albert Chan

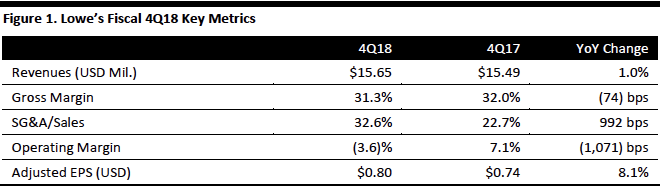

[caption id="attachment_78280" align="aligncenter" width="660"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

Lowe’s reported fiscal 4Q18 revenues of $15.65 billion, up 1.0% and below the $15.75 consensus estimate.

Comps were 1.7%, below the 2.1% consensus estimate. US home-improvement comps increased 2.4%. Online comps increased 11%.

Adjusted EPS was $0.80, up 8.1% year over year and beating consensus by a penny. Adjusted 4Q18 EPS excludes $1.83 per share of charges for the impairment of Canadian goodwill, Orchard Supply Hardware, US and Canada store closures, Mexico impairment, non-core activities, and Product Specialists Interiors. Adjusted 4Q17 EPS excludes $0.07 per chare of charges for the impact of tax reform and a one-time cash bonus attributable to tax reform. GAAP EPS was $(1.03), compared to $0.67 in the year-ago quarter.

Details from the Quarter

Management commented that it had worked intensely during the past six months to transform the company in preparation for an improved spring and fiscal 2019. Comps improved every month of the quarter, culminating in US comp growth of 5.8% in January.

Further, management believes that US macroeconomic fundamentals remain sound for 2019 and plans to continue to implement process and technology improvements to to improve results. While management anticipates continued weakness in the Canadian housing market in the near-term, the team remains confident in its market position there and in its long-term potential.

Other points:

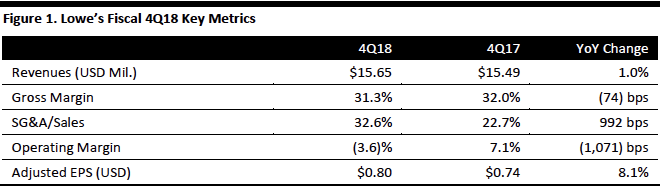

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Lowe’s reported fiscal 4Q18 revenues of $15.65 billion, up 1.0% and below the $15.75 consensus estimate.

Comps were 1.7%, below the 2.1% consensus estimate. US home-improvement comps increased 2.4%. Online comps increased 11%.

Adjusted EPS was $0.80, up 8.1% year over year and beating consensus by a penny. Adjusted 4Q18 EPS excludes $1.83 per share of charges for the impairment of Canadian goodwill, Orchard Supply Hardware, US and Canada store closures, Mexico impairment, non-core activities, and Product Specialists Interiors. Adjusted 4Q17 EPS excludes $0.07 per chare of charges for the impact of tax reform and a one-time cash bonus attributable to tax reform. GAAP EPS was $(1.03), compared to $0.67 in the year-ago quarter.

Details from the Quarter

Management commented that it had worked intensely during the past six months to transform the company in preparation for an improved spring and fiscal 2019. Comps improved every month of the quarter, culminating in US comp growth of 5.8% in January.

Further, management believes that US macroeconomic fundamentals remain sound for 2019 and plans to continue to implement process and technology improvements to to improve results. While management anticipates continued weakness in the Canadian housing market in the near-term, the team remains confident in its market position there and in its long-term potential.

Other points:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Lowe’s reported fiscal 4Q18 revenues of $15.65 billion, up 1.0% and below the $15.75 consensus estimate.

Comps were 1.7%, below the 2.1% consensus estimate. US home-improvement comps increased 2.4%. Online comps increased 11%.

Adjusted EPS was $0.80, up 8.1% year over year and beating consensus by a penny. Adjusted 4Q18 EPS excludes $1.83 per share of charges for the impairment of Canadian goodwill, Orchard Supply Hardware, US and Canada store closures, Mexico impairment, non-core activities, and Product Specialists Interiors. Adjusted 4Q17 EPS excludes $0.07 per chare of charges for the impact of tax reform and a one-time cash bonus attributable to tax reform. GAAP EPS was $(1.03), compared to $0.67 in the year-ago quarter.

Details from the Quarter

Management commented that it had worked intensely during the past six months to transform the company in preparation for an improved spring and fiscal 2019. Comps improved every month of the quarter, culminating in US comp growth of 5.8% in January.

