albert Chan

What’s the Story?

The Covid-19 pandemic has impacted consumer behavior and resulted in significant shifts in the US retail landscape. Although loyalty programs have long been a key strategy for retailers to drive growth and retain customers, retailers now need to be more dynamic in their approach to such programs, adapting to suit the needs of customers in the present climate.

In this report, we examine best practices for loyalty programs and how retailers can leverage data to drive growth, as well as several emerging trends in the implementation of such programs.

Why It Matters

Retailers are paying closer attention to developing and fine-tuning their loyalty program strategies. The pandemic has seen consumers favor reduced shopping trips, convenience and low prices, threatening their loyalty to previously preferred retailers: According to a McKinsey report, 78% of US consumers have switched stores, brands or the way they shop due to the pandemic. For more on shifting consumer behaviors, see Coresight Research’s US Consumer Tracker, which analyzes weekly consumer survey findings.

Loyalty programs present opportunities for retailers to re-attract lost customers as well as retain customers. The value of loyal customers is that they typically spend more and are more likely to promote the brand to others. According to management consulting firm A.T. Kearney, it costs five to 25 times more to acquire a new customer than to retain an existing one, indicating how crucial it is for retailers to get their loyalty programs right.

Loyalty programs provide another channel for retailers to engage with consumers and differentiate themselves from the competition through enhanced customer experiences. A well-designed loyalty program can go a long way in helping retailers to gain a larger share of wallet and increase customer retention, and the data harvested through such programs provide retailers with insights into their customers and can power personalization in marketing and promotions.

Loyalty Programs in the US: In Detail

Types of Loyalty Programs: Proprietary vs. Coalition

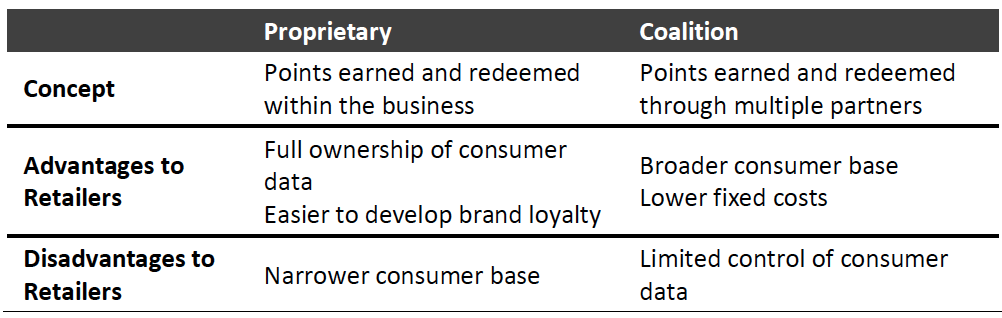

There are two types of loyalty program in the retail sector: proprietary and coalition. Retailers need to assess their strategic goals and consumer preferences before determining which type to implement.

Figure 1. Two Types of Loyalty Program

[caption id="attachment_125872" align="aligncenter" width="550"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Proprietary Programs

These programs aim to focus on the company’s core business and build a personal connection with customers. Retailers have full control of the program’s operation and marketing, as well as full ownership of customer data, allowing them to create a more consistent experience across channels and offer more customized solutions for consumers. This is intended to build emotional connections with shoppers, who are then more likely to promote the business to others.

Examples of loyalty programs of this type include Family Mart’s membership program, IKEA Family, Sephora Beauty Insiders and Starbucks Rewards.

Coalition Programs

These programs are consolidated single platforms that benefit several companies. In addition to some retailers, airlines (frequent-flyer programs) and cobranded credit cards often adopt this kind of loyalty program. It is easier and faster for consumers to earn points compared to proprietary programs since coalition programs offer a wider assortment of incentives built around low-, medium- and high-frequency shopping partners. Moreover, the lower-cost structure of coalition programs versus individual programs enable retailers to pass those savings on to the customer with more attractive incentives.

