Source: Company reports/Fung Global Retail & Technology

4Q16 Results

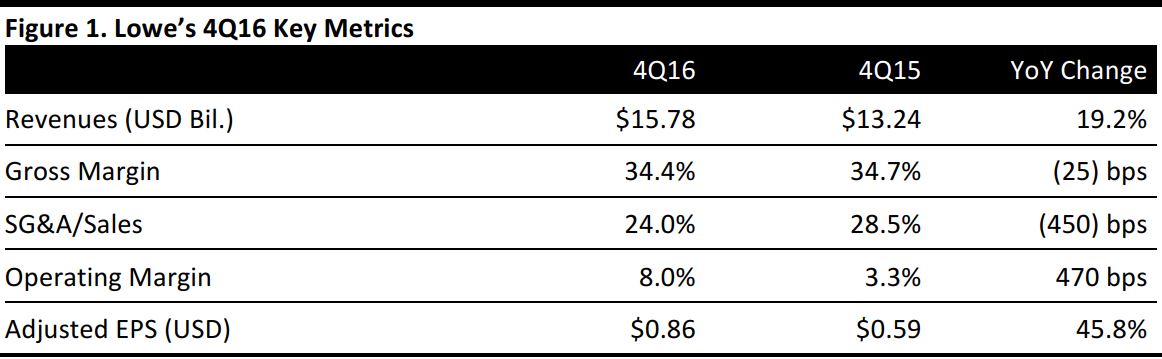

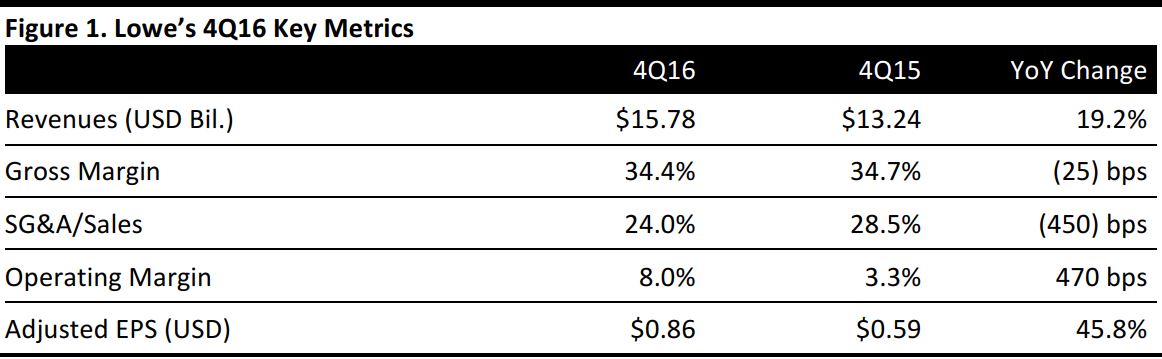

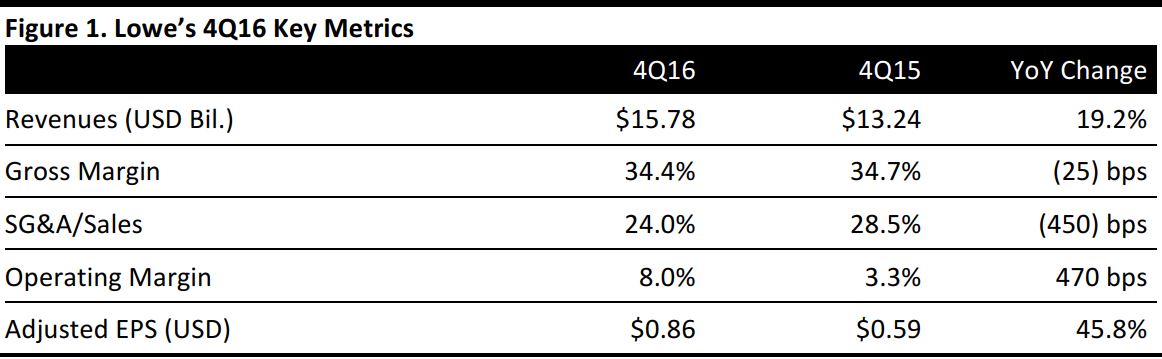

Lowe’s reported total revenues of $15.78 billion for 4Q16, up 19.2% from the year-ago quarter. Same-store sales were up 5.1% from the year-ago quarter, beating the 2.4% consensus estimate. Comp sales were driven by a 4.0% increase in average ticket and a 1.1% increase in customer transactions.

The company reported positive comps in 12 of its 13 product categories. Appliances, outdoor garden, kitchens, lumber, building materials, rough plumbing and electrical all posted comps that were above the company’s average. Pro customer comp sales were also above the company average.

Comps for the US were up 5.1%, and comps were positive in all 14 regions of the country. Internationally, Mexico and Canada posted positive comps that were up by double digits and mid-single digits, respectively.

The company saw a decrease in SG&A that was driven by a $530 million noncash impairment charge from its exit of an Australian joint venture. This year-over-year comparison drove 403 basis points of expense leverage.

Lowe’s reported 4Q16 adjusted EPS of $0.86, up 45.8% from the year-ago quarter and beating the consensus estimate of $0.79. GAAP EPS was $0.74, compared with $0.01 in the year-ago quarter.

Management commented that Lowe’s continues to benefit from a strong housing market. Housing prices have been steadily increasing, encouraging consumers to spend on remodeling and other improvements. In addition, the company’s strong holiday performance and strength in omnichannel retailing drove strong results, according to management.

FY16 Results

For FY16, Lowe’s reported revenue of $65 billion, up 10.1% from FY15, and total company comp growth of 4.2% year over year. Comp sales in the US were up 4.1%.

The retailer reported full-year adjusted EPS of $3.99, up 21.3% from $3.29 the previous year and above company expectations. GAAP EPS was $3.48, compared with $2.73 in the previous year.

As of February 3, Lowe’s operated 2,129 stores, up 15% from 2015. The store-number increase was largely driven by the purchase of Canadian home-improvement chain Rona.

FY17 Outlook

Lowe’s expects total revenue to increase by approximately 5% in FY17, to about $68.27 billion, above the $67.66 billion consensus estimate. The company also expects same-store sales to increase by 3.5%.

The company expects FY17 EPS of $4.64, up about 16.3% from FY16 and above the consensus estimate of $4.53.

Macroeconomic fundamentals remain favorable for Lowe’s. The retailer expects rising home prices, as well as job gains and rising consumer sentiment, to encourage more spending on home projects. The company expects to add 35 stores to its fleet in 2017.