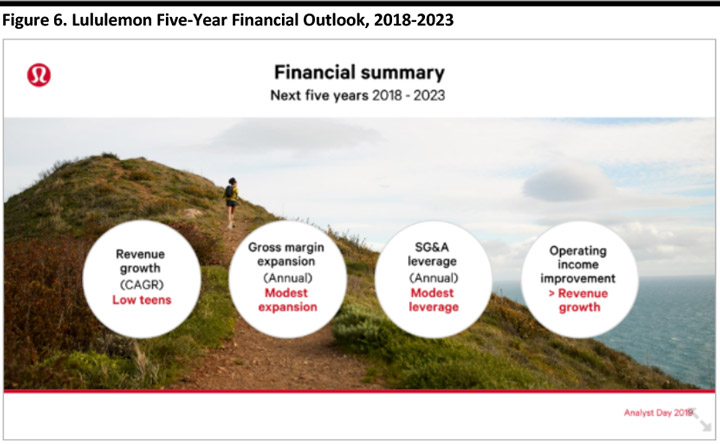

Lululemon Expects Total Annual Growth at a CAGR in the Low Teens and EPS Growth to Meet or Exceed its Operating Income Growth

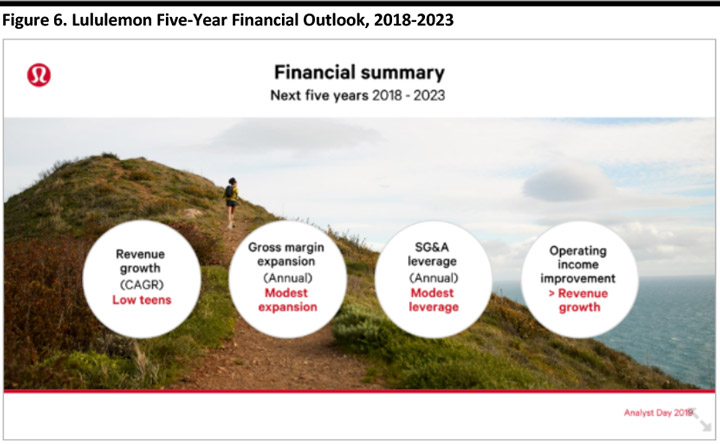

The company reported that in addition to more than doubling men’s and digital revenue and quadrupling international revenue, the company expects total annual revenue to grow at a compound annual growth rate in the low teens. In the company’s last annual earnings report for 4Q19, the company’s annual revenues increased 26% to $3.3 billion.

In its strategic plan, the company also said it expects modest gross margin expansion annually, modest SG&A expansion annually and operating income growth to exceed revenue growth annually.

[caption id="attachment_85388" align="aligncenter" width="720"]

Source: Company reports [/caption]

Lululemon Expects Total Annual Growth at a CAGR in the Low Teens and EPS Growth to Meet or Exceed its Operating Income Growth

The company reported that in addition to more than doubling men’s and digital revenue and quadrupling international revenue, the company expects total annual revenue to grow at a compound annual growth rate in the low teens. In the company’s last annual earnings report for 4Q19, the company’s annual revenues increased 26% to $3.3 billion.

In its strategic plan, the company also said it expects modest gross margin expansion annually, modest SG&A expansion annually and operating income growth to exceed revenue growth annually.

[caption id="attachment_85388" align="aligncenter" width="720"] Source: Company reports [/caption]

