Web Developers

Lowe’s will acquire all of the issued and outstanding common shares of Rona for C$24 per share in cash, and all of the issued and outstanding preferred shares of Rona for C$20 per share in cash. The total transaction value is C$3.2 billion (US$2.3 billion). The offer represents a premium of 104% to Rona’s closing common share price on February 2 and a 38% premium to Rona’s 52-week high of C$17.36.

Rona is one of Canada’s largest retailers and distributors of hardware, building materials, and home renovation and gardening products, with locations across Canada. It operates a multiformat, multibannered portfolio of stores. In its retail chain, the company has 236 corporate-owned stores using three formats under three different banners. In its distribution, Rona serves 260 dealer-owned stores utilizing nine distribution centers across Canada.

Source: Company reports

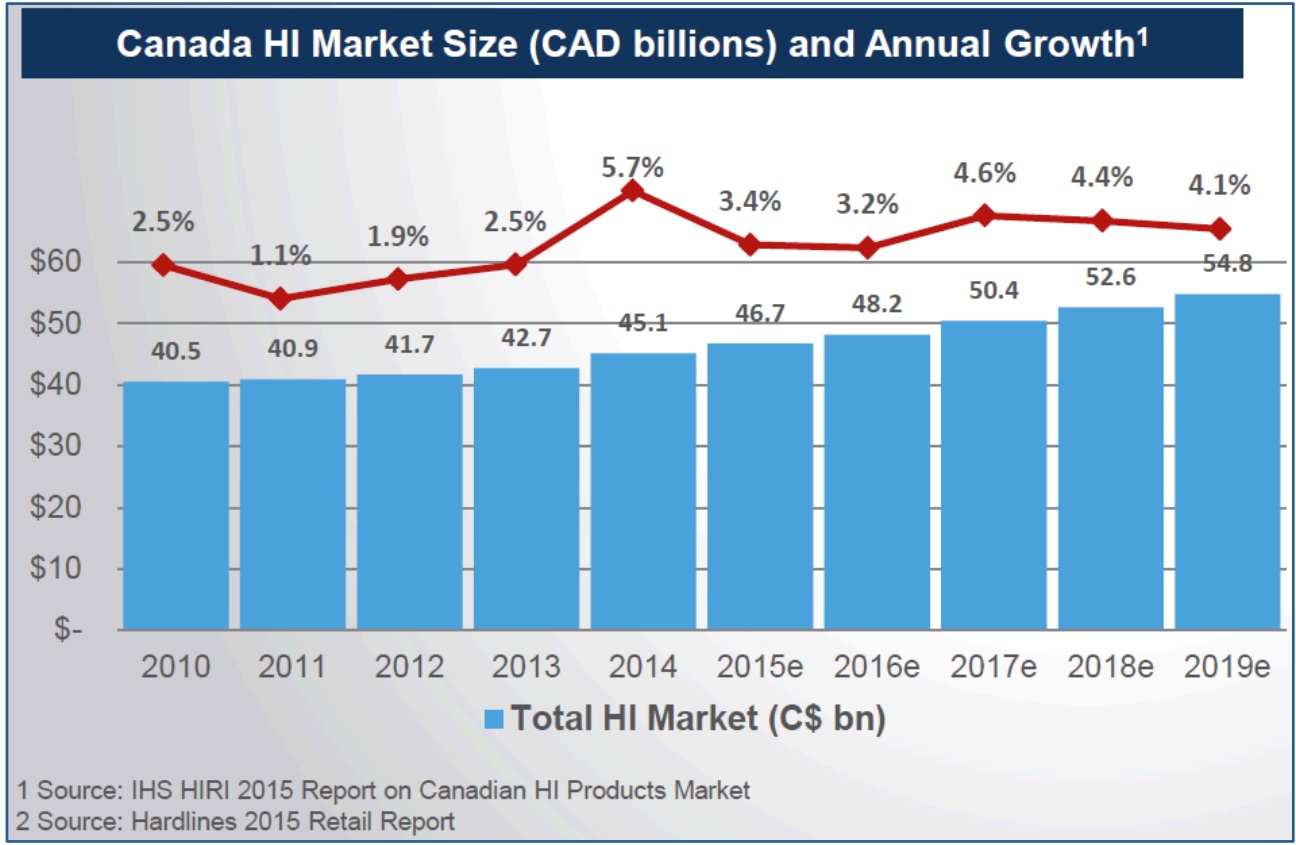