From a retailer perspective, these programs do not require heavy investment in their development and management, as they are not bespoke. However, companies have limited access to consumer data, and it is difficult to differentiate from competitors, presenting challenges in driving customer loyalty. Examples of coalition programs include Matas, Star Alliance and Upromise.

Leveraging Consumer Data: Personalized Promotion and Rewards

Fully 78% of US online shoppers are more likely to shop with brands that provide better personalized experiences, according to a June 2019 study from digital marketing company Avionos. By analyzing consumers’ shopping behaviors using technologies such as artificial intelligence (AI), companies can create specific promotions and rewards that resonate with their customers and therefore drive return on investment. For example, based on historical purchasing behavior, the Starbucks Rewards program offers discounts for customers on the beverage that they often order, as well as birthday rewards.

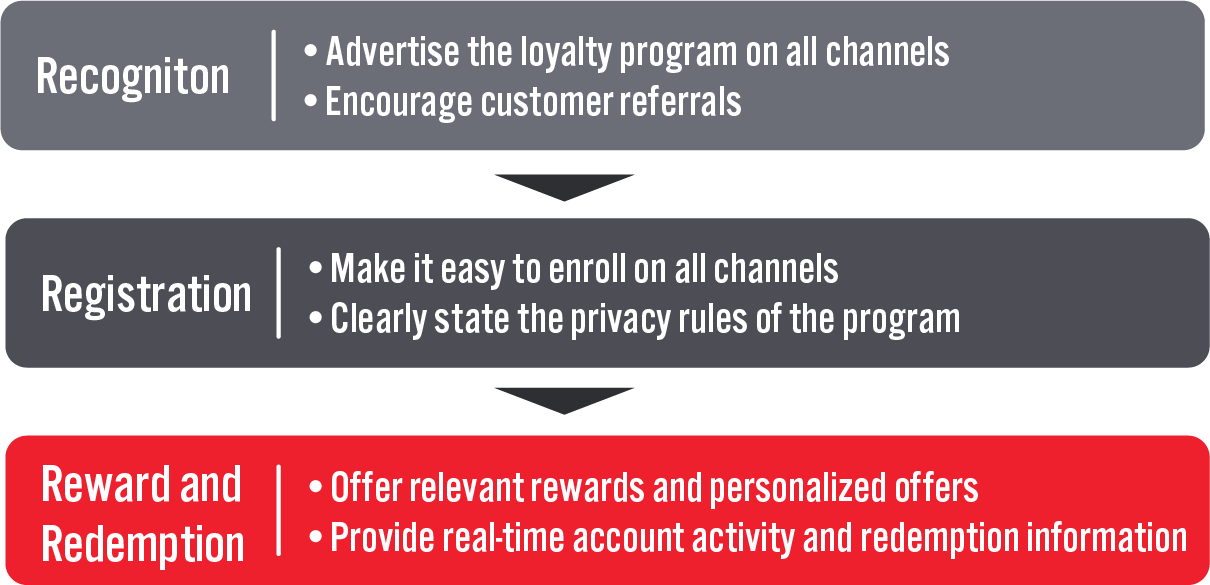

Loyalty Program Best Practices To Improve Customer Experience

Loyalty programs help retailers to elevate the customer experience if implemented effectively. Brands must therefore identify consumer pain points in the process of joining and using the program in order to mitigate the risk of deterring sign-ups. Below, we examine some of the best practices for retailers in offering loyalty programs.

Figure 2. Loyalty Programs: Best Practices

[caption id="attachment_125874" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Recognition

Retailers should promote their loyalty program on both offline and online channels:

- Loyalty program banners and signages should be highly visible in the brick-and-mortar store, and sales associates should be trained to pitch the program to every customer.

- Offering a signup bonus or instant reward is the quickest way to attract customers to join the program.

- Existing members can be incentivized to promote the loyalty program by offering rewards for referrals.

- Retailers should announce the launch of their program over email to existing subscribers, as well as on social media and through their official website to attract new customers.

