albert Chan

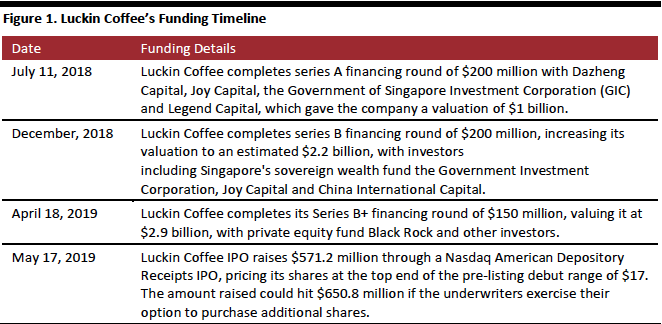

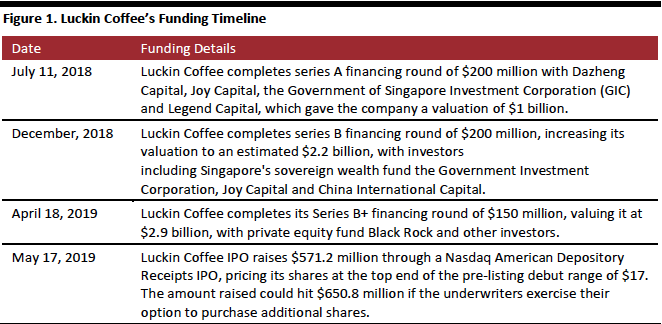

Luckin Coffee, China’s answer to Starbucks, undertook an IPO on May 16, 2019. The company raised some $571.2 million through the IPO, pricing its shares at the top end of the pre-listing debut range of $17. The amount raised could hit $650.8 million if the underwriters exercise their option to purchase additional shares. In its first day of trading, shares of Luckin Coffee jumped to a high of $24.62 before settling back to levels around $18.50 in trading early the following week.

In this report, we profile Luckin Coffee's offering and discuss its store-opening plans. We begin with some quick facts about the company from its prospectus:

A Luckin Coffee pick-up store

A Luckin Coffee pick-up store

Source: Company reports[/caption] Luckin Coffee says its pick-up store locations enable the company to stay close to their target customers: Office workers and students. The pick-up rate rose from 35% in April 2018 to 61% in December, 2018, according to China Daily. With the low cost of renting and running this type of stores, Luckin Coffee has been able to expand rapidly, according to the company. Luckin Coffee to Use IPO Funds to Open More Stores Luckin Coffee CEO Qian Zhiya said in a press conference on January 3, 2019, that the company plans to open about 2,500 new stores in China in 2019, which would bring its total to 4,500. The company said it plans to continue promotions for three to five years, but is changing the offering. For example, since January 1, 2019, Luckin Coffee to continue it buy two get one free promotion but will end its buy five get five free promotion. The company also raised the threshold for free delivery has from ¥35 (around $5) to ¥55 (around $8). However, the company is still losing money and has warned it may continue to incur losses for the foreseeable future. The company reported a ¥550 million (around $85.3 million) net loss in the first quarter of 2019 on ¥478.5 million ($71.3 million) revenue, following a net loss of ¥1.62 billion (around $241.3 million) in 2018, on total 2018 revenue of ¥840.7 million ($125.3 million). [caption id="attachment_88815" align="aligncenter" width="662"] Source: China Daily/Technode/Reuters/Coresight Research[/caption]

Key Insights

Luckin Coffee, the company many call China’s answer to Starbucks, leverages smaller size pick-up stores to expand rapidly. The company also recently cut delivery time from 30 to 16 minutes on average. If the company completes its aggressive expansion plan of opening 2,500 new stores in 2019, Luckin Coffee will have 4,870 stores by the end of 2019, overtaking Starbucks’ 3,500 to become the largest coffee chain in China. With this IPO, Luckin Coffee has fattened its war chest to fund its ambition of becoming China’s number one coffee chain.

Source: China Daily/Technode/Reuters/Coresight Research[/caption]

Key Insights

Luckin Coffee, the company many call China’s answer to Starbucks, leverages smaller size pick-up stores to expand rapidly. The company also recently cut delivery time from 30 to 16 minutes on average. If the company completes its aggressive expansion plan of opening 2,500 new stores in 2019, Luckin Coffee will have 4,870 stores by the end of 2019, overtaking Starbucks’ 3,500 to become the largest coffee chain in China. With this IPO, Luckin Coffee has fattened its war chest to fund its ambition of becoming China’s number one coffee chain.

- Second-largest coffee network in China in terms of number of stores as of December 31, 2018, and in cups of coffee sold in 2018.

- Some 2,370 self-owned stores across 28 cities in China as of March 31, 2019.

- Served more than 16.8 million cumulative transacting customers from its inception to March 31, 2019.

- Sold around 90 million of coffee and other products in 2018.

- Located within 500 meters (1,600 feet) of densely populated locations such as office buildings, commercial areas and university campuses, according to the company’s IPO prospectus.

- Smaller than average at around 20-60 square meters (around 215-646 square feet).

- Limited in seating.

- Lower cost thanks to low rent and fit-out costs compared to a full service store.

A Luckin Coffee pick-up store

A Luckin Coffee pick-up storeSource: Company reports[/caption] Luckin Coffee says its pick-up store locations enable the company to stay close to their target customers: Office workers and students. The pick-up rate rose from 35% in April 2018 to 61% in December, 2018, according to China Daily. With the low cost of renting and running this type of stores, Luckin Coffee has been able to expand rapidly, according to the company. Luckin Coffee to Use IPO Funds to Open More Stores Luckin Coffee CEO Qian Zhiya said in a press conference on January 3, 2019, that the company plans to open about 2,500 new stores in China in 2019, which would bring its total to 4,500. The company said it plans to continue promotions for three to five years, but is changing the offering. For example, since January 1, 2019, Luckin Coffee to continue it buy two get one free promotion but will end its buy five get five free promotion. The company also raised the threshold for free delivery has from ¥35 (around $5) to ¥55 (around $8). However, the company is still losing money and has warned it may continue to incur losses for the foreseeable future. The company reported a ¥550 million (around $85.3 million) net loss in the first quarter of 2019 on ¥478.5 million ($71.3 million) revenue, following a net loss of ¥1.62 billion (around $241.3 million) in 2018, on total 2018 revenue of ¥840.7 million ($125.3 million). [caption id="attachment_88815" align="aligncenter" width="662"]

Source: China Daily/Technode/Reuters/Coresight Research[/caption]

Key Insights

Luckin Coffee, the company many call China’s answer to Starbucks, leverages smaller size pick-up stores to expand rapidly. The company also recently cut delivery time from 30 to 16 minutes on average. If the company completes its aggressive expansion plan of opening 2,500 new stores in 2019, Luckin Coffee will have 4,870 stores by the end of 2019, overtaking Starbucks’ 3,500 to become the largest coffee chain in China. With this IPO, Luckin Coffee has fattened its war chest to fund its ambition of becoming China’s number one coffee chain.

Source: China Daily/Technode/Reuters/Coresight Research[/caption]

Key Insights

Luckin Coffee, the company many call China’s answer to Starbucks, leverages smaller size pick-up stores to expand rapidly. The company also recently cut delivery time from 30 to 16 minutes on average. If the company completes its aggressive expansion plan of opening 2,500 new stores in 2019, Luckin Coffee will have 4,870 stores by the end of 2019, overtaking Starbucks’ 3,500 to become the largest coffee chain in China. With this IPO, Luckin Coffee has fattened its war chest to fund its ambition of becoming China’s number one coffee chain.