Source: Company reports

4Q15 Results

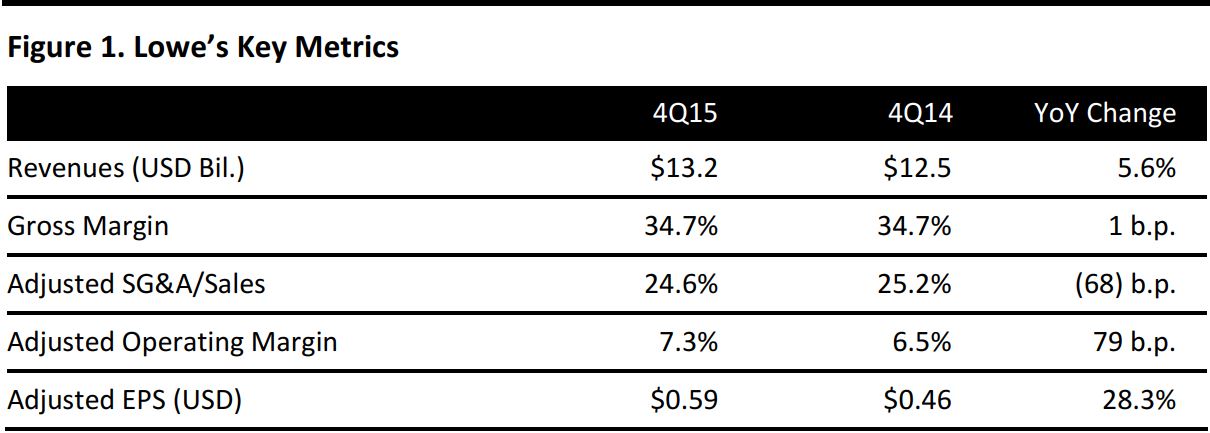

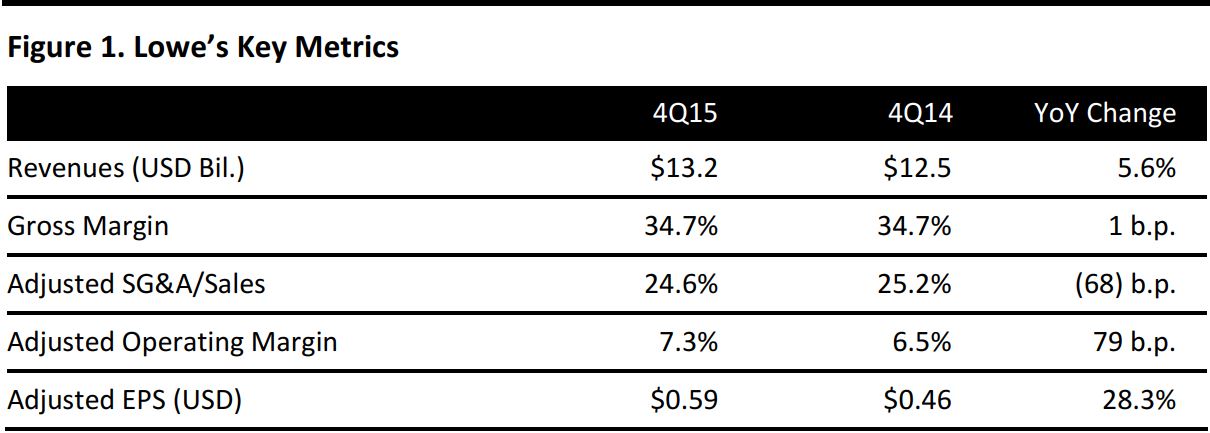

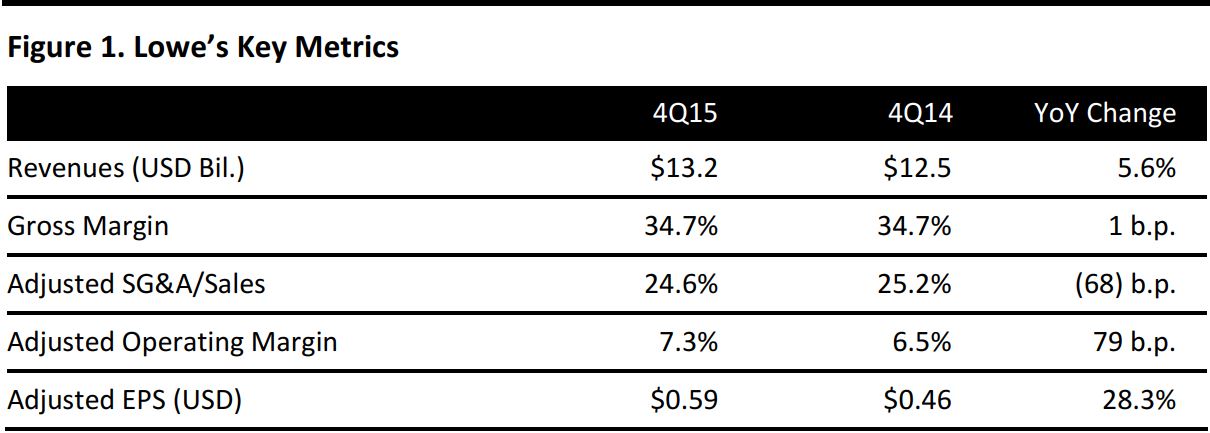

Lowe’s reported 4Q15 revenues of $13.2 billion, up 5.6% from $12.5 billion in the year- ago quarter.

For the same period, total comps were up 5.2% and US comps were up 5.5%. All 14 regions in the company’s US home improvement business delivered positive comps, as did all 13 product categories. Lumber and building materials, paint, soil and lawn care, and appliances were the top-performing product categories in terms of comp growth. The company’s efforts to drive traffic paid off with a 3.6% increase in comp transactions and a 1.6% increase in average ticket size.

Adjusted net earnings were $541 million (up 20.2% year over year) and adjusted EPS was $0.59 (up 28.3% year over year), adjusted for the impact of a $530 million impairment charge from exiting a joint venture with Woolworths Limited in Australia.

Management was pleased with another quarter of solid results, which were driven by an improving macro environment and favorable weather. The company confirmed its strategic focus on the North American market and its commitment to improving its offerings to professional customers. Lowe’s recently announced the acquisition of RONA, which is part of an effort to spur growth in the Canadian market.

2015 Results

Revenues for 2015 were $59.1 billion, up 5.1% from $56.2 billion the prior year and exceeding management’s expectation of 4.5%–5% growth for the year.

Comps increased by 4.8% for the overall business and by 5.1% for the US home improvement business. Overall comp growth was higher than the company’s guidance of 4%–4.5% growth for the year.

Adjusted net earnings were $541 million and adjusted EPS was $3.29, reflecting the $530 million impairment charge related to the joint venture exit in Australia. EPS in the prior year was $4.80.

Guidance

Lowe’s guided for 2016 sales growth of 6% in a 53-week business year, which is expected to result in sales of $62.6 billion, above the consensus estimate of $61.8 billion. Having an additional week in the calendar is expected to increase sales by 1.5% and EPS by $0.05–$0.06.

The company guided for a 4% increase in comp sales and EPS of $4.00 for the year, slightly above the consensus estimate of $3.97. The company also plans to open about 45 new home improvement stores and hardware stores, including 20 Orchard locations and 12 stores in Canada.