Registration

Program enrollment should be quick and easy for consumers, whether it is done online or offline. With data privacy being a priority for many consumers, it is important that retailers request only necessary information and inform consumers how they will use that information.

Rewards and Redemption

As all loyalty programs offer rewards, it is key for each retailer to differentiate itself in some way from its competitors. Rewards should be relevant and resonate with the brand’s target consumers. Offering tiered membership and providing personalized offers also make loyal customers feel more appreciated (which we discuss in later sections of this report).

Ensuring that rewards are reasonably attainable is important. According to a 2019 report from digital marketing solutions provider Merkle (formerly HelloWorld), top complaints for loyalty programs include the long time it takes to earn a reward and the short expiration of reward points; retailers should offer achievable targets that keep loyalty program members engaged on a regular basis, as well as rewards that would appeal to consumers and are redeemable in a reasonable time frame.

In addition, consumers expect a seamless reward accrual and redemption process. As part of this, retailers should provide loyalty program members with real-time account information such as a record of purchase history and rewards earned.

Key Trends in Retail Loyalty Programs

Retailers are evolving their loyalty programs to better meet consumer expectations, such as through implementing upgrades and offering premium membership tiers. Below, we discuss four key trends that we are seeing in the loyalty program market.

1. Premium Membership on the Rise, but Tiered Loyalty Programs Will Continue To Be PopularPremium loyalty programs are those for which customers have to pay a fee in exchange for access to exclusive discounts, and according to loyalty program specialist Clarus Commerce, these programs usually target the top 20% of a retailer’s customers.

The key driver behind a consumer’s decision to join a premium loyalty program is a clear recognition of value that the program offers. According to Clarus Commerce’s 2020 Premium Loyalty Data Study, 70% of consumers would join a premium loyalty program if a preferred retailer offered one and the benefits were valuable. Moreover, almost 70% of premium loyalty program members in the US indicated that they would join another premium loyalty program in 2020.

The same study found that strong premium loyalty programs can be effective in warding off competition. Around 87% of consumers who are satisfied with the benefits offered by a paid loyalty program of their favorite retailers will likely choose that retailer over a competitor even if the latter offers a lower price, according to the study. Such consumers are also more likely to recommend the brand to their families and friends.

More retailers are offering paid membership options that provide a superior experience for customers. With access to better and exclusive benefits, paid members tend to be more committed to the brand and engage more frequently. According to a 2020 McKinsey survey on loyalty programs, paid loyalty program members are 60% more likely to spend more on a brand after subscribing, while free loyalty program members are only 30% more likely to increase spending on the brand. The membership fee also provides an additional stream of income for retailers to fund the program’s operating budget.

However, it is also advantageous for retailers to offer a free program for the other 80% of their customer base. A free loyalty program enables a low barrier to entry, which makes it easier for retailers to acquire new members. However, basic/free programs can fail to provide sufficient benefits that are deemed valuable enough by consumers or drive true engagement among members. Offering a clear path for members to access greater benefits is a way to overcome this challenge—and this can be done through tiered loyalty programs.

Tier-based programs encourage customers to increase spending and engagement so as to reach the next level or avoiding dropping to a lower level; customers are prepared to keep spending to avoid losing valued privileges. Tiered loyalty programs should aim to create more targeted experiences through segmentation and targeted communication. These programs typically keep customers engaged over a longer period of time and give members that reach a new tier a sense of achievement, encouraging them to keep aiming for the next level.