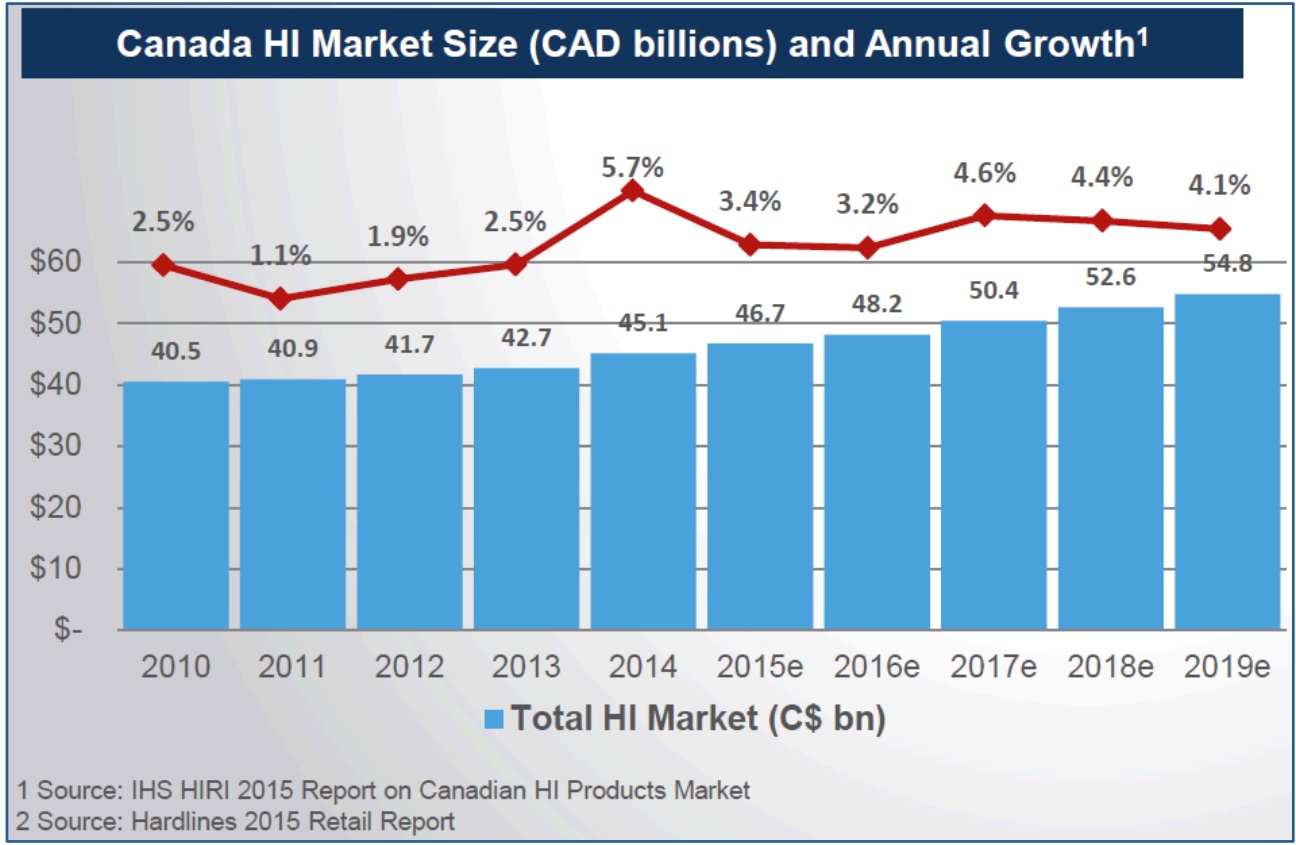

As a point of reference, Lowe’s began growing organically in Canada in 2007 and now operates 42 stores in the country, primarily in Ontario and, to a lesser degree, in the western part of the country. Lowe’s launched an e-commerce site in 2012. With a strong foundation in place, the company is looking to scale the Canadian business and grow its profitability. The agreement is based on a strategic rationale for both companies. The deal provides an entry for Lowe’s into Quebec, which represents almost 25% of the Canadian home improvement market, but where Lowe’s has no presence. It also combines Lowe’s scale with Rona’s local expertise. The Canadian home improvement market is estimated to be worth C$45 billion. It is a stable market with a forecasted CAGR of 3.9% from 2014 to 2018. A high level of home ownership and well-developed infrastructure support the growth. The deal is expected to close in the second half of 2016.