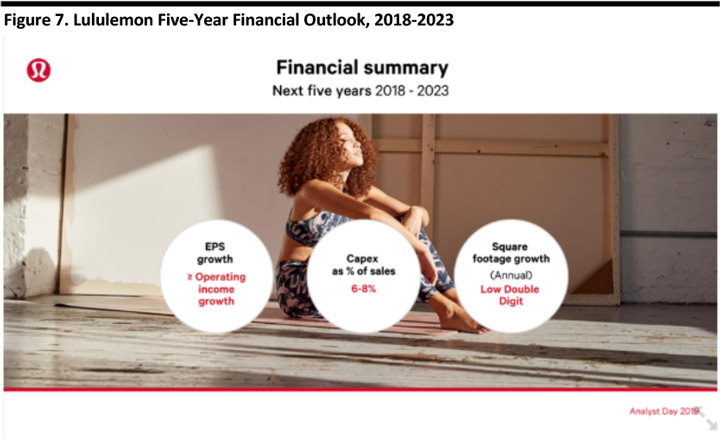

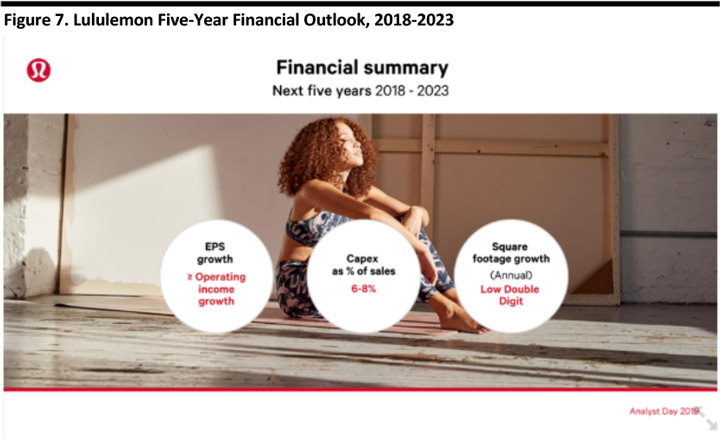

The company expects earnings per share (EPS) growth to exceed, or equal, its operating income growth, annually. The company reported that it will have annual capital expenditures of 6-8% of sales. The company expects annual square footage growth in the low single digits.

[caption id="attachment_85389" align="aligncenter" width="720"]

Source: Company reports [/caption]

The company expects earnings per share (EPS) growth to exceed, or equal, its operating income growth, annually. The company reported that it will have annual capital expenditures of 6-8% of sales. The company expects annual square footage growth in the low single digits.

[caption id="attachment_85389" align="aligncenter" width="720"] Source: Company reports [/caption]

Source: Company reports [/caption]

Source: Company reports [/caption]

Lululemon Finishes 2018 Crossing $3 Billion

Management opened the investor day with an overview of its 2018 financial results and highlighted the company’s achievements. The company reached 24% revenue growth, 90% GAAP EPS growth, $3.3 billion in revenue and 45% e-commerce comps. Management stated that it had over seven million guests in 2018, and had a 92% high-value guest retention rate – meaning that customers in the top 20% of spend have a 92% engagement rate – highlighting that its most loyal customers are very loyal.

[caption id="attachment_85383" align="aligncenter" width="720"]

Source: Company reports [/caption]

Lululemon Finishes 2018 Crossing $3 Billion

Management opened the investor day with an overview of its 2018 financial results and highlighted the company’s achievements. The company reached 24% revenue growth, 90% GAAP EPS growth, $3.3 billion in revenue and 45% e-commerce comps. Management stated that it had over seven million guests in 2018, and had a 92% high-value guest retention rate – meaning that customers in the top 20% of spend have a 92% engagement rate – highlighting that its most loyal customers are very loyal.

[caption id="attachment_85383" align="aligncenter" width="720"] Source: Company reports [/caption]

Lululemon Plans to Grow Core Categories and Expand into New Categories Including Selfcare and Footwear

Management stated it is looking to expand its existing core women’s product categories and new product lines supporting yoga, running and training. In 2018, women’s core categories comprised 70% of Lululemon’s revenue, with women’s bottoms driving the core of the company’s business. Management commented the company is looking to expand its core categories to drive even more business. Two categories they highlighted were bras and outerwear. The company is currently looking to redesign the bra concept – so the bra becomes as popular as the pant and the bra customer becomes as loyal as the bottoms customer. To that end, the company is designing running bras, support bras and variations on the “strappy yoga bra.”