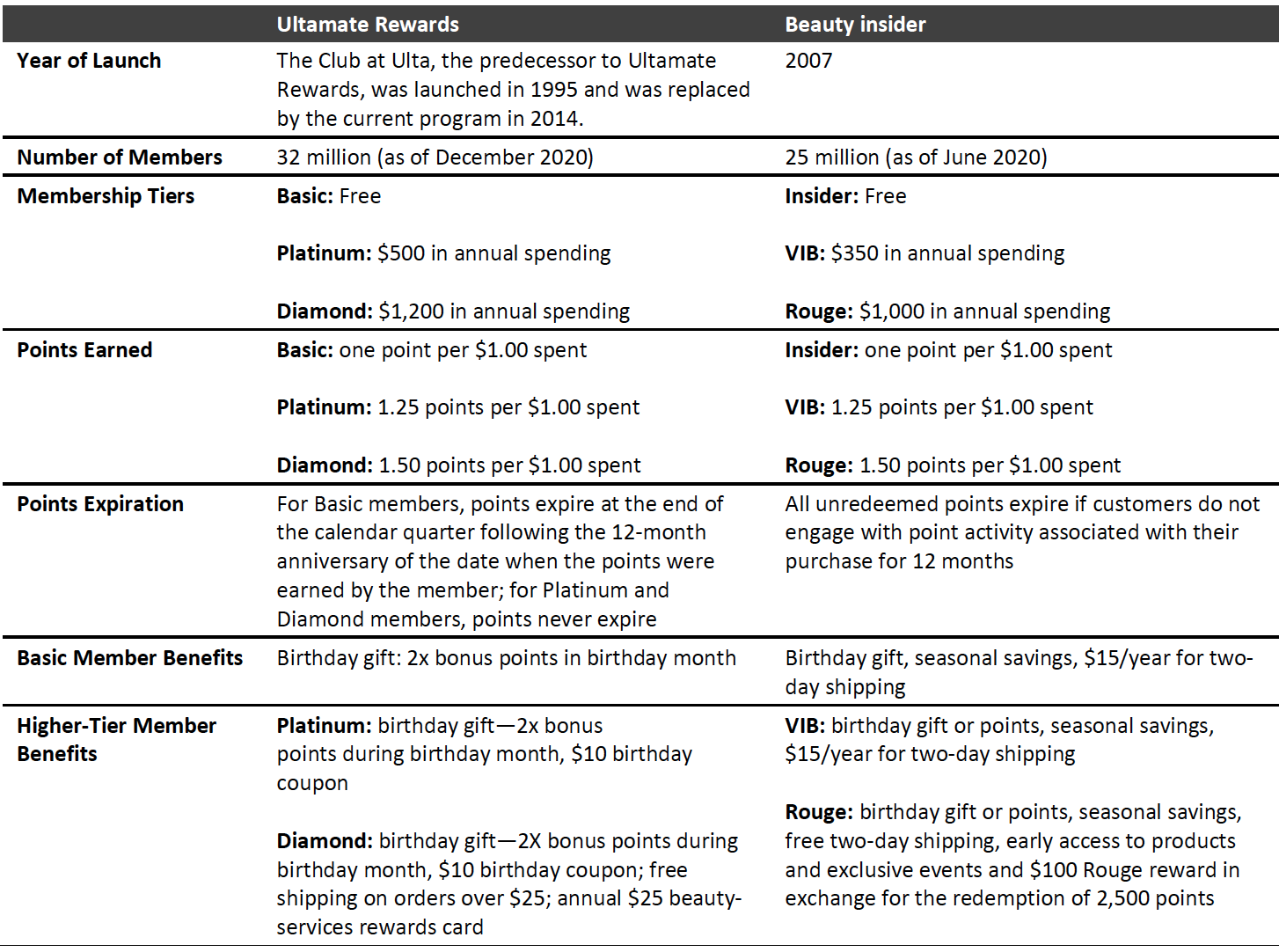

Beauty retailers Sephora and Ulta Beauty are examples of retailers that run tiered loyalty programs, which we outline in Figure 3.

