Source: Company reports/Coresight Research

4Q17 Results

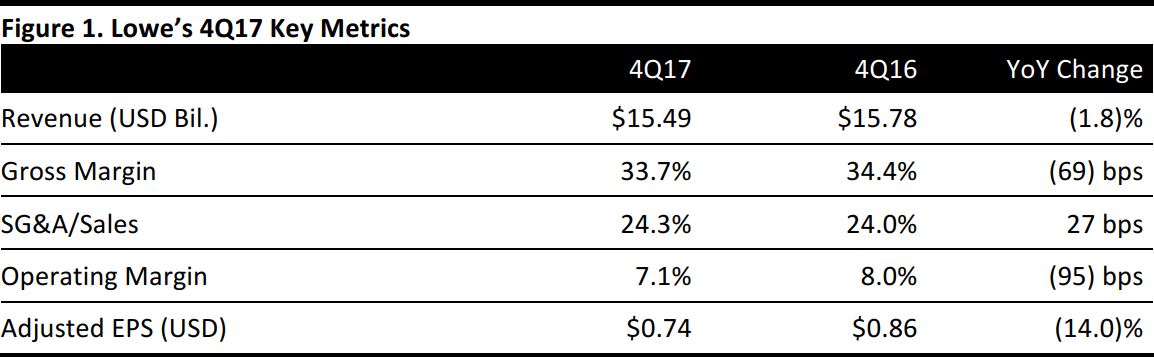

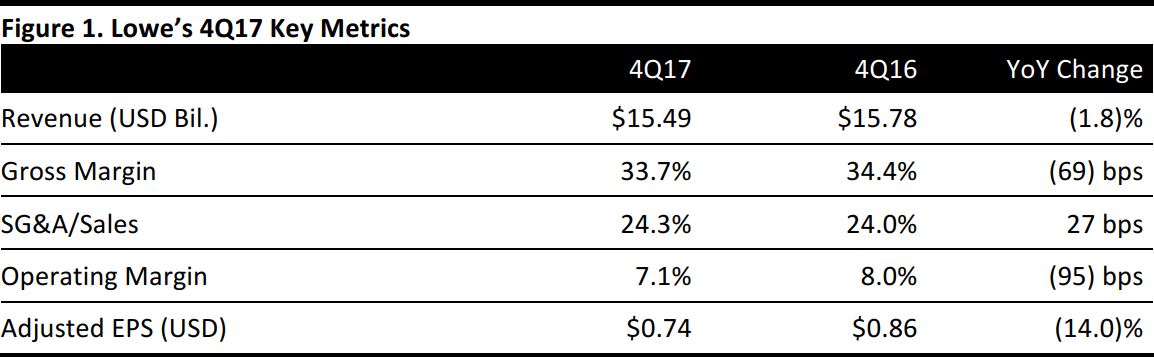

Lowe’s reported 4Q17 net sales of $15.49 billion, down 1.8% year over year but beating the $15.35 billion consensus estimate.

Comps increased by 4.1%, which exceeded management’s expectations. Comps for the US home improvement business increased by 3.7%.

Adjusted EPS was $0.74, compared with $0.86 in the year-ago quarter and missing the $0.87 consensus estimate. GAAP EPS was $0.67, compared with $0.74 in the year-ago quarter, with the difference owing to a $0.02 per share charge due to the Tax Cuts and Jobs Act of 2017 and a $0.05 per share charge from an employee bonus.

FY17 Results

Lowe’s net sales were $68.62 billion for the full year, up 5.5% from $65.02 in the prior year.

Comps increased by 4.0% for the full year; comps for the US home improvement business increased by 3.9%.

Full-year adjusted EPS was $4.39, up 10% from $3.99 in the prior year. Full-year GAAP EPS was $4.09, compared with $3.57 in the prior year.

As of the end of the fiscal year, the company operated 2,152 home improvement and hardware stores in the US, Canada and Mexico, representing 214.9 million square feet of retail selling space.

Details from the Quarter and Full Year

- Fiscal 2017 represented the highest sales and net earnings in the company's history.

- Quarterly comps exceeded management's expectations. Consumer messaging, strong holiday event performance and integrated omnichannel customer experiences contributed to comp growth.

- The home improvement business delivered positive comps in 13 of 14 regions. In addition, comps were positive in 9 of 11 product categories, with one category flat. Appliances led product category growth with double-digit comps. Comps were above average in tools and hardware, rough plumbing and electrical, and lumber and building materials.

- In local currency, Mexico comps were in the high single digits and Canada comps were in the mid-single digits.

- Management cited significant progress integrating RONA (which was acquired in May 2016), recording double-digit online sales growth and rolling out appliances to approximately 100 locations. Other achievements include five RONA big-box conversions, driving strong growth in the affiliated dealer business, and further improving shared supplier partnerships and procurement efforts. RONA posted its highest comp in 13 years. Management believes it is well positioned for continued growth and on track to double operating profitability in Canada by 2021.

- The integration of Maintenance Supply Headquarters and Central Wholesalers remains on track and provides an opportunity to improve and expand the company’s ability to serve multifamily property management customers.

- com recorded comp growth of 28% for the quarter and 34% for the year.

- The company continues to improve its in-home selling program, and customers can now request services online. Lowe’s is centralizing its process for providing installation quotes, allowing for greater efficiency and a more consistent customer experience. Its project specialists offer a differentiated capability in capturing and serving project demand for the do-it-for-me, or DIFM, customer.

Outlook

For 2018, management pledged to improve execution with a focus on conversion, gross margin and inventory management. Management is also continuing to build the capabilities required to deliver simple and seamless experiences and strengthen its position in omnichannel.

For 2018, the company expects the following:

- Total sales to increase by 4%, i.e., to $71.36 billion, compared with consensus of $71.29 billion.

- Comps to increase by 3.5%, ahead of the 3.3% consensus estimate.

- The addition of 10 home improvement and hardware stores.

- Operating margin to decrease by 10 basis points, i.e., to 9.5%.

- EPS of $5.40–$5.50, below the consensus estimate of $5.87.