The company said it is expanding into new categories: selfcare and footwear. The company tested selfcare in four markets over the past year, including the following products: deodorant, dry shampoo, facial moisturizer and lip balm. Management said they believe the customer “trusts Lululemon” as a provider of these products and that initial feedback was positive. The company will roll out these initial products to 50 doors and online in June 2019.

Lululemon said it used a “touch and feel” approach to developing the new products – using soft packaging. Management said the lip balm has a different feel that others currently available. The company also has future plans to enter the footwear market, but said it will take a methodical approach to market entry and share detailed plans at a later date, promising something “unique, defined, and focused.” Management said the new categories are not material to its five-year projections.

[caption id="attachment_85384" align="aligncenter" width="720"]

Source: Company reports [/caption]

Lululemon Plans to Grow Core Categories and Expand into New Categories Including Selfcare and Footwear

Management stated it is looking to expand its existing core women’s product categories and new product lines supporting yoga, running and training. In 2018, women’s core categories comprised 70% of Lululemon’s revenue, with women’s bottoms driving the core of the company’s business. Management commented the company is looking to expand its core categories to drive even more business. Two categories they highlighted were bras and outerwear. The company is currently looking to redesign the bra concept – so the bra becomes as popular as the pant and the bra customer becomes as loyal as the bottoms customer. To that end, the company is designing running bras, support bras and variations on the “strappy yoga bra.”

The company said it is expanding into new categories: selfcare and footwear. The company tested selfcare in four markets over the past year, including the following products: deodorant, dry shampoo, facial moisturizer and lip balm. Management said they believe the customer “trusts Lululemon” as a provider of these products and that initial feedback was positive. The company will roll out these initial products to 50 doors and online in June 2019.

Lululemon said it used a “touch and feel” approach to developing the new products – using soft packaging. Management said the lip balm has a different feel that others currently available. The company also has future plans to enter the footwear market, but said it will take a methodical approach to market entry and share detailed plans at a later date, promising something “unique, defined, and focused.” Management said the new categories are not material to its five-year projections.

[caption id="attachment_85384" align="aligncenter" width="720"] Source: Company reports [/caption]

Lululemon Expects to Double its Men’s Business by 2023

Management said it hopes to double its men’s business by 2023. In 2018, 21% of its revenue was from its men’s category, a $690 million category today. Management highlighted that its brand has low awareness with men, which it believes provides a significant opportunity. The company is focusing on guest acquisition and building brand awareness, for example by:

Source: Company reports [/caption]

Lululemon Expects to Double its Men’s Business by 2023

Management said it hopes to double its men’s business by 2023. In 2018, 21% of its revenue was from its men’s category, a $690 million category today. Management highlighted that its brand has low awareness with men, which it believes provides a significant opportunity. The company is focusing on guest acquisition and building brand awareness, for example by:

- Creating a running franchise that includes thermal properties.

- Creating a training line for men that won’t abrade while working out.

- Developing a line that is “taking cues from streetwear.”

- Signing former Philadelphia Eagles Quarterback Nick Foles to be its first men’s brand ambassador.

Source: Company reports [/caption]

Lululemon Continues to Build its Community through Experiential Stores, Ambassadors and Events

Lululemon is rooted in an active ambassador program that has helped to create its community.

The company currently has over 2,000 ambassadors globally and 15,000 former ambassadors. A typical ambassador program with Lululemon lasts two years, but the company maintains the relationships afterwards.

Management reported that “community” is a trend in the marketplace: People participate in events and communities. The brand was founded on the principle of people getting together to do yoga, run and attend events. Management said its community actively influences the company’s product innovations and designs.

The company hosts over 4,000 events annually, and announced it will open a 20,000-square-foot experiential store in Lincoln Park, Chicago in July 2019. The store will offer all-day classes, provide a place for coffee, juices and smoothies, and will also host over 45 ambassadors when the store opens.