Figure 3. Tiered Loyalty Programs: Comparison of Ulta Beauty’s Ultamate Rewards and Sephora’s Beauty Insider

[caption id="attachment_125873" align="aligncenter" width="700"] Source: Company reports[/caption]

2. Loyalty Programs Are Increasingly Being Integrated into Mobile Apps

Source: Company reports[/caption]

2. Loyalty Programs Are Increasingly Being Integrated into Mobile Apps

Mobile apps are an effective tool for driving user engagement and enhancing the customer experience, as retailers can send push notifications of promotions and personalized marketing to customers. According to web traffic analysis company StatCounter, 54.5% of all Internet traffic takes place on mobile devices, as of February 2021—as such, mobile apps have become a key component of loyalty programs. According to the Consumer Incentives 2019 report by payment management services provider Wirecard, 70% of consumers manage their rewards/incentive programs via a mobile app.

Retailers can boost omnichannel shopping via mobile apps by utilizing mobile location functionality to offer information and promotions regarding a specific physical store when a customer is nearby. Loyalty program apps therefore enable users to receive instant updates on purchases, personalized offers and rewards—as well as providing a smoother checkout process, with many retailers offering in-app payment options.

There are a number of retailers that have implemented loyalty programs through an app. We present a few examples below.

- 7-Eleven launched its 7Rewards points program on its mobile app in 2015 with a reward of a free drink after a customer purchases six drinks. The retailer subsequently expanded the program in 2017 to enable customers to earn reward points for hundreds more 7-Eleven product purchases. In December 2020, the retailer launched the 7-Eleven Wallet app through which users can access touchless payment and loyalty offers. As a bonus, the retailer is currently offering 2,000 7Rewards points to first-time users when they load $20 into their 7-Eleven Wallet, for a limited time.

- Casey’s General Stores announced the launch of its first loyalty program, Casey’s Rewards, in January 2020. The program uses the retailer’s app, which it updated in July 2019, as a central part of the program in order to create a seamless experience for its customers.

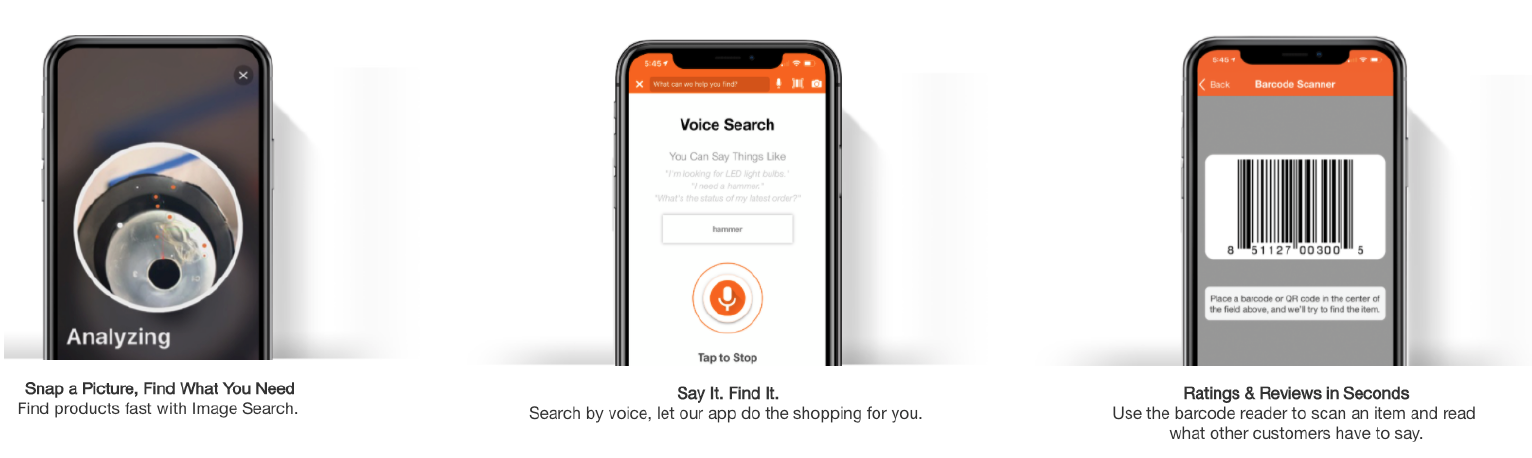

- Home Depot updated its loyalty program app for home-improvement professionals in October 2020, adding gamification features (which we discuss in the next section). Members of the Pro Xtra program can earn points when shopping at Home Depot and redeem perks through the app. The app offers members greater transparency into the loyalty program and enables them to avoid the inconvenience of carrying membership cards and key fobs that could wear out or get damaged easily.