Further, management believes that US macroeconomic fundamentals remain sound for 2019 and plans to continue to implement process and technology improvements to to improve results. While management anticipates continued weakness in the Canadian housing market in the near-term, the team remains confident in its market position there and in its long-term potential.

Other points:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Lowe’s reported fiscal 4Q18 revenues of $15.65 billion, up 1.0% and below the $15.75 consensus estimate.

Comps were 1.7%, below the 2.1% consensus estimate. US home-improvement comps increased 2.4%. Online comps increased 11%.

Adjusted EPS was $0.80, up 8.1% year over year and beating consensus by a penny. Adjusted 4Q18 EPS excludes $1.83 per share of charges for the impairment of Canadian goodwill, Orchard Supply Hardware, US and Canada store closures, Mexico impairment, non-core activities, and Product Specialists Interiors. Adjusted 4Q17 EPS excludes $0.07 per chare of charges for the impact of tax reform and a one-time cash bonus attributable to tax reform. GAAP EPS was $(1.03), compared to $0.67 in the year-ago quarter.

Details from the Quarter

Management commented that it had worked intensely during the past six months to transform the company in preparation for an improved spring and fiscal 2019. Comps improved every month of the quarter, culminating in US comp growth of 5.8% in January.

Further, management believes that US macroeconomic fundamentals remain sound for 2019 and plans to continue to implement process and technology improvements to to improve results. While management anticipates continued weakness in the Canadian housing market in the near-term, the team remains confident in its market position there and in its long-term potential.

Other points:

- Management is encouraged by customer response to the assortment and service changes in 4Q18 by results in early spring categories, and this progress was evident in improvement we in the paint category. For the past 10 consecutive quarters, paint has delivered comps below the company average. Lowe’s is leveraging its exclusive partnership with Sherwin-Williams, enabled paint to exceed expectations in paint in the quarter and raise its comp above the company average.

- Paint represents the first area of the business in which management has implemented its retail fundamentals framework of improved staffing and in-stocks while remediating issues from previous business resets. Management expects this renewed focus across multiple categories to start to offer improved results in 2019.

- The US we delivered positive comps in 11 of 14 geographic regions, and the Tampa/Houston markets faced tough comparisons due to Hurricanes Irma and Harvey. The US also delivered positive comps in eight of 11 product categories, with offers in tools and hardware delivering above-average comps due to strong customer response in Craftsman products, which gained market share in category. The company also achieved above-average comps in lawn and garden, appliances and lumber and building materials.

- Traffic to the website was strong in the quarter, however the company was unable to capitalize fully on the traffic due to system outages on Black Friday weekend. In January, we made a leadership change, hiring Mike Amend as the new President of Online Business. Amend has knowledge and expertise in the home improvement omnichannel space, will work with the company’s new Chief Information Officer, Seemantini Godbole, to transform Lowes.com in 2019.

- In 2019, management will continue to focus on key areas: driving merchandising excellence, transforming the supply chain, delivering operational efficiency and intensifying customer engagement, representing an unchanged strategic focus hasn’t changed. The second item has been renamed slightly to supply chain transformation from omnichannel previously.

- Management offered its view that the US home improvement industry should continue to benefit from several factors, including income growth, a lower federal tax rate, gains on household formation and continued home price appreciation, which is further supported by an aging housing stock. As home prices increase, consumers tend to stay in their homes longer and due to an improved financial position, they tend to invest in their homes, all of which drive investment in home-improvement projects.

- To capitalize on this supportive macro environment, management will focus on five areas in which it is seeing signs of progress in its business:

1. Delivering better customer service — customer-satisfaction scores have improved for both DIY and Pro customers.

2. Merchandise Service Teams (MST) pilots showed positive results.

3. Improvement in performance versus expectations in key categories. In addition the improvement in paint, the company is resetting to better position itself for the spring selling season.

4. Lowe’s continues to see strong customer response to Craftsman, with market share gains in every Craftsman category since introducing the brand. Craftsman outdoor power equipment will be launched this spring.

5. Positive results in the Pro business, driven in part from investment in job-lot quantities.

Outlook The company offered the following guidance for fiscal 2019:- Total sales growth of approximately 2% (slightly above the 1.8% consensus estimate).

- Comp growth of approximately 3%.

- Operating income as a percentage of sales to increase 375 to 385 basis points, to 0.1%-0.2%. Adjusted operating margin to increase 85 to 95 basis points.

- EPS of $6.00-$6.10, in line with the $6.04 consensus estimate.