Lululemon Plans to Quadruple International Expansion Over the Next Five Years and Double Digital Expansion: China is a Huge Opportunity

In 2018, international revenues totaled $360 million. The company reported that it anticipates its international revenues will grow at a compound annual rate of 30%, quadrupling by 2023. The company is taking a balanced strategy between stores and online in China, skewed slightly more toward stores. The company reported that it is also investing in Korea and Japan. The company reported it expects its digital business to double by 2023, driven by website enhancements and the international market, particularly China.

[caption id="attachment_85386" align="aligncenter" width="720"]

Source: Company reports [/caption]

Lululemon Continues to Build its Community through Experiential Stores, Ambassadors and Events

Lululemon is rooted in an active ambassador program that has helped to create its community.

The company currently has over 2,000 ambassadors globally and 15,000 former ambassadors. A typical ambassador program with Lululemon lasts two years, but the company maintains the relationships afterwards.

Management reported that “community” is a trend in the marketplace: People participate in events and communities. The brand was founded on the principle of people getting together to do yoga, run and attend events. Management said its community actively influences the company’s product innovations and designs.

The company hosts over 4,000 events annually, and announced it will open a 20,000-square-foot experiential store in Lincoln Park, Chicago in July 2019. The store will offer all-day classes, provide a place for coffee, juices and smoothies, and will also host over 45 ambassadors when the store opens.

Lululemon Plans to Quadruple International Expansion Over the Next Five Years and Double Digital Expansion: China is a Huge Opportunity

In 2018, international revenues totaled $360 million. The company reported that it anticipates its international revenues will grow at a compound annual rate of 30%, quadrupling by 2023. The company is taking a balanced strategy between stores and online in China, skewed slightly more toward stores. The company reported that it is also investing in Korea and Japan. The company reported it expects its digital business to double by 2023, driven by website enhancements and the international market, particularly China.

[caption id="attachment_85386" align="aligncenter" width="720"] Source: Company reports [/caption]

Lululemon Expects Total Annual Growth at a CAGR in the Low Teens and EPS Growth to Meet or Exceed its Operating Income Growth

The company reported that in addition to more than doubling men’s and digital revenue and quadrupling international revenue, the company expects total annual revenue to grow at a compound annual growth rate in the low teens. In the company’s last annual earnings report for 4Q19, the company’s annual revenues increased 26% to $3.3 billion.

In its strategic plan, the company also said it expects modest gross margin expansion annually, modest SG&A expansion annually and operating income growth to exceed revenue growth annually.

[caption id="attachment_85388" align="aligncenter" width="720"]

Source: Company reports [/caption]

Lululemon Expects Total Annual Growth at a CAGR in the Low Teens and EPS Growth to Meet or Exceed its Operating Income Growth

The company reported that in addition to more than doubling men’s and digital revenue and quadrupling international revenue, the company expects total annual revenue to grow at a compound annual growth rate in the low teens. In the company’s last annual earnings report for 4Q19, the company’s annual revenues increased 26% to $3.3 billion.

In its strategic plan, the company also said it expects modest gross margin expansion annually, modest SG&A expansion annually and operating income growth to exceed revenue growth annually.

[caption id="attachment_85388" align="aligncenter" width="720"] Source: Company reports [/caption]

The company expects earnings per share (EPS) growth to exceed, or equal, its operating income growth, annually. The company reported that it will have annual capital expenditures of 6-8% of sales. The company expects annual square footage growth in the low single digits.

[caption id="attachment_85389" align="aligncenter" width="720"]

Source: Company reports [/caption]

The company expects earnings per share (EPS) growth to exceed, or equal, its operating income growth, annually. The company reported that it will have annual capital expenditures of 6-8% of sales. The company expects annual square footage growth in the low single digits.

[caption id="attachment_85389" align="aligncenter" width="720"] Source: Company reports [/caption]

Source: Company reports [/caption]