Home Depot’s mobile app

Home Depot’s mobile appSource: Company website[/caption] 3. Gamification Is Becoming More Integral to Loyalty Programs

Gamification in loyalty programs encourages recurring behavior, incentivizes specific actions, spurs engagement beyond transactions and offers a more fun and memorable customer experience.

Consumers across age groups in the US are showing growing affinity toward gamified programs. According to Merkle’s 2019 Loyalty Barometer Report focused on US consumers, almost one-third of all participants—and 40% of millennials—said that there should be games within loyalty programs. Additionally, 80% of millennials and almost two-thirds of baby boomers are interested in gaining rewards not just for purchases but also for engaging with their favorite brands. Luxury cosmetics company Lancôme, for example, offers reward points to consumers for social sharing and brand advocacy.

- Home Depot introduced gamification features (including bonus rewards) to its loyalty program app in October 2020 to encourage repeat store visits and drive purchases as members track their advancement to the next reward level.

- Victoria’s Secret created an app in September 2018, which the brand integrated with its PINK Nation customer loyalty program. Users could gain points for signing up to the "Fashion Show Sweeps" contest, giving them the opportunity to win a trip to the Victoria’s Secret Fashion Show. Users could gain additional points by sharing the promotion on Facebook and playing daily trivia games. Apart from gathering a lot of customer data, the promotion led to increased visits and more participation on the website, according to the company.

Other examples of retailers that gamified parts of their loyalty programs in 2020 to drive longer-term usage include CVS Pharmacy and Wendy's.

Retailers are increasingly recognizing that including gamification elements in loyalty programs is an effective way to drive sales and boost consumer engagement. We expect to see more brands and retailers adopting this approach in 2021 and beyond.

4. Personalization Will Have a Greater Role To Play Within Loyalty ProgramsLoyalty programs are becoming more digitally focused and tailored, giving consumers relevant and personalized offers in real time. According to global marketing firm Epsilon, 80% of US consumers are more likely to make a purchase when brands offer personalized experiences.

Introducing new loyalty offers for consumers without appropriate personalization and segmentation of those offers runs the risk of the promotions being irrelevant to the consumer.

One obvious example of implementing personalization through loyalty programs is in email marketing campaigns. Blender manufacturer and retailer Vitamix sends a monthly email to its loyalty club members with information about the customer’s total points earned over time, overall spending over time and total redeemable points, as well as relevant reward offers. According to the company, this strategy attracts more customers to its e-commerce site to redeem their rewards. The retailer launched its loyalty program in June 2019 and as of August 2020 had almost 120,000 loyalty club members.

Another example is home-furnishings brand Jonathan Adler hosted an online event exclusively to its loyalty club members in 2020. The brand sent each of its loyalty program members a private code that could be entered on its website to access the event. Members who made eligible purchases gained 1,000 loyalty points, amounting to $100 off.

What We Think

Implications for Brands/Retailers

- Basic/free programs can fail to provide sufficient benefits that are deemed valuable enough by consumers or drive true engagement among members. Offering a clear path for members to access greater benefits is a way to overcome this challenge—and this can be done through tiered loyalty programs.

- Retailers should look to introduce or improve the gamification and personalization elements in their loyalty programs to enhance the overall efficacy of their programs—both in driving sales and boosting engagement.

- Retailers should invest in improving the mobile app-based loyalty program experience that they offer to their consumers, ensuring that the benefits, rewards and experience on offer stand out against those offered by competitors.

Implications for Technology Vendors

- The increasing popularity of mobile app-focused loyalty programs, as well as the rising importance of gamification and personalization, present significant opportunity for technology vendors to work